HTX Research report details pre market crypto trading and token launch risks

HTX Research, a research unit of crypto exchange HTX Group, published a report on 18 December 2025 examining the growth of pre-market trading in digital assets and how it is influencing token launch and exchange listing processes.

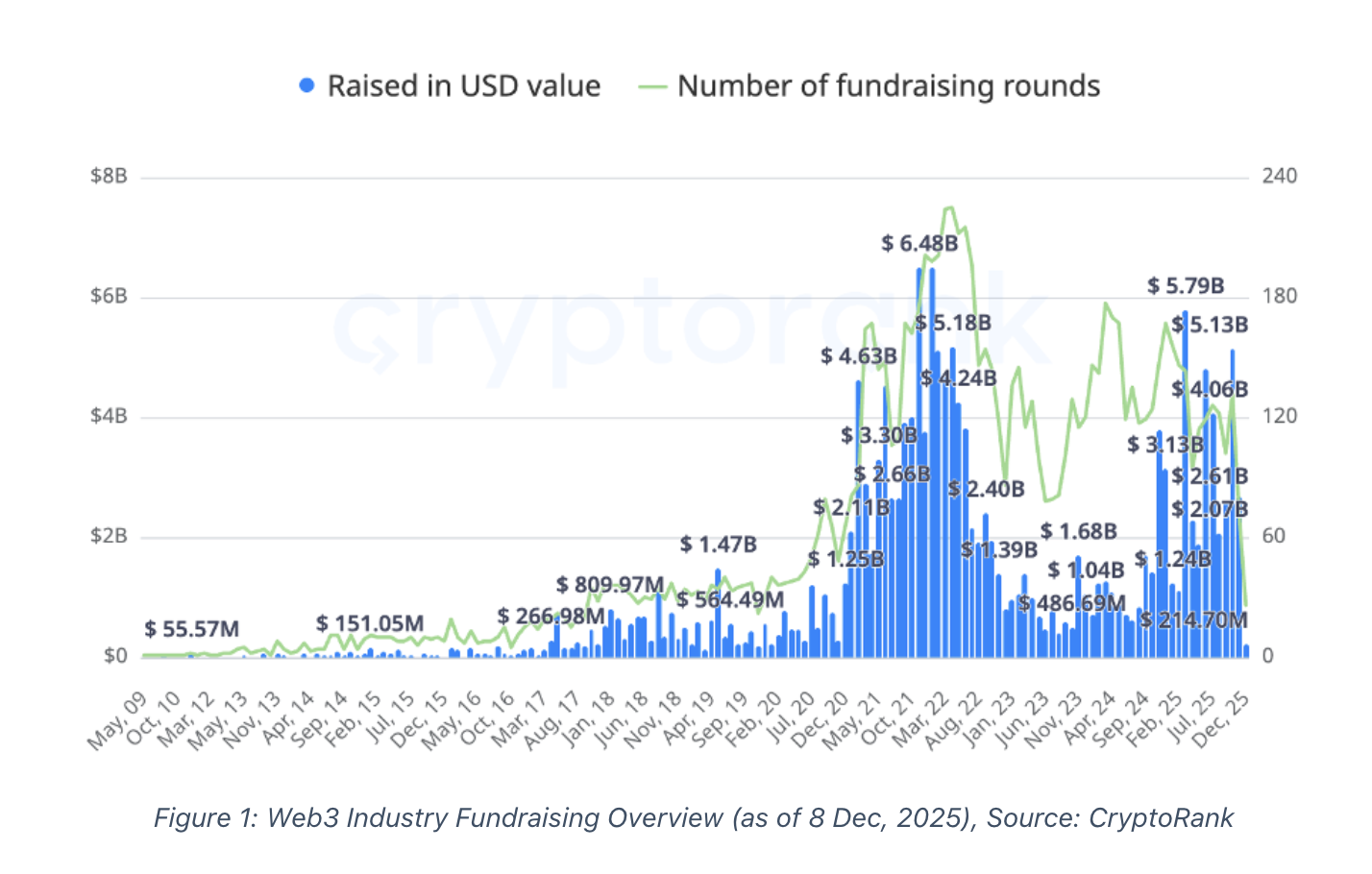

In the report, titled The Pre-Market Asset Trading Ecosystem: Mechanism Evolution, Market Structure, and Future Trends Behind Its Multi-Billion Scale, HTX Research describes pre-market activity as a “1.5-level market” that sits between primary fundraising and secondary spot markets. The report links the expansion of this segment to tighter primary-market funding and longer token issuance timelines after the market downturn that began in late 2022, as well as to the broader use of points systems, airdrop expectations and early-access programs before Token Generation Events.

HTX Research groups pre-market instruments into three categories. Token-value anchored products are tied to expected token prices and include over-the-counter pre-market trades, pre-market spot trading and pre-market perpetual futures. Points-anchored assets are linked to participation points that may later translate into airdrops and are traded through OTC and yield-splitting structures. Rights-anchored assets package future entitlements such as whitelist access, early participation slots or token allocations into tradable formats such as NFTs or vouchers.

