Exodus Bitcoin wallet review 2026: UX king or fee trap?

Exodus is often called the “Apple of crypto wallets” for its stunning design, but pretty charts do not pay gas fees. We tested the wallet claim of seamless swaps and found that while the UX is world-class, the “convenience tax” on trading might shock active users. Here is the data-driven breakdown.

In a market filled with clunky, developer-focused tools, Exodus has always been the “cool kid.” Since 2015, it has prioritized one thing above all else: design. It doesn’t look like a piece of software; it looks like a high-end fintech dashboard from a sci-fi movie.

A wallet needs to be more than just a pretty screensaver for your portfolio. At GNcrypto, we don’t grade on aesthetics. To write this review, we didn’t just stare at the UI. We loaded it with funds, executed cross-chain swaps, tested the mobile-to-desktop sync, and scrutinized the fees that pay for that polished interface.

The big question we aim to answer: is Exodus a serious tool for the 2025 crypto native, or is it a “tourist trap” designed to extract fees from beginners? We analyzed the closed-source code (what we could see of it), the spread on their built-in exchange, and the reality of their hardware wallet integration.

What Exodus wallet is

Exodus is a non-custodial, multi-chain software wallet. It was one of the first wallets to make crypto look “friendly,” and it remains the gold standard for onboarding.

- The “walled garden”: Unlike MetaMask, which feels like a developer tool you have to configure, Exodus comes ready out of the box. You don’t add networks; they are already there. You don’t hunt for token logos; they are auto-populated.

- Publicly traded trust: Exodus (the company) is one of the few consumer wallet providers whose parent company is publicly listed (NYSE American: EXOD) and files regular reports with the U.S. SEC. While this doesn’t make the code fully open-source, it adds a layer of corporate accountability that anonymous wallet teams lack.

- The hybrid model: It operates as a hot wallet by default, but its deep integration with Trezor allows you to view and manage your cold storage funds using the beautiful Exodus interface. This is a killer feature for those who hate Trezor’s native “Suite” app.

In the Exodus Bitcoin wallet review, we treat it as a “Portfolio Command Center.” It excels at showing you what you have and how much it’s worth, but it charges a premium if you try to move things around too much inside its walls.

User experience & design

If design were a hash rate, Exodus would be mining the entire block. This is the category where Exodus absolutely crushes the competition. While wallets like MetaMask or Electrum look like they were built by engineers for engineers, Exodus looks like it was built by a high-end fintech design studio.

In our methodology, User Experience & Interface accounts for 15% of the score, and Exodus earns nearly every point here.

The “Apple” of сrypto

The interface is clean, dark-mode native, and buttery smooth. There is zero lag when switching tabs.

