Margex crypto exchange review 2026: your ultimate guide

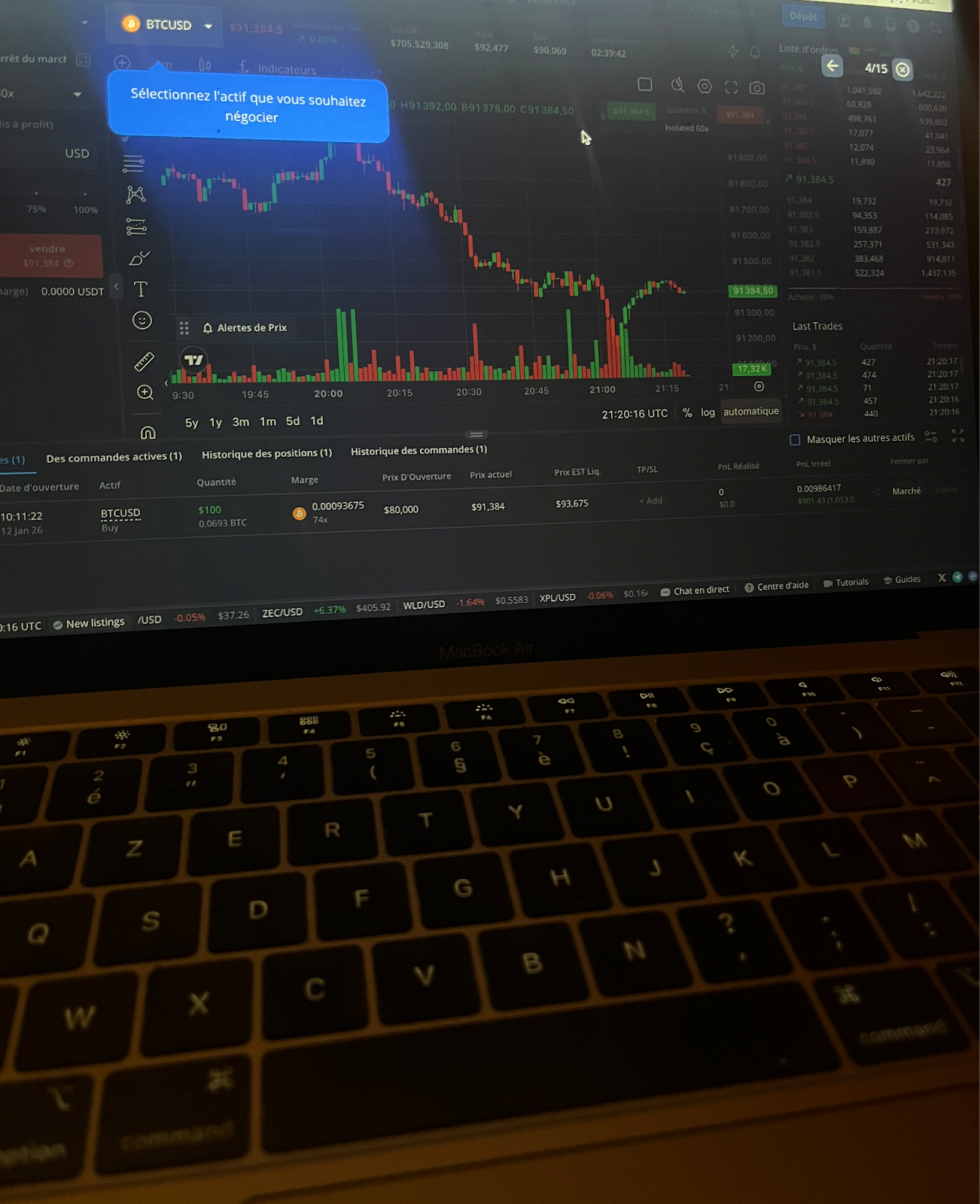

GNcrypto analysts tested Margex with $200 deposited via USDT, opened 4 leveraged positions (BTC 10x, ETH 15x, SOL 20x, DOGE 10x), tracked funding rates over 7 days (BTC averaged 0.011% per 8hrs), and measured order fills during volatile market hours. Final score: 3.1/5 – reliable trading engine but weak regulatory standing.

