Best LocalCoinSwap alternatives for P2P privacy

LocalCoinSwap was a pioneer in non-custodial trading, but the P2P landscape has evolved. Whether you need deeper liquidity or true decentralized arbitration, we found the platforms that offer a superior peer-to-peer experience.

Liquidity & Volume

5.0

Payment Methods

4.0

Liquidity & Volume

4.0

Payment Methods

4.0

Liquidity & Volume

4.0

Payment Methods

4.5

Liquidity & Volume

3.5

Payment Methods

4.5

Liquidity & Volume

3.5

Payment Methods

3.5

For those of us who believe “Not your keys, not your coins” is a commandment rather than a suggestion, LocalCoinSwap was a breath of fresh air. It offered a non-custodial bridge between fiat and crypto without the overbearing surveillance of centralized giants. It was the place where you could trade purely on smart contracts or multisig scripts, keeping your opsec tight and your funds safer.

But as the “cypherpunk” ethos faces new regulatory headwinds in 2026, relying on a single platform is a single point of failure we cannot afford. You might have noticed liquidity drying up on certain pairs, or perhaps you are just looking for a protocol that integrates deeper privacy tech like the Lightning Network or Tor by default. We have been there, refreshing the order book and wishing for a darker, more robust alternative.

While LocalCoinSwap is still a solid tool in the privacy stack, it isn’t the only game in town anymore. We wanted to find an alternative to LocalCoinSwap that pushes the envelope further – platforms that don’t just facilitate trades but actively engineer out the possibility of censorship.

Below, we’ve compiled the best P2P marketplaces that still respect the original vision of Bitcoin. These are the protocols we fire up when we want to trade peer-to-peer, permissionless, and private.

Why users seek alternatives to LocalCoinSwap

While LocalCoinSwap remains a popular non-custodial marketplace, the P2P landscape of 2026 has exposed cracks in its “middle-ground” model. For privacy advocates and high-volume traders, the platform often feels like it is stuck halfway between a centralized exchange and a true protocol. The migration to a LocalCoinSwap alternative is usually driven by three distinct frustrations.

LocalCoinSwap markets itself as a private, no-KYC platform. However, in practice, it often functions as a “Soft KYC” environment.

- The reality: While the platform itself may not ask for your passport immediately, many high-volume sellers do. To access the best rates or higher limits, you are frequently forced to upload ID to a stranger in a chat window.

- The limitation: True privacy seekers are moving to protocols like MEXC P2P or Bisq, where identity is protected by code (using onion routing or ephemeral identities) rather than just platform policy.

LocalCoinSwap supports over 300 payment methods, but liquidity is often “a mile wide and an inch deep.”

- The problem: Outside of major pairs like BTC/USD or ETH/EUR, order books can be barren. This lack of competition leads to massive spreads, where the only available offers are priced 5%–10% above market rate.

- The risk: In low-liquidity zones, you are more likely to encounter scammers who manipulate these thin markets, leaving you with few safe options.

Despite being “non-custodial” (smart contracts hold the funds), the dispute process is fully centralized. If a trade goes wrong, you are at the mercy of a customer support ticket. Recent user reports from 2025 highlight frustrating delays and unresponsive support teams when dealing with “card draining” scams or complex technical glitches.

