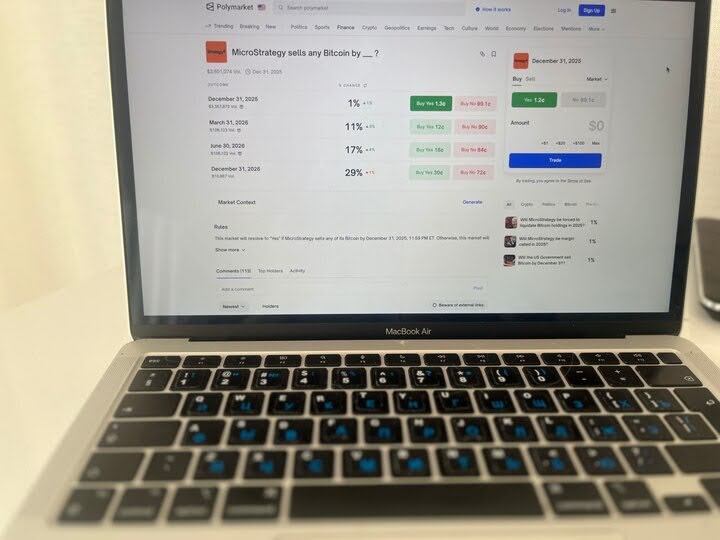

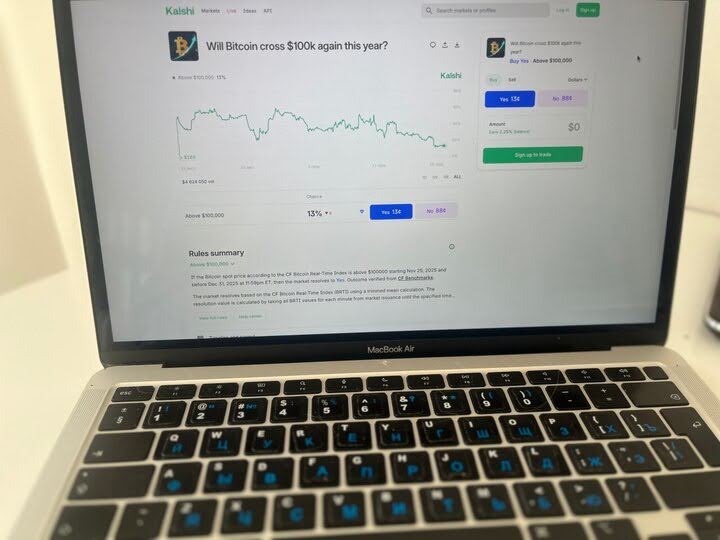

Polymarket vs Kalshi comparison 2026: fees, access, liquidity, and key risks

Choosing between Kalshi and Polymarket in 2026 is mostly about rails and friction. One is regulated and USD first, the other is crypto native and fast. We ran the numbers on a trade to show what fees, spreads, and access rules can really cost you before you click Buy.

We stress-tested the typical beginner path on both platforms, and the trade-offs are clear. Polymarket tends to feel cheaper and faster if you are comfortable with crypto rails (USDC, a wallet, and sometimes bridging), because your main friction is usually the spread. Kalshi feels more like a regulated, USD-first exchange, which can be easier to trust and reason about, but costs can show up more explicitly and access is tighter.

We ran the numbers on a simple $200 scenario. On Polymarket, a $0.60 bid and $0.62 ask is $0.02 of friction per contract, or $2 on 100 contracts. On Kalshi, if you use debit, a 2% funding fee would cost $4 upfront, and an immediately matched 100-contract trade around $0.60 can add about $1.68 in trading fees (before spread). Add the eligibility reality check too: Kalshi lists restricted jurisdictions, including Ukraine. The table below shows how each platform scores across our categories.

