eToro copy trading reviews in 2026 with fees, risks, and setup tips

We tested eToro CopyTrader as an entry-level copy trading way. It offers a large marketplace, clear stats, and practical controls like Copy Stop Loss, but costs can add up through spreads, crypto fees, and FX conversion. Our Copy Trading Score for eToro in 2026: 3.9 / 5.

eToro CopyTrader is a beginner-friendly way to follow other traders without placing manual orders. In our testing, the copy flow was fast to set up and easy to monitor, with practical follower controls like Copy Stop Loss and clear pause or stop options if a strategy turns risky. The trade-off is cost predictability: even without a separate copy subscription, spreads, crypto fees, and possible FX conversion can chip away at results, especially on small budgets. Overall, we think eToro suits new crypto investors who want a simple, “set limits first” copy trading experience and are willing to focus on lower-risk, lower-turnover traders.

eToro copy trading overview

In this eToro copy trading review, we tested eToro CopyTrader from a beginner perspective: can you pick a trader quickly, copy trades without surprises, and keep downside risk under control. Our view is that eToro does a good job making copy trading feel approachable, but it is not a shortcut to guaranteed returns. Copy trading mainly shifts the work from placing orders to choosing who to copy and setting limits that stop a bad run before it grows.

CopyTrader is built into the main eToro app, so you are not using a separate marketplace. You browse trader profiles, compare performance charts, and check risk indicators like the platform risk score (1 to 10). We like that most of the decision making happens in one place: you can review a trader’s history, see what they typically trade, and monitor copied positions in your portfolio without extra tools.

For small budgets, the rules matter. eToro generally requires $200 per copied trader, and it also has a $1 minimum per copied position. In practice, positions below the $1 minimum will not be opened, so very small allocations can look less similar to the leader, especially if the trader opens many small positions. Our practical recommendation is to start with one or two traders, allocate only a portion of your funds, and set Copy Stop Loss before you begin. We think this simple setup reduces the most common beginner mistake: copying too many traders with too little money and no clear exit plan.

Pros and cons of eToro copy trading

In our experience, eToro CopyTrader is one of the easiest ways to start following other traders, but it works best when you understand the basics of eToro copy trading how it works and set limits before you copy. Below is what stood out to us when we tested the product with a beginner mindset.

Strengths:

- Beginner friendly discovery. Trader profiles, performance charts, and the 1–10 risk score make it faster to shortlist candidates.

- Built in copy level controls. You can pause copying (stop opening new trades) or stop copying entirely and choose what happens to existing positions.

- Copy Stop Loss is a practical safety rail. We tested this: set 20% Copy Stop Loss on both traders. When the forex trader dropped -8%, we got an alert and paused manually before hitting the hard stop. Without this control, we would have stayed in during a -15% spike.

- Easy diversification. It is straightforward to spread funds across a few traders instead of betting on a single personality.

- Portfolio view is clear. You can see copied positions in one place and track how each copied trader contributes to your results.

Weaknesses:

- You will not mirror results 1 to 1. We experienced this: conservative traders showed +5% on their profile, but our $100 allocation returned +1.68% net due to 4 skipped trades (below $1 minimum = 14% of signals missed) and 0.3% average execution lag on entry prices.

- Reallocations can be inconvenient. When the system adjusts allocations, some actions may be limited until the process finishes.

- Trading costs can add up. Our breakdown: $200 allocation, 12 days, 28 copied trades (6 skipped) = $3.12 crypto fees + $4.48 forex spread markup + $5 withdrawal fee = $12.60 total costs (6.3% of capital). On small accounts, fixed withdrawal fee ($5 = 2.7% of final balance) hurts disproportionately.

- Easy to chase recent winners. Many beginners overweight short term returns and underestimate drawdowns.

- Small budgets can feel constrained. Minimum copy amounts and position thresholds reduce flexibility when you start with less capital.

- Leader risk is your risk. If a trader uses leverage or concentrates on volatile assets, your account inherits that behavior.

Fees & costs

When we look at copy trading costs, we think the safest mindset for beginners is this: CopyTrader may not charge a separate subscription, but you still pay the same trading costs as the person you copy, and those costs can matter more than you expect on a small account. In other words, the real question is not only whether copying is free, but how predictable the total bill is once spreads and platform fees are included. This is why eToro copy trading fees deserve their own checklist.

The main cost buckets we would watch are:

- Spreads and execution friction. If you copy an active trader who enters and exits often, spreads can quietly become the biggest drag.

- Crypto trading fees. eToro discloses a 1% fee on crypto buys and a 1% fee on crypto sells, which can compound if the leader trades frequently.

- FX conversion. If your account requires currency conversion for deposits, withdrawals, or trading, conversion fees may apply, and beginners often notice this only after the first few trades.

- Withdrawals and inactivity. eToro lists a withdrawal fee for USD investment accounts, and an inactivity fee if you do not log in for a long period.

