Markets on Feb. 2, 2026: crypto slides, metals pull back, and the S&P 500 turns defensive

To start the week, investors are cutting risk and moving some money into cash and short-term U.S. Treasuries. Crypto is falling alongside ETF flows, precious metals are sharply correcting after record highs, and the S&P 500 is backing away from the 7,000 area. The main drivers are Trump’s tariff policy, a U.S. budget fight, and rising tension around Iran.

According to CoinMarketCap, the total crypto market cap is around $2.56 trillion today, down roughly 4% over the past 24 hours. Volumes are also lower but still elevated at about $160 billion for the day. Bitcoin is trading around $75,000, while Ether is holding near $2,200. It looks like a familiar move into cash.

Traders tend to de-risk when they can’t read the dollar, don’t know what policy decisions could land next, and aren’t sure how long the U.S. government shutdown will drag on.

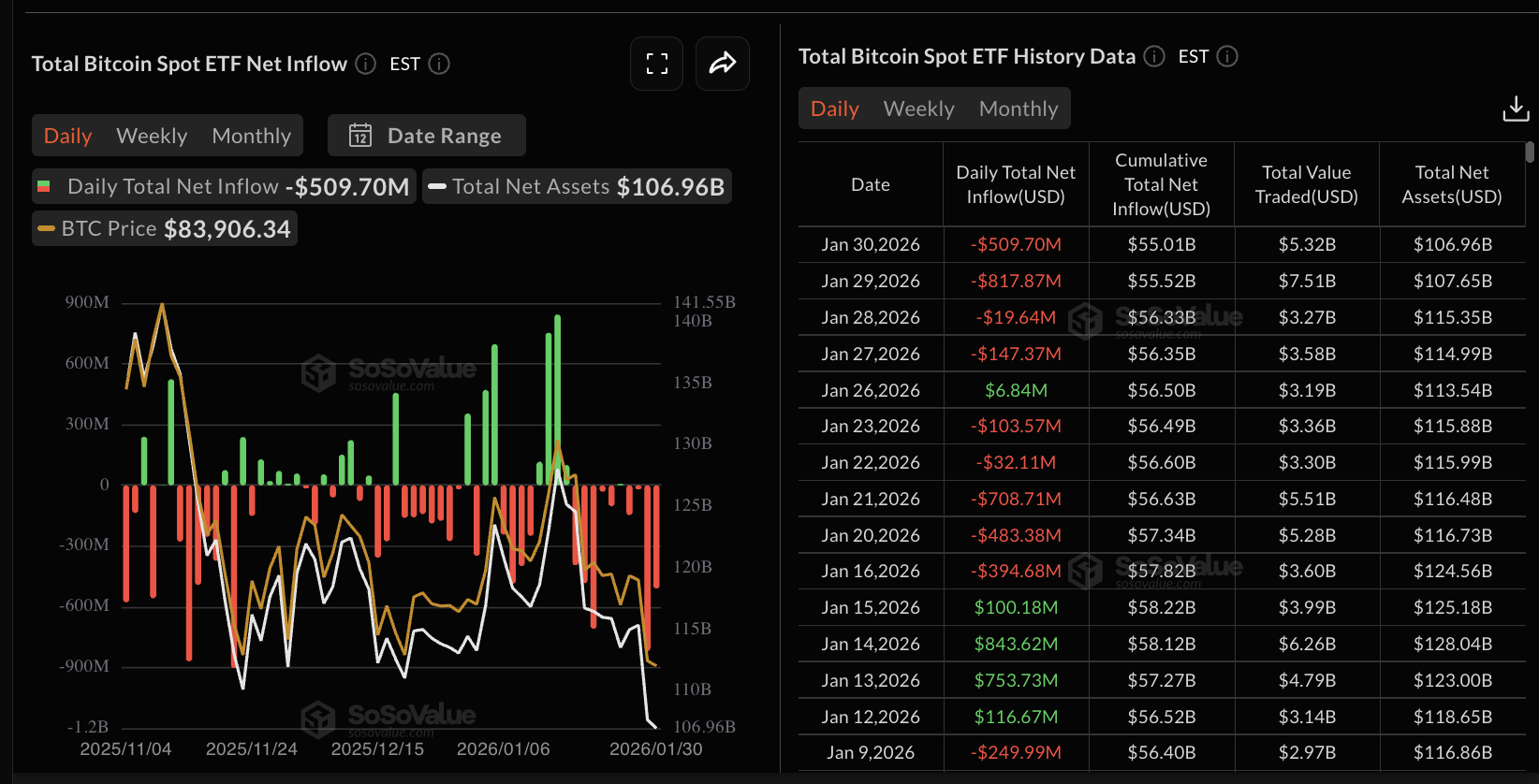

The clearest pressure point for crypto is in the funds. SoSoValue data shows spot Bitcoin ETFs saw heavy outflows last week. One peak came on Jan. 29, when about $818 million left the products in a single day. Another hit followed on Jan. 30, with roughly $510 million in outflows. For the market, that matters because it suggests institutional money isn’t rushing to buy the dip and is waiting for clearer macro conditions.

Precious metals are under pressure as well. After a record run, gold and silver pulled back sharply. As of Feb. 2, gold was dipping toward $4,700 per ounce, while silver slid toward the $80 area. Several factors are overlapping.

The nomination of hawkish Kevin Warsh to lead the Fed supported the dollar and cooled expectations for near-term rate cuts. At the same time, exchanges raised margin requirements, and some speculators started closing positions faster than they planned.

U.S. equities look calmer in this picture, but they’re tightening up too. The S&P 500 is holding near 6,900 and has backed off recent highs. S&P 500 futures were down about 1.1% on the day, and Nasdaq futures were down roughly 1.5%.

Investors are digesting tariff threats from the Trump administration aimed at Europe amid the Greenland dispute, along with another turn in the budget fight in Washington. A partial government shutdown began over the weekend, and even if officials say they can resolve it in the next few days, the fact that it happened adds a risk premium.

Iran is another major variable. Talk of increased pressure from Washington, possible sanctions, and military scenarios is pushing investors to look for protection in commodities and currencies. Oil isn’t spiking yet, but more traders are reacting to headlines rather than spreadsheets. That may be the main theme of the day.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.