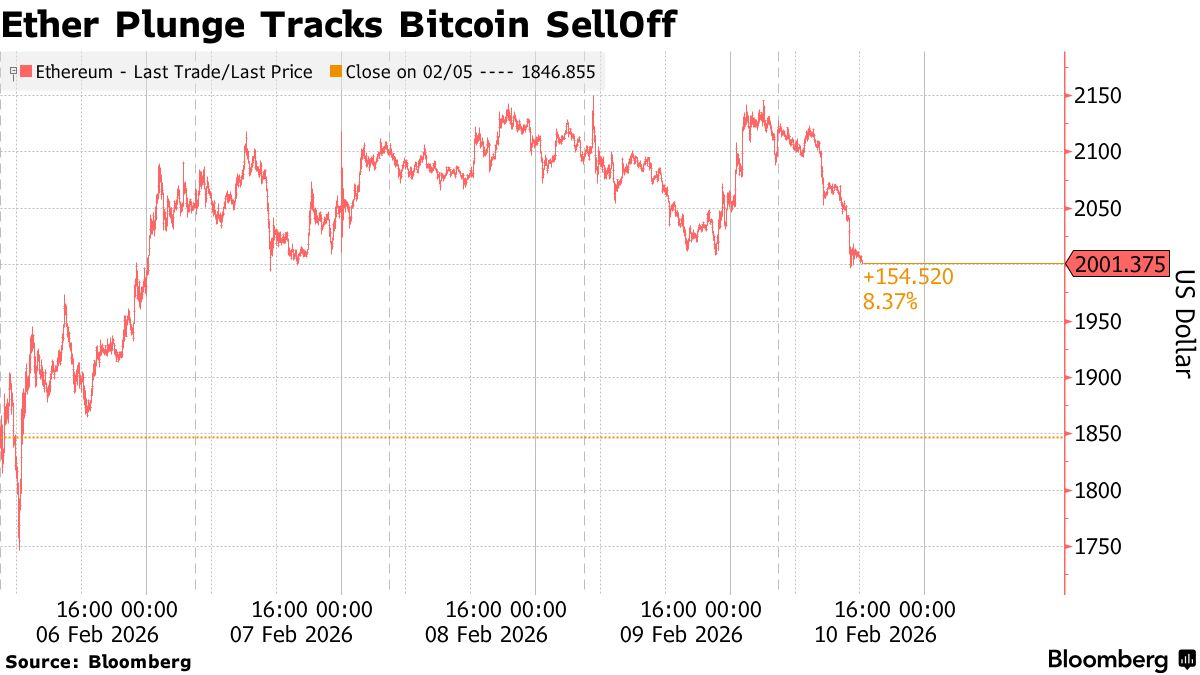

Ether falls alongside Bitcoin, deepening the market drawdown

Ethereum accelerated its decline, falling below $2,000 amid deepening risk-off sentiment and a renewed drop in Bitcoin, which again approached $68,000.

Ethereum extended its slide on Tuesday, dropping to $1,994 — its lowest level in months. ETH was down as much as 6% intraday and traded near $2,012 at the start of the New York session. The move mirrored Bitcoin, which fell up to 2.4% and briefly dipped to $68,666. Last week, BTC nearly reached $60,000 before rebounding.

Both ether and bitcoin have been declining since October, when a sharp sell-off triggered the steepest downtrend in years. Bitