Is Bisq safe? The unfiltered truth about decentralized trading

Centralized exchanges promise safety through insurance and regulation, yet they fail repeatedly. Bisq promises safety through code and cryptography. We strip away the marketing to analyze the actual security model: is a decentralized escrow truly unbreakable, or are you just trading one risk for another?

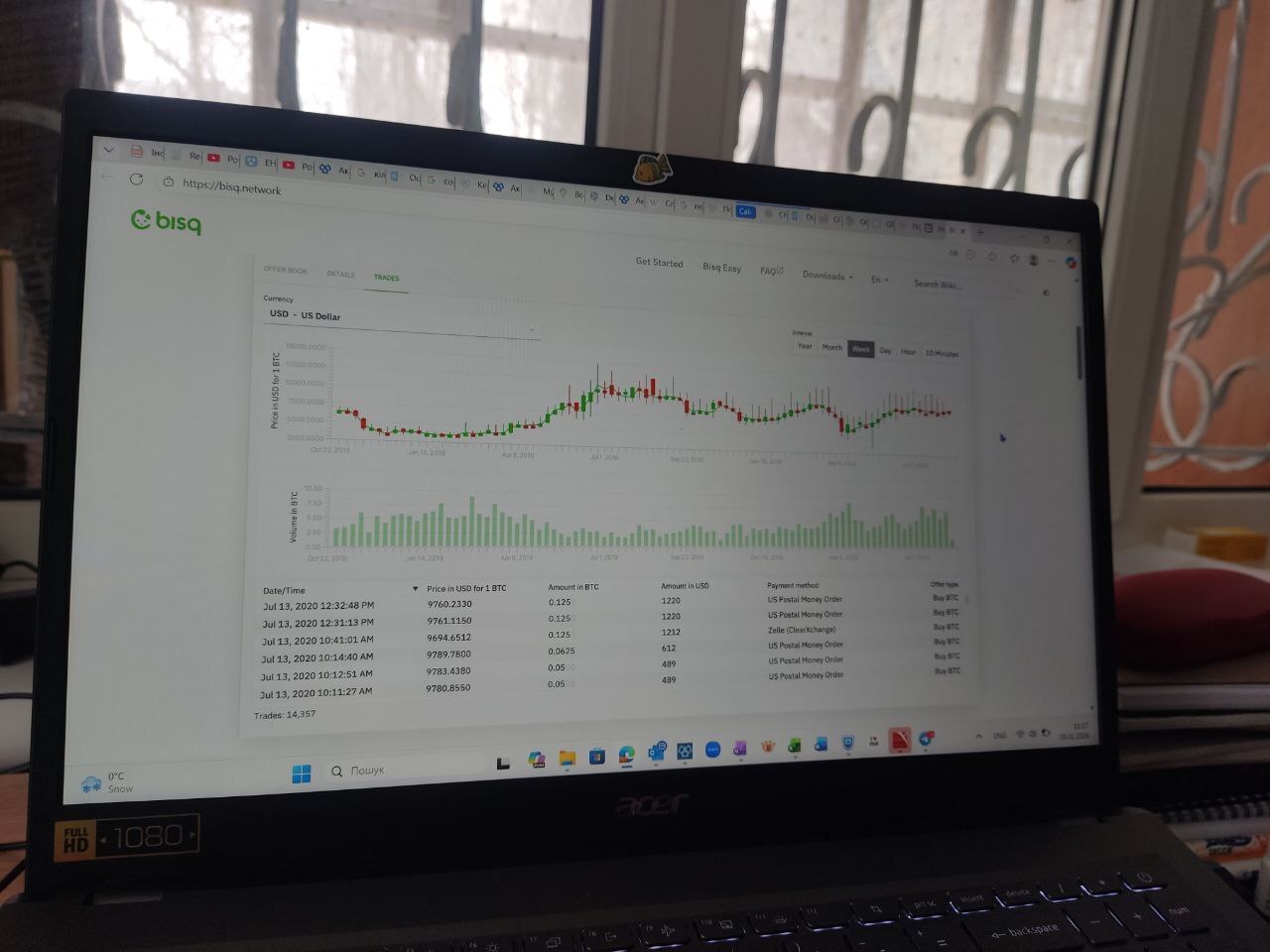

Liquidity & Volume

5.0

Payment Methods

4.0

Liquidity & Volume

4.0

Payment Methods

4.0

Liquidity & Volume

4.0

Payment Methods

4.5

Liquidity & Volume

3.5

Payment Methods

4.5

Liquidity & Volume

3.5

Payment Methods

3.5

Let’s be honest: using Bisq feels less like online banking and more like handling uranium. You know it’s powerful, you know it’s the “purest” form of the asset, but you also know that one slip-up with your private keys and it’s over. There is no “Forgot Password” button, no support ticket to file, and definitely no CEO you can sue if things go south.

For most traders, “safety” usually means having a company to blame. We look for licenses, audits, and insurance funds to make us feel secure. Bisq flips this logic entirely. It asks you to stop trusting companies and start trusting mathematics. The argument is compelling: a hacker cannot drain an exchange wallet if the exchange doesn’t have a wallet. A government cannot leak your passport data if the platform never asked for it.

But does this radical “zero-trust” model actually work in the real world? When we ask if the platform is secure, we aren’t talking about whether the app crashes. We are asking about the structural integrity of the escrow system. Can a mediator collude with a scammer to steal your funds? Is the code robust enough to withstand a directed attack? In this analysis, we are ignoring the user interface and liquidity to focus strictly on the armor. We want to find out if Bisq is the safest exchange in the world, or just the most dangerous one for the unprepared.

Platform overview and background

To understand why Bisq feels so different from a polished Silicon Valley startup, you have to look at its DNA. We dug into the history and found that this isn’t just a trading app; it’s a form of protest code. Founded in 2014 by Austrian developer Manfred Karrer (originally under the name Bitsquare), the project was born out of the chaos of the Mt. Gox collapse. The mission was simple but radical: build an exchange that cannot steal your money, because it doesn’t hold it.