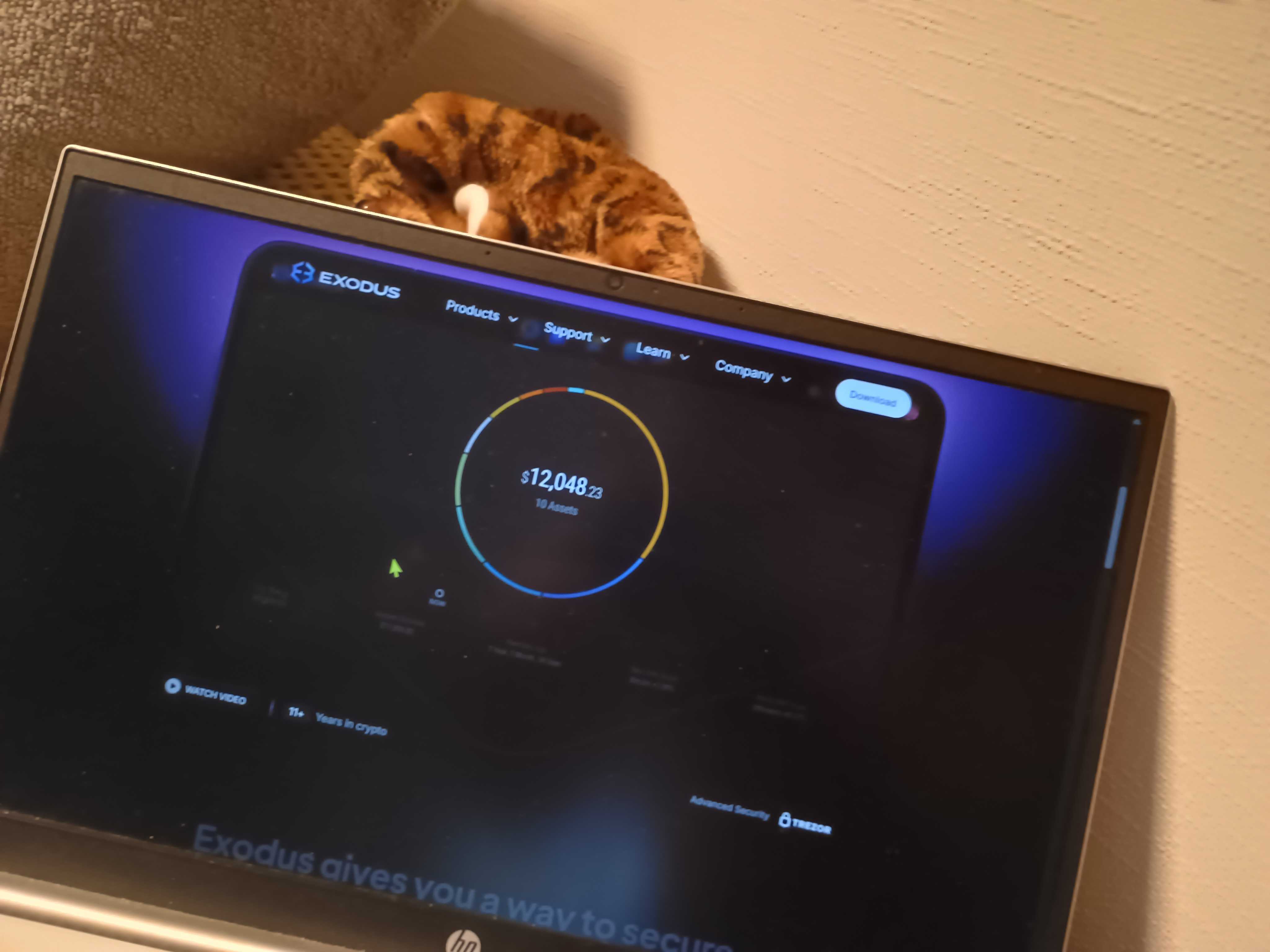

- The portfolio view: Instead of a boring list of numbers, you get a beautiful, color-coded donut chart breaking down your asset allocation. For a beginner trying to understand if they are “over-exposed” to meme coins, this visual feedback is instant and valuable.

- No “crypto jargon”: Exodus deliberately hides the plumbing. You won’t see “gwei” or “UTXO management” by default. You just see “Network Fee.” This is great for grandma, but annoying for power users who want to know exactly what they are paying per byte.

Desktop vs mobile sync

We tested the synchronization between the Windows desktop app and the Android mobile app.

- The setup: You don’t create an account with an email. You simply scan a QR code from your desktop screen using your mobile camera.

- The result: It synced instantly. The continuity is seamless. You can start a transaction on your PC and watch it confirm on your phone while walking to the fridge.

- Biometrics: The mobile app integrates perfectly with FaceID and fingerprint scanners. Exodus crypto wallet safety review passed on 5+. It feels less like a vault and more like a modern banking app.

Customization (the “fun” factor)

Exodus is one of the few wallets that lets you change “skins” and themes. We switched to the “Matrix” theme and the “Deep Space” background. Does this make your crypto safer? No. Does it make checking your portfolio during a bear market slightly less depressing? Absolutely.

The UX is so polished that it sometimes oversimplifies critical data. On the mobile app, advanced fee customization (like setting a custom nonce or specific sat/vByte fee for Bitcoin) is buried or non-existent compared to power-user wallets. You are trading control for convenience.

For 90% of retail users, this is the best-looking software they will ever install. It lowers the anxiety of self-custody by making it look professional and approachable.

Pros, cons & costs

To determine if Exodus is the right tool for your portfolio, we looked beyond the beautiful Exodus wallet reviews and its animations and focused on the friction points. Is the “Apple-like” experience worth the premium price tag on swaps?

Strengths:

- The “Apple” experience (unmatched UX): This is the primary reason Exodus exists. It abstracts away the scary parts of crypto (UTXOs, gas limits, chain IDs) behind a stunning, lag-free interface. If you are onboarding a non-technical friend or family member to crypto, this is the wallet you install for them. It prevents the “what is a gwei?” panic attacks common with MetaMask, making portfolio tracking feel like a high-end banking app.

