JPMorgan launches the tokenized MONY money market fund on Ethereum

JPMorgan has introduced its first tokenized money market fund, My OnChain Net Yield Fund (MONY), issued on the Ethereum blockchain. The product is launching through the Kinexys Digital Assets platform and marks one of the bank’s most significant steps toward tokenizing traditional finance.

The fund received an initial $100 million contribution from JPMorgan. Clients can subscribe to MONY in dollars or USDC and receive digital tokens representing their share of the fund. The product is aimed at high-net-worth and institutional investors that meet strict qualification thresholds.

The launch reflects rising demand for real-time, on-chain yield products. JPMorgan says the new class of on-chain instruments is attracting investors with faster settlement and greater operational efficiency.

Asset tokenization continues to gain ground as a strategic priority for major financial institutions. JPMorgan joins a growing list of firms developing similar products, including BlackRock and Goldman Sachs.

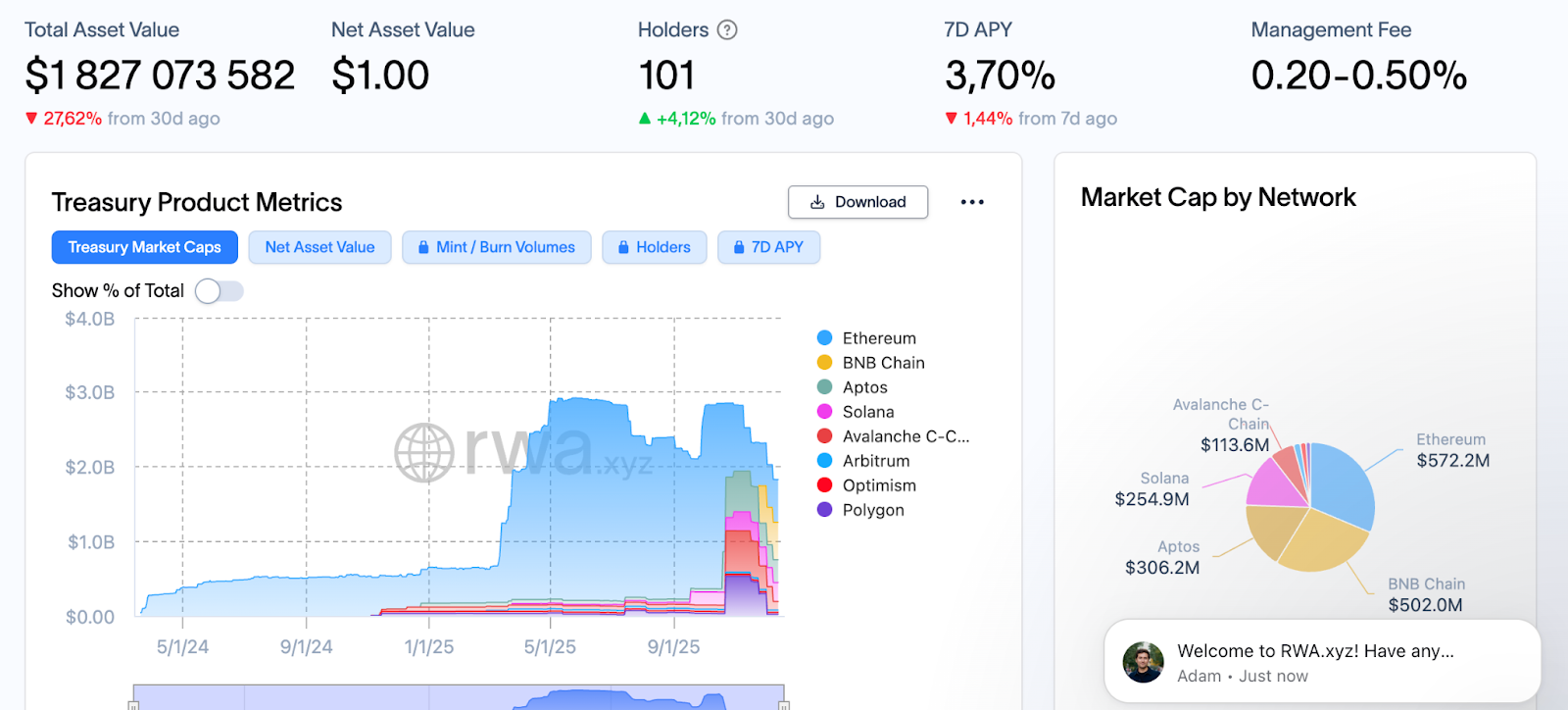

BlackRock’s progress is especially notable: its tokenized money market fund, BUIDL, has become the largest in the segment, reaching about $1.8 billion in assets under management by mid-December.

The infrastructure supporting tokenized treasury markets is expanding quickly, and MONY adds a new institutional player to that landscape.

Tokenized money market funds are emerging as a bridge between traditional finance and the on-chain economy. They offer blockchain benefits such as transparency, automation, and instant reporting while preserving regulated structures and traditional risk profiles.

The launch of MONY strengthens JPMorgan’s position as one of the most active institutional advocates for digital assets. The bank has spent years building its blockchain infrastructure and experimenting with tokenized deposits, settlement instruments, and debt products.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.