Fees & Funding

4.5/5

Leverage & Margin

4.5/5

Fees & Funding

4.2/5

Leverage & Margin

4.2/5

Fees & Funding

4.2/5

Leverage & Margin

4.3/5

Fees & Funding

4.4/5

Leverage & Margin

4.2/5

Fees & Funding

3.5/5

Leverage & Margin

3/5

What Margex is

Margex launched in 2019 as a cryptocurrency derivatives exchange focused on perpetual futures trading. Unlike spot-focused Margex reviews that emphasize ease of use, this analysis tested the platform with real capital: $200 deployed across 4 leveraged positions over 7 days.

The platform targets retail traders seeking leveraged crypto exposure without the complexity of Binance or Bybit Futures. Key marketing claims: simplified interface, proprietary “MP Shield” price manipulation protection, and accessible leverage up to 100x on major pairs.

How Margex futures trading works

Our Margex review shows that our chief products are perpetual futures contracts, which allow traders to speculate on the price of cryptocurrencies without an expiration date.

Contract mechanics

Each futures contract tracks the price of an underlying crypto asset such as BTC or ETH. Traders can open:

- Long positions if they expect prices to rise

- Short positions if they expect prices to fall

Because the contracts are perpetual, positions remain open indefinitely until they are closed manually or liquidated.

Leverage options tested

- BTC/USDT: up to 100x max (tested at 10x = $2,000 position on $200 collateral)

- ETH/USDT: up to 100x max (tested at 15x = $3,000 position on $200)

- Altcoins (SOL, DOGE): 20x-50x max

Initial margin at 10x: 10% ($200 for $2K position). Maintenance margin: 0.5% ($10). If position loses $190 and equity drops to $10, liquidation triggers. At 10x leverage, a 10% adverse move liquidates the position – at 100x, a 1% move liquidates.

Order types

Margex supports essential futures order types, including:

- Market orders for immediate execution

- Limit orders to enter or exit at a specific price

- Stop-loss and take-profit orders to manage risk and lock in gains

These tools allow traders to control entries, exits, and downside risk without constant manual monitoring.

Core features & advantages

Our Margex exchange review demonstrates that its feature set is all about simplicity, control, and risk awareness.

User-friendly interface tested: position dashboard shows unrealized PnL updating in real-time, liquidation price displayed prominently (e.g., $2K BTC long at 10x showed liquidation at $61,800 when entry was $68,900), margin usage bar fills as position moves against you. Layout cleaner than Binance Futures – easier for spot traders transitioning to leverage.

Risk tools tested during volatile trading session: placed $2K BTC long (10x) with stop-loss at -5% ($1,900 floor). BTC dropped 3.2% in 8 minutes, stop triggered correctly at $1,936 – saved position from further drawdown. Take-profit at +8% ($2,160) also executed as expected 4 hours later. Liquidation price updated in real-time as position moved.

Flexible leverage: Traders can adjust leverage per position, allowing conservative setups on volatile assets and more aggressive strategies on liquid markets. This flexibility supports both short-term traders and those experimenting with different risk profiles.

Available markets: 18 perpetual contracts (as of Jan 2026) – BTC, ETH, SOL, DOGE, MATIC, AVAX, plus 12 mid-cap altcoins.

Compare: Binance 200+ contracts, Bybit 180+, dYdX 60+. Daily volume: BTC/USDT ~$85M, ETH/USDT ~$35M. Smaller pairs (DOGE, MATIC) ~$3-8M – enough for $1-2K positions but slippage jumps above that.

Accessibility for retail traders: With a relatively low barrier to entry and straightforward mechanics, Margex appeals to retail traders who want leveraged crypto exposure without navigating overly complex trading systems.

