Glassnode analysts expect Bitcoin to keep sliding

In the latest Week On-chain report, Glassnode says the market has shifted into defense mode. Bitcoin is holding below key cost levels, fear-driven selling is lifting realized losses, and derivatives are going through a hard deleveraging. With spot demand still weak, Glassnode sees elevated downside risk.

In early February, Bitcoin is again testing the lower end of the range it has been stuck in for weeks. Price slipped into the $72,000 area, bounced, then lost momentum again. In its latest Glassnode report, the research team labels the setup “Bears In Control” and argues the current market structure looks more like a continuation phase than a clean turn.

The first warning sign is where the cycle’s center of gravity sits. Glassnode highlights a break below the True Market Mean, a metric that approximates the average cost basis of coins that are actively circulating.

That level used to act as support. Now it is overhead resistance around $80,200. Above that sits another hurdle: the cost basis of short-term holders, which the analysts place near $94,500. The lower edge of the broader corridor is the Realized Price, around $55,800, an area that has tended to attract longer-term demand in past cycles.

Against that backdrop, the key question is what spot buyers are doing right now. Glassnode notes spot volumes remain low: the 30-day average has not recovered even though price has already dropped from $98,000 to $72,000. When bid depth is thin, even moderate selling can push price harder than it normally would.

Flows into spot Bitcoin ETFs have also weakened, and Glassnode says interest from corporate and sovereign-style treasuries has started to fade as well.

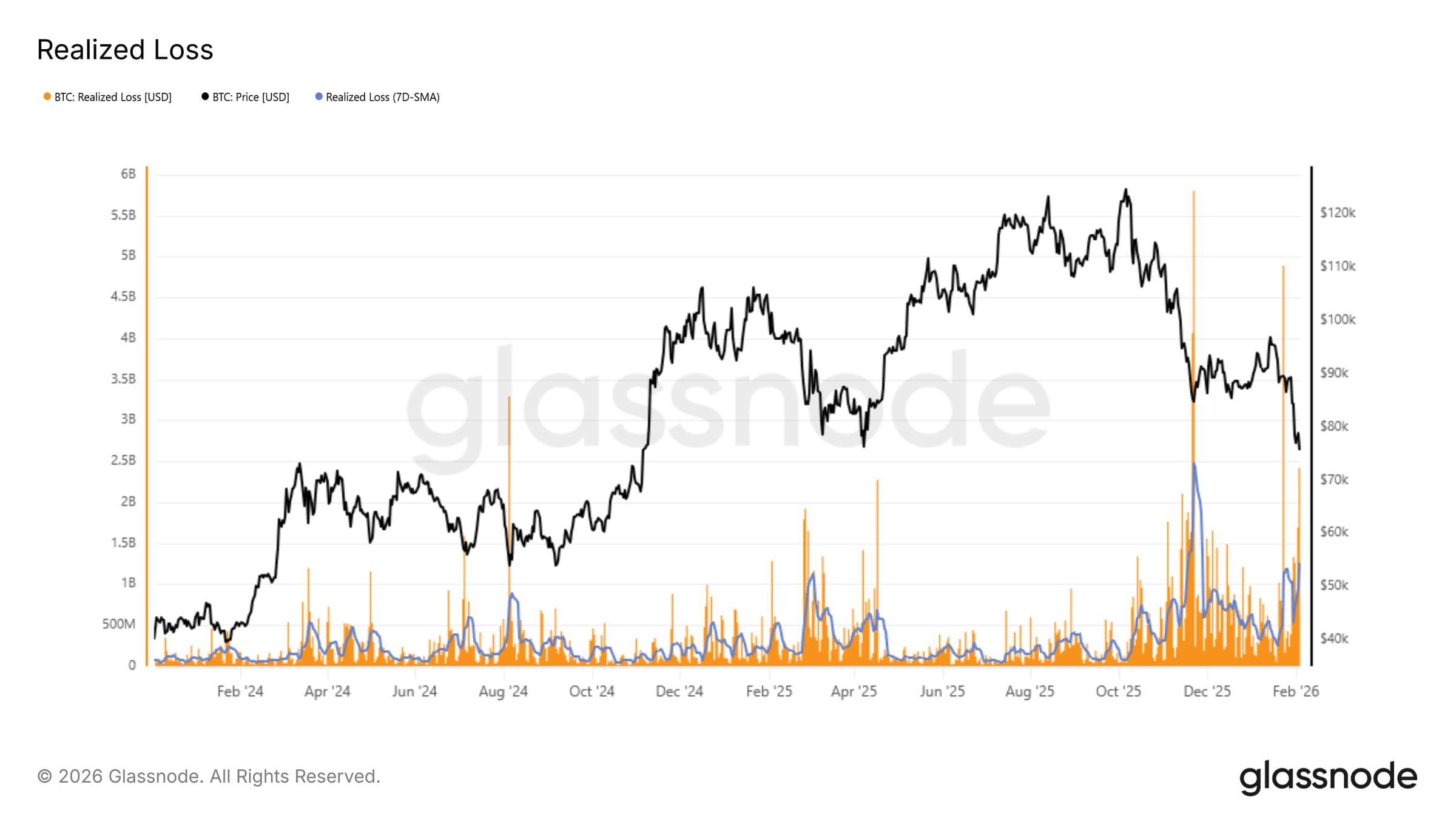

Next comes fear selling, which shows up most clearly in realized losses. Glassnode says the 7-day average of realized losses rose above $1.26 billion per day. During the bounce off the $72,000 area, daily realized losses peaked above $2.4 billion, nearly double the current 7-day average. Spikes like that often appear when holders close underwater positions and parts of the market are forced out by liquidity constraints.