Polymarket vs Kalshi at a glance

| Category | Polymarket | Kalshi | Winner |

|---|---|---|---|

| Market Selection & Coverage | 5.0 | 4.0 | Polymarket |

| Liquidity & Volume | 5.0 | 4.0 | Polymarket |

| Fees & Total Cost | 5.0 | 5.0 | Tie |

| Resolution Quality & Speed | 4.8 | 5.0 | Kalshi |

| Market Pricing Efficiency | 4.8 | 4.0 | Polymarket |

| Regulatory Compliance & Access | 4.5 | 5.0 | Kalshi |

| Deposit/Withdrawal Methods | 4.7 | 4.0 | Polymarket |

| Tools & User Experience | 4.2 | 4.0 | Polymarket |

| Total Score | 4.8 | 4.5 | Polymarket |

How Kalshi and Polymarket work

Kalshi and Polymarket both let you trade simple Yes or No outcomes, but the “plumbing” behind each trade is different. In both cases you are buying a contract (or share) that settles to $1 if the outcome is true and $0 if it is false. The market price is best read as an implied probability, not a guarantee. A contract trading at $0.62 is basically saying the crowd is pricing the outcome around 62%, and that number can move fast when news hits or when liquidity is thin.

We walked through the typical flow a new user would follow on both platforms:

- Pick a market you actually understand.

- Open the market rules and confirm what counts as “true” and which source decides it.

- Check the bid and ask to see the spread.

- Place a limit order (so you control your entry price).

- Either sell before settlement or hold to the final outcome.

We ran the numbers on a beginner-sized trade to sanity-check the payout. Buy 100 Yes shares at $0.62 and your cost is $62. If the outcome resolves true, you receive $100 at settlement, so your profit is $38 before spread, fees, and any network or payment costs.

According to public documentation, Polymarket is crypto-native: positions settle in USDC, and outcomes are typically resolved via an oracle process commonly described as UMA’s Optimistic Oracle with an on-chain dispute path. Kalshi is an exchange-style U.S. venue with a clearer rulebook-driven structure and USD rails, which many beginners find easier to reason about.

Action steps we would recommend for a first-time trader:

- Prefer objective markets tied to official results, timestamps, or hard metrics.

- Start small and use limit orders, especially if you are deciding between Polymarket or Kalshi.

Key differences between Kalshi and Polymarket

Both platforms let you trade Yes or No outcomes, but they run on different rails. In practice, that changes how fast you can fund, what you pay to trade, and how comfortable the resolution process feels.

Polymarket runs on crypto rails. You typically fund with USDC, place trades instantly, and your biggest day-to-day cost is not a posted fee but the spread and slippage. Some products can also apply taker-style fees, most notably 15-minute crypto markets, so it is worth checking the specific market page before you trade. We stress-tested the cost model with a simple spread example: if the bid is $0.60 and the ask is $0.62, the spread is $0.02. On 100 contracts, that is $2 of friction before you even consider whether you are right.

Kalshi runs on regulated USD rails. The upside is a clearer rulebook-style structure, but costs are more “visible” and access is tighter. For example, Kalshi publishes a fee schedule (maker versus taker style), and certain funding methods add explicit charges.

We ran the numbers on a $200 beginner deposit: if you use debit, a 2% fee would cost $4 upfront. Kalshi can also add an explicit trading fee: at roughly a $0.60 price on 100 contracts, the published fee table shows about $1.68 in trading fees (fees can vary by market and execution), which is why we like using limit orders when possible.

Kalshi also lists restricted jurisdictions, so some readers simply cannot use the platform under its own rules.

Resolution style is another real difference. Based on public docs and widely reported platform history, Polymarket outcomes are typically described as going through UMA’s Optimistic Oracle with an on-chain dispute path. We think that transparency is a plus, but beginners should still avoid subjective wording where the community can argue what counts as true. Kalshi ties markets to defined terms and sources, and its rulebook describes a formal outcome review process, which can feel more predictable when the market question is tightly written.

Action steps we would recommend:

- Pick your platform based on your rails and eligibility first: USDC comfort points you toward Polymarket, while regulated USD rails point you toward Kalshi, if you are allowed to access it.

- Before every trade, do a 10-second cost check: fees (if any) plus spread, then use limit orders on any market where the spread looks wide.

In this Kalshi vs Polymarket comparison, we walked through the typical beginner decision path: access first, then total friction (fees plus spread), then only clear-resolution markets.

