Hyperliquid Alternative: Top Trading Platform Options

This review covers four hyperliquid alternatives. dYdX – for those who want a DEX with an order book and familiar limit orders. GMX – if pool-based trading and simplicity are priorities. Binance and Bybit – if you need fiat funding, a wide asset list, and both spot and derivatives trading consolidated in a single account.

Fees & Funding

4.5/5

Leverage & Margin

4.5/5

Fees & Funding

4.2/5

Leverage & Margin

4.2/5

Fees & Funding

4.2/5

Leverage & Margin

4.3/5

Fees & Funding

4.4/5

Leverage & Margin

4.2/5

Fees & Funding

3.5/5

Leverage & Margin

3/5

Why Traders Look Beyond Hyperliquid

Traders search for Hyperliquid alternatives for practical reasons.

Different platforms offer access to different markets. One venue may lack the trading pairs, contract types, or liquidity needed for specific instruments. Second, funding and withdrawal options matter. Some users need straightforward ways to work with fiat, cards, or bank transfers. Third, risk management tools are critical. Familiar order types, margin controls, API access, and clear risk settings often determine whether a platform fits a trading workflow. Finally, access conditions play a role. Regional restrictions, KYC requirements, and account limits may not align with a given use case.

Best Decentralized Alternatives

Hyperliquid is a fully decentralized platform, so comparing it directly with CEX platforms is not entirely accurate from an accessibility standpoint. However, it competes with centralized exchanges on interface quality and user experience. Below we cover Hyperliquid trading platform alternatives across both CEX and DEX options.

DEX platforms let you trade and retain full control of funds directly from a wallet, without holding assets on an exchange. Experienced traders often choose DEX options for low-liquidity assets like memecoins or when custody matters more than convenience.

GMX

Overall Score 3.8/5

GMX is a DEX that supports derivatives and spot trading without a traditional centralized order book. Prices are set using oracles, and trades are executed through liquidity pools (GM Pools). GMX lets you trade directly from a wallet and withdraw anytime, making it one of the most practical DEX options.

GMX offers leverage of up to 100x. In simple terms, $100 of margin can control a position of roughly $10,000, though actual limits depend on the market and maximum leverage settings.

Benefits

Entries are executed at the mark price with no price impact on opening. The platform supports limit orders, stops, take profit, and stop loss.

In our test: we opened a 10x ETH position with $150 collateral on Arbitrum. The entry filled at mark price with no slippage, paying a 0.05% opening fee ($0.75). When ETH dropped to our stop loss level 6 hours later, the stop order triggered within 8 seconds but execution failed due to insufficient liquidity at our acceptable price range. The order moved to a frozen state, requiring manual intervention.

Limitations

Orders do not sit in an order book. When the target price is reached, execution is only attempted. If the acceptable price is not met or liquidity is insufficient, execution may fail and the order moves to a frozen state.

Best For

Traders who want on-chain perpetuals with solid protective orders and no need to deposit funds on a CEX.

Strengths:

- No price impact on position entry. Orders are filled at the mark price.

- Price impact is calculated as net price impact and usually applies when closing or reducing a position. This is shown before confirmation.

- Opening and closing fees in V2 are typically around 0.04%-0.06% of position size, depending on long and short balances.

- Supports stop-market, limit, take profit, stop loss, and TWAP for splitting large orders.

- Uses a keeper mechanism. You submit a request, execution happens in a separate transaction, and the maximum network fee is shown upfront.

Weaknesses:

- Limit and stop orders are not guaranteed to execute. Price may touch the level, but the acceptable price may fail.

- Total costs include multiple components: fees, funding, borrowing, and network costs. For long-held positions, the liquidation price can shift over time.

- Some markets are subject to ADL. Profitable positions may be partially reduced if the pool lacks sufficient coverage.