- Best-in-class hardware bridge (Trezor): Most hot wallets treat hardware support as an afterthought. Exodus treats it as a core feature, offering a native integration with Trezor Model T and One. You can keep your life savings ($50k+) on your cold storage Trezor, but view and manage the portfolio data through the beautiful Exodus desktop UI. You get the security of cold storage with the visual clarity of a hot wallet – a “hybrid” setup that few competitors get right.

- 24/7 human support: In an industry notorious for “read the FAQ” customer service, Exodus stands out with responsive, human email support. When you panic because your transaction is “pending” for 3 hours, getting a real human reply in 40 minutes (as we did in our test) is invaluable compared to the silence from open-source dev teams.

Weaknesses:

- The “convenience tax” (high swap costs): The in-app exchange is effortless to use, but financially punishing. The spreads often range from 2% to 5%, depending on volatility. If you are an active trader trying to “swing trade” ETH for SOL during a market pump, you will lose significant capital here. On a $1,000 swap, you might pay ~$40 in hidden spreads compared to ~$2 on a centralized exchange. It is strictly for lazy, low-volume rebalancing.

- Closed-source “black box”: Unlike Electrum or MetaMask, Exodus is not fully open-source. Large parts of the core wallet code are proprietary. You cannot verify how the randomness for your keys is generated. If you are a privacy maximalist or a “cypherpunk” who believes in “Don’t Trust, Verify,” Exodus is a non-starter. You are forced to trust the company’s reputation rather than the code itself.

- Limited fee control (mobile): The mobile app often over-simplifies network fees, giving you fewer options to set custom “sats/vbyte” for Bitcoin transactions. During a mempool spike (network congestion), Exodus might default to a high fee to ensure speed. A power user on a wallet like Sparrow could manually set a lower fee and wait, saving $10-$20, whereas the Exodus user is often forced to overpay for block space.

Trustworthiness check

- 2015 – Present (clean record): Exodus has never suffered a “centralized” hack. Their servers do not hold keys, so they cannot be breached in the traditional sense.

- Phishing scams: Because Exodus is popular, it is a popular target for phishing. Fake “Exodus Support” bots swarm Twitter, and fake apps appear on Play Store. Note: This is a social engineering issue, not a code flaw, but it puts users at risk.

- Regulation: Exodus (the company) is a SEC-reporting entity. This forces a level of transparency regarding their business model and leadership that is unique in the crypto space. We know who the CEO is; we know their revenue sources. This is rare.

GNcrypto’s overall Exodus wallet rating

| Assessment criteria | Rating (out of 5) |

|---|---|

| Security & Key Management | 4 |

| Supported Assets & Networks | 5 |

| Transaction Costs & Speed | 3 |

| User Experience & Interface | 5 |

| DeFi & dApp Integration | 4 |

| Recovery & Backup Systems | 4 |

| Customer Support & Documentation | 4.5 |

| Final Score | 4.2 |

Methodology – why you should trust us

At GNcrypto, we put transparency first when evaluating hot cryptocurrency wallets. Our reviews are based on hands-on testing and thorough analysis across all key dimensions that matter for self-custody and daily crypto use.

How we collect data

We test wallets with real funds (small amounts), generate new wallets, execute transactions on mainnet, and interact with DeFi protocols.

- Hands-on testing: We download the wallet (mobile + desktop), generate a new seed phrase to document the backup flow, and test authentication methods (PIN, biometrics).

- Live transactions: We add Bitcoin, Ethereum, and L2 assets, sending test transactions to measure speed and fee accuracy. We also verify custom token imports and NFT display functionality.

- DeFi stress test: We connect to dApps (like Uniswap or OpenSea) via WalletConnect and test native swap and staking features.

- Support & recovery: We attempt to recover the wallet on a second device using the seed phrase and submit anonymous support tickets to measure response times.

Categories & weights

- Security & Key Management – 25%

- Supported Assets & Networks – 20%

- Transaction Costs & Speed – 15%

- User Experience & Interface – 15%

- DeFi & dApp Integration – 10%

- Recovery & Backup Systems – 10%

- Customer Support & Documentation – 5%

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.