Kraken futures 2026: platform review for beginner and experienced traders

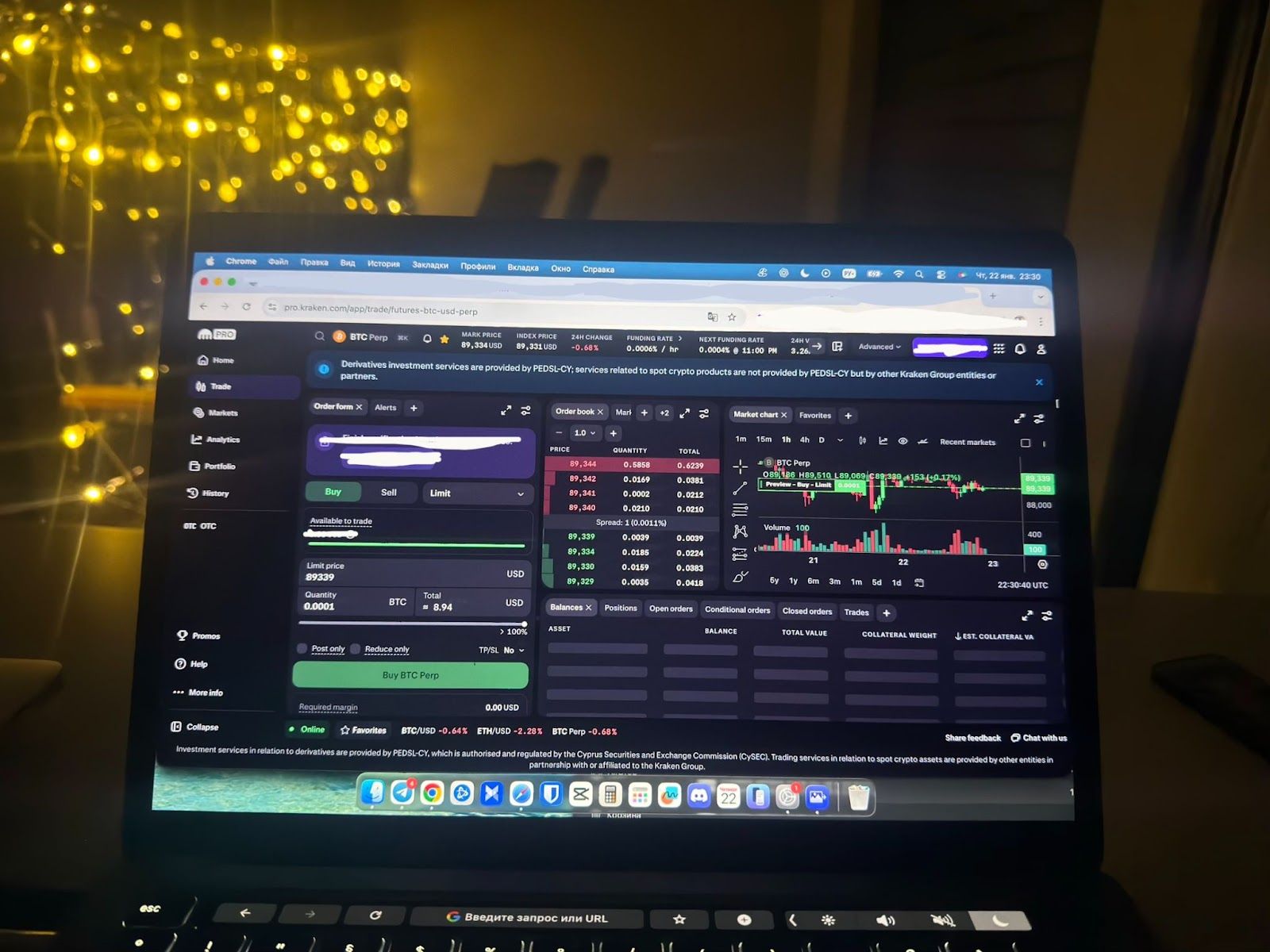

GNcrypto conducted live futures trades on Kraken Futures to evaluate fees, available leverage, order execution, and overall usability. We also reviewed liquidity across major trading pairs, contract selection, and key trust signals, resulting in a final rating of 4.1/5.