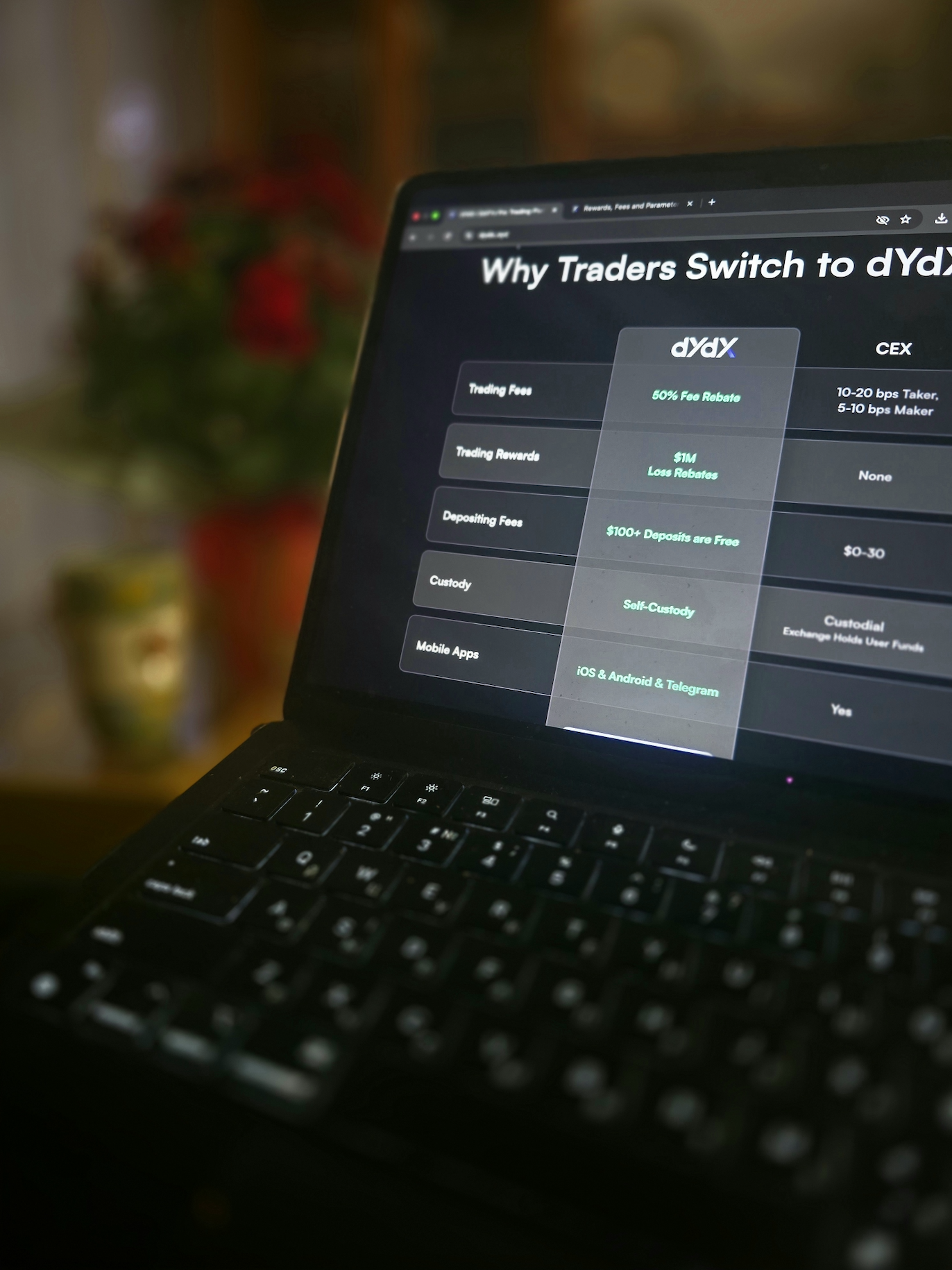

dYdX

Overall Score 4.0/5

dYdX is a derivative DEX with a central order book similar to a CEX. Limit orders rest in the book, maker and taker roles apply, and post-only orders are supported. dYdX fits traders who need an order book with precise control over trade entry.

Trading runs on dYdX Chain, a separate network built on Cosmos. Order matching is handled by the validator set, with price-time priority, and order book updates are available via a streaming API. This runs faster and more exchange-like than many on-chain perpetuals without an order book.

Benefits

A full order book, post-only support, reliable stops and take profit orders, and a clear maker-taker fee model.

In our test: we bridged $200 USDC from Arbitrum to dYdX Chain using the fast bridge (12-minute finality, $0.85 fee). We placed a post-only limit order to buy 0.002 BTC. The order rested in the book for 18 minutes before filling as maker (0.01% fee = $0.19). We then tested a stop-market order – when BTC hit our level during a 2.8% drop, the stop executed with $45 slippage.

Limitations

Trading is limited to perpetuals, not spot. Deposits and withdrawals rely on bridges. While onboarding can be fast, it adds extra fees and route dependency. Access is also subject to jurisdictional restrictions.

