Ethereum sets a transaction record as the staking exit queue hits zero

On Jan. 19, Ethereum set a new high for daily transactions on the base layer. At the same time, the validator exit queue dropped to zero, meaning nobody is currently waiting to deactivate. The entry queue is still long, which suggests continued demand for staking and strong interest in ETH.

On-chain data suggests the heavier load has come alongside lower average fees. A similar setup appeared in late 2025, when Ethereum had already set a record for transaction count amid low fees. Analysts also pointed out that a “transaction” doesn’t always mean a “new user”: the totals can include transfers, smart-contract calls, bot-driven chains, and routine technical operations run by services.

In early 2026, a noticeable share of activity has been tied to stablecoins and the way layer-2 networks operate. That lines up with growth in active addresses and an influx of new users. In this setup, the base layer more often acts as a settlement layer where results are finalized, while a lot of smaller actions happen on L2.

A zero exit queue looks especially striking against the backdrop of fall 2025. Back then, requests to withdraw stake were measured in millions of ETH, and waiting times could stretch into weeks. By late December, the balance started to shift: the entry queue grew larger than the exit queue.

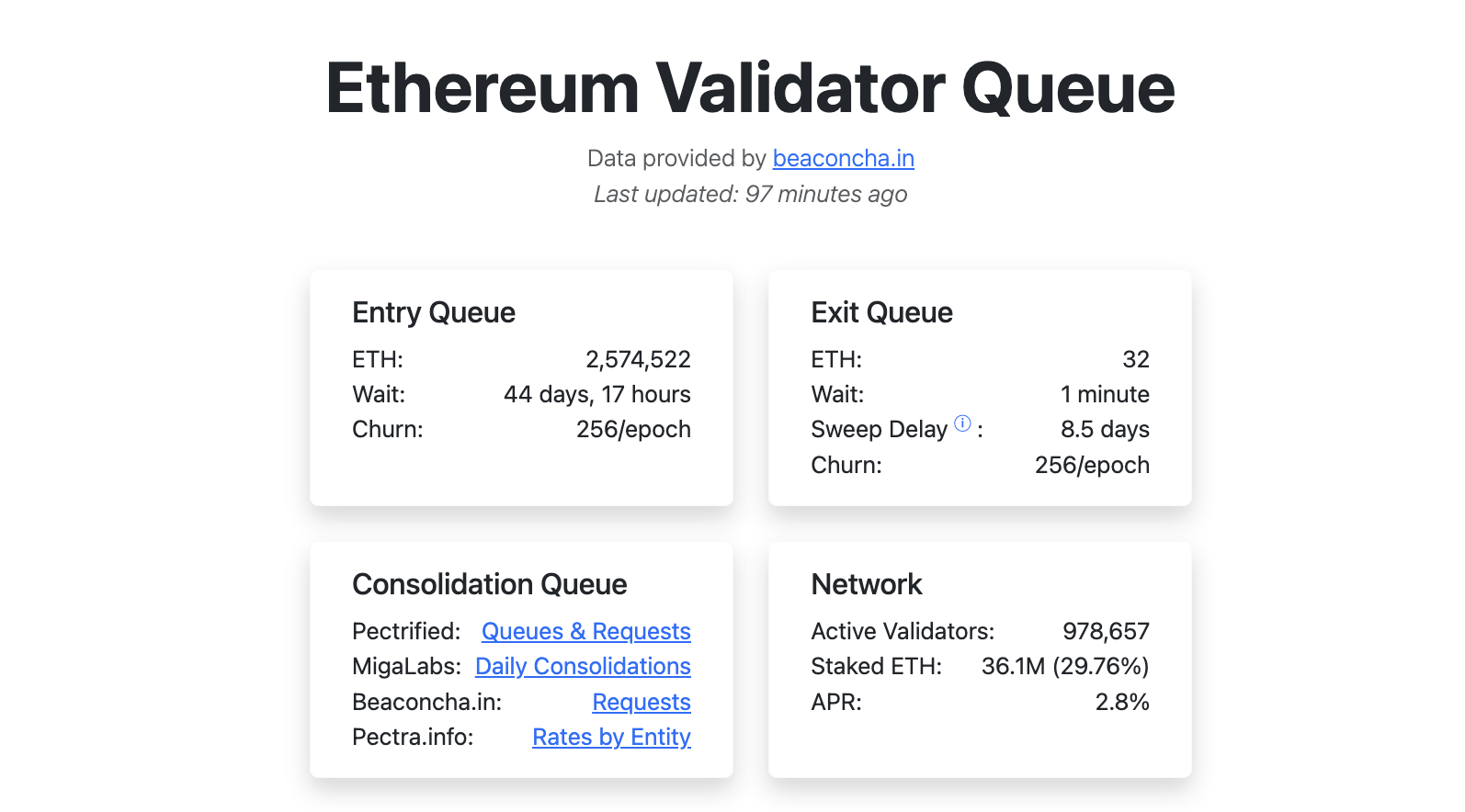

Right now, based on queue tracker data, roughly 2.6 million ETH is waiting to be activated, and the estimated wait for new validators is around a month and a half. Exit requests, by contrast, can clear in minutes. Those queues are protocol-limited on purpose: a sudden wave of exits could weaken network security, so the metric is often treated as a quick read on sentiment.

Throughput also depends on how much data a block can fit. In late November, validators backed raising the block gas limit to 60 million, which expanded base-layer capacity.

Next, the market will watch whether this mix holds: high usage, low fees, and no line of validators looking to leave staking. If it does, talk about tighter ETH supply will likely grow louder. If not, the numbers could cool off fairly quickly.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.