Kalshi or PredictIt in 2026: fees, access, and rules compared

Prediction markets are picking up a lot of new users in 2026, but the experience can be surprisingly different. We compared Kalshi and PredictIt to map where the real friction shows up before you even place your first trade.

Kalshi reads like a regulated, USD-first event market, which can be easier to trust and reason about, but eligibility can be tighter due to jurisdiction limits. PredictIt feels more like a politics-first forecasting venue with centralized resolution and fee friction that shows up when you cash out.

We stress-tested the cost model with a simple $200 scenario. If you finish $50 ahead on PredictIt, a 10% profit fee trims that profit by $5 (balance $245). If you withdraw the full $245, a 5% withdrawal fee is $12.25, so you receive $232.75 (net profit: $32.75). On Kalshi, using debit can add a 2% funding fee, or $4 on $200, before you even place a trade. The table below shows how each platform scores across our categories.

GNcrypto’s overall Kalshi vs PredictIt rating

| Category | Kalshi | PredictIt | Winner |

|---|---|---|---|

| Market Selection & Coverage | 4.0 | 4.7 | PredictIt |

| Liquidity & Volume | 4.0 | 4.4 | PredictIt |

| Fees & Total Cost | 5.0 | 3.2 | Kalshi |

| Resolution Quality & Speed | 5.0 | 4.8 | Kalshi |

| Market Pricing Efficiency | 4.0 | 3.9 | Kalshi |

| Regulatory Compliance & Access | 5.0 | 4.7 | Kalshi |

| Deposit/Withdrawal Methods | 4.0 | 4.0 | Tie |

| Tools & User Experience | 4.0 | 4.4 | PredictIt |

| Total Score | 4.5 | 4.3 | Kalshi |

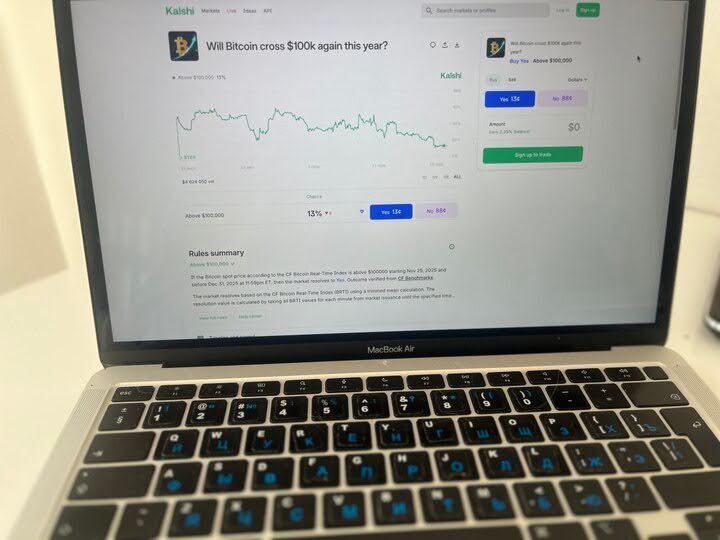

How Kalshi operates as a regulated event market

Kalshi is a U.S. event contracts exchange that operates under CFTC oversight, which matters for users because the platform is built around formal rulebooks, defined contract terms, and a documented dispute and outcome process. In a PredictIt vs Kalshi comparison, this is the clearest “regulated, USD first” model.

Mechanically, you are trading simple Yes or No contracts that settle at $1 or $0 once the outcome is confirmed by the market’s stated source. Prices behave like implied probabilities: if a contract is trading around $0.60, we read that as roughly 60% odds. You can enter and exit before settlement by buying or selling in the order book, where you will see a bid and an ask.

We walked through the typical flow a new user would follow: pick a market, open the market page, read the contract terms (especially the resolution source and settlement timing), then choose how to place an order. For most beginners, the practical choice is a limit order instead of a market order, because a market order can cross a wide spread on thinner markets and lock in an unnecessary loss.

Action steps for beginners

- Before you fund, check the Member Agreement and access rules for restricted jurisdictions and product limitations, so you do not get stuck mid-onboarding.

- Start with one highly liquid, headline market and place a small limit order, then watch how the bid and ask move before sizing up.

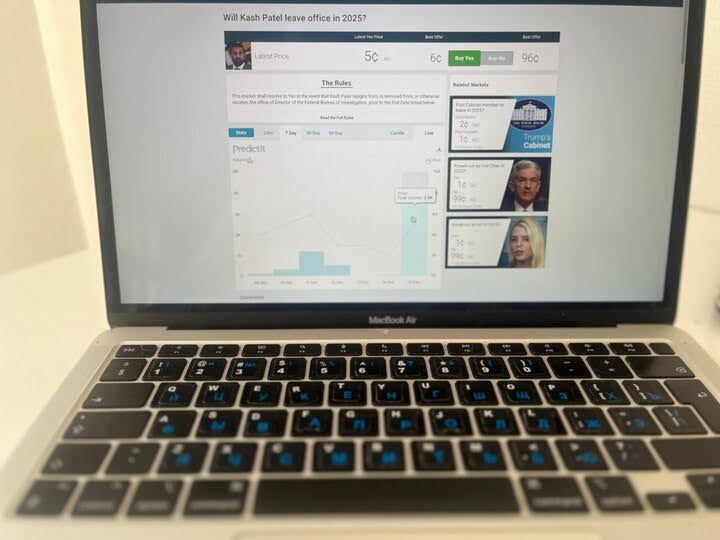

How PredictIt approaches political forecasting

PredictIt is politics first. Most markets are built around U.S. elections, nominations, and vote counts, and the mechanics stay simple: you buy Yes or No contracts that trade between $0 and $1 and settle to $1 if you are right and $0 if you are wrong. We treat the price as an implied probability, so a contract trading at $0.58 reads like about 58%.