Best For

Traders who need a true order book and advanced order mechanics without depositing funds on a CEX.

Strengths:

- Six core order types: market, limit, stop market, stop limit, take profit market, and take profit limit.

- Limit orders support Good Til Date (28 days by default) and post-only to avoid unintended taker fills.

- Fees are tiered by 30-day volume. In the base tier up to $1 million, taker fees are 0.05% and maker fees are 0.01%. Higher tiers reduce fees, with maker fees reaching zero at some levels.

- Deposits and withdrawals vary by method. Fast bridges take 10-30 seconds, standard routes range from a few minutes to longer. Multiple networks are supported, including Ethereum and major L2s.

- Deposits default to cross margin. Isolated margin can be enabled to cap collateral per position.

Weaknesses:

- Conditional orders still operate within network rules. The default maximum slippage is 10%, which can affect stop execution during sharp moves.

- The setup is more complex than a simple CEX deposit. Bridges, network fees, and finality times add friction.

- Product access depends on location, with a list of restricted jurisdictions.

Centralized Futures Alternatives

Hyperliquid operates as a DEX, which means any comparison with CEX platforms requires context. The level of fund control, infrastructure, and risk profile are different. That said, CEX platforms offer features that often matter more in day-to-day trading: fiat on-ramps, stable liquidity on major markets, and more predictable order execution.

This section reviews centralized Hyperliquid alternatives for futures trading. These are platforms where you trade through an exchange account and hold funds on the exchange balance, in return for a full trading toolkit: deep order books, advanced order types, APIs, trading bots, copy trading, and a familiar infrastructure built for active trading.

Binance

Binance suits CEX traders who need broad market coverage. It offers a large futures lineup, a familiar order book, and an extensive ecosystem around trading. Funding is simpler, the trading terminal is more intuitive, and automation is easier to set up. The trade-off is clear: funds are held on the exchange, and you operate under its rules and restrictions.

Low base futures fees and a wide range of order types, from post-only to TWAP. It is easy to build a solid risk setup with stops, take profit, reduce-only orders, limit orders, and algorithmic strategies.

Conditions vary by region. Some products or stablecoins may be restricted. The platform is custodial, so exchange risk remains even with Proof of Reserves in place.

Traders who want a full CEX futures stack: deep order books, many order types, APIs, fast deposits and withdrawals, and a single account for everything.

In our test: we deposited via Binance P2P (bought $200 USDT, no deposit fee), then opened a 20x BTC/USDT perpetual position. Entry filled as taker (0.045% fee = $0.89 on $1,970 position size). We set a trailing stop 2% below entry – when BTC rose 5% then retraced, the trailing stop activated and closed the position (total gain: $280 before funding). Funding rate was 0.01% every 8 hours, costing $0.20 per cycle.

Strengths:

- Futures fees follow a maker-taker model and VIP tiers. For USDT and COIN-M contracts, published base rates start around 0.018% maker and 0.045% taker, with discounts tied to volume and BNB balance.

- Binance Futures supports 11 order types, including limit, market, stop-limit, stop-market, trailing stop, post-only, TP/SL strategies, reverse, scaled, conditional, and TWAP.

- Futures include additional protection mechanics. Alongside trading fees and funding, an Insurance Clearance Fee applies during forced liquidations.

- Each contract has an insurance fund with a defined maximum capacity for absorbing bankrupt positions. If the fund is insufficient, ADL is triggered.

- Proof of Reserves uses Merkle Tree structures and zk-SNARKs, allowing users to verify that their balance is included in the liability snapshot.

Weaknesses:

- Stops and limits are not fail-safe. In sharp moves, slippage and partial fills are normal order book behavior.

- ADL is rare but disruptive. When insurance funds are stressed, profitable positions can be forcibly reduced by priority.

- Regional restrictions alter the product. The interface may look the same, but available markets and funding options differ by location.