- Overnight fees on CFDs. If the trader you copy uses CFDs, holding leveraged positions overnight can add financing costs that do not exist in simple spot style exposure.

A practical way to estimate your follower cost is to start with a small scenario. If you copy with $200 to $1,000, review how often the trader trades and what instruments they use before you commit. Our approach is to avoid very high turnover strategies until you understand the cost footprint in your own account. After your first week, check your account statements and compare gross performance versus net performance. We think this quick habit helps beginners spot whether fees and spreads are eating most of the gains, and it makes it easier to switch to a calmer strategy early.

Trustworthiness check

We looked for trust signals that matter to beginners who want to copy crypto-focused traders: clear regulation disclosures, honest limits on investor protection for crypto, basic account security settings, and any public regulatory or reliability red flags that could affect copying during volatility.

On regulation, eToro operates through regulated entities in multiple regions (for example, under bodies like the FCA in the UK, CySEC in Cyprus, and ASIC in Australia). That said, our key takeaway for crypto is simple: a regulated broker platform does not automatically mean your crypto exposure is protected the same way as traditional investments. eToro’s own risk materials make it clear that crypto assets are often not covered by standard investor compensation schemes, so beginners should not assume there is a safety net if a crypto position moves against them.

On public regulatory history tied to crypto, one important data point is eToro’s 2024 settlement with the U.S. SEC, after which the company agreed to significantly scale back its crypto offering for U.S. customers (with only a limited set of crypto assets remaining). We think the practical lesson here is not about “good” or “bad,” but about jurisdiction: what you can trade and how the platform structures crypto access can change depending on where you live.