Unlike modern exchanges that race to list the newest meme coin, Bisq has spent over a decade refining a single, robust mechanism for trading Bitcoin without a middleman. In 2017, it rebranded to Bisq to avoid trademark issues, and in 2019, it took the ultimate step in decentralization. Karrer stepped down from his leadership role, handing the keys over to the Bisq DAO (Decentralized Autonomous Organization).

Today, there is no “Bisq Inc.” to sue, no office to raid, and no CEO to pressure. The platform is maintained by a distributed network of coders and mediators who are paid in BSQ tokens, making it one of the few truly headless organizations in the crypto space. When we installed the software for this review, we weren’t just using an app; we were connecting to a decade-old, censor-proof network that runs entirely on its own momentum.

How Bisq handles security

If you are used to the “Fort Knox” model of centralized exchanges – where a company builds a massive digital vault and hires guards to protect it – Bisq will feel alien. Bisq’s security philosophy is simple: there is no vault to rob. Because the exchange is non-custodial software running on your own computer, there is no central “honeypot” of user funds for hackers to target.

Instead of trusting a company, Bisq forces you to trust mathematics. Every trade is secured by a 2-of-2 Multi-Signature (Multisig) escrow. When we initiated our test trade, our Bitcoin wasn’t sent to Bisq; it was sent to a shared address on the blockchain that required both our signature and the seller’s signature to release. This means that even if the Bisq developers wanted to steal our funds, they couldn’t – they simply don’t have the keys.

This architecture changes the answer to “is Bisq safe” from a question of corporate reputation to a question of protocol design. To prevent fraud, Bisq employs a “security deposit” system. Both the buyer and seller must lock up extra BTC (usually 15-50% of the trade amount) as collateral. If the seller tries to run off with your fiat without releasing the Bitcoin, they lose their deposit, making scamming mathematically unprofitable. Combined with the fact that all traffic is routed through Tor to hide your IP address and location, Bisq offers a level of privacy and security that no centralized platform can match – provided you don’t lose your own private keys.

Role of multisig escrow

On a standard exchange, “escrow” means the company holds your money and promises to give it back. On Bisq, “escrow” is a piece of code that doesn’t trust anyone – not even the platform itself. During our $200 test trade, this was the moment that felt the most distinct from a typical Coinbase experience. Instead of sending funds to a corporate wallet, the software generated a 2-of-2 Multi-Signature address unique to our specific trade.