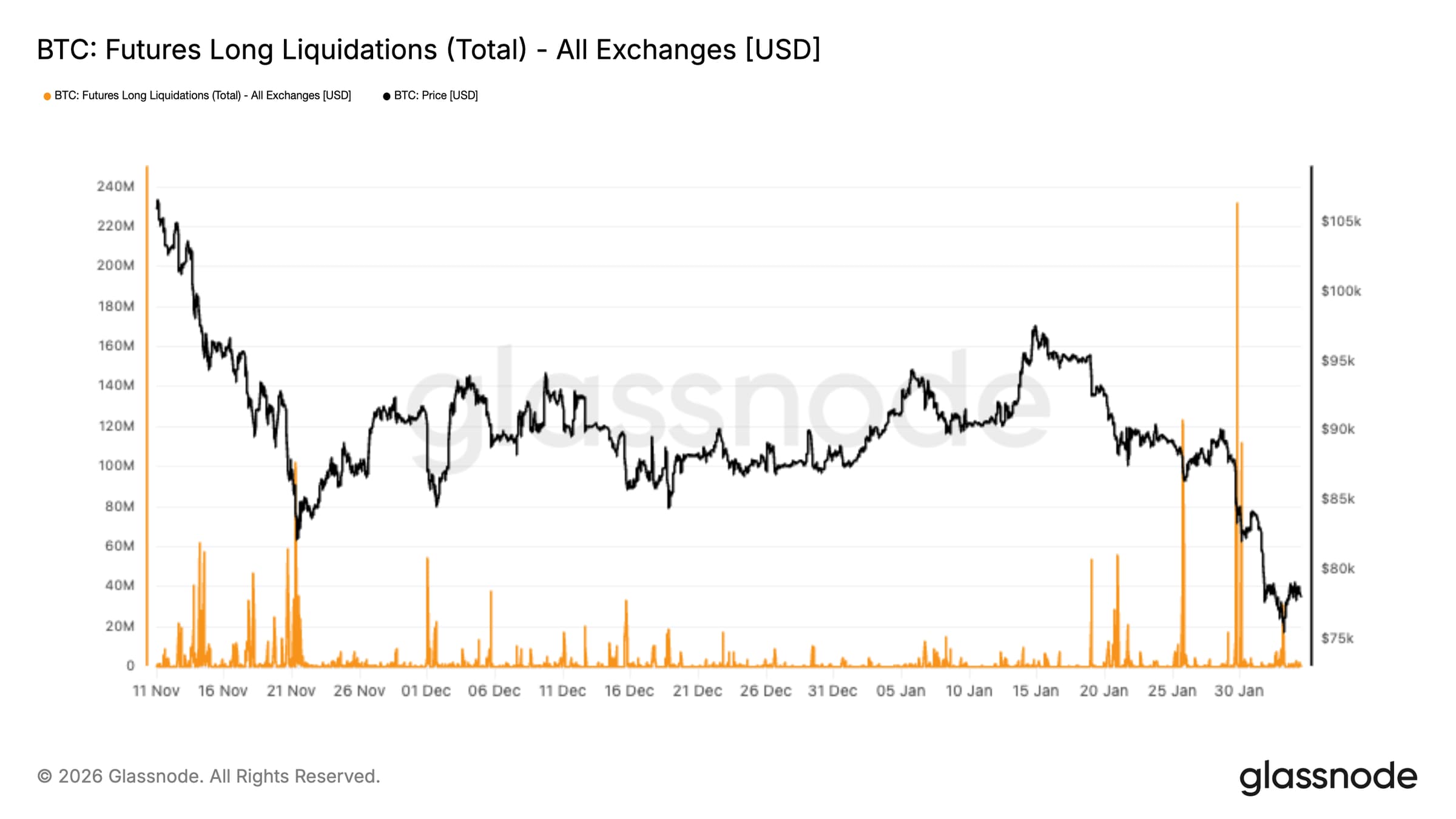

The most fragile layer right now is derivatives. Glassnode points to a liquidation cascade: total long liquidations produced the largest exchange-wide spike of this entire downswing and helped drive Bitcoin toward the $70,000 area. Another detail matters here: liquidations were noticeably lighter in November and December. That suggests leverage rebuilt even while spot demand stayed weak. The market is now going through forced deleveraging, and with it comes the exit of positions that were supported by collateral and borrowed funds.

Options markets back up the defensive tone. Short-dated implied volatility jumped to nearly 70% during tests of $73,000, and weekly implied volatility rose by about 20 points over two weeks. Put skew strengthened, and the weekly volatility term premium turned negative, around -5, after sitting near +23 a month ago. That shift suggests traders are still paying up for near-term protection, and the market is absorbing sharp moves less smoothly.

Glassnode’s takeaway is restrained but clear: deleveraging removes excess risk, yet durable bottoms usually form when spot buyers return and inflows become consistent. Until that happens, bounces may stay fragile and the risk balance remains tilted to the downside.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.