Market size, users & volume

When people talk about “size” in prediction markets, the headline numbers can be distracting. We walked through what a beginner actually needs to see on the screen to avoid getting stuck: tight spreads, visible depth, and a clean exit path.

Polymarket is often described as the largest venue on major headlines, which usually means more two-way trading and quicker price updates on the most popular markets. At the same time, public reporting has raised questions about volume quality in crypto-native venues, so we treat big volume stats as directionally useful, not perfect ground truth. In practice, the beginner signal is simpler: do bids and asks stay close together when news hits, and can you get filled without chasing the price.

Kalshi can show very strong activity in peak moments, but liquidity is not uniform. We stress-tested a “long tail” mindset with one rule: if you see no bids or asks (an empty order book), it is effectively untradeable right now. Even when there are offers, thin markets can have wide spreads, so your entry price matters more than your prediction.

We ran the numbers on a quick spread check. If bid is $0.48 and ask is $0.52, the spread is $0.04. On 100 contracts, that is $4 of friction on entry before any edge. On a small $50–$100 beginner position, that can erase the profit you expected from a “good call.”

Action steps we would recommend:

- Do a 10-second liquidity check before every trade: look at bid/ask, then scan the nearest depth. If the spread is wide or you see no bids/asks (an empty book), skip the market.

- Start with high-activity markets and use limit orders. If you need to exit, scale out in smaller chunks instead of forcing a single big market order.

When you hear debates about Kalshi vs Polymarket volume, we think the practical takeaway is this: trust what you can observe (spread and depth), and trade where you have a realistic path to enter and exit at fair prices.

Polymarket vs Kalshi comparison – which should you choose?

If you are new to prediction markets, we think the right pick comes down to two practical questions: how you want to fund your account, and what kind of markets you actually plan to trade.

If you want the lowest explicit costs and the widest range of markets

Choose: Polymarket

Polymarket is usually the better fit if you are comfortable using USDC and a wallet. According to public docs, most markets have no platform trading fees and no platform deposit or withdrawal fees, so your main cost is spread and slippage. We ran the numbers on a simple spread check: a $0.60 bid and $0.62 ask is $0.02 of friction per contract, or $2 on 100 contracts.

If you want regulated USD rails and a rulebook-style structure

Choose: Kalshi

Kalshi is built for U.S.-style, regulated event trading with card and bank rails, which many beginners find easier to understand than wallets and bridging. The trade-off is that costs can be more explicit and access can be tighter. We walked through the eligibility reality check first: if you are in a restricted jurisdiction (Kalshi’s member agreement lists Ukraine), you should treat that as a hard stop.

If you plan to trade often and take small profits

Choose: Polymarket

Small edges survive best when the friction is low. We stress-tested a beginner-sized $200 path: a 2% debit funding fee would cost $4 upfront on Kalshi, and an immediately matched 100-contract trade around $0.60 can add about $1.68 in trading fees, before you even consider the spread. If you expect to enter and exit frequently, that extra drag matters.

If you want the simplest onboarding and are fine with making fewer, higher-conviction trades

Choose: Kalshi

If you prefer a traditional account flow, Kalshi can feel more familiar than managing a wallet and stablecoins. The practical expectation is that KYC and bank rails can slow you down, so we would treat it as a “pick your spots” platform: trade fewer markets, focus on the most liquid contracts, and plan ahead for funding and withdrawal timing.

Methodology – why you should trust us

We use a weighted, category-based model and combine public data with hands-on checks to rate prediction market platforms on a 1.0–5.0 scale (in 0.1 steps). Our focus is practical trading quality: fees, liquidity, access, how outcomes get resolved, and the day-to-day user experience.

How we collect data

- Public sources: fee pages, market lists, platform rules/resolution criteria, access and compliance disclosures, and official regulatory documents where relevant.

- First-hand checks: we place test trades, look at effective costs (fees + spreads), and review how easy it is to place, exit, and track positions.

We do not audit balance sheets or guarantee solvency. These ratings reflect usability, market quality, and how reliably a platform resolves outcomes – not whether it will exist forever.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.