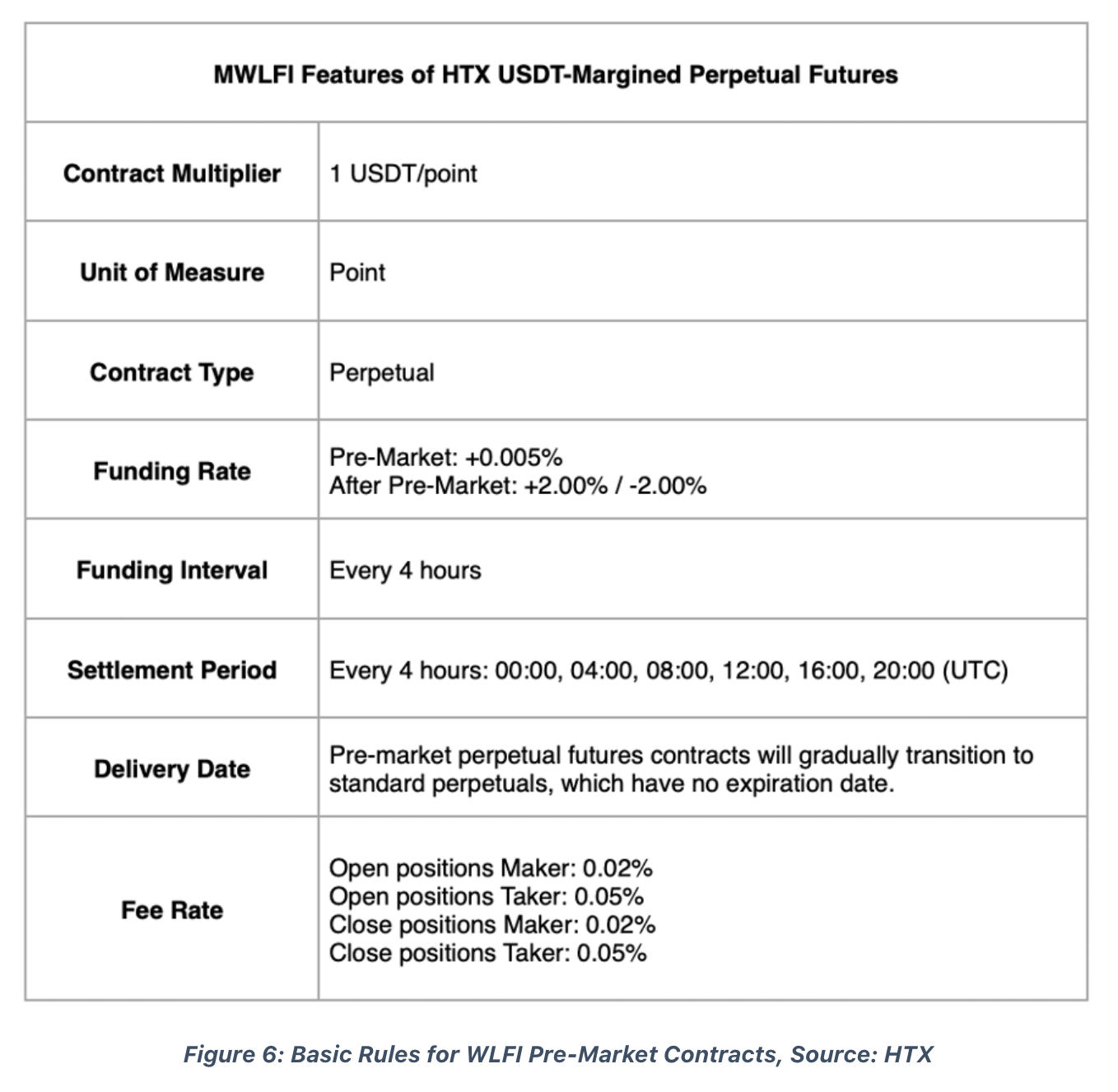

The report notes that activity has expanded beyond OTC and spot formats into derivatives, with pre-market perpetual futures used for price discovery and for expressing directional exposure ahead of listing. HTX cited its WLFI/USDT pre-market perpetual futures as an example of exchange-led pre-issuance trading tied to the WLFI (World Liberty Financial) project.

On market size, HTX Research said pre-market turnover for large projects can reach hundreds of millions of dollars and that cumulative pre-market volumes for names including WLFI and Monad have exceeded $1 billion. The report also flags risks, including thin liquidity, price impact from large traders, settlement dependence on project teams, information asymmetry and inconsistent rules and standards across venues and asset types. Additional context on HTX’s operations is covered in our HTX reviews.

As GNcrypto reported earlier, Base co founder Jesse Pollak confirmed on 19 November 2025 that his personal creator token, JESSE, is set to launch on the Base App from the account jesse.base.eth, and warned users to expect impersonation and phishing attempts around the rollout. Pollak said official updates would come only from his verified X account and his Base App profile, and urged followers to verify links and contracts before interacting; Wu Blockchain reposted the warning on 20 November 2025 and highlighted the same official accounts to follow.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.