Jump Trading acquires stakes in Kalshi and Polymarket

Jump Trading will receive equity stakes in Kalshi and Polymarket in exchange for providing liquidity, expanding its influence over the largest prediction markets.

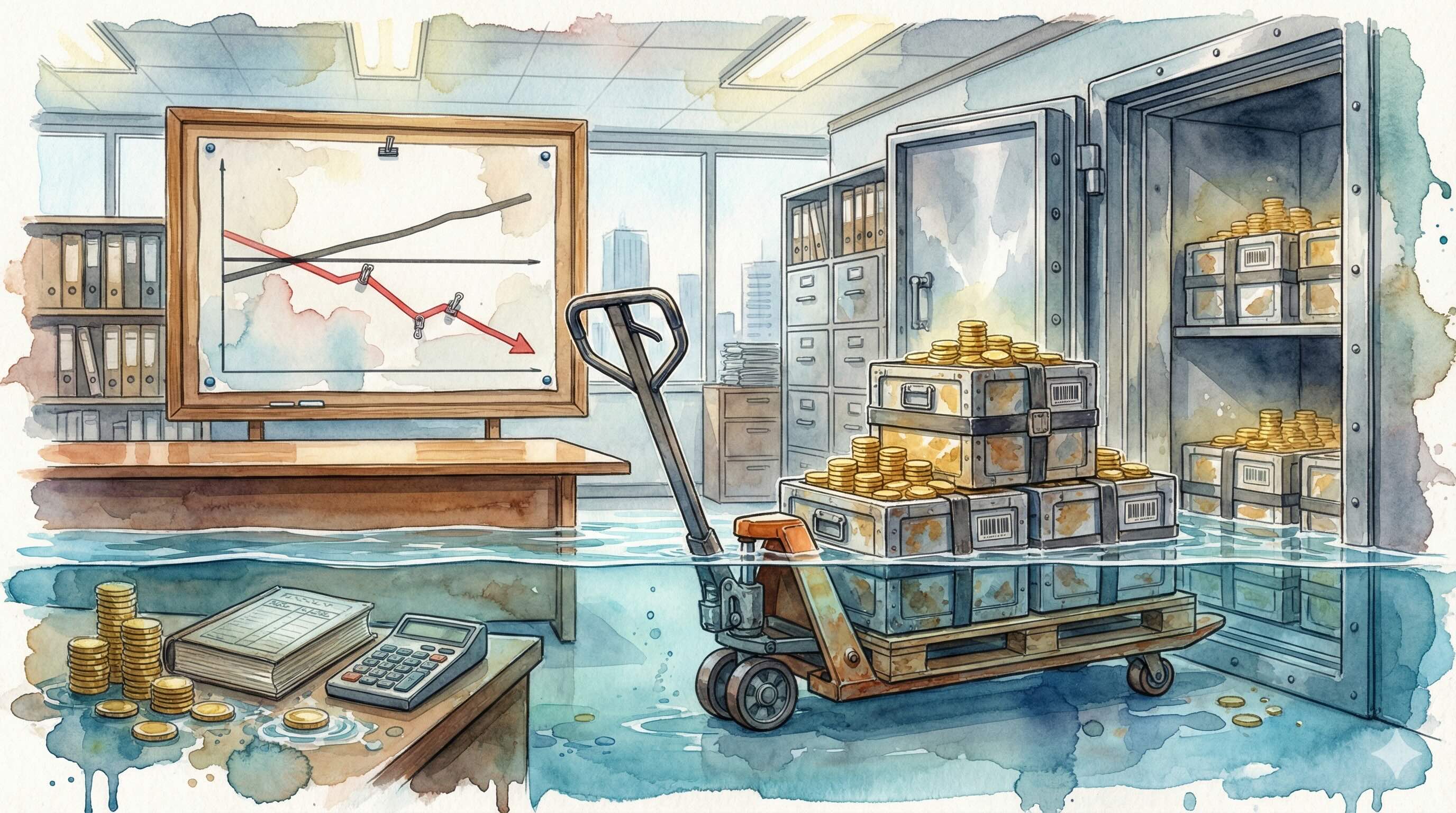

Jump Trading is set to acquire stakes in two of the largest prediction market platforms – Kalshi and Polymarket – under agreements in which the firm will supply liquidity to their markets. The structure departs from standard market-making models: instead of fixed fees, Jump receives equity. In Kalshi’s case, the stake has already been determined, while its share in Polymarket will depend on the amount of liquidity ultimately provided.

Both platforms have seen rapid growth. Kalshi has recently reached multibillion-dollar trading volumes and is approaching an $11 billion valuation. Polymarket – which relies on fully on-chain settlement – is valued at roughly $9 billion. Their rise reflects the broader boom in prediction markets, where users trade contracts tied to political, economic, and cultural outcomes.

For Jump, the deals mark a deeper move into a young but fast-expanding sector. The firm has assembled a team of more than 20 traders and engineers focused on event-driven markets and the automation of supporting infrastructure, positioning Jump as one of the most technically advanced liquidity providers in the space.

Prediction markets are enjoying a surge in popularity despite a heavy regulatory backdrop. They are increasingly viewed not only as speculative venues but also as tools for measuring collective expectations – from elections to major sporting events. Liquidity shortages remain one of the biggest constraints on platform growth, making the arrival of a player of Jump’s scale a significant boost.

Institutional investors see these developments as a signal of the sector’s continued maturation. Deals in which a major trading firm receives equity stakes for providing liquidity may become a template for the future – blending capital, technology, and market-making in a structure that benefits both sides.

Jump’s growing involvement also aligns with a broader trend: institutional capital is steadily exploring event-outcome markets as a new class of digital assets. Amid weakness in the broader crypto market, this segment has emerged as one of the most dynamic and capital-intensive areas of growth.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.