Markets on Feb. 9, 2026: crypto steadies, metals catch a bid, the S&P 500 holds near 6,900

After the last week sharp slide, markets are trying to catch their breath. Bitcoin is back around $71,000, but the geopolitical tape still keeps traders on edge. Gold is again near $5,000, silver has snapped back, and the S&P 500 is holding 6,900 even as futures hint at caution.

According to CoinGecko, total crypto market cap is around $2.48 trillion today, up roughly 1.4% over the past 24 hours. Daily volume looks steadier at about $102 billion. On paper that reads like a bounce, but sentiment still feels fragile.

Bitcoin is trading near $70,900, with ether around $2,090. That’s a very different picture than Thursday, when the market took a hard hit and bitcoin slid to about $63.5K after a heavy sell-off. Some buyers have stepped back in, but nobody’s acting like the danger is gone.

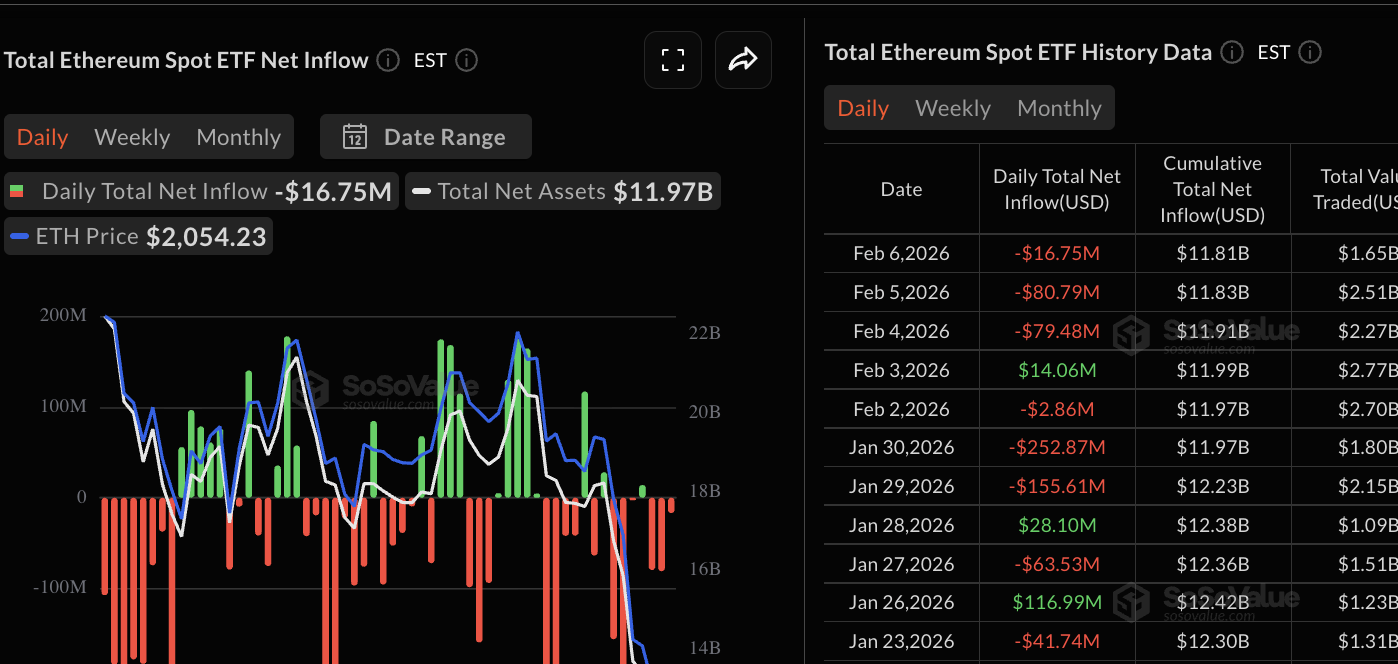

The stress point remains where the biggest checks are written. Adding up SoSoValue’s daily figures for Feb. 2–6, spot bitcoin ETFs saw about $318 million in net outflows for the week. Spot Ethereum ETFs posted roughly $166 million in net outflows over the same stretch. Solana ETFs looked firmer: based on the available data for Feb. 2–5, they held a small net inflow of around $2.9 million.

One detail that stood out was Friday’s shift. On Feb. 6, spot bitcoin ETFs swung back to a $371 million net inflow on the day, while Ethereum had a $16.75 million outflow.

Against that kind of crypto pressure, metals have been the surprise bright spot. Odaily reports gold (XAUUSDT) rising to about $5,018 per ounce. Silver (XAGUSDT) in the same data is around $81.74, up nearly 5% on the day. You can read that as a return to classic safety trades, but it also looks like short covering after a rough week.

