Fed cuts rates, but Bitcoin remains below $100,000 amid fragile range

The U.S. Federal Reserve cut its benchmark rate by 0.25 percentage points — the third reduction this year — in line with market expectations. Following the decision, Bitcoin made a typical pre-FOMC move, climbing above $94,000.

According to CNBC, the vote came in at 9–3, reflecting divisions among Fed members over the outlook for inflation and economic growth. This raised concerns that the rate-cut cycle in 2026 could unfold more slowly.

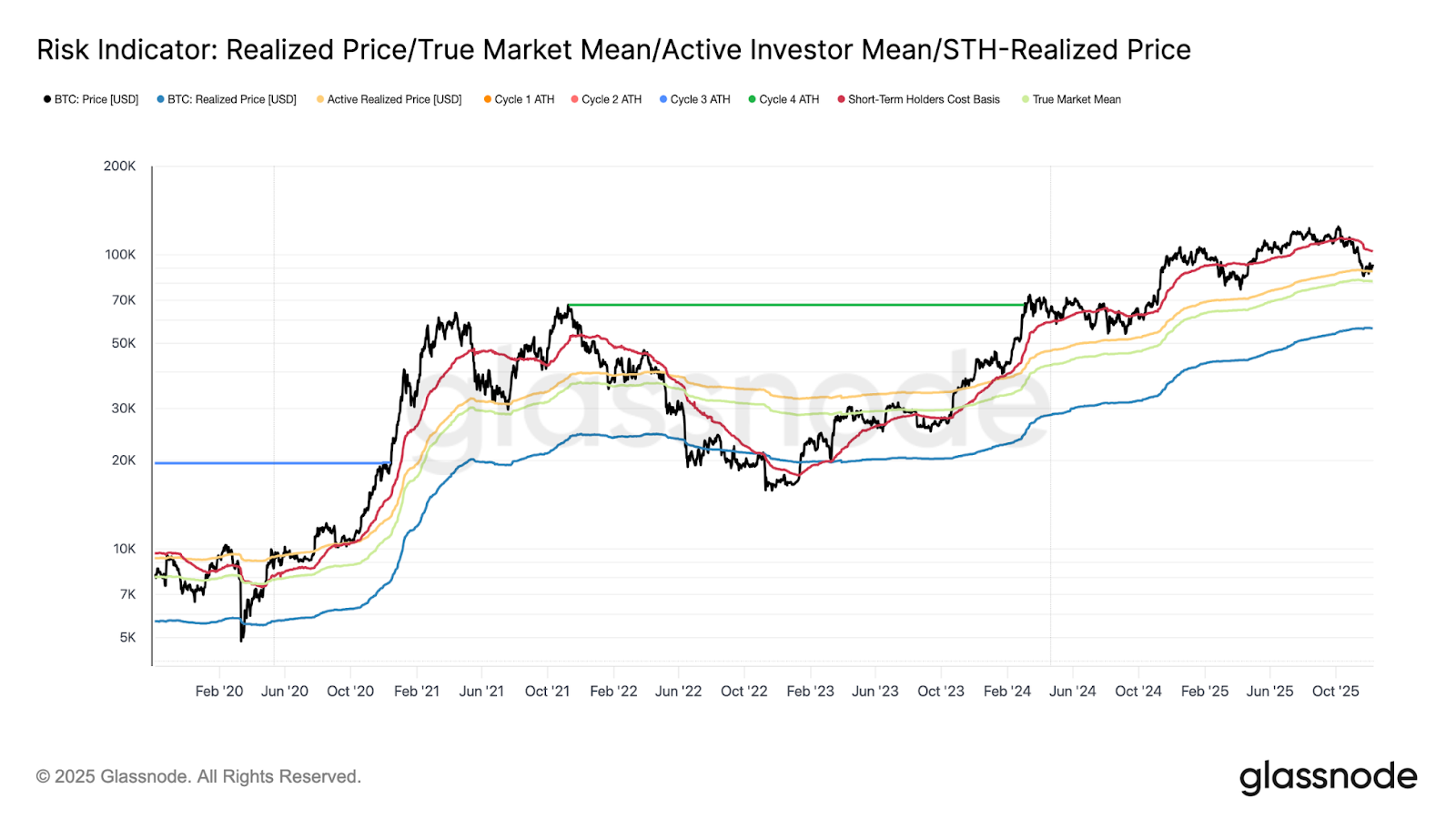

Glassnode reports that Bitcoin remains in a structurally fragile range between its short-term cost basis ($102,700) and True Market Mean ($81,300). This narrow price band keeps BTC below $100,000 and heightens pressure from unrealized losses. The longer the price stays in this range, the greater the risk of forced selling.

Unrealized losses have climbed to 4.4% — surpassing 2% for the first time in two years — signaling that the market has entered a stress phase. Realized losses have also reached $555 million per day, matching levels seen during the FTX collapse. Meanwhile, long-term holders are taking profits at record levels, exceeding $1 billion per day with a peak near $1.3 billion. These sell-offs from older wallets, combined with capitulation among top buyers, are keeping BTC from reclaiming the $95,000–$102,000 range.

Another trend is rising prices amid falling open interest in futures. According to CryptoQuant, the market is showing divergence: spot demand is growing while futures activity declines. Since the November 21 low, open interest has continued to fall despite price gains, suggesting limited leveraged demand.

Historically, sustained rallies require increasing futures activity, analysts note. Currently, spot volumes account for only about 10% of derivatives trading, which could restrict further upside if expectations for rate cuts weaken.

Analysts warn that the Fed’s rate cut doesn’t guarantee an immediate BTC rebound. With the market still under pressure — from long-term holders realizing profits to expanding unrealized losses — Bitcoin may stay below $100,000 until a new catalyst emerges.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.