Ethereum validator exit queue may grow to 1.6M ETH

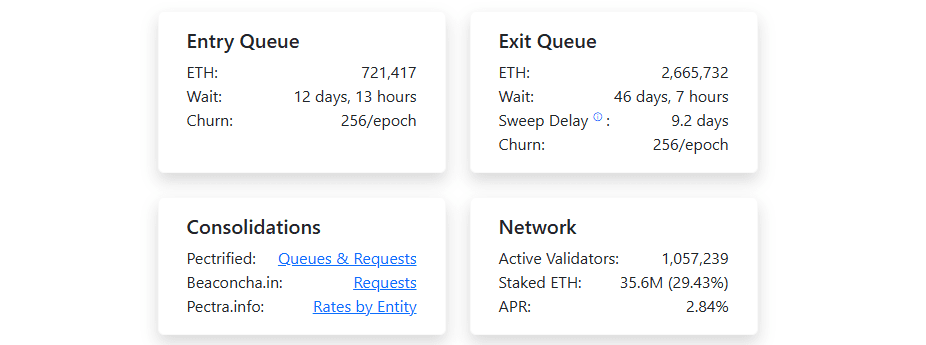

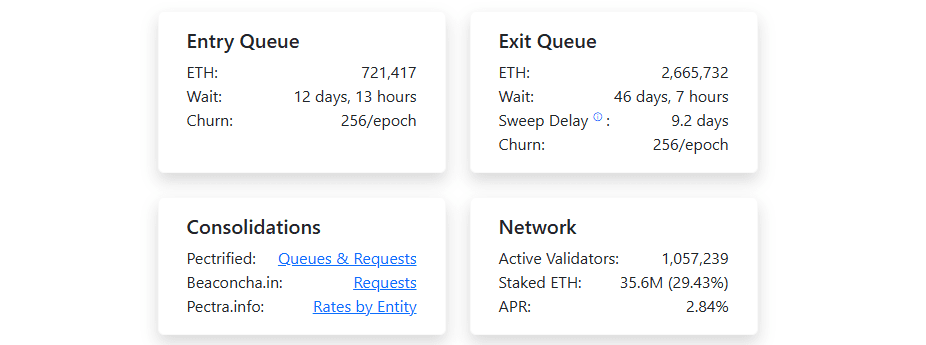

The Ethereum validator exit queue could soon jump to 1.63M ETH, according to ValidatorQueue. The trigger was Kiln Finance’s announcement that it is beginning an “orderly exit” of all its validators following an incident involving its partner SwissBorg.

Last week, SwissBorg disclosed an API breach in which attackers drained about 193,000 Solana tokens from its Earn program. In response, Kiln decided to withdraw its Ethereum validators to provide additional protection for client assets.

The exit process may take 10 to 42 days, Kiln said. The market raised concerns about potential pressure on ETH’s price, as mass unstaking is sometimes seen as a signal to sell. However, Ethereum analyst and educator Anthony Sassano argued the risk is minimal. “These ETH will be relaunched with new keys. They are not going to be sold,” he wrote on X.

Currently, about 35.6M ETH, or 29.4% of total supply, is staked. A withdrawal of 2.6M coins accounts for less than 10% of that, lowering the likelihood of meaningful price impact.

At press time, ETH trades at $4,306. Analysts say the queue dynamics highlight the ecosystem’s maturity: major validators are upgrading infrastructure to meet new security standards without posing significant risks to the market.

The exit process may take 10 to 42 days, Kiln said. The market raised concerns about potential pressure on ETH’s price, as mass unstaking is sometimes seen as a signal to sell. However, Ethereum analyst and educator Anthony Sassano argued the risk is minimal. “These ETH will be relaunched with new keys. They are not going to be sold,” he wrote on X.

Currently, about 35.6M ETH, or 29.4% of total supply, is staked. A withdrawal of 2.6M coins accounts for less than 10% of that, lowering the likelihood of meaningful price impact.

Ethereum exit queue currently stands at about 2.6M ETH. Source: validatorqueue.com

Ethereum has already gone through periods of record queues. In August, the network saw the largest validator exit in its history (more than 1M ETH). And in early September, the entry queue hit a two-year high ($3.7B worth of ETH) due to rising adoption across institutional players and digital asset treasuries.

At press time, ETH trades at $4,306. Analysts say the queue dynamics highlight the ecosystem’s maturity: major validators are upgrading infrastructure to meet new security standards without posing significant risks to the market.