Ethereum ETFs attract $637M in weekly inflows

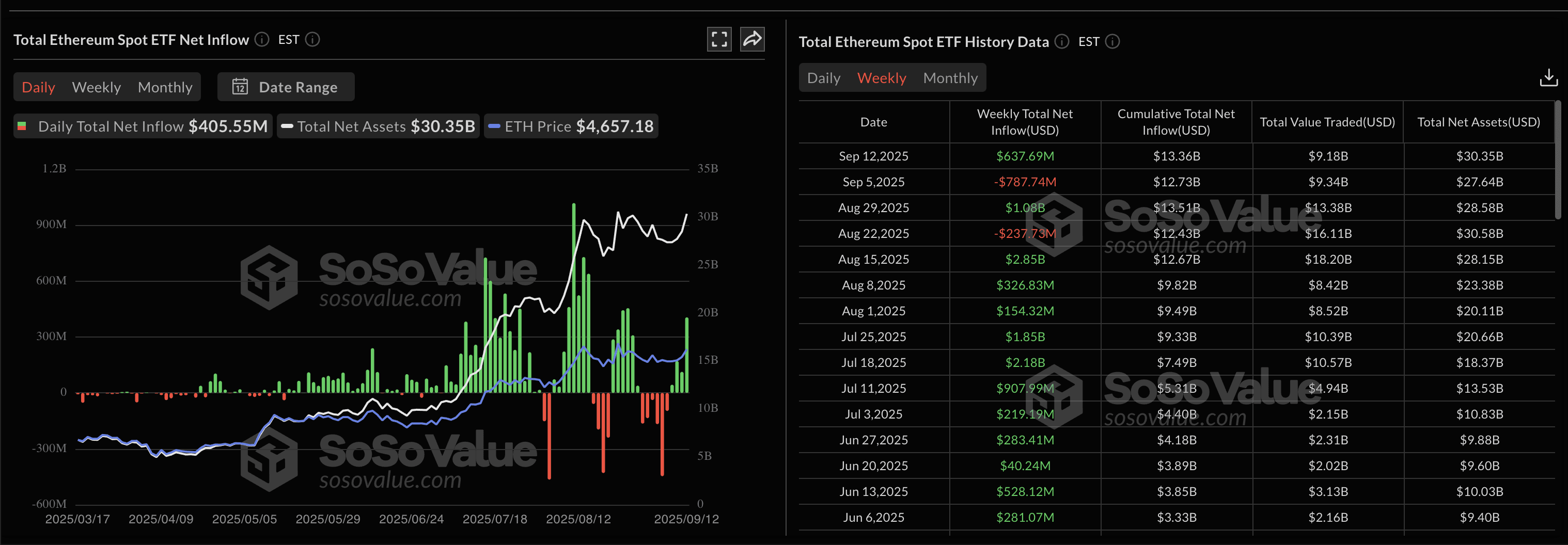

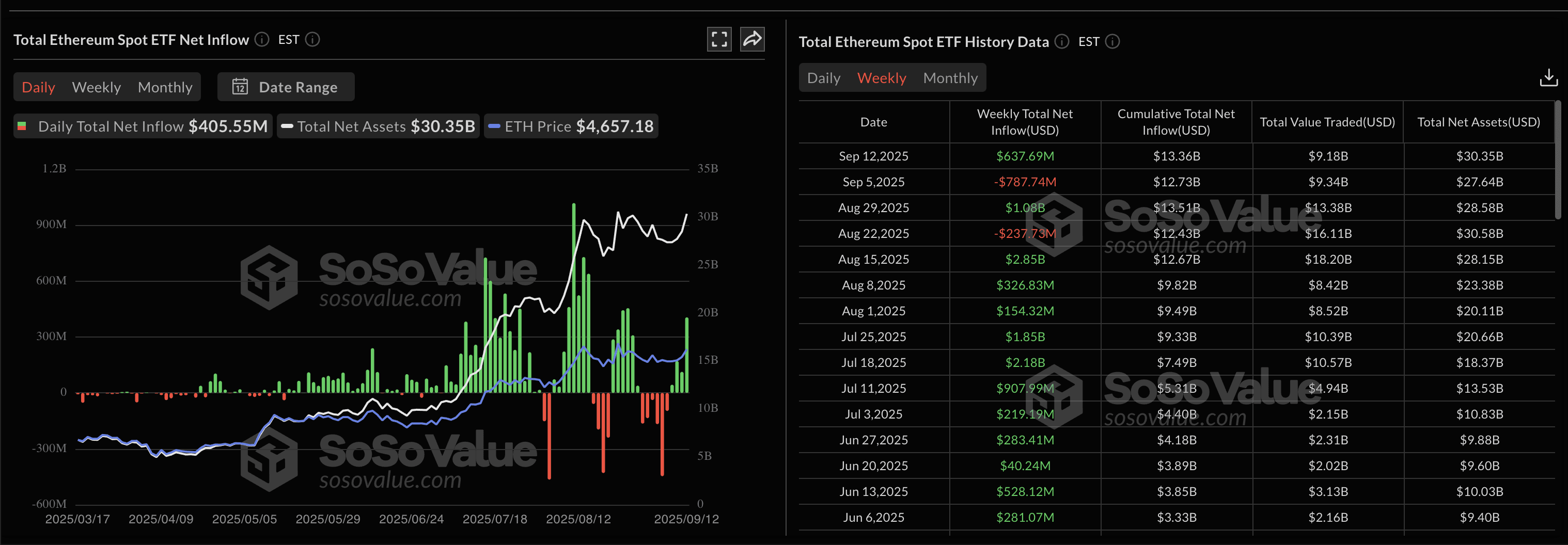

Institutional demand for Ethereum is back, with ETH exchange-traded funds (ETFs) recording over half a billion dollars in new capital last week.

Last week, Ethereum funds had one of their toughest weeks yet. From September 2 to 6, 2025, they experienced four straight days of outflows totaling $787.7 million, which was one of the largest institutional exits since their launch.

The withdrawals were largely attributed to profit-taking after August’s rally and general investor anxiety amid macroeconomic concerns and recession fears.

However, sentiment flipped from September 7 to 14. Over the week, ETH ETFs attracted over $637 million, offsetting previous outflows and bringing the market back into a positive zone.

The new wave of inflows began in the middle of the week and peaked on Friday, September 12. On that day alone, Ethereum ETFs attracted $406 million, according to SoSoValue data.

The second week of September showed a significant inflow into ETH ETFs. Source: sosovalue

ETF issuers BlackRock and Fidelity led the inflows. The BlackRock iShares Ethereum Trust (ETHA) fund attracted $165 million, while the Fidelity Ethereum Fund (FETH) increased its assets by $163 million. Smaller contributions came from Grayscale ETHE (+$23.84M), Grayscale ETH (+$17.57M), and Bitwise ETHW (+$16.62M).

The total trading volume in ETH ETFs for the week reached $2.55 billion, which underscores the growing interest of large players in the Ethereum market. Current assets under management (AUM) in Ethereum ETFs have now exceeded $30 billion.

For comparison, Bitcoin ETFs also showed significant inflows during the same period ($2.4 billion), which indicates a renewed institutional confidence in the cryptocurrency market.