dYdX vs Hyperliquid: Fees, leverage, and perpetuals compared

We tested both dYdX and Hyperliquid with real futures trades to see which non-custodial platform offers better fees, leverage, and trading workflow for active perp traders.

Fees & Funding

4.5/5

Leverage & Margin

4.5/5

Fees & Funding

4.2/5

Leverage & Margin

4.2/5

Fees & Funding

4.2/5

Leverage & Margin

4.3/5

Fees & Funding

4.4/5

Leverage & Margin

4.2/5

Fees & Funding

4.5/5

Leverage & Margin

4/5

In this comparison, we look at two non-custodial derivatives DEX platforms with order books: Hyperliquid and dYdX. Both allow trading perpetual contracts directly from a wallet, without holding funds with a broker, but they approach this in different ways.

Hyperliquid operates as a high-speed L2 engine, focused on performance and flexible leverage across BTC, ETH, and liquid altcoins. dYdX is built around its own dYdX Chain, with stricter leverage limits, clearly defined margin rules, and deep liquidity on major markets.

Our evaluation follows the GNcrypto methodology. We assess fees and funding, leverage and margin requirements, contract selection and order book depth, execution stability, security, and interface usability.

Hyperliquid vs dYdX at a glance

| Category | Hyperliquid | dYdX | Winner |

|---|---|---|---|

| Overall GNcrypto rating | 4.2 / 5 | 4.2 / 5 | Hyperliquid (overall) |

| Daily spot turnover (approx.) | N/A (futures-only DEX) | N/A (futures-only DEX) | Draw |

| Tradable assets (spot) | N/A | N/A | Draw |

| Liquidity & volume rating | 5 / 5 | 4.5 / 5 | Hyperliquid |

| Fees & total cost rating | 4.5 / 5 | 4 / 5 | Hyperliquid |

| Asset selection rating | 4 / 5 | 4.5 / 5 | dYdX |

| Tools & order controls | 4 / 5 | 4 / 5 | Draw |

| Fiat access & minimum trade size | 1 / 5 | 1 / 5 | Draw |

| Reliability & transparency rating | 4.5 / 5 | 4 / 5 | Hyperliquid |

We tested both platforms with $200 in USDC, opening leveraged positions (10×-20×) on BTC-USD and ETH-USD perpetuals. We monitored funding rates across multiple 8-hour cycles, tested order execution speed during US and Asia trading hours, measured spreads and slippage on market orders, and compared total trading costs (fees + funding) over multi-day holds.

Two models of decentralized futures

When looking at a Hyperliquid vs dYdX comparison, we focused on two distinct approaches to decentralized derivatives. Hyperliquid is built as its own L1 blockchain with a fully on-chain order book and smart contract-based clearing. The platform looks like a traditional CEX terminal, but all trades and positions are recorded on the Hyperliquid network. Control over protocol parameters is gradually shifting toward on-chain governance and the Hyperliquid Points program.

dYdX takes a different path. The platform runs on a dedicated dYdX Chain built with the Cosmos SDK and Tendermint. Settlement and position storage happen on-chain, while the order book and matching engine operate in a fully decentralized off-chain module maintained by network validators. This delivers CEX-like performance while preserving a non-custodial model. User funds remain in wallets, and liquidation and margin rules are hard-coded into the protocol.

Liquidity & order execution

In terms of liquidity and order execution, dYdX and Hyperliquid are already closer to large CEX platforms than to most DEXs. dYdX has been living longer and has reached a significant scale. Cumulative trading volume on the platform has exceeded $1.5 trillion, and the BTC-USD and ETH-USD pairs consistently rank among the top derivatives markets by turnover.

Order books on major pairs are deep, spreads are tight, and slippage for medium-sized trades becomes noticeable mainly during volatility spikes. Trades execute without gas fees through an off-chain matching engine, which makes dYdX feel closer to a traditional exchange terminal than to DeFi.

Hyperliquid focuses on speed. According to public data, the platform has processed more than $300 billion in derivatives volume in some months and reports throughput of up to 200,000 transactions per second, with median confirmation times around 0.2 seconds and the 99th percentile below one second.

