Hyperliquid vs Kraken 2026: CEX and DEX compared

We compared Hyperliquid and Kraken through hands-on testing and broke down what matters in practice: access, user onboarding, fees, execution, and risk management. This Kraken vs Hyperliquid comparison helps you choose the right platform.

Fees & Funding

4.5/5

Leverage & Margin

4.5/5

Fees & Funding

4.2/5

Leverage & Margin

4.2/5

Fees & Funding

4.2/5

Leverage & Margin

4.3/5

Fees & Funding

4.4/5

Leverage & Margin

4.2/5

Fees & Funding

4.5/5

Leverage & Margin

4/5

Kraken vs Hyperliquid at a glance

| Category | Kraken | Hyperliquid | Winner |

|---|---|---|---|

| Overall GNcrypto rating | 3.6 / 5 | 4.2 / 5 | Hyperliquid (overall) |

| Daily spot turnover (approx.) | ≈$1.58B | ≈$0.63B* | Kraken |

| Tradable assets (spot) | 562 | 47 perpetual markets (no spot) | Kraken |

| Liquidity & volume rating | 3.5 / 5 | 4.0 / 5 | Hyperliquid |

| Fees & total cost rating | 3.0 / 5 | 4.2 / 5 | Hyperliquid |

| Asset selection rating | 4.0 / 5 | 4.0 / 5 | Kraken |

| Tools & order controls | 4.0 / 5 | 4.6 / 5 | Hyperliquid |

| Fiat access & minimum trade size | 4.0 / 5 | 3.2 / 5 | Kraken |

| Reliability & transparency rating | 4.5 / 5 | 3.7 / 5 | Kraken |

Trading experience compared

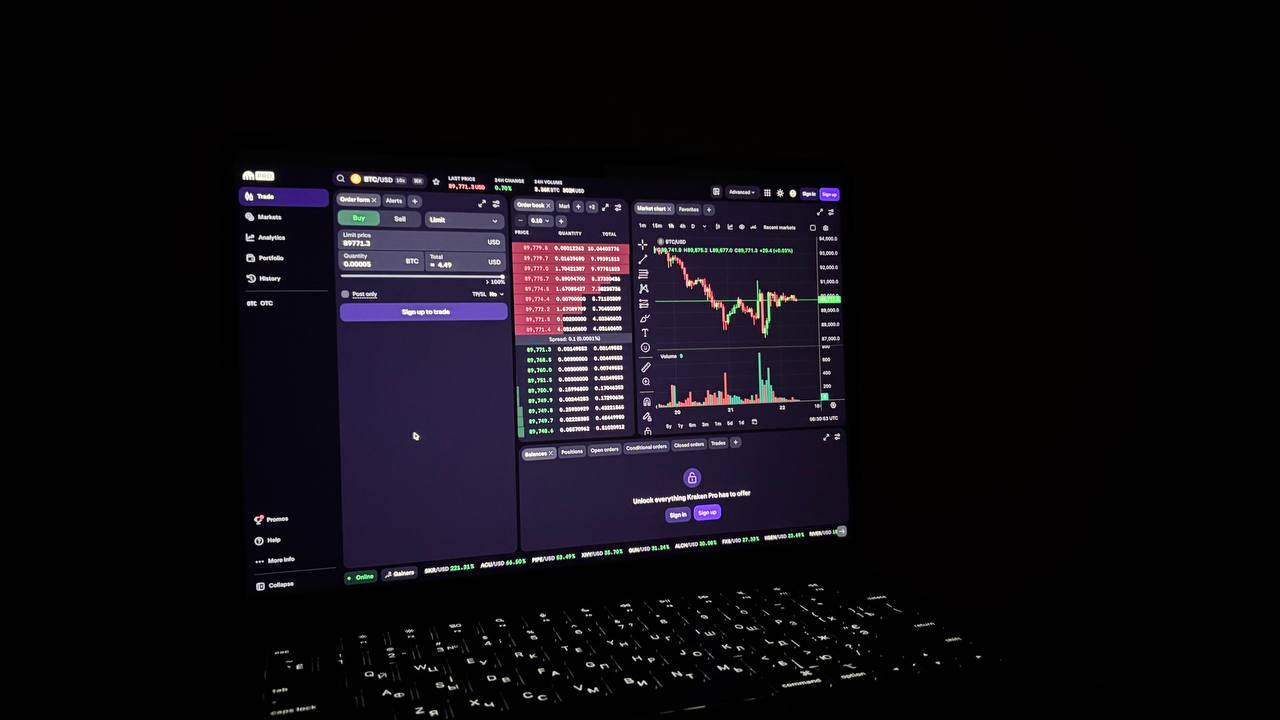

In our test, Kraken felt like an accessible CEX for spot trading: registration, fiat funding, and a separate Kraken Pro mode for order-book trading. Our testing flow was straightforward: we funded the account, selected a trading pair, and placed a limit or market order to buy an asset. This reduced the risk of errors, since all key actions were handled in a single interface and did not require working with a DEX wallet or interacting directly with the blockchain.

Hyperliquid is a different case. It is a derivatives DEX, with trading via a crypto wallet and full personal responsibility for funds. In terms of execution on highly liquid pairs such as BTC and ETH, Hyperliquid performed better: orders were filled quickly, and slippage at typical retail sizes was minimal.