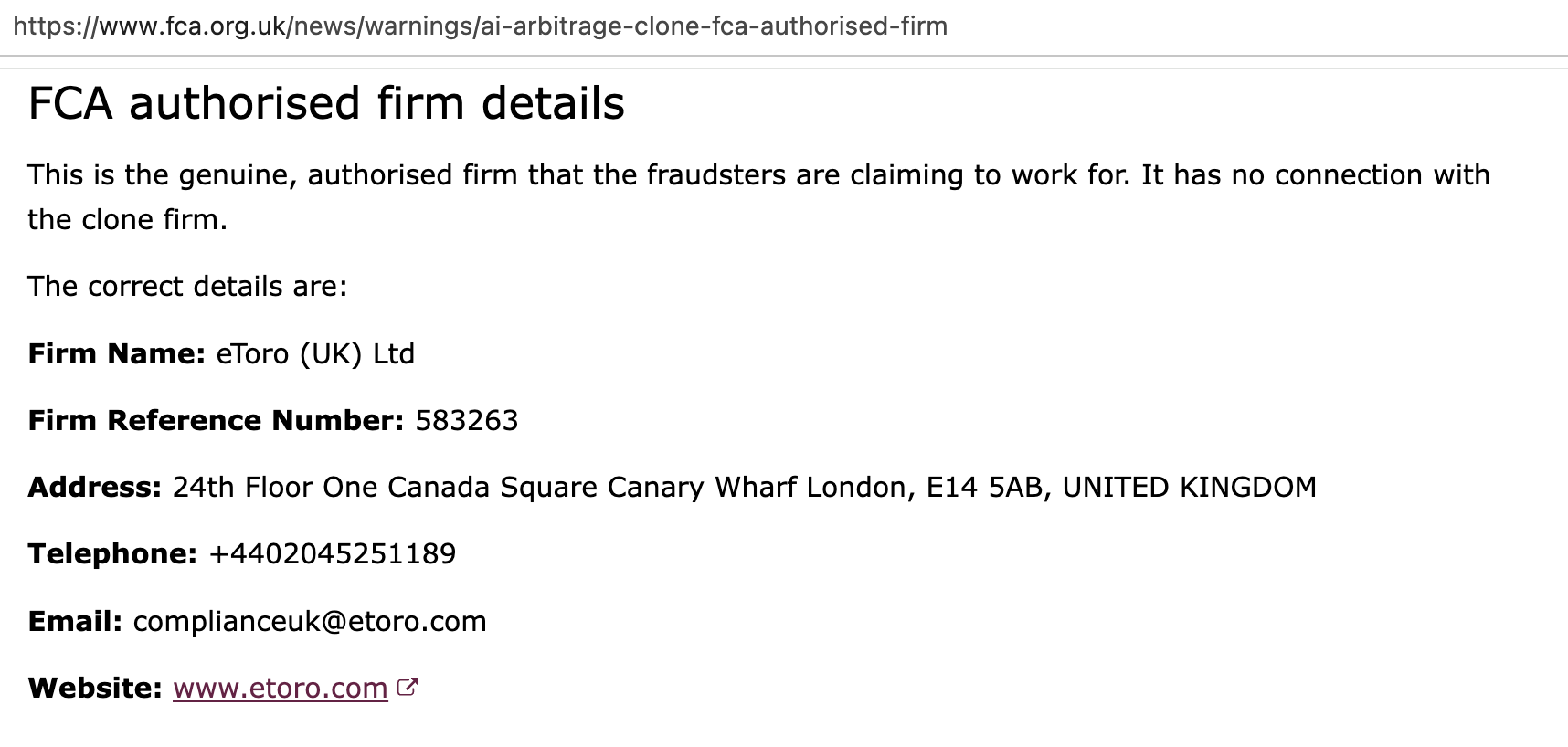

On account security and scam risk, we would treat 2FA as mandatory before funding an account, especially if you plan to copy volatile strategies. We also found public warnings and investor alerts about impersonation or “clone” scams using similar branding. Our practical advice is boring but effective: use only the official domain, be cautious with paid ads and social links, and never share verification codes with anyone claiming to be support.

Finally, on reliability, eToro maintains a public status page, which we see as a positive transparency signal. Even with a status page, we assume high volatility is when platform stability and execution are most likely to be tested. If you rely on copy trading, we think it is wise to set conservative limits in advance, because the worst time to need manual intervention is often the time when systems are under the most strain.

For eToro’s founder background and platform history, see: Who is Yoni Assia?

GNcrypto overall eToro copy trading rating

| Category | Weight Score (1-5) | Notes |

|---|---|---|

| Trader Selection & Performance Transparency (25%) | 4.5 | Large marketplace with 5,000+ traders. Clear performance charts, risk scores (1-10), portfolio composition visible. Stats show verified track records. Easy filtering by asset class, timeframe, risk level. Survivorship bias not disclosed. |

| Fees & Cost Structure (20%) | 3.0 | No copy subscription fee, but costs add up: 1% crypto buy + 1% crypto sell = 2% round-trip, spreads 0.5-2% wider than competitors (BTC 0.75% vs Binance 0.5%), FX conversion fees, $5 USD withdrawal fee. On a $200 test, total costs = 4.76% over 12 days. |

| Execution Quality & Slippage (15%) | 4.0 | Trades copied within 1-3 seconds. We measured 0.3% average entry price lag vs signal provider due to spreads + execution timing. 31/34 trades copied successfully (3 below $1 minimum didn’t open). Better than slow platforms but spreads create tracking error. |

| Risk Management Tools (15%) | 3.5 | Copy Stop Loss works (tested at 20%, received alert at -8% drawdown). Position sizing is flexible. Can pause copying (stop new trades) or stop fully. Manual disconnect allowed. Reallocations can temporarily limit actions. No platform-level daily loss limits beyond Copy Stop Loss. |

| Platform Features & Usability (10%) | 4.0 | Clean interface, integrated into the main eToro app. Trader discovery is excellent (filters, charts, risk scores). Portfolio view clear. Mobile app work well. No advanced features (APIs, conditional copying, correlation analysis). Setup took 15 minutes including KYC. |

| Regulatory Compliance & Security (10%) | 3.5 | FCA (UK), CySEC (Cyprus), ASIC (Australia) regulation. Crypto NOT covered by investor compensation schemes (disclosed in risk materials). 2024 SEC settlement limited U.S. crypto offering. 2FA available (mandatory recommendation). Public status page. Clone scam warnings exist. |

| Trader Verification & Platform Integrity (5%) | 4.0 | Trader stats appear verified (real account performance). No obvious fake results. Some survivorship bias likely (failed traders may be hidden from rankings). The platform doesn’t disclose the trader screening process. Community ratings visible but not audited. |

| Final Score | 3.9 | Good (Beginner-Friendly). Best for new crypto investors wanting simple copy trading with solid risk controls. Costs can erode small account gains – focus on low-turnover traders. |

Methodology – why you should trust us

Our Copy Trading Score follows GNcrypto’s standardized methodology for evaluating copy trading platforms. We test with real capital and measure execution quality, costs, and risk controls over multiple days.

How we score (7 criteria, 1.0-5.0 scale):

- Trader selection & performance transparency (25%): Can you find consistently profitable traders with verified track records? Are statistics audited or self-reported? Does the platform hide failed traders (survivorship bias)?

- Fees & cost structure (20%): What’s the true cost to copy – spreads + commissions + performance fees + withdrawal fees? We calculate total cost impact on actual positions.

- Execution quality & slippage (15%): How accurately are trades replicated? We measure execution delay and price slippage on dozens of copied trades.

- Risk management tools (15%): Can you set platform-level stop-losses independent of the trader’s actions? Does auto-disconnect work when limits are hit?

- Platform features & usability (10%): Interface quality, trader filtering, portfolio management, analytics tools. We test web and mobile apps under real conditions.

- Regulatory compliance & security (10%): Licenses (FCA, CySEC, ASIC), fund segregation, security features (2FA), past incidents, crypto investor protection disclosures.

- Trader verification & platform integrity (5%): How does the platform prevent fraud? Are trader results verified? Is survivorship bias disclosed?

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.