Global markets are waking up on Fed rate‑cut hopes

Thursday is shaping up as a cautiously optimistic day in global markets. Stocks in Europe and Asia are moving higher as investors get used to the idea of a US “soft landing” and are slowly adding risk again. The main driver is growing confidence that the Federal Reserve will take its first step toward cutting rates in December.

According to the CME FedWatch tool, the probability of a December rate cut is currently in the 80–85% range, whereas just a week ago markets were pricing in less than a one‑in‑three chance. The lack of fresh macro data due to the prolonged US government shutdown has only amplified the impact of Fed commentary: investors read the recent dovish‑leaning remarks from Mary Daly and Christopher Waller as a green light to slowly rotate back into risk assets.

European equity benchmarks are in what looks like a “moderate rally” phase. The STOXX 600 is trading not far from recent highs, and the pattern of gains points to a classic risk‑on mood: tech and defense names are outperforming, while defensive sectors such as healthcare are lagging. For now, investors are willing to look past stretched valuations in some stories as long as the base case remains a potential Fed rate cut backed by broadly resilient earnings.

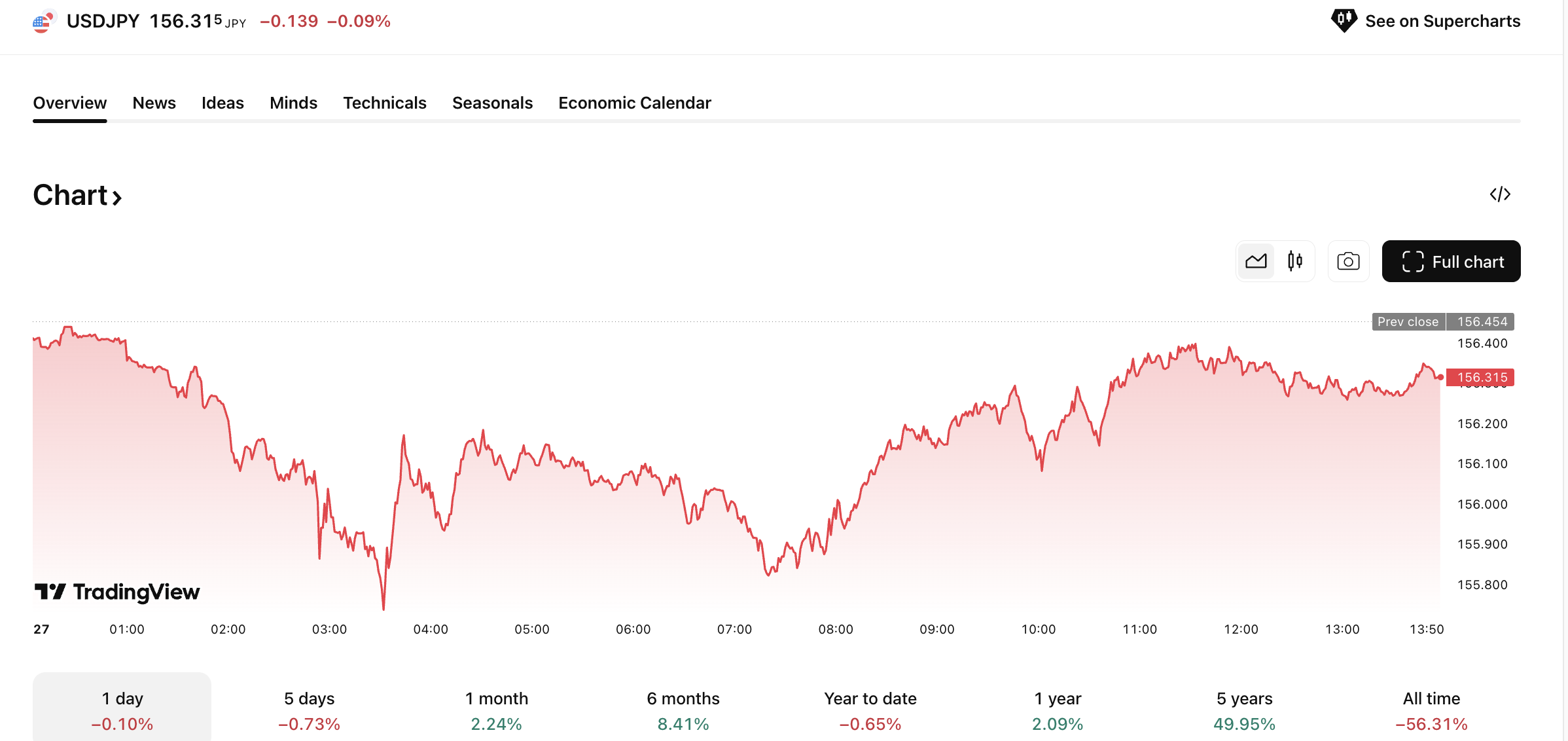

The currency market looks more nervous. The dollar index, DXY, is trying to stabilize after several weak sessions, but most of the focus is on the Japanese yen. The USD/JPY pair is holding near the 156 level, firmly in the zone where traders are constantly on alert for possible intervention by Japan’s Ministry of Finance. Signals that the Bank of Japan could raise rates in the coming months are seen as a cautious attempt to reverse the multi‑year regime of ultra‑cheap money.

Against this backdrop of FX swings, digital assets look relatively confident. Bitcoin has moved back above $90,000, snapping a bearish stretch and reminding traders that liquidity bets tend to spill over into the crypto space.

At the same time, gold is consolidating around the $4,150‑per‑ounce level, responding both to expectations of a softer Fed stance and to ongoing demand for insurance against geopolitical risk.

If the Fed’s December decision matches current market expectations and the Bank of Japan really does start a rate‑hike cycle, markets could enter 2026 in “recalibration mode”: the dollar gradually loses ground to the yen, major global equity indices drift toward the upper end of their yearly ranges, and yields on 10‑year US and European government bonds shift below today’s levels.

Any renewed scare around AI‑related spending or a fresh inflation spike, however, could quickly bring volatility back and remind traders that the current upswing still rests on a fragile consensus.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.