Liquidity differences in Kraken vs Hyperliquid are also clear. Kraken offers predictable depth on spot markets and works well for standard trades and rebalancing. Hyperliquid provides solid depth on top perpetuals, but on less liquid markets costs rise faster. As position size increases, slippage starts to have a noticeable impact on entry and exit prices.

Fees & funding

Every trader looks at the total cost of a trade, not just the numbers in the Kraken vs Hyperliquid comparison fee table. These two platforms also follow different models: a CEX focused on spot trading versus a DEX built around perpetual futures.

Kraken charges fees under a classic maker-taker schedule in Kraken Pro, roughly 0%-0.25% for makers and 0.10%-0.40% for takers, with rates decreasing as volume grows. Instant Buy/Convert is simpler but more expensive. On small amounts, a fixed markup is added to the price, which made the trades we executed in this mode noticeably more costly than in the Pro terminal. Fiat deposit and withdrawal fees should also be considered, as they depend on your bank.

By contrast, Hyperliquid operates under a different model. Trading fees on perpetuals are low, around 0.0175% for makers and 0.03% for takers. Deposits and withdrawals incur only network fees, with no platform charges. As with Kraken, there is a second cost component: funding. When we held positions longer than usual, especially with higher leverage, funding rates ate into profits despite the low trading fees.

Our verdict: for mid-term spot trading and larger deposits, Kraken Pro is the better choice. For active derivatives trading and frequent market entries and exits, Hyperliquid is more cost-efficient.

Security & risk

After testing Hyperliquid vs Kraken, we reached a clear conclusion that Kraken follows a security-first service model. The exchange stores 95% of assets in cold wallets and uses 2FA and hardware keys, trusted address lists, granular API permissions, and continuous monitoring of intrusion attempts.

The platform is certified under ISO/IEC 27001 and has passed a SOC 2 audit. It also runs regular proof-of-reserves checks, where both an independent auditor and users can verify that exchange balances are backed by real assets. Based on our research, there have been no public cases of client funds lost due to infrastructure breaches over more than 13 years of operation.

Hyperliquid relies on a different trust layer: blockchain and smart contract security. It is a derivatives exchange built on its own L1, where all orders, trades, and liquidations are recorded on-chain, and funds are held in user wallets and smart contracts. Critical components of the infrastructure, such as bridges and validators, have been audited by Zellic. The project has also run a competitive audit on Code4rena and maintains a public bug bounty with rewards of up to $1M for critical vulnerabilities.

At the same time, a significant part of the system, including the full L1 logic, is not yet covered by audits at the same depth. Based on our research, we account for the inherent risks of a new network and on-chain derivatives, including L1 instability, oracle manipulation, and cascading liquidations.

Kraken vs Hyperliquid – which should you choose?

If you’re a beginner or first-time buyer

Choose: Kraken

Kraken is easier if you are just starting out in crypto. The platform lets you fund an account with a bank card, complete KYC, and buy BTC or ETH right away. There is no need to deal with networks, bridges, or wallet mechanics. Everything happens inside the exchange.

If you’re an active derivatives trader

Choose: Hyperliquid

Hyperliquid is more appealing if you already trade futures and want access to new trading pairs that have not yet been listed on CEX platforms. Low fees, fast order book performance, and solid depth on top pairs make it suitable for opening and closing positions within minutes. You trade via a crypto wallet and continue to manage margin directly.

If you mainly want a spot portfolio with fiat access

Choose: Kraken

Kraken works well for spot trading. The exchange offers hundreds of coins and the Kraken Pro terminal. In our test, we funded the account with euros and dollars and built a portfolio of BTC, ETH, and altcoins. All fees are visible upfront, and trades do not depend on network congestion or bridge availability.

If you want low fees and on-chain leverage

Choose: Hyperliquid

If the goal is the lowest possible leveraged trading costs and direct on-chain execution, Hyperliquid offers more freedom. You control your wallet, choose leverage, and trade without a centralized intermediary. In return, you need to monitor funding rates, margin levels, and protocol-level technical risks. Here, that is part of the daily workflow, not something you can ignore.

How we tested Kraken vs Hyperliquid

We evaluated both platforms using the same GNcrypto methodology, so the Kraken vs Hyperliquid comparison is consistent across all sections.

GNcrypto relies on a single rating framework built around seven pillars: liquidity & volume, fees & total cost, asset selection & trading pairs, execution quality, tools & order controls, fiat access & minimum trade size, reliability & transparency.

Each pillar is converted into a 1.0–5.0 star score in 0.1-point steps and then rolled into an overall rating (3.6 for Kraken, 4.2 for Hyperliquid). For both platforms, we started with public data: fee schedules, supported markets, status pages, proof-of-reserves or protocol documentation, security materials and regulatory disclosures. Then we added hands-on testing: on Kraken we opened an account, passed KYC, funded it with fiat and crypto and placed live spot orders in Kraken Pro; on Hyperliquid we connected a wallet, bridged funds to the exchange, opened and closed perpetual positions with leverage and tracked commissions, funding and execution quality.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.