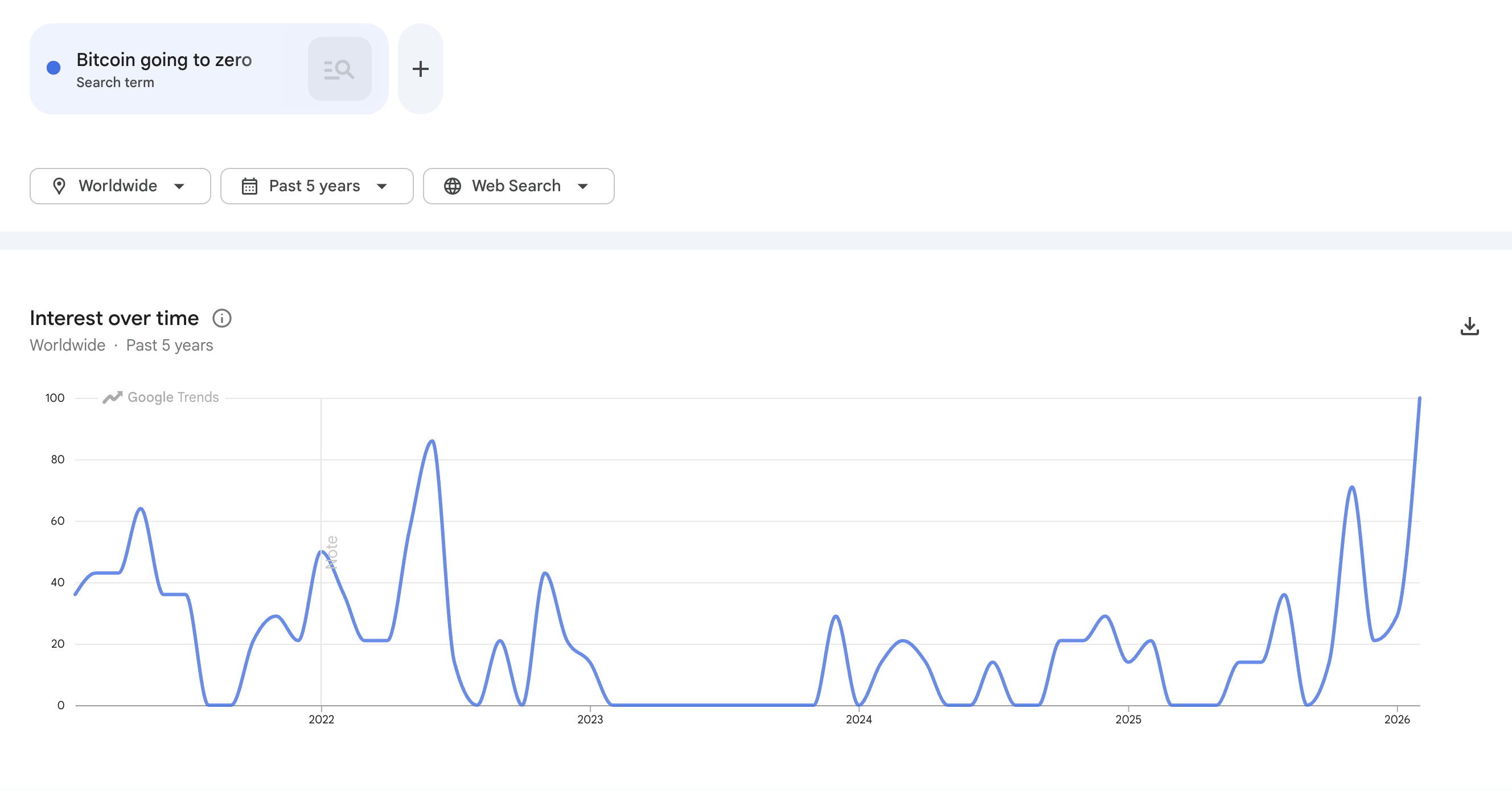

‘Bitcoin going to zero’ searches jump as ETFs gain buyers

Searches for “Bitcoin going to zero” hit the highest since November 2022 amid a price pullback, while sovereign funds such as Abu Dhabi and some corporations increased spot Bitcoin ETF stakes, Perception reports.

Worldwide Google searches for the phrase “Bitcoin going to zero” have climbed to their highest level since early November 2022, Google Trends data show, coinciding with a pullback from Bitcoin’s recent record and a shift to ‘extreme fear’ on the Bitcoin Fear & Greed Index.

The last time interest reached similar levels was November 2022, when FTX froze withdrawals and Bitcoin fell toward $15,000. Sentiment gauges tracking crypto investors have since dropped to zones last seen around the Terra collapse and the FTX fallout.

Perception, a crypto intelligence firm that analyzes narratives across industry sources, reports that the drivers of fear differ from 2022. Founder Fernando Nikolic attributes today’s worry to macroeconomic risks and to amplification from a prominent bearish commentator, rather than to failures inside crypto.

He identified strategist Mike McGlone as the most visible voice pushing a “Bitcoin to zero (or near-zero)” storyline in recent weeks, citing repeated calls for a drop toward $10,000 and warnings of a 2008-style market crash. He has “essentially been the go-to bearish quote for the past three weeks,” Nikolic noted, adding that heavy repetition in media coverage may be feeding the search spike.

Despite rising retail anxiety, Perception observes increasing accumulation by institutions. Nikolic pointed to sovereign wealth funds in Abu Dhabi adding to Bitcoin exchange-traded funds and to large corporations continuing to build reserves. Perception’s data show media sentiment bottomed on February 5 and improved over the following two weeks, while searches for “Bitcoin going to zero” peaked in mid-February. Nikolic’s view: “Retail fear lags professional media sentiment by about 10-14 days.”

The search spike comes amid high global uncertainty. The World Uncertainty Index, which counts references to “uncertainty” in country reports, sits at its highest level in the Federal Reserve Bank of St. Louis data series, above peaks during the 2008 financial crisis and the 2020 COVID-19 shock. Research on the index finds that such spikes often precede weaker output and slower growth as companies delay investment and hiring.

Nikolic also flagged a separate thread of “quantum” anxiety that has appeared periodically since October 2025, rising when prices fall and easing when they stabilize. Google Trends shows “Bitcoin quantum” searches peaking in November 2025 and declining since. He characterized it as “an amplifier of existing bearish sentiment, not a standalone driver.”

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.