Best LocalCoinSwap alternative by user needs

MEXC

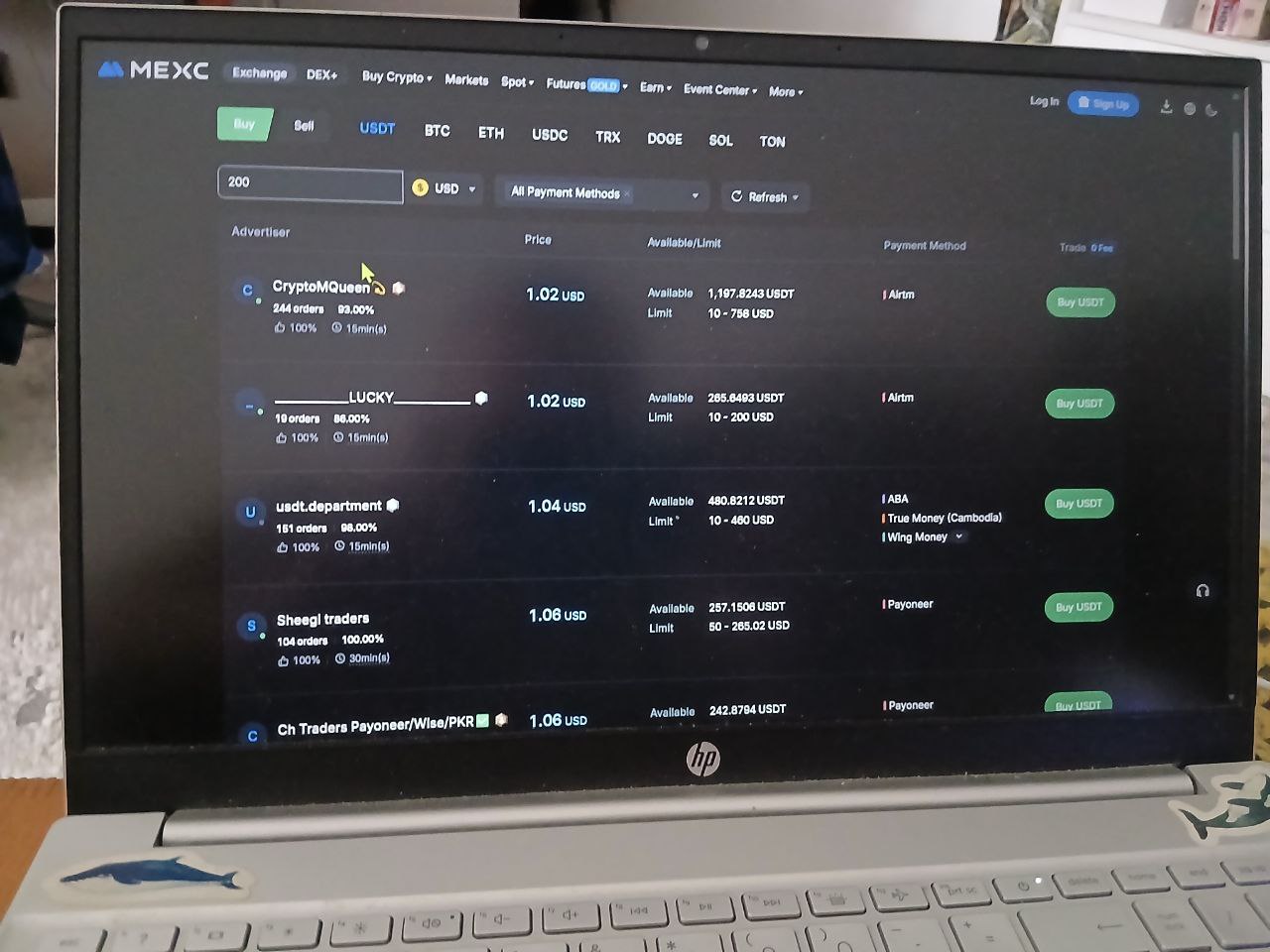

MEXC is the bustling highway for speed and leverage. It is the best alternative to LocalCoinSwap for traders who care less about anonymity and more about efficiency. While it lacks the non-custodial ethos, it compensates by acting as a zero-fee gateway directly into one of the world’s most aggressive spot and futures markets.

The headline feature is the cost: 0% trading fees for takers, making it arguably the cheapest way to onboard fiat. Unlike LocalCoinSwap’s standalone wallet, MEXC P2P is natively integrated into the exchange; once your USDT is released from escrow, it can be instantly moved to the futures wallet for high-leverage trading without transaction fees. It also supports over 30 fiat currencies and diverse payment methods like Wise, Revolut, and SEPA, catering to a global audience.

The trade-off is centralization. Unlike LocalCoinSwap, MEXC requires identity verification (KYC), meaning your privacy is nonexistent. While the platform fee is zero, merchants often bake a “hidden spread” into their rates – our tests showed prices ~0.8% above spot. Additionally, liquidity is strictly concentrated in USDT; if you are looking to buy niche altcoins directly via P2P, you will likely find empty order books.