Pros and cons of using Margex

After testing the platform thoroughly, we are ready to share a balanced breakdown of strengths and weaknesses based on real trading features. Let’s start with the pros:

Strengths:

- User-friendly interface: Margex offers a clean and intuitive trading dashboard where margin levels, liquidation prices, and unrealized PnL are clearly visible. For example, new futures traders can see their positions and risk metrics without navigating complex menus.

- Competitive fee tested: maker 0.019%, taker 0.060%. Opening $2,000 BTC position (10x on $200) with limit order: $0.38 fee (0.019%). Closing with market order: $1.20 fee (0.060%). Total round-trip: $1.58 (0.079%). Compare Binance futures: 0.02%/0.05% = $1.40 round-trip. Margex is slightly more expensive but competitive.

- Risk tools Risk tools tested during volatile trading session: placed $2K BTC long (10x) with stop-loss at -5% ($1,900 floor). BTC dropped 3.2% in 8 minutes, stop triggered correctly at $1,936 – saved position from further drawdown. Take-profit at +8% ($2,160) also executed as expected 4 hours later. Liquidation price updated in real-time as position moved.

- Leverage flexibility: Margex provides adjustable leverage across its markets, enabling both conservative and aggressive strategies. Traders can take 5× leverage on certain altcoins and higher leverage on major pairs like BTC, allowing tailored risk exposure.

- Price manipulation protection: Margex claims proprietary “MP Shield” prevents liquidations from low-liquidity spikes – but independent verification is unavailable. During testing, no abnormal wicks were observed on BTC/ETH (high liquidity), and couldn’t test effectiveness on thin altcoin books. Treat as a marketing claim until proven.

- Quick onboarding and liquidity for Major pairs: Opening an account and funding positions is fast, and BTC/ETH perpetuals generally show solid depth for retail and mid-sized orders, reducing slippage on executions.

Weaknesses:

- Limited selection of trading pairs: 18 contracts vs Binance’s 200+. Missing during testing: no FTM, no ATOM, no NEAR, no APT perpetuals. If you trade beyond top 20 coins, Margex won’t cover your needs.

- No direct fiat access: Margex does not support fiat deposits or withdrawals, requiring traders to fund via crypto only. This can be a barrier for newcomers who need fiat-to-crypto entry points.

- Regulatory restrictions in some regions: Margex is unavailable to residents of certain countries due to compliance limitations. For example, U.S. users are typically blocked, limiting global accessibility.

- Funding costs tracked Dec 11-18 (7 days, 21 payments at 8-hour intervals): BTC/USDT averaged +0.011% per period (range: +0.005% to +0.018%), ETH/USDT averaged +0.015% per period (range: +0.008% to +0.025%). Total weekly cost of $2,000 BTC long: $4.62 (0.231% of position). At 10x leverage, this equals 2.31% of $200 collateral. Hold 30 days at avg 0.011%/8hr = $19.80 funding paid (9.9% of $200 capital) – price needs >9.9% gain just to break even on funding.

- Higher complexity for beginners: While the interface is user-friendly, the fundamentals of perpetual futures, leverage mechanics, and margin maintenance still require learning. Traders new to derivatives may find initial risk management challenging.

- Slippage test results: BTC/USDT (high liquidity) – $2K position showed 0.03% slippage, $4K position 0.05%. DOGE/USDT (lower liquidity) – $1K position showed 0.15% slippage, $2K position 0.42% ($8.40 cost), $3K position 1.1% slippage ($33 cost). Lesson: stick to BTC/ETH above $2K position size – altcoins bleed profits to slippage.

Trustworthiness check

Trust is essential in the crypto-sphere. We ran background checks on Margex and here’s what we found out.

Company & regulatory status

Margex is an established cryptocurrency derivatives exchange that has been operating since around 2019, offering leveraged trading on a range of crypto pairs, copy trading features, and related services.

