Ethereum ETFs record $557M in net inflows this week

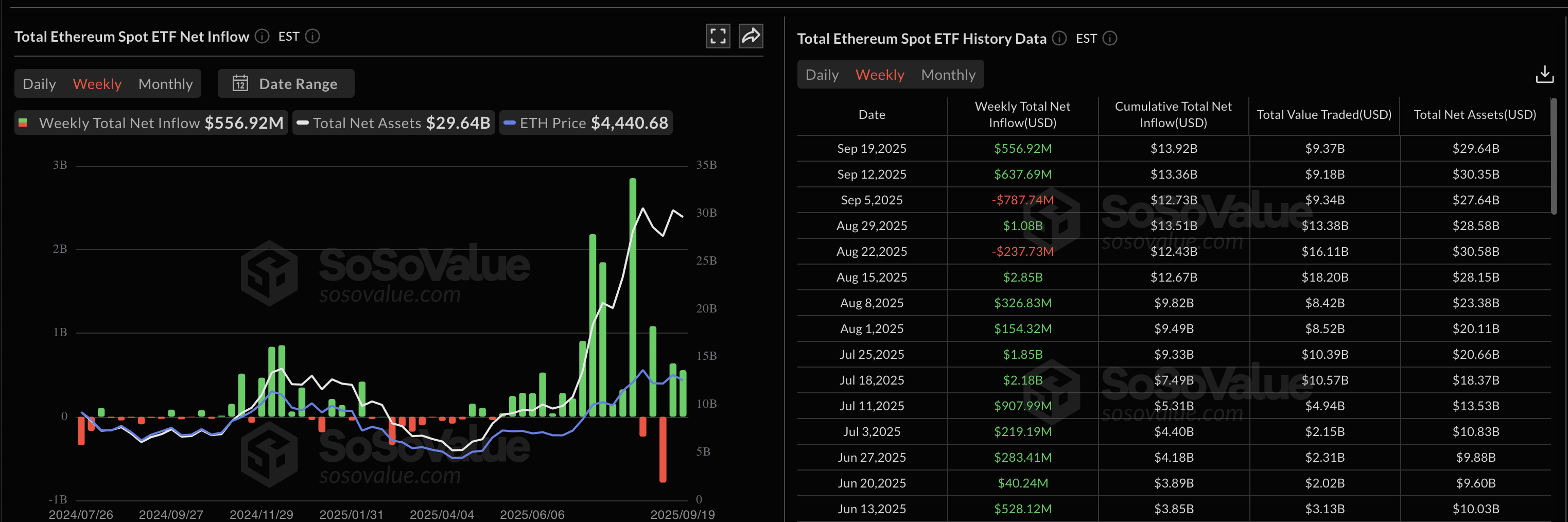

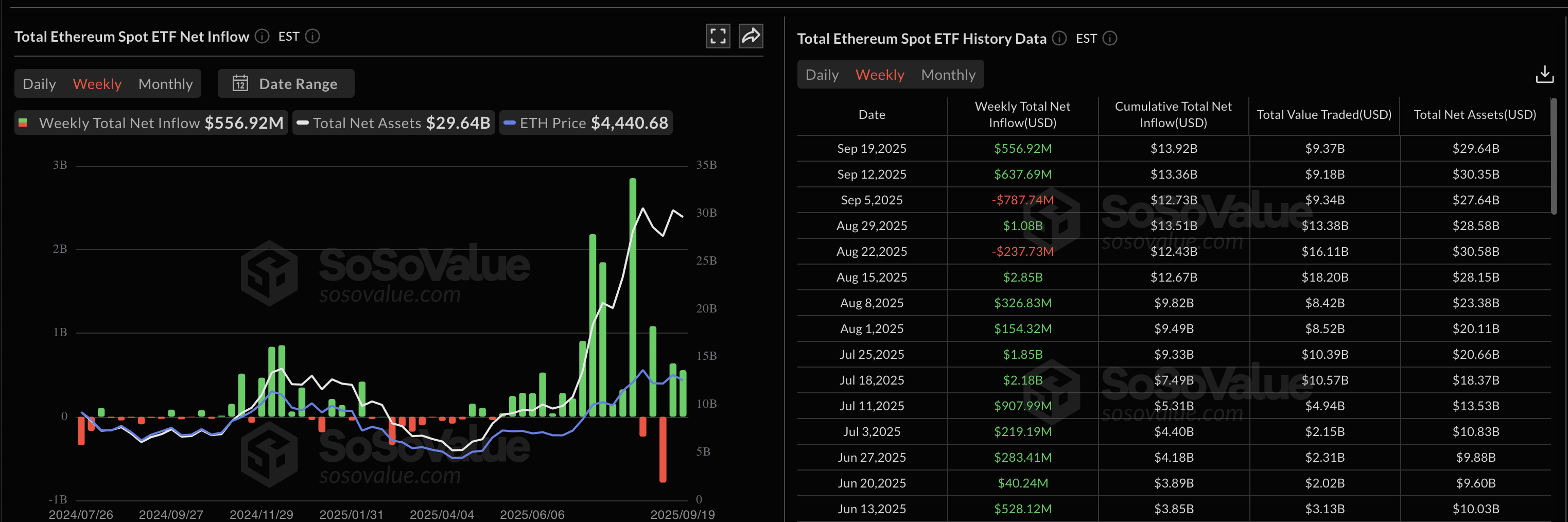

Institutional investors continue to back Ethereum-based products: SoSoValue reports more than half a billion dollars in cumulative inflows during the week of September 15–21.

Last week (September 8-14), the net inflow was about $637 million. This week it slowed to $557 million, but inflows remained positive.

Expectations are now tied to the potential launch of a staking Ethereum ETF. Such a product could free up liquidity for investors and open the door to reinvestment in Ethereum-related products to optimize their market strategies. The SEC is expected to make a final decision in October 2025.

The week started with a strong inflow: on Monday alone, the funds brought in more than $360 million. On Tuesday, the market faced an outflow of $61.7 million, and on Wednesday, followed by a smaller decline of $1.9 million on Wednesday. From Thursday, the trend reversed with $213 million in inflows, and on Friday the week closed with an additional $47.7 million.

From September 15-21, the inflow to ETH ETFs slowed down slightly. Source: SoSoValue

The leaders among issuers were Fidelity (FETH), which attracted $159 million on Thursday, and BlackRock (ETHA), which accounted for $47.7 million on Friday. Grayscale (ETHE) added $22.9 million, while Invesco Galaxy (QETH) contributed $2.7 million.

Despite midweek fluctuations, the overall balance remained positive. Institutional interest in Ethereum was high: the total trading volume in ETFs for the week exceeded $2.5 billion, and assets under management (AUM) remain above $30 billion (over 5.5% of ETH’s market cap).

For comparison, Bitcoin ETFs recorded a net inflow of about $887 million over the same period, which reflects a broader recovery in institutional confidence across the cryptocurrency market.