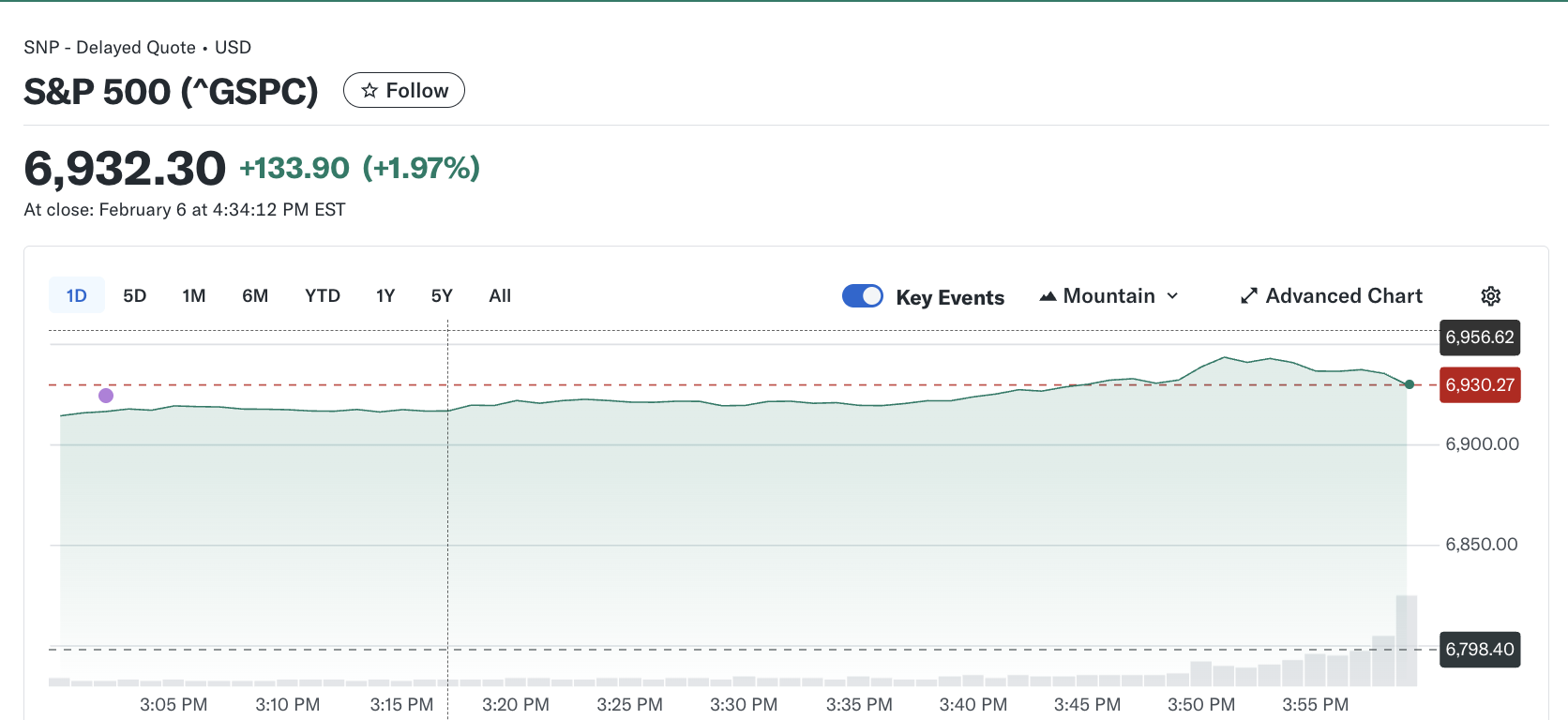

U.S. stocks have been calmer, though not exactly bullish. By Friday’s close on Feb. 6, the S&P 500 was around 6,932. Market recap data also shows E-mini S&P 500 futures holding near 6,930, according to CME Group and historical quote feeds.

From here, it’s politics and external risks doing most of the steering. Iran is still a headline machine. Oil dipped on talk that the U.S. and Iran would keep negotiations going, but fear comes back fast when the talks stall.

Cuba was another loud part of the week. Reuters reported a U.S. Embassy warning in Havana amid fuel shortages and power outages. On top of that, Nicaragua shut down a key route that Cuban migrants had been using.

And one more storyline has been weighing on the market’s overall mood: the latest releases and reporting tied to the Epstein case, including an AP report. It’s not a “fundamentals” story, but it adds to the level of political noise. Lately that noise has been setting the tempo more often than macro spreadsheets.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.