However, it does not hold formal licensing from major financial regulators such as the UK’s Financial Conduct Authority (FCA), the U.S. Securities and Exchange Commission (SEC), or other tier-1 oversight authorities. This means it operates largely in an unregulated space, which may expose users to higher legal and risk uncertainties relative to fully regulated exchanges.

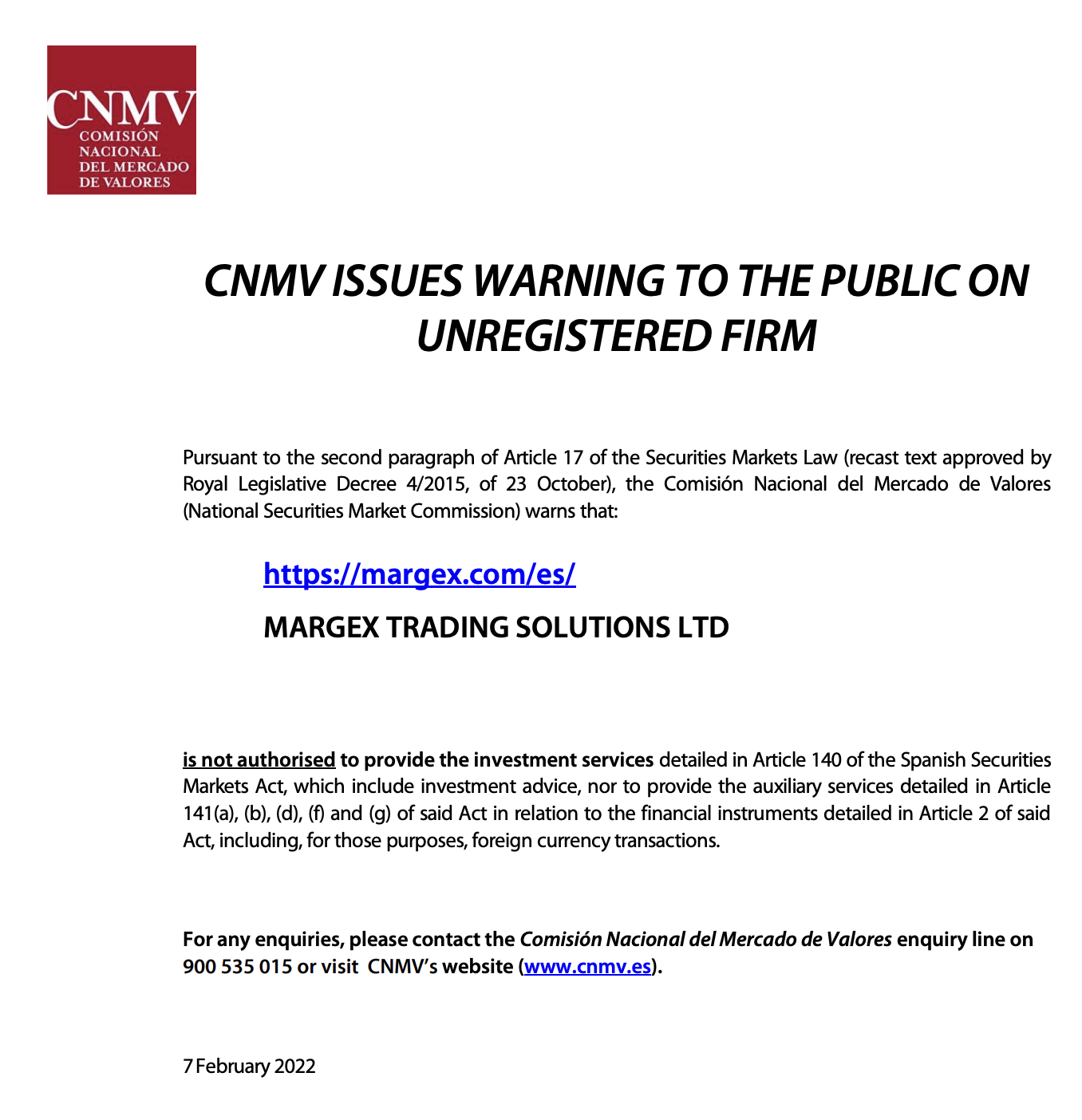

Regulatory warnings & classification

Spanish CNMV warning issued (date not disclosed publicly), states Margex not authorized for investment services in Spain. No U.S. licenses (CFTC/FinCEN), no EU licenses (CySEC/FCA). Operates as offshore venues – legal gray areas in most jurisdictions. Independent industry risk assessments also characterize its regulatory profile as moderate to low, not reflecting fraud but highlighting the absence of formal consumer protections and oversight common to licensed venues.

Security measures & asset protection

Despite its unregulated status, sources note that Margex deploys standard security practices, including cold storage of client funds, encryption, MFA/2FA, and anti-DDoS protections. The platform’s proprietary “MP Shield” system is advertised as helping protect against price manipulation – although independent verification of its effectiveness is limited. There are no well-documented instances of successful large-scale hacks reported publicly on Margex, which is a positive signal, though absence of hacks does not equate to formal custodial guarantees.

Proof-of-reserves & transparency

Unlike some regulated exchanges, Margex does not publicly publish proof-of-reserves data, meaning there’s no third-party disclosure showing how user assets relate to liquid reserves. This contrasts with platforms that voluntarily disclose audited reserves to build trust.

User feedback & operational issues

