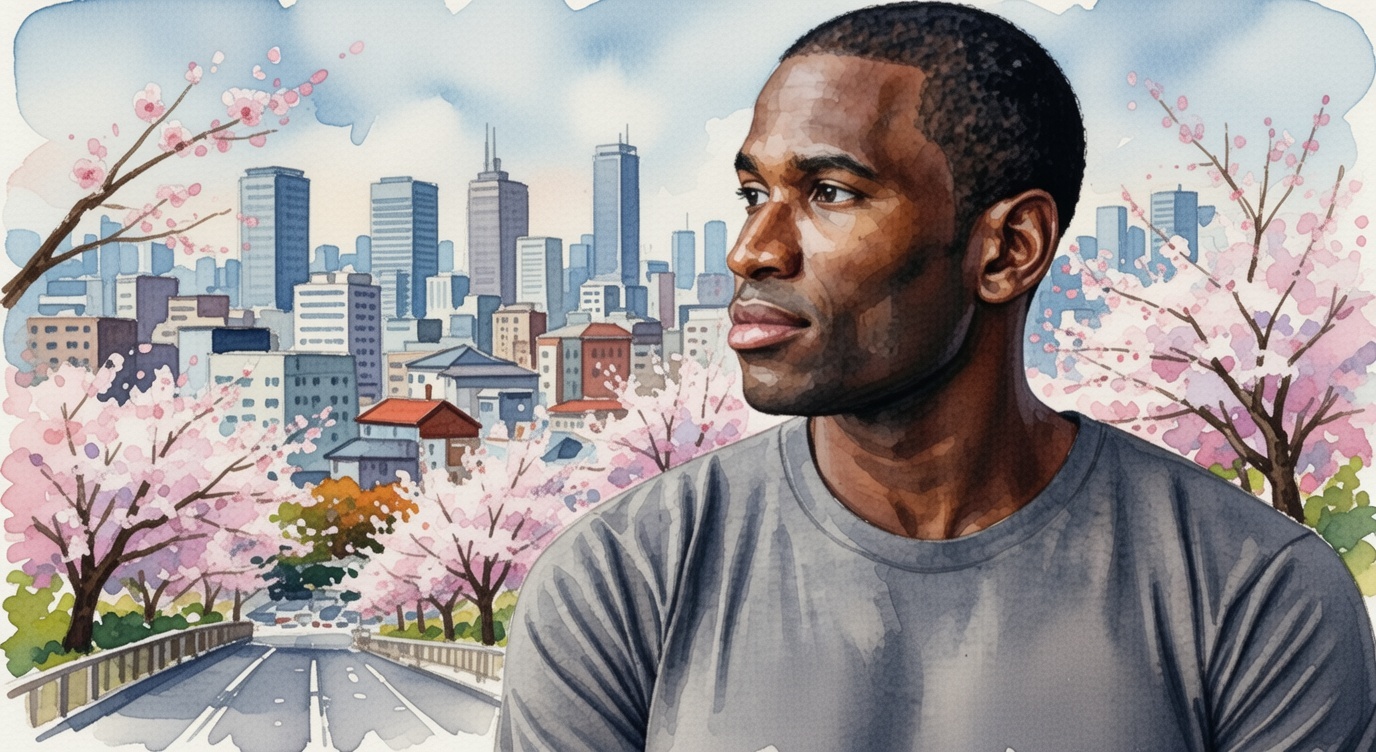

Fidelity macro chief sees 2026 year off for Bitcoin

Fidelity macro chief Jurrien Timmer argues Bitcoin peaked Oct. 6 and expects a yearlong cooldown, calling 2026 an off year with support near $65,000.

Fidelity’s director of global macroeconomic research, Jurrien Timmer, indicated in a Thursday post on X that Bitcoin’s four-year halving cycle likely topped at the Oct. 6 all-time high. He remains constructive long term but warned that a typical “winter” could follow.

“While I remain a secular bull on Bitcoin, my concern is that Bitcoin may well have ended another 4-year cycle halving phase,” he wrote. “Bitcoin winters have lasted about a year, so my sense is that 2026 could be a “year off” (or “off year”) for Bitcoin. Support is at $65-75k.”

Others map out a different path. Tom Shaughnessy, co-founder of Delphi Digital, expects new all-time highs in 2026 once market stresses tied to early October resolve. “We are working through a one-time disastrous 10/10 liquidation event that broke the market,” he posted on X. “Once that’s worked through, we hit $BTC ATHs in 2026 as prices rubber band to reflect the progress outside 10/10.” He links the outlook to expanding Wall Street integrations and new regulated products.

Recent trading has softened. Earlier this week, Bitcoin slipped below $85,000, and bearish commentary picked up across X, Reddit, and Telegram, based on readings from market intelligence firm Santiment. Positioning tracked by Nansen showed “smart money” accounts net short Bitcoin by roughly $123 million while holding about $475 million in cumulative net long positions in Ether, pointing to a split view between the two largest tokens.

The divide centers on timing and shape of the current cycle following the Oct. 6 peak. Timmer leans on historical four-year patterns and a potential 2026 pause, while other analysts anticipate new highs that year as structural factors — including product rollouts and regulatory progress — work through the system.

As we covered previously, Grayscale Investments released its 2026 outlook, forecasting Bitcoin to set a new all-time high in the first half of 2026. The firm attributed the call to continued institutional demand and a friendlier U.S. policy backdrop, and said rising public-sector debt and related inflation risks are supporting portfolio demand for Bitcoin and Ether.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.