On BTC and ETH, order books are well supplied, and slippage remains moderate even for aggressive market orders. On lower-liquidity altcoins, depth is thinner. During off-peak hours, spreads widen, and large positions are better split into a series of limit orders.

An additional advantage of Hyperliquid for aggressive strategies is lower taker fees, around 0.03% versus the 0.05% base rate on dYdX, which becomes noticeable with frequent entries and exits.

In our test with a $1,000 BTC-USD position opened via market order, Hyperliquid filled with 0.08% slippage during US hours, dYdX with 0.05% slippage. Both platforms executed in under 1 second, with dYdX’s deeper book showing advantage on larger position sizes.

Our verdict: in the dYdX vs Hyperliquid comparison, dYdX comes out ahead due to its long-established liquidity and more predictable execution for mid-term positions. Hyperliquid, however, is more attractive for active scalpers and traders who prioritize speed and short-term trades.

Fees & incentives

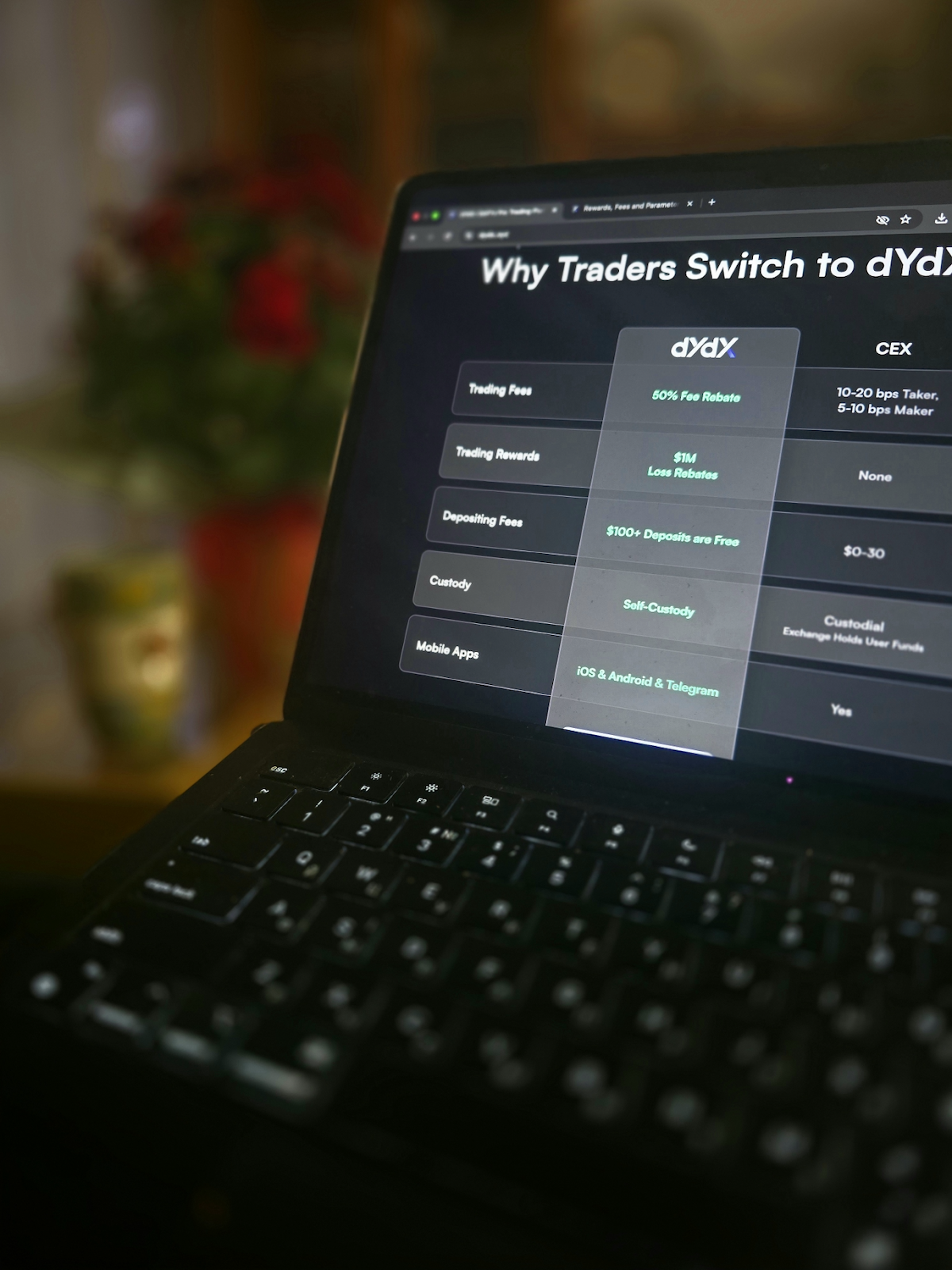

dYdX uses a maker-taker fee model with volume-based tiers. On major pairs, base rates are around 0.01% for makers and 0.05% for takers, decreasing as 28-day trading volume grows. There are no separate deposit fees. DYDX token holders receive fee discounts and can earn tokens through trading campaigns.

Hyperliquid’s base taker fee on perpetuals is around 0.035%, dropping to about 0.025% for larger accounts. Makers receive rebates, with the platform paying out for adding liquidity instead of charging a fee. The platform also runs a points system. Every fee paid converts into points that later factor into reward and token distributions.

In a dYdX vs Hyperliquid comparison focused on fees and incentives, dYdX emphasizes predictable rates and transparent volume-based discounts. Hyperliquid takes a more aggressive approach to incentivizing volume through points, rebates, and higher leverage.

If you value clarity and predictable fees, dYdX is easier to work with. If you are willing to take on more risk for potential cashback and bonuses, Hyperliquid is more compelling.

dYdX vs Hyperliquid – which should you choose?

If you’re new to decentralized futures

Choose: dYdX

For a first step into on-chain derivatives, dYdX is the safer option. The platform has been live for years, and the interface gently steers users toward moderate leverage. All key position parameters, including margin, liquidation levels, and funding, are always visible. This suits traders coming from CEX platforms who want to try perpetuals with less friction.