“Degens” and active traders looking for the fastest, cheapest bridge between fiat cash and high-leverage futures.

Strengths:

- Zero fees: Takers pay a flat 0% commission, beating almost any non-custodial competitor.

- Ecosystem sync: Instant, free transfers from P2P to spot/futures wallets for immediate trading.

- Fiat variety: Supports 30+ currencies and popular fintech apps like Wise and Revolut.

- Escrow speed: Centralized escrow ensures funds are locked immediately, preventing “runner” scams.

Weaknesses:

- Mandatory KYC: Requires full identity verification, defeating the purpose for privacy seekers.

- Hidden spreads: Merchants often mark up rates by ~0.8%, acting as a hidden cost.

- Asset limits: effectively a USDT-only marketplace; liquidity for other coins is often nonexistent.

Bitget

If LocalCoinSwap is the “Wild West” of peer-to-peer trading, Bitget is the “Country Club.” It is the best LocalCoinSwap alternative for users who are willing to trade anonymity for a safety net. While it completely lacks the privacy features of a non-custodial marketplace, it replaces them with a massive $300 million protection fund and a direct pipeline into the world’s largest copy-trading ecosystem.

The biggest draw is the “Zero-Fee” structure for takers, allowing you to onboard fiat without losing a percentage to the platform. Bitget supports over 70 fiat currencies and a dizzying array of payment methods (Wise, Revolut, Zelle), making it a global powerhouse. Security is also a standout: unlike LocalCoinSwap’s smart contracts, Bitget backs its P2P desk with a $300M Protection Fund and publicly verifiable Proof of Reserves (PoR) that consistently exceed 200%.

The “cost” of this safety is your privacy. Mandatory KYC is non-negotiable, meaning every trade is linked to your real-world identity. While the platform fee is zero, our tests revealed a “nerd tax” in the form of a ~0.6% spread above spot prices. Additionally, the P2P desk is limited to major assets like USDT and BTC; if you want exotic alts, you must buy USDT first and trade on the spot market.op

Social traders and copy-trading enthusiasts who want a safe, insured gateway to fund their portfolios.

Strengths:

- Zero Taker Fees: Buyers pay 0% platform fees, keeping upfront costs low.

- Safety Net: Backed by a $300M Protection Fund and 200%+ Proof of Reserves.

- Fiat Depth: Supports 70+ currencies and niche payment methods like Pix and Zelle.

- Copy-Trading Sync: Instantly fund copy-trading accounts without internal transfer fees.

Weaknesses:

- Mandatory KYC: Complete loss of privacy; requires ID verification for all users.

- Hidden Spreads: Merchants often price assets ~0.6% above market value.

- Merchant Lag: Trade speed depends on humans; some trades can take 15+ minutes to clear.

- Limited Assets: P2P market is restricted to “majors” (USDT, BTC, ETH) only.