This mechanism is the core answer to the skeptic’s question: is Bisq legit or just a risky experiment? The legitimacy is hard-coded into the transaction itself. For the trade to proceed, both the seller (locking up the Bitcoin being sold) and us (the buyer) had to fund this multisig address. Crucially, we also both had to post a security deposit (roughly 15% of the trade value).

Because the address is “2-of-2,” moving the funds requires the digital signatures of both parties. Bisq cannot seize the funds, and the seller cannot run off with them. The Bitcoin sits in mathematical limbo until the seller confirms they have received the fiat payment. Only then do both software nodes sign the release transaction. If the seller tries to ghost us after receiving the cash, they can’t access their own security deposit or the locked Bitcoin, meaning they lose more money than they would gain by scamming. It’s a ruthless, brilliant system where financial self-interest forces strangers to be honest.

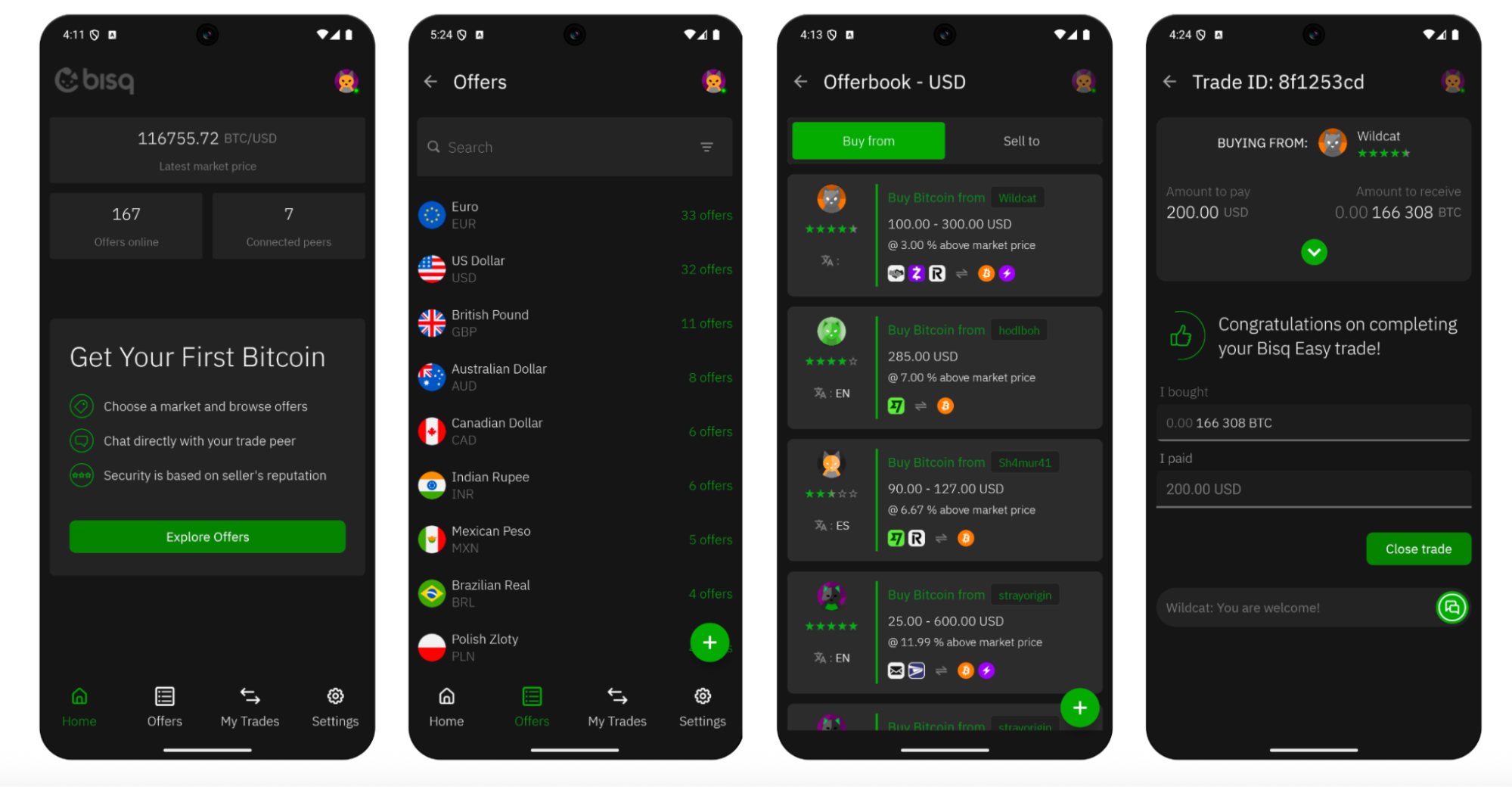

How to use Bisq safely

On Bisq, you cannot rely on a browser padlock or a support ticket to save you. True safety here demands rigorous “operational security” (OpSec). During our test drive, we realized quickly that while the protocol is bulletproof, the user is the weak link. Because there is no help desk to reset your password, you are effectively acting as your own bank vault manager.

Our Survival Guide:

- Write it down (offline): When you first create a wallet, Bisq generates a seed phrase. Do not screenshot this. Do not save it in a text file named “passwords.” Write it on paper and hide it. If your computer crashes, this paper is the only thing standing between you and total loss.

- Check account age: Bisq limits new accounts to small trades (0.01 BTC) to prevent fraud. When picking a seller, we specifically looked for peers with “signed accounts” older than 30 days. It’s the P2P equivalent of checking a seller’s eBay rating.

- Beware of “chargebacks”: The code protects your Bitcoin, but it can’t stop banking fraud. If a buyer sends you money via PayPal or Zelle and then claims it was “unauthorized” to their bank, they might reverse the charge. Stick to final, hard-to-reverse payment methods like SEPA or wire transfers for larger amounts.

Ultimately, asking is Bisq legit is the wrong question; the code is open-source and verified by thousands. The real question is: are you disciplined enough to use it? The platform is legitimate, but it is unforgiving. If you download a compromised version of the software or let malware onto your PC, no amount of multisig encryption can save you. Always verify the PGP signature of the installer before you run it.

