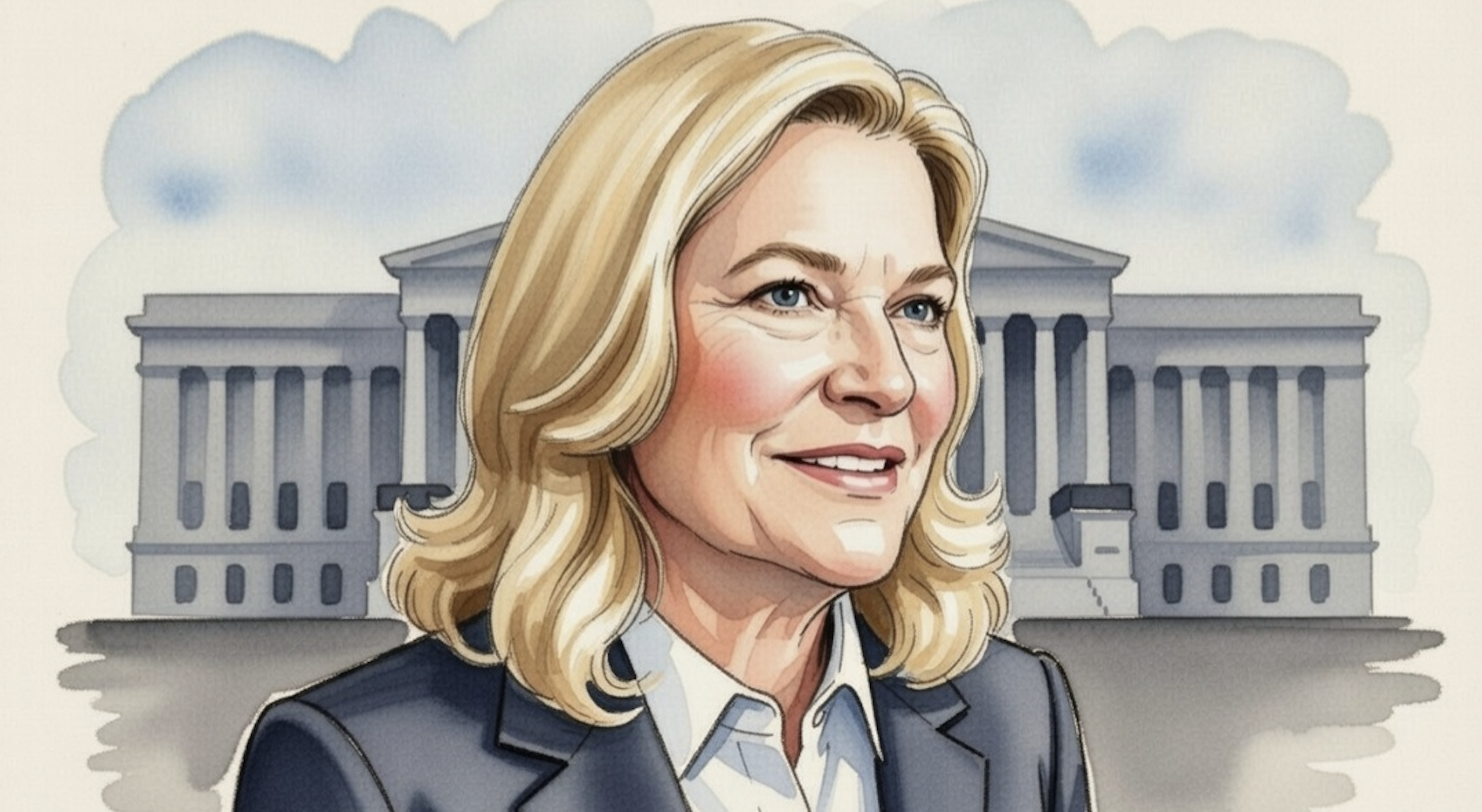

Senate shelves crypto bill over rewards; Lummis presses banks

Sen. Cynthia Lummis urged banks to adopt stablecoins after the Senate scrapped a CLARITY Act markup amid a dispute over whether digital asset firms can offer rewards on payment stablecoin balances.

Sen. Cynthia Lummis urged banks to adopt stablecoins after Senate leaders pulled a planned markup of the CLARITY Act on Thursday, following lender objections to customer rewards and Coinbase’s withdrawal of support.

The Wyoming Republican described stablecoins as a faster, cheaper payment option and “an entirely new financial product” banks could offer to customers. In an interview, she encouraged lenders to view digital dollars as a business opportunity, not a threat.

Talks over the market structure legislation have stalled as banking groups warned that rewards tied to holding stablecoins could pull deposits from traditional accounts, a concern they view as acute for community banks that rely on stable funding for local lending.

Lummis indicated the pushback is centered on a separate stablecoin bill, the GENIUS Act, where lenders seek tighter limits to prevent products that resemble “interest” or a “bank-type product.” Staff tried to address the issue by labeling incentives as “bonuses or rewards,” yet committee work remains on hold.

The markup cancellation came hours after Coinbase Chief Executive Brian Armstrong withdrew support for the package, citing disagreements over stablecoin yield provisions and contending the draft would be worse than the current regulatory status.

An updated Senate draft circulated in January would bar digital asset service providers from paying “any form of interest or yield” solely for holding payment stablecoins. Banking trade groups have pressed lawmakers to limit such incentives, arguing they could accelerate deposit flight.

Lummis argued stablecoins can reduce costs and speed transactions in the United States and across borders. “Money can be transmitted on the blockchain more quickly than it can if you’re going through existing bank structures,” she noted, adding that safeguards developed with the Federal Reserve are intended to protect users.

She pointed to potential new revenue lines for banks, including digital asset custody-permitted in several states-and the use of blockchain-based payment rails that compete with debit card networks.

Treasury Secretary Scott Bessent pressed senators to pass the CLARITY Act during testimony before the Senate Banking Committee, calling continued uncertainty untenable. Opponents who argue the industry can operate without new law, he told them, “should move to El Salvador.”

Digital asset analyst Nic Puckrin described the drawn-out process as an anticlimax that has weighed on investor expectations and could cap prices. He argued stablecoins have “strategic significance” for the U.S. dollar during market or geopolitical stress and characterized them as a growing competitor to bank deposits. “Short of an outright ban on any form of rewards, there’s little that can stop this,” he added.

Banking groups have warned that allowing issuers or platforms to offer rewards could shift balances out of traditional accounts, reshaping funding models for loans. Research from a global bank estimated roughly $500 billion could move from deposits into stablecoins by 2028.

Lummis remains confident the Senate will return to the legislation. According to her, Majority Leader John Thune has pledged to reserve floor time later in the spring after negotiators attempt to resolve the stablecoin provisions that derailed the markup.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.