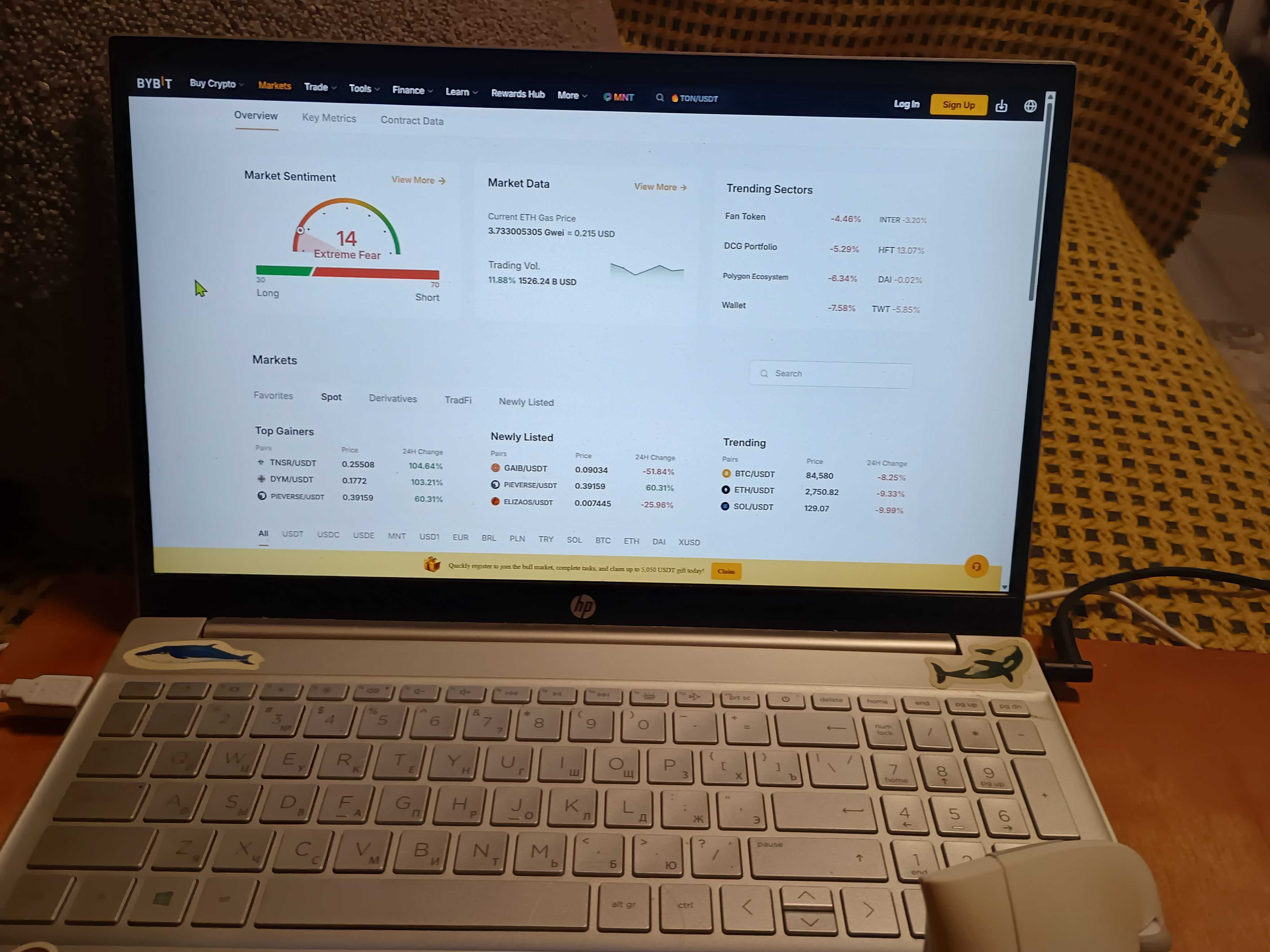

Bybit

Bybit is a CEX built for traders who prioritize fast execution, deep order books, and a full suite of futures tools in one place. Compared with DEX platforms, there are fewer technical steps. Funding, margin, orders, and risk controls all live in a single interface. The cost of that convenience is typical for a CEX: funds are held on the exchange, and access and products vary by region.

Clear maker-taker fees, a wide range of order types, strong risk tools such as reduce-only, TP/SL, and trailing stops, and well-designed workflows for active trading.

Fees and conditions differ by product and account tier. In extreme market moves, ADL and slippage are possible. Custodial risk remains, even with Proof of Reserves.

Traders who want a centralized futures terminal where a unified balance and account-level risk management matter more than simply having another order book.

In our test: we deposited $200 USDT to spot wallet, then switched to Unified Trading Account mode. Without manual transfer, we immediately used the spot USDT as collateral for a 15x ETH/USDT perpetual position. Entry filled at $3,225 (0.06% taker fee = $0.31). We tested Close on Trigger by setting it to close the entire position if ETH dropped below $3,100 – when ETH hit $3,095 during a sharp move, the position closed automatically within 3 seconds at $3,093 (minor slippage).