If you’re an active, fee-sensitive futures trader

Choose: dYdX

On major pairs such as BTC and ETH, dYdX fees are noticeably lower, especially for high-volume traders who rely on limit orders. Order book depth is strong and slippage is minimal, which makes total trade costs predictable. If your strategy depends on frequent entries and exits via maker orders, dYdX is more cost-efficient.

If you mainly want long-tail altcoin exposure and points

Choose: Hyperliquid

Hyperliquid is more appealing if you are targeting second- and third-tier market moves. The platform offers a wider range of exotic perpetuals, an active points program, and regular trader campaigns. It feels close to a CEX in terms of speed and interface density, while remaining fully on-chain.

Hyperliquid stands out for its broad asset lineup and gamification, while dYdX emphasizes mature infrastructure and disciplined risk management. In a hyperliquid vs dYdX comparison, this is clear in trading style. The former encourages more aggressive strategies, while the latter rewards discipline and focus on liquid pairs.

If you want maximum experimentation and incentive farming

Choose: Hyperliquid

For traders who enjoy testing new strategies, farming points, and are comfortable with a younger protocol, Hyperliquid offers more opportunities. Frequent listings, layered incentives, and higher leverage make it a natural venue for active degens. dYdX, by contrast, is better suited to those who prioritize transparent rules and stable execution.

How we tested dYdX vs Hyperliquid

We evaluated both platforms using our weighted, category-based model across 7 criteria: trading fees & funding costs, leverage & margin requirements, contract selection & liquidity, platform performance & risk controls, security & decentralization, user experience & trading interface, and customer support. Each criterion receives a score from 1.0 to 5.0, weighted by importance.

Our testing combined public data (fee schedules, documentation, audits, tokenomics) with hands-on verification using real capital: connected wallets, deposited USDC, opened leveraged perpetual positions, and monitored spreads, slippage, and liquidation behavior during live trading.

For full methodology: How we test decentralized futures platforms

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.