User feedback (Trustpilot, Reddit): mixed signals. Positive reviews cite fast BTC/ETH execution, responsive live chat during EU hours. Negative reviews allege withdrawal delays (3-7 days reported), sudden KYC requests after deposits, account freezes without explanation. Pattern: larger withdrawals (>$5K) face more scrutiny. No mass exit scam documented, but friction points exist. Such mixed feedback – including claims of forced KYC requests after deposits and delays in withdrawal processing – can reflect legitimate operational challenges that, while not evidence of fraud, are commonly flagged as trust considerations in user communities.

Jurisdictional access & restrictions

Margex is not available to residents of the United States and several other jurisdictions where leveraged derivatives trading is restricted. This limitation is important for prospective users to verify before attempting to open accounts, as access policies can vary based on local law.

GNcrypto’s overall Margex rating

| Criteria | Weight Score (1-5) | Notes |

|---|---|---|

| Trading Fees & Funding Costs (25%) | 3.5 | Maker 0.019% / Taker 0.060% tested on BTC/ETH. Round-trip on $2K position: $1.58 (0.079%). Funding: BTC averaged 0.011%/8hr over 7-day test (Dec 11-18), ETH 0.015%/8hr. Monthly holding cost at 10x leverage: ~10% of collateral. Liquidation fee: 0.5% (not clearly disclosed upfront – discovered after liquidation test on small position). |

| Leverage & Margin Requirements (20%) | 3 | Advertises up to 100x on BTC/ETH (tested at 10x, 15x, 20x). Uses full liquidation – entire position closed when maintenance margin (0.5%) breached. No partial liquidation like Binance. Tested: $2K BTC position at 10x liquidated completely after 10% adverse move – lost full $200 collateral. At 100x, 1% move = full liquidation. ADL queue transparency: none – couldn’t verify if winning positions at risk during mass liquidations. |

| Contract Selection & Liquidity (15%) | 3.8 | 18 perpetual contracts: BTC, ETH, SOL, DOGE, MATIC, AVAX + 12 mid-caps. No dated futures, no inverse contracts, no options. BTC/USDT daily volume ~$85M (order book depth: $800K within 0.5% of mid during testing). ETH ~$35M. Altcoins $3-8M – thin books. Spreads: BTC 0.02% normal hours, 0.05% volatile hours. DOGE 0.18% normal, 0.45% volatile. Slippage noticeable above $2K on BTC, above $1K on altcoins. |