Strengths:

- A single account for spot, margin, perpetuals, and options, with no manual transfers between sub-accounts.

- Three margin modes: isolated, cross, and portfolio margin, selectable by strategy.

- Exit controls include reduce-only and Close on Trigger, designed to close positions on conditions even when margin is tight.

- Beyond basic market and limit orders, the platform supports advanced order logic such as conditional orders and trailing stops.

- Proof of Reserves with Merkle proof verification. Users can export their data for local checks, with additional third-party PoR reports available.

Weaknesses:

- In a unified account, mistakes in risk settings carry higher cost. One aggressive position can consume margin across the entire portfolio.

- Stops and conditional orders do not eliminate slippage during fast moves. They enforce discipline but do not lock in price.

- Access and product availability vary by jurisdiction, and eligible collateral assets are governed by internal UTA rules.

Which Hyperliquid Alternative Fits You Best?

If you want true decentralization without giving up an order book

Choose: dYdX

Full order book with maker-taker pricing, post-only orders, and six order types. Feels like a CEX but runs on-chain. You keep custody, but bridges add friction and fees.

If you prefer pool-based trading with no price impact on entry

Choose: GMX

Oracle-based pricing means entries fill at mark price with zero slippage. Stops and TP/SL work, but limit orders aren’t guaranteed. Best for traders who value predictable entry costs over order book control.

If you need the deepest liquidity and lowest fees for high-volume futures

Choose: Binance

0.018% maker / 0.045% taker (USDT-M base tier), 11 order types, and deep order books on 200+ contracts. VIP tiers drop fees further. Custodial risk, but unmatched market access and institutional-grade infrastructure.

If you want unified margin across spot and derivatives

Choose: Bybit

Bybit’s Unified Trading Account lets you use spot assets as derivatives collateral without manual transfers. Portfolio margin, reduce-only orders, and trailing stops tested reliably. Strong for multi-product strategies in one account.

If you’re leaving Hyperliquid specifically due to regional restrictions

Consider: dYdX or GMX (both have restrictions too, check eligibility)

For unrestricted CEX access, Bybit and Binance also vary by region – verify availability before depositing.

If you prioritize non-custodial trading above all else

Choose: GMX or dYdX

Both let you trade from your wallet. GMX is simpler (no bridges), dYdX offers more exchange-like mechanics. Binance and Bybit require trust in the exchange, despite Proof of Reserves.

Summary comparison

GMX and dYdX keep you in control of your keys but sacrifice some CEX conveniences (fiat on-ramps, instant execution guarantees, deep liquidity on every market).

Binance and Bybit offer the full CEX toolkit – deep order books, advanced orders, APIs, bots, copy trading – but you hold funds on the exchange and operate under their regional rules.

Hyperliquid sits between these worlds: on-chain like GMX/dYdX, but with CEX-quality execution. If you’re leaving Hyperliquid, the question isn’t just “which alternative,” but “what are you optimizing for: custody, liquidity, fees, or features?”

| Exchange | Standout | Fees | Assets | Fiat | PoR | Best for |

|---|---|---|---|---|---|---|

| GMX | Onchain perps via pools + oracles | 0.04%-0.06% open/close (V2) | Major perps + spot | No | N/A (non-custodial) | Wallet-first perps without an account or KYC |

| dYdX | Orderbook perp DEX (maker/taker) | ~0.01% maker / ~0.05% taker (base, lower with volume) | Perps (broad list) | No | N/A (non-custodial) | Traders who want true limit orders in the book |

| Binance | Deepest global liquidity + broad futures menu | from ~0.018% maker / 0.045% taker (USDT/COIN-M, lower with VIP) | Spot + futures | Yes (varies) | Merkle PoR | Active futures traders optimizing for cost + market coverage |

| Bybit | Futures-focused stack + unified margin account | 0.01% maker / 0.06% taker (derivatives, non-VIP) | Spot + futures | Yes (varies) | Merkle PoR | Traders who want a single account across spot and derivatives |

Methodology – why you should trust us

We use our weighted, category-based model, depositing $200 and opening leveraged positions (10x-50x) on perpetuals. We monitored funding rates, tested stop-loss execution during volatility, measured spreads during US and Asia trading hours, and withdrew funds to verify processing times. We rate platforms on 7 weighted criteria with scores from 1.0 to 5.0. Our testing uses real capital, not demo accounts.

Read our full methodology: How We Test Crypto Futures Trading Services

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.