Ethereum ETFs post record $788M weekly outflows

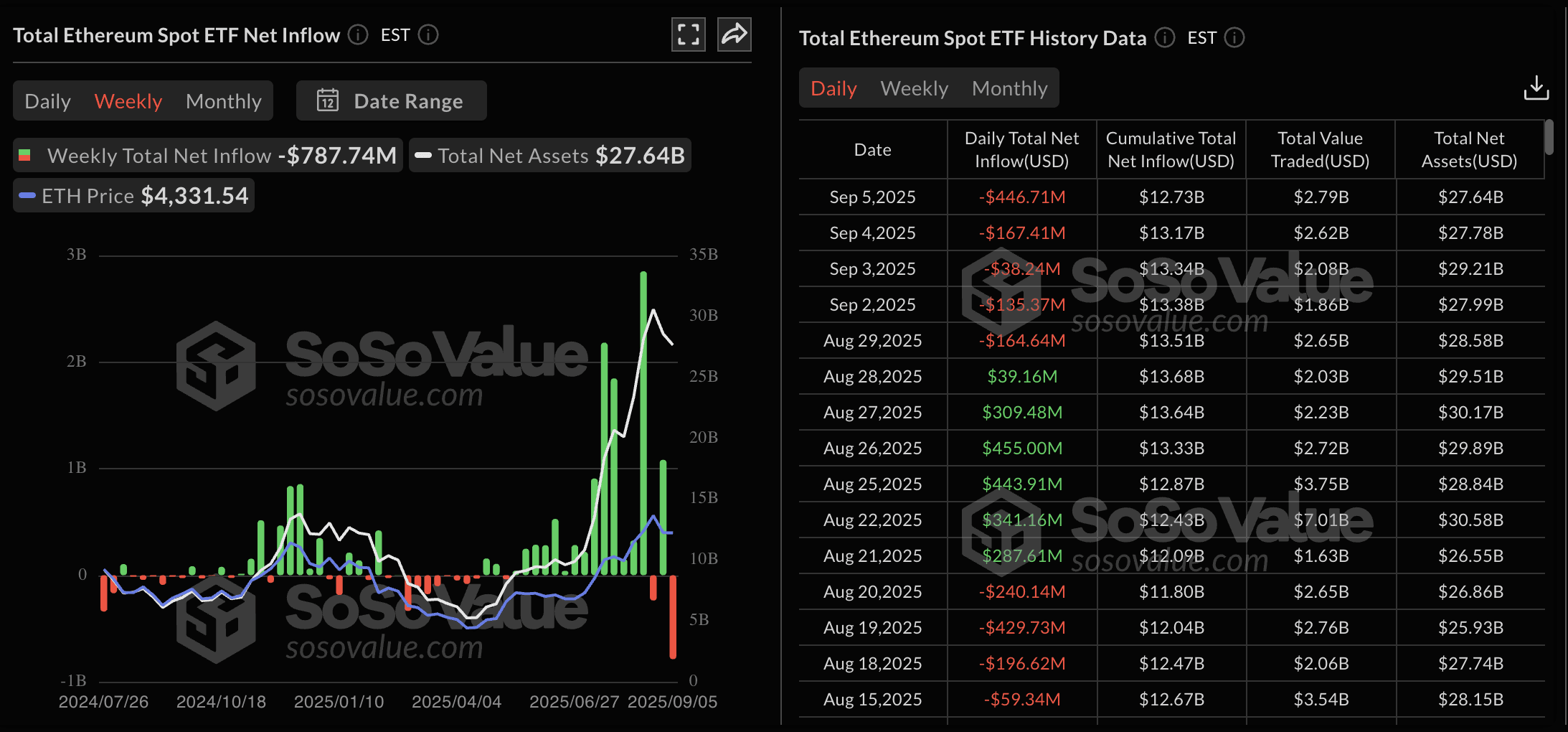

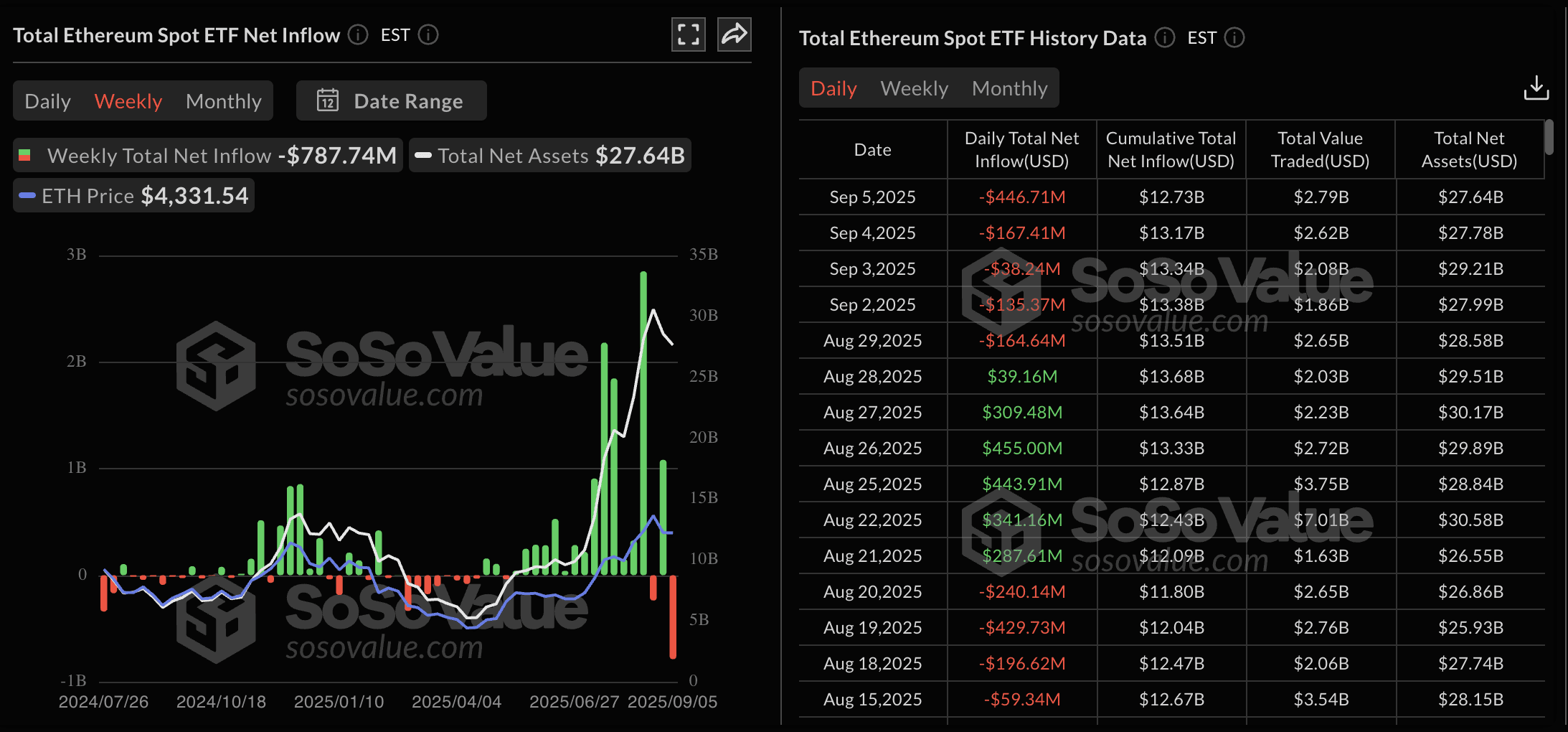

Ethereum spot exchange-traded funds suffered their largest setback yet, with $788 million in net outflows recorded between September 2 and 5, according to data from SoSoValue.

The figure marks the biggest single-week withdrawal since the launch of Ethereum ETFs earlier this year and came with no net inflows during the period.

BlackRock’s ETHA led the decline, shedding $312 million in assets over the week. Fidelity’s FETH followed closely with $288 million in outflows. Despite the losses, cumulative inflows remain substantial: ETHA has attracted $12.81 billion since launch, while FETH has brought in $2.48 billion. The biggest selloff came on September 5 with $446.7 million leaving the products and marking it as the second-largest single-day outflow since the ETFs launched earlier this year.

As of now, Ethereum spot ETFs hold $27.64 billion in assets, equivalent to 5.28% of the cryptocurrency’s total market capitalization. Historical inflows stand at $12.73 billion, underscoring that institutions are still net buyers over the long term, even if short-term sentiment has turned sharply negative.

The market impact was immediate. Ethereum’s price slipped to around $4,280 during the week, down nearly 2%. Analysts say the redemptions reflect profit-taking after a strong summer run, with institutional investors shifting allocations rather than abandoning the asset altogether.

By comparison, Bitcoin spot ETFs posted a modest $250 million in net inflows over the same period, led by BlackRock’s IBIT.

As of now, Ethereum spot ETFs hold $27.64 billion in assets, equivalent to 5.28% of the cryptocurrency’s total market capitalization. Historical inflows stand at $12.73 billion, underscoring that institutions are still net buyers over the long term, even if short-term sentiment has turned sharply negative.

The market impact was immediate. Ethereum’s price slipped to around $4,280 during the week, down nearly 2%. Analysts say the redemptions reflect profit-taking after a strong summer run, with institutional investors shifting allocations rather than abandoning the asset altogether.

By comparison, Bitcoin spot ETFs posted a modest $250 million in net inflows over the same period, led by BlackRock’s IBIT.