Gold steadies after volatility as rate expectations shift

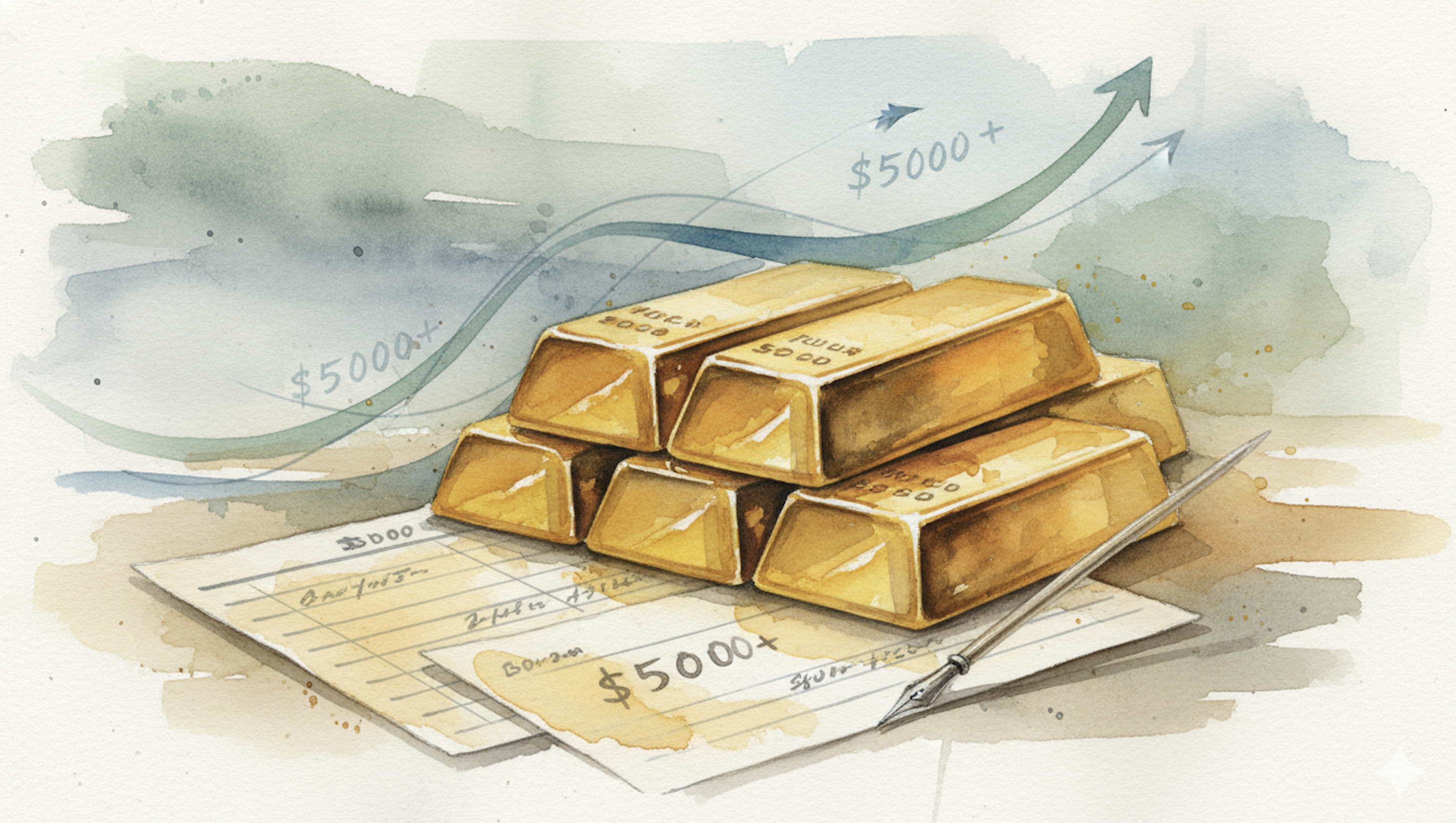

Gold traded back above $5,000 an ounce on Monday, Feb. 9, 2026, as buyers returned after last week’s sharp swings, with a weaker U.S. dollar and renewed focus on upcoming U.S. jobs and inflation data reinforcing expectations for lower interest rates later this year.

Spot gold rose about 1% to $5,008.51 per ounce by 11:41 GMT, extending gains after a 4% jump on Friday, while U.S. gold futures for April delivery climbed to $5,029.40.

Trading stabilized after an unusually volatile period in late January, when precious metals fell hard from record highs. Gold has recovered around half of the losses it suffered after plunging from an all-time high hit on Jan. 29, with the $5,000 level now acting as a key reference point for traders assessing whether the rebound can hold.

The currency and rates backdrop has been a central driver. The U.S. dollar fell about 0.3% on Feb. 9, making dollar-priced bullion cheaper for overseas buyers, while investors looked ahead to a dense U.S. data calendar that could shift expectations for Federal Reserve policy. Markets were already pricing at least two 25-basis-point rate cuts for 2026, a setup that tends to support non-yielding assets like gold by reducing the opportunity cost of holding them.

Policy commentary also fed into rate sensitivity. San Francisco Federal Reserve President Mary Daly said on Friday she viewed the U.S. labor market as being in a “precarious” position and that additional rate cuts may be needed, putting extra attention on labor and inflation prints due later in the week.

Local political dynamics in Japan added to the day’s bullish tone for bullion. Early trading strength in Asia coincided with a landslide election victory for incumbent Japanese Prime Minister Sanae Takaichi, which reinforced expectations for looser fiscal policy and continued pressure on the yen – conditions described as supportive for gold as investors seek a store of value.

Official-sector buying from China remained another key plank under demand. Data released over the weekend showed China’s central bank extended its gold purchases for a 15th month in January, adding to a trend that has been closely watched as part of reserve diversification efforts.

Despite the rebound, gold entered Feb. 9 still meaningfully below its late-January peak. At the prior Friday close, bullion was about 11% below the Jan. 29 all-time high, even as it remained up roughly 15% for the year, reflecting how quickly the market’s tone has shifted between momentum buying and forced selling.

The late-January surge that preceded the pullback was fueled by a mix of speculative positioning and demand for hard assets amid geopolitical tension and concerns tied to currencies and sovereign debt. After the rally accelerated, the selloff that followed was described as a reset after prices ran too far too fast, leaving the market more sensitive to macro catalysts such as the dollar and rate expectations.

Silver, which has traded with higher volatility than gold, also gained on Feb. 9. Spot silver rose 2.4% to $79.87 per ounce after a near 10% jump in the prior session, following a dramatic reversal from a Jan. 29 all-time high of $121.64. Analysts cited in market coverage described silver as behaving more like a risk asset than gold at times, tending to outperform when broader risk appetite is strong.

Other metals were mixed, with spot platinum down 1.4% at $2,066.17 per ounce and palladium down 0.9% at $1,691.45, reflecting more idiosyncratic demand concerns tied to industrial usage and the vehicle market.

Traders now turn to the next set of U.S. macro signals. The week’s schedule includes January nonfarm payrolls, CPI and jobless-claims data, releases that can quickly change how investors price the path for rates – an important input for gold after the metal’s rapid round-trip from record highs to a sharp pullback and back above $5,000 by Feb. 9.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.