Fees & Funding

4.5/5

Leverage & Margin

4.5/5

Fees & Funding

4.2/5

Leverage & Margin

4.2/5

Fees & Funding

4.2/5

Leverage & Margin

4.3/5

Fees & Funding

4.4/5

Leverage & Margin

4.2/5

Fees & Funding

4.5/5

Leverage & Margin

4/5

Kraken Futures is a centralized exchange for trading perpetual futures on over 95 cryptocurrencies, including BTC and ETH. We deposited $200 and opened positions with leverage of up to 50×. Order execution was fast, trading fees ranged from 0.02% to 0.05%, and stop-losses, take-profits, and trailing orders worked flawlessly. There was no noticeable slippage on major trading pairs. The interface is complex and not particularly beginner-friendly, and mobile trading requires two separate apps: Kraken and Kraken Pro. All positions are secured with 2FA and the EPP process. Overall, the platform is best suited for experienced traders who value advanced order flexibility and low fees.

Exploring Kraken futures

We tested Kraken Futures and immediately noticed that it’s not just a standalone exchange, but part of the broader Kraken ecosystem, where spot trading, staking, margin trading, and futures are all available in one place.

Traders are drawn to Kraken Futures by the wide range of order types, which allow for highly flexible position management. The platform supports limit and market orders, stop-loss and stop-loss limit orders, take-profit and take-profit limit orders, as well as trailing stop and trailing stop limit orders.

In practice, this makes it possible to plan entry and exit strategies in advance, automate profit-taking, and limit losses without the need for constant market monitoring.

Another key feature is leverage of up to 50×, which allows traders to control larger positions with less capital. At the same time, this significantly increases risk, so beginners should approach leveraged trading with caution.

Kraken Futures is also convenient thanks to its seamless integration with Kraken Pro. There’s no need to switch between different interfaces – account data, balances, and open orders are all accessible in one place. Overall, the platform feels reliable and is suitable both for beginners willing to learn futures trading and for experienced traders looking for advanced tools.

Kraken futures fees & order types

We looked into Kraken Futures trading features, including how the platform handles fees and the types of orders it offers.

Fees:

Maker fees start at 0.02% per trade, while taker fees begin at 0.05%. For high trading volumes, fees can be reduced to almost zero – down to 0% for makers and as low as 0.01% for takers. These are among the most competitive rates in the futures market.

Order types:

Kraken Futures stands out for its wide range of order types, which is especially important for active trading and effective risk management.

- Market Orders execute instantly at the best available price. They’re useful when speed is critical, such as during sudden market movements, allowing traders to enter or exit positions without delay.

- Limit Orders let you set your own price. The order will only execute at the specified price or better, which is helpful for precise entries and reducing trading fees.

- Stop-Loss Orders automatically close a position when the price moves against you, helping limit losses without constantly monitoring the chart.

- Stop-Loss Limit Orders provide a more precise version of a stop order, allowing you to set the exact execution price once the stop level is triggered.

- Take-Profit Orders lock in gains when the price reaches a predefined level.

- Take-Profit Limit Orders allow you to close a position at a predetermined price rather than at market, giving more control over execution.

- Trailing Stop Orders “follow” the price, moving with the market to help capture profits during strong trends.

- Trailing Stop Limit Orders combine the trailing stop mechanism with limit execution, offering greater precision and control over your trades.

In practice, this comprehensive set of order types allows traders to plan their trade strategies in advance and avoid having to react manually to the market at every turn.

Final thoughts on Kraken futures

Traders often ask: is Kraken good for futures trading? Based on our testing, Kraken Futures is a platform designed for those who want to trade futures safely and with full transparency.

Who it’s for:

- Beginners who are willing to learn about order types and risk management

- Experienced traders who need access to a wide range of contracts and high leverage

- Anyone who wants everything in one interface with Kraken Pro

Strengths:

- Secure and Reliable: During testing, a position with 20× leverage was automatically closed by the EPP system before it could reach a negative balance.

- Accepts Fiat Currencies: You can fund your account directly in USD, EUR, or GBP – we tested a transfer from the spot wallet, and the funds arrived within seconds.

- Lots of Trading Options: We simultaneously held BTC and ETH, opening both long and short positions – the platform handled everything without delays or errors.

- Reputable Exchange: Kraken has been operating since 2011 and has a proven track record, which builds trust.