The risks we took: what could go wrong

During our mystery shop, the scariest moment was waiting for the fiat notification on our phone. While Bisq’s code is arguably safer than a centralized exchange, the bridge to the real world is where the danger lies. Because you are interacting with strangers and traditional banks, there are risks here that no amount of cryptography can solve.

1. The “bank freeze” nightmare. This is the single biggest risk for any P2P trader. Banks detest crypto, and if your trading partner is careless enough to write “Bitcoin payment” in the Zelle or wire transfer memo, your bank will likely flag the transaction and freeze your entire account.

- Our Experience: We were paranoid about this. We strictly followed the rule: leave the memo blank. But you are trusting a stranger to do the same. If they slip up, you pay the price.

2. The triangulation scam. In this scenario, a scammer sets up a trade with you but pays you using a stolen bank account. You see the money, release the Bitcoin, and walk away happy. Two weeks later, the real owner of the stolen bank account files a fraud report, and the bank reverses the transfer. You lose your Bitcoin and the cash.

- Bisq’s Defense: Bisq mitigates this with “Account Signing.” New users have low limits (0.01 BTC) until a trusted peer “signs” their account by completing a trade. It’s effective, but not 100% bulletproof.

3. “Bisq easy” & reputation risks. With the introduction of Bisq 2 and the “Bisq Easy” protocol, the platform introduced a way to trade without locking up Bitcoin collateral. Instead, it relies on Reputation (burning BSQ tokens or proving past trade history).

- The Catch: This lowers the security model. In the classic version, math protects you (multisig). In Bisq Easy, you are trusting a reputation score. If a high-reputation seller decides to “exit scam” and burn their reputation for a big payday, you could be left holding the bag.

4. The “fat finger” factor. There is no “undo” button. If you send your Bitcoin to the wrong address, or if you lose the piece of paper with your seed phrase, your money is gone forever. There is no support agent who can verify your identity and restore your access. You are the bank, which means you are also the bank’s security guard and IT support.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.