HashKey launches $500M fund to invest in crypto treasuries

Hong Kong’s largest licensed crypto exchange, HashKey, announced the launch of a $500M fund. The new vehicle will invest in leading Digital Asset Treasuries (DAT) projects and Web3 infrastructure.

The company says the fund will be multi-currency and diversified, but its core allocations will remain in BTC and ETH as the most liquid and established assets. The fund aims to connect traditional finance with on-chain assets, targeting over $500 million in its first fundraising phase.

The DAT strategy envisions public companies allocating part of their capital to purchase cryptocurrencies, betting on price appreciation and stronger appeal of their own shares. In essence, it is the digital equivalent of corporate foreign exchange and gold reserves.

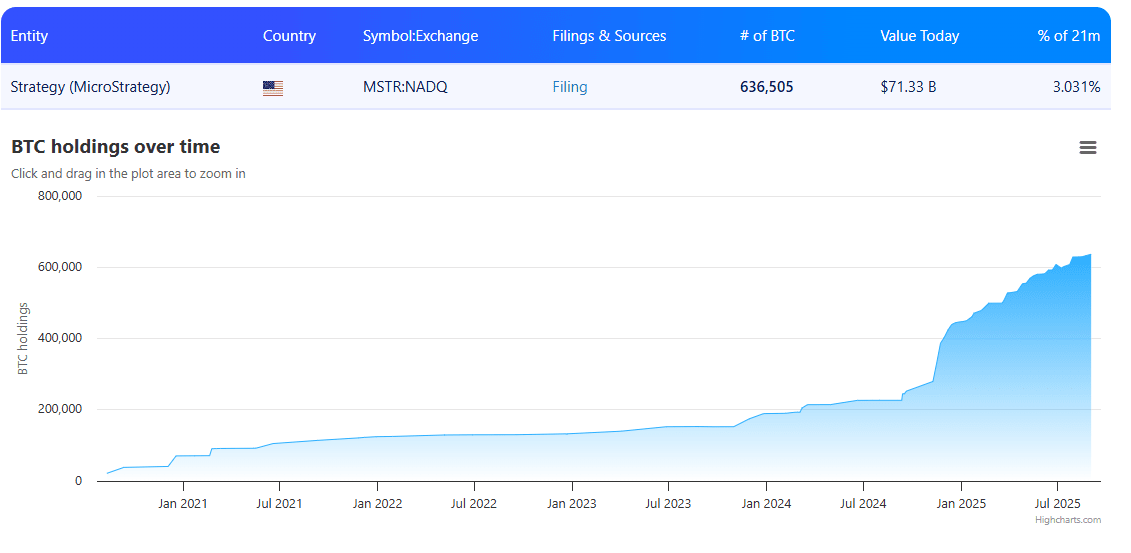

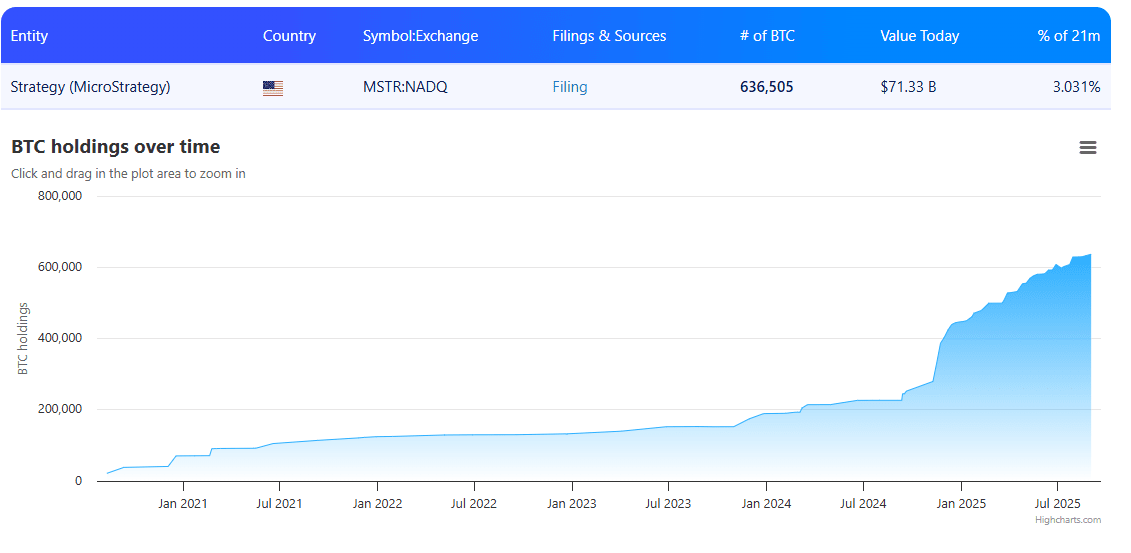

The most prominent example is Michael Saylor’s Strategy (MSTR). In 2020, it became the first public company to actively accumulate Bitcoin and by June 2025 had built reserves worth $63B. MSTR stock has since become a proxy vehicle for investors seeking BTC exposure through traditional markets.

HashKey Group launched in 2018 and provides digital asset services such as asset management, brokerage and tokenization in regions such as Hong Kong, Singapore, Japan, Ireland and Bermuda. The company also invested in over 600 blockchain and crypto companies worldwide, including more than 400 projects in the Ethereum ecosystem.

At $500M, the fund will rank among the largest institutional products in Asia. For the crypto market, it signals growing interest from regulated players. For Hong Kong, it reinforces the city’s status as a regional hub where the DAT strategy gets state-level support.

The DAT strategy envisions public companies allocating part of their capital to purchase cryptocurrencies, betting on price appreciation and stronger appeal of their own shares. In essence, it is the digital equivalent of corporate foreign exchange and gold reserves.

The most prominent example is Michael Saylor’s Strategy (MSTR). In 2020, it became the first public company to actively accumulate Bitcoin and by June 2025 had built reserves worth $63B. MSTR stock has since become a proxy vehicle for investors seeking BTC exposure through traditional markets.

BTC accumulation by Strategy (MSTR). Source: bitbo.io

Strategy’s success prompted other companies to adopt similar models. According to Standard Chartered, by mid-2025 the combined reserves of such firms exceeded 100,000 BTC.

HashKey Group launched in 2018 and provides digital asset services such as asset management, brokerage and tokenization in regions such as Hong Kong, Singapore, Japan, Ireland and Bermuda. The company also invested in over 600 blockchain and crypto companies worldwide, including more than 400 projects in the Ethereum ecosystem.

At $500M, the fund will rank among the largest institutional products in Asia. For the crypto market, it signals growing interest from regulated players. For Hong Kong, it reinforces the city’s status as a regional hub where the DAT strategy gets state-level support.