Bisq

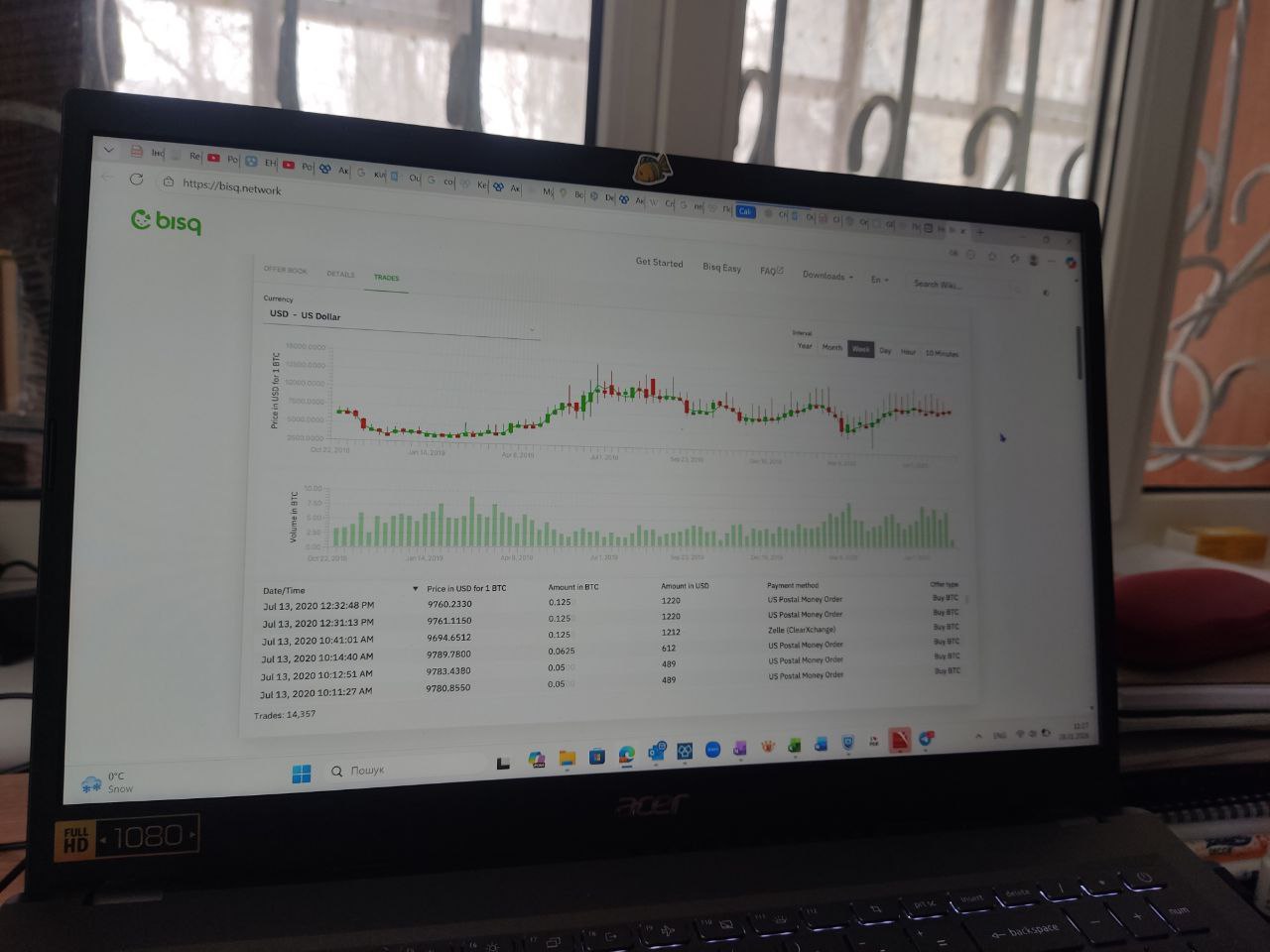

Bisq is a bunker buried under a mountain. It is the ultimate LocalCoinSwap alternative for privacy maximalists who don’t trust websites at all. Unlike its web-based competitors, Bisq is a downloadable piece of software that connects you to a global, encrypted network (Tor) where no central server – and no CEO – can ever freeze your funds.

Benefits

The “Holy Grail” here is the absolute absence of KYC. There are no accounts, no ID uploads, and no data leaks because your data never leaves your hard drive. Security is enforced by code, not promises: trades use a 2-of-2 multi-signature escrow where both buyer and seller must lock a security deposit, ensuring “skin in the game” that prevents scams without a middleman. It is also the undisputed king of liquidity for Monero (XMR) trades, offering a safe haven for swapping BTC for privacy coins.

Limitations

Freedom isn’t free – it’s heavy. The software is resource-intensive and can feel sluggish, taking time to sync with the Tor network. The biggest hurdle for beginners is the “chicken and egg” problem: to buy Bitcoin on Bisq, you technically need to already own a small amount of Bitcoin to pay the security deposit. Additionally, liquidity for anything outside of BTC, USD, EUR, and XMR is often nonexistent, leaving you staring at empty order books.