The onboarding flow feels closer to a traditional website than a crypto-style app. There’s no wallet setup, which lowers technical friction, but it introduces rules friction instead: platform fees, withdrawal limits, and very specific market resolution wording. According to platform materials and the platform history, PredictIt operates under a CFTC no-action framework (updated in 2025), which sets operating conditions and investment-style guardrails for the market. The trade off is that outcome decisions remain centralized, so the market rules on the page matter a lot.

We ran the numbers on a beginner-sized scenario to show how fees bite. Suppose you start with $200 and end up $50 ahead. A 10% profit fee reduces that $50 profit by $5, so your balance becomes $245. If you withdraw the full $245, a 5% withdrawal fee is $12.25, so you receive $232.75 (net profit: $32.75). If you withdraw only the $45 profit and keep the $200 on-platform, 5% takes $2.25 and you receive $42.75.

Action steps for beginners

- Open the market page and read the resolution criteria like a mini contract. If the wording is subjective or the source is unclear, skip it.

- Plan withdrawals around the fee and the post-first-deposit hold period, so you are not surprised by timing or cost.

If you are deciding between Kalshi or PredictIt, PredictIt makes sense if you want a politics-focused option with a traditional account feel and structured guardrails, even if total costs run higher.

Key differences between Kalshi and PredictIt

Kalshi and PredictIt both let you trade simple Yes or No event contracts, but the experience is different because they are built for different kinds of users.

Regulation and structure. Kalshi operates like a regulated U.S. venue with formal rulebooks, required identity checks, and USD-first funding paths. PredictIt is much more politics-first and runs inside a CFTC no-action style perimeter with structured limits and rules, but it is still a more centralized setup from a user perspective.

Where the friction shows up. We used a $200 test to understand how timing affects real costs. If you fund Kalshi by debit and the fee is 2%, you effectively start at $196 before you even place a trade. PredictIt can feel cheaper on the way in, but it can charge on the way out. We ran the numbers on a small win: if you make $20 in profit, the 10% profit fee leaves $18. If your post-trade balance is $218 and you withdraw it, a 5% withdrawal fee is $10.90, so you receive $207.10 (net profit: $7.10).

Resolution model. For new users, the biggest mindset shift is how outcomes get finalized. Kalshi is more rulebook-driven with a documented review process, while PredictIt resolution is ultimately centralized to the platform, so the market page criteria matters a lot.

Access reality check. Kalshi has explicit jurisdiction and state-level constraints, and PredictIt access and rules have also changed over time under its regulatory framework. Beginners should treat eligibility as step zero.

The real choice between Predictit or Kalshi is where you want your friction to live: upfront funding and exchange-style structure, or later-stage fees and centralized resolution on politics-heavy markets.

Kalshi vs PredictIt comparison – which should you choose?

If you are new to prediction markets, we think the right pick comes down to two practical questions: how you want to fund your account, and what kind of markets you actually plan to trade.

If you want a regulated, rulebook-first venue with USD rails

Choose: Kalshi

Kalshi is designed as a regulated U.S. event market, which can be easier to trust if you want clear contract terms, a stated resolution source, and a formal review process. The trade-off is that access can be tighter. The platform lists restricted jurisdictions, so for some users this is a hard stop before fees even matter.

If you mainly want U.S. politics depth and are fine paying for it

Choose: PredictIt

PredictIt is politics-first, so it can feel more purpose-built when your entire strategy is elections, nominations, and vote-count markets. The cost trade-off is real. In a $200 test, a $50 win shrinks to $32.75 after profit and withdrawal fees if you cash out fully, or $42.75 if you withdraw only profits. That’s why we see PredictIt as a platform for fewer, higher-conviction political trades rather than frequent turnover.

If you plan to trade often and take small profits

Choose: Kalshi

Small edges survive best when friction is low and predictable. PredictIt clips small wins by design, so repeated exits compound the drag. Kalshi can still charge explicit fees, but you can control where they show up. We stress-tested the cost model with a $200 example: if you fund by debit and the fee is 2%, you lose $4 upfront. If you instead use bank rails that are listed as fee-free, you start at the full $200 and your main costs become spread plus the trading fee on your executions. This is also where limit orders matter: lowering execution friction is often more important than chasing a “perfect” forecast.

If you want the simplest web-style experience and are fine making fewer trades

Choose: PredictIt

If you do not want to manage wallets or think about deposit methods, PredictIt can feel more like a straightforward web account, with the key work happening on the market page itself. The practical expectation is that you should trade less and plan around the withdrawal fee and the post-first-deposit hold period, so timing does not surprise you when you want your money back.

Methodology – why you should trust us

We use a weighted, category-based model and combine public data with hands-on checks to rate prediction market platforms on a 1.0–5.0 scale (in 0.1 steps). Our focus is practical trading quality: fees, liquidity, access, how outcomes get resolved, and the day-to-day user experience.

How we collect data

- Public sources: fee pages, market lists, platform rules/resolution criteria, access and compliance disclosures, and official regulatory documents where relevant.

- First-hand checks: we place test trades, look at effective costs (fees + spreads), and review how easy it is to place, exit, and track positions.

We do not audit balance sheets or guarantee solvency. These ratings reflect usability, market quality, and how reliably a platform resolves outcomes – not whether it will exist forever.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.