Weaknesses:

- Regional Restrictions: Currently, access to the platform is limited for users from Afghanistan, Belarus, Cuba, the Democratic Republic of Congo, Iran, Iraq, Japan, Libya, North Korea, Russia, Sudan, South Sudan, and Syria.

- Challenges for Beginners: During our first use of a limit order with isolated margin, a partial execution occurred, highlighting the need for careful monitoring.

- Two Separate Apps: Kraken has two separate mobile applications instead of a single one: the basic Kraken app and the more advanced Kraken Pro. Futures trading is only available in Kraken Pro, while the main app focuses on spot trading and basic operations. This is a drawback for users expecting an all-in-one experience – they need to navigate two versions and install a separate app specifically for futures trading.

- Unstable App Performance: When we installed Kraken Pro on both iOS and Android, we noticed lag on both platforms, which made placing orders inconvenient. Glitches and malfunctions were observed during trading, including unresponsive buy/sell buttons or the need to restart the app multiple times to execute an order.

- Weak Support: We submitted a ticket regarding a failed order, and it has yet to receive a response.

- Unintuitive Interface: While using the exchange, we found the Kraken Futures interface far from intuitive. Even basic actions, such as adjusting leverage, require time and attention – the necessary settings are hidden in non-obvious locations and can easily be missed on the first attempt.

Trustworthiness check

We looked into Kraken’s reliability and tested how safe it is to use the platform.

In 2024, a notable incident occurred: a bug in the system allowed approximately $3 million to be withdrawn from the exchange’s fund. The good news is that users’ funds were not affected, and Kraken promptly fixed the issue. The team responded quickly and professionally, which inspires confidence.

Security:

- Two-factor authentication (2FA) is mandatory.

- The EPP system prevents margin positions from going negative – in practice, you won’t lose more than your initial investment, even if the market moves sharply against you.

Risks:

- Phishing and DDoS attacks remain potential threats to user accounts.

- It is crucial to enable 2FA, use a unique password, and be cautious with links.

- Occasionally, users report slow support when suspicious logins occur, so it’s recommended to monitor your account regularly.

GNcrypto’s overall rating

| Criteria | Rating (out of 5) | Weight | Notes |

|---|---|---|---|

| Trading Fees & Funding Costs | 4.5/5 | 25% | Fees are low (maker 0.02%, taker 0.05%), with possible discounts for high trading volumes. There are no hidden charges or gas fees. |

| Leverage & Margin Requirements | 4/5 | 20% | Leverage of up to 50× is available, with both isolated and cross margin options. Beginners should exercise caution when taking large positions. |

| Contract Selection & Liquidity | 4.4/5 | 15% | Over 95 perpetual futures are available, with high liquidity for popular pairs like BTC and ETH. Less liquid pairs may experience slippage. |

| Platform Performance & Risk Controls | 4/5 | 15% | Orders are executed quickly, and the interface is stable. The EPP system protects against negative balances, and there are few restrictions on stop order types. |

| Security & Regulatory Compliance | 3.5/5 | 10% | Two-factor authentication (2FA), cold wallets, and the EPP system are in place. Kraken does not officially provide licenses or proof-of-reserve statements. In 2024, a bug occurred but was fixed promptly without any loss to users. |

| User Experience & Trading Interface | 4/5 | 10% | The interface is not particularly user-friendly: key settings, including leverage and order parameters, are not intuitively placed, and the default chart layout is quite compact. Beginners will need time to get accustomed to it, and even experienced traders will need some time to adapt. |

| Customer Support & Educational Resources | 4/5 | 5% | Customer support is available 24/7, though responses are not instantaneous. Educational materials are provided, but they are somewhat limited. |

Final Score: 4.1/5

Our verdict: Kraken Futures is suitable for both experienced traders and beginners with basic knowledge. The platform attracts users with low fees, fast order execution, and extensive leverage options.

Methodology – Why You Should Trust Us

We tested Kraken Futures using our weighted, category-based model, depositing $200 in BTC and opening leveraged positions (10x-50x) on BTC/USD and ETH/USD perpetuals. We monitored funding rates over 5 days, tested stop-loss execution during volatility, measured spreads during US and Asia trading hours, and withdrew funds to verify processing times. We rate platforms on 7 weighted criteria with scores from 1.0 to 5.0. Our testing uses real capital, not demo accounts.

Read our full methodology: How We Test Crypto Futures Trading Services

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.