Ethereum sets a record for daily transactions

As of Dec. 31, 2025, Ethereum reached a new activity high: the seven-day moving average for transactions rose to about 1.87 million. The metric stayed elevated throughout the week.

According to Etherscan data, Ethereum mainnet posted an all-time high of 2,230,801 transactions in a single day. The record was set on Dec. 29, 2025. Activity eased afterward but remained close to peak levels on Dec. 30–31.

A higher transaction count does not always mean more unique users are arriving on-chain. A “transaction” can be a simple transfer, a smart contract interaction, a bot-driven sequence, or operational activity from infrastructure services. Because of that, analysts typically look at the broader picture: active addresses, fee trends, gas usage, and whether pending transaction queues are building up.

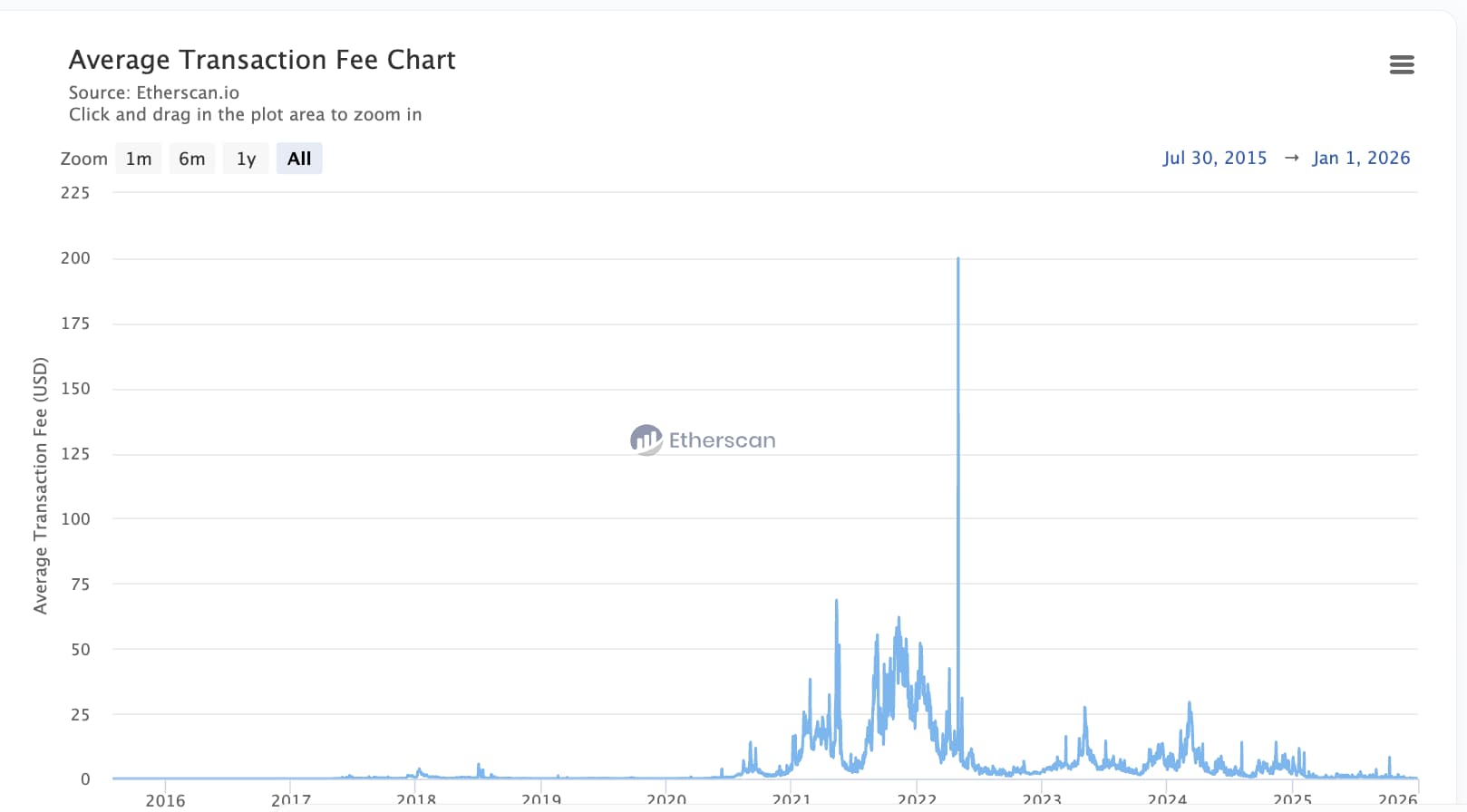

Fees are a key part of the context. Etherscan’s historical charts show the average transaction fee in USD peaked on May 1, 2022, at $200.06. By contrast, the latest Etherscan stats show an average fee over the past 24 hours of roughly $0.12, with about 1.94 million transactions over the same period.

High throughput that previously came with a sharp rise in costs is now more frequently paired with lower fees.

The combination points to strong demand for Ethereum’s base layer. Over the past few years, many user-facing apps and lower-value activity have moved to Layer 2 networks. Still, a record on Layer 1 suggests mainnet continues to serve as a settlement venue where balances are finalized, application states are anchored, and higher-value flows prioritize liquidity and security.

The record also functions as a stress test over more than a single day. One-time spikes can be driven by short-lived events. A seven-day moving average at a new high suggests more sustained usage. At the same time, Etherscan’s network charts show daily new addresses above 360,000 in the latest read, which may indicate a broader base of participants.

Even so, a record does not guarantee the trend continues. Transaction activity can be affected by seasonality, bursts from individual protocols, arbitrage cycles, stablecoin flows, and marketing-driven events. Still, the pairing of high transaction volume and low fees is notable for Ethereum and suggests the network is handling heavier activity with less pressure on costs.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.