🚀 Is the "Santa Claus Rally" Skipping Crypto This Year?

posted 27 Dec 2024

Spanning the last five trading days of December and the first two of January, the “Santa Claus Rally” has often brought festive gains. This year, though, it seems to have taken a holiday itself.

Holiday cheer seems to be in short supply for the markets. So far, neither the S&P 500 nor Bitcoin has delivered the dramatic rally traders were hoping for. Instead, the crypto market saw a sharp downturn heading into the season.

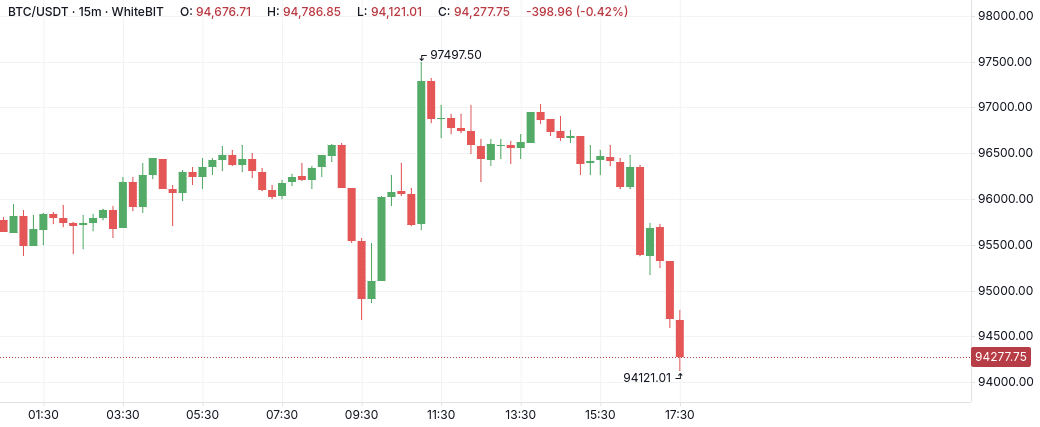

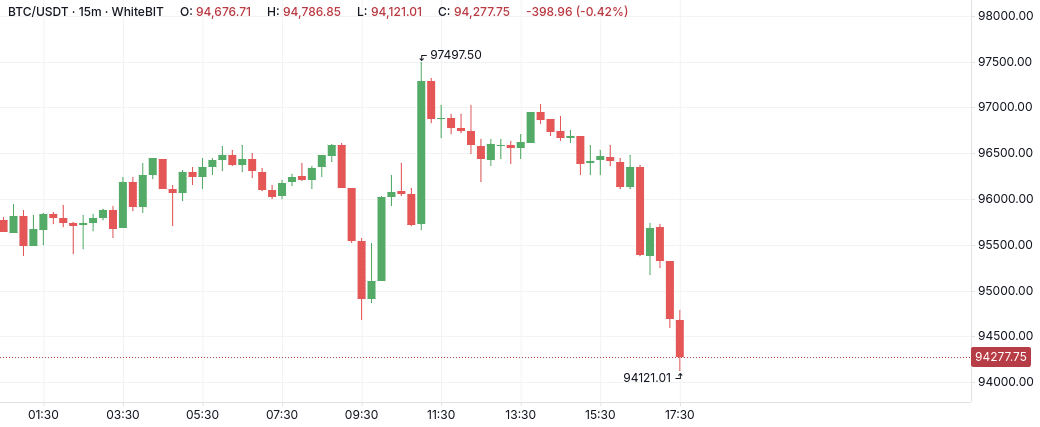

On December 27, Bitcoin fell below $95,000, and Ethereum slipped under $3,350.

Chart of BTC/USDT trading pair, 15-minute timeframe. Source: WhiteBIT

This market slump followed remarks from Federal Reserve Chair Jerome Powell, who delivered a hawkish message during a recent press conference. Taming inflation, it seems, remains a daunting task.

According to Nick Timiraos, chief economics correspondent for The Wall Street Journal, the Federal Reserve is grappling with a critical challenge: maintaining an apolitical stance toward President Trump’s agenda while preparing to counter any inflationary pressures his policies might induce.

The WSJ article reveals that the central bank initially planned four rate cuts but now expects only two reductions in 2025, followed by another two in 2026. This projection, of course, is flexible and could evolve as fresh data rolls in.

The expiration of cryptocurrency options on December 27 was a headline event, representing a combined volume of $18 billion. According to GeeksLive, 150,000 BTC options closed with a put-to-call ratio of 0.69, a Max Pain price of $85,000, and a notional value of $14.17 billion. ETH options for 1.12 million tokens concluded with a put-call ratio of 0.41, a Max Pain point of $3,000, and a notional value of $3.74 billion.