Best for

Die-hard privacy advocates and “cypherpunks” who value sovereignty over convenience.

Strengths:

- Zero KYC: No identity verification ever; you are just a node on the network.

- Tor Integration: All traffic is routed through Tor by default, masking your IP address.

- Multisig Security: Funds are locked in a 2-of-2 on-chain escrow, not held by a company.

- XMR Liquidity: One of the few places with deep order books for private Monero swaps.

Weaknesses:

- Deposit Barrier: You need to hold BTC beforehand to pay the security deposit.

- Complex UX: The interface is “designed by engineers for engineers,” not casual users.

- Performance: The app can be slow to start and sync compared to web-based platforms.

- Low Liquidity: Finding trades for niche fiat currencies or altcoins can be difficult.

Which alternative should you choose?

If you want total privacy and don’t trust any central company

Choose: Bisq

The only true “cypherpunk” option. It runs on your own hardware over Tor, has zero KYC, and secures funds via 2-of-2 multisig. You trade speed for sovereignty—no CEO can ever freeze your account.

If you want zero fees and instant access to 1,000+ altcoins

Choose: MEXC

The “speed demon” choice. Takers pay 0% fees, and you can instantly move your P2P funds into a futures account to trade niche altcoins with leverage. Best for active traders who view P2P as just a funding gateway.

If you want a “bank-like” safety net and passive income tools

Choose: Bitget

The “socialite” choice for LocalCoinSwap alternatives. It sacrifices privacy (mandatory KYC) for security, backing user funds with a $300M Protection Fund. Ideal if you want to fund your account safely and immediately start using Copy Trading features.

Summary comparison

Bisq keeps you in full control of your keys and identity (no KYC, Tor routing) but sacrifices the conveniences of a centralized platform (instant execution, high liquidity, mobile apps).

MEXC and Bitget offer the full “CEX” toolkit – instant escrow release, 0% taker fees, and deep liquidity – but you effectively hand over custody of your funds to the exchange and must adhere to strict regional KYC rules.

LocalCoinSwap sat in the middle of these worlds: non-custodial yet web-based. If you are leaving LocalCoinSwap, the question isn’t just “which alternative,” but “what are you optimizing for: sovereignty or efficiency?”

| Exchange | Standout | Fees | Assets (P2P) | Fiat | PoR / Custody | Best for |

|---|---|---|---|---|---|---|

| Bisq | True DEX: No KYC, Tor-routed, Multisig escrow | ~0.15% – 1.15% (Lower with BSQ token) | BTC, XMR | Unlimited (P2P) | N/A (Self-Custody / On-Chain) | Privacy Maximalists who refuse to share ID |

| MEXC | Speed & Leverage: 0% fees for takers with instant transfer to futures | 0% Taker (Spread applies) | USDT, BTC, ETH | 30+ Currencies | Merkle Tree PoR (Centralized) | Active Traders using P2P as a funding gateway |

| Bitget | Safety Net: Backed by $300M Protection Fund | 0% Taker (Spread applies) | USDT, BTC, ETH, USDC | 70+ Currencies | 200%+ Reserve Ratio | Social Traders who prioritize insured platforms |

How we test P2P platforms

At GNcrypto, we put transparency first when evaluating peer-to-peer (P2P) cryptocurrency trading platforms. Our reviews are based on hands-on testing and thorough analysis across all key dimensions that matter for safely buying and selling crypto directly with other users.

We do not audit platform solvency or guarantee user safety from all scams. Instead, our scores reflect observable escrow mechanisms, order book depth, and platform support quality. We do not accept payment for ratings or modify scores based on partnerships.

Categories & weights

We rate P2P platforms on seven criteria. Escrow and Liquidity are weighted heaviest because a platform that isn’t safe or has no one to trade with is useless, regardless of how pretty the UI is.

- Escrow & Trade Safety – 25%

- Liquidity & Order Book Depth – 20%

- Fees & Payment Methods – 15%

- Verification & Account Limits – 15%

- Platform Performance & Reliability – 10%

- User Experience & Trade Flow – 10%

- Customer Support & Dispute Handling – 5%

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.