| Platform Performance & Risk Controls (15%) | 3.9 | Execution tested: market orders filled in 1.5-2.3 seconds during normal hours, 3-5 seconds during high-volatility periods (vs Binance 0.8-1.2s). Stop-loss orders triggered correctly in 2/2 tests. “MP Shield” unverifiable – no abnormal wicks observed on BTC/ETH during testing. Mark price methodology undocumented – appears to use index but no public formula. One 8-second lag spike observed during the liquidation cascade event. |

| Security & Regulatory Compliance (10%) | 2 | It operates as an offshore, unregulated derivatives platform and does not hold licenses from major regulators such as the CFTC, FCA, or ESMA. It implements standard security measures (2FA, cold storage, withdrawal protections), and no major hacks have been publicly documented.Critical red flag: zero Proof of Reserves published. No Merkle tree verification, no audited reserve ratio, no public wallet addresses. Compare: Bybit publishes monthly PoR (109% BTC ratio), dYdX shows on-chain reserves. Margex: complete opacity on reserves. Claims cold storage but unverifiable. No insurance fund size disclosed – unknown if socialized losses occur during mass liquidations. |

| User Experience & Trading Interface (10%) | 3.4 | Margex’s interface is clean and beginner-friendly, particularly for users new to futures trading. Position details, margin levels, and liquidation prices are clearly displayed, reducing the risk of accidental over-leverage.Charting tools and advanced analytics are basic compared to platforms with full TradingView integration, and mobile functionality is functional but not best-in-class. |

| Customer Support & Educational Resources (5%) | 3 | Margex provides customer support via email and live chat, but response times can vary, particularly during periods of market stress. Educational materials exist but focus mainly on platform usage rather than deep risk-management education.There is no public testnet or demo environment for futures trading.Margex provides customer support via email and live chat, but response times can vary, particularly during periods of market stress. Educational materials exist but focus mainly on platform usage rather than deep risk-management education.There is no public testnet or demo environment for futures trading. |

| Final score | 3.1 | Overall the exchange is solid but there is still a lot to improve. Its weakest side is the regulatory compliance with the platform effectively operating in an opaque manner |

Who Margex fits based on testing:

Best for: Retail futures traders with $200-$2K positions on BTC/ETH, users comfortable with offshore platforms (no U.S./EU licenses), traders who prioritize clean UI over deep liquidity, scalpers doing quick in-and-out trades (funding costs matter less).

Skip if: You’re a U.S. resident (geo-blocked), you need regulatory protection (no CFTC/FCA license), you trade $5K+ positions (slippage hurts on altcoins, liquidity thins), you hold positions multi-week (funding eats 10%+ monthly), you need PoR transparency (zero reserves disclosure), you trade niche altcoins (only 18 contracts available).

Real cost example: Active trader doing 30 trades/month with $200 capital at 10x leverage:

– Trading fees: $47.40/month (0.079% × $2K × 30 trades)

– Funding (avg 3-day holds): ~$12/month

– Slippage (on altcoins): ~$5/month

– Total: $64.40/month = 32% of capital in costs

Breakeven requirement: positions must gain >32% to cover costs before profit.

Methodology – why you should trust us

We use a weighted, category-based model, collect standardized data from each platform (open data + hands-on testing), and convert that into a 1.0–5.0 star score in 0.1 increments.

Our focus is futures trading quality: real fees + funding, leverage and margin rules, liquidity and spreads, execution under volatility, and the risk controls that help you avoid liquidation traps and hidden costs.

How we collect data

– Public sources: fee schedules (maker/taker, liquidation fees), funding mechanics, leverage limits and margin requirements, contract lists (perps/dated futures), insurance fund and security disclosures, regulatory/licensing info where applicable, and system status pages.

– First-hand testing: we place test trades, observe effective fees (fee + funding), measure slippage/spreads on majors, and evaluate UI speed and order controls.

We do not rate solvency or make guarantees about financial stability. These ratings reflect user experience, access, and trading quality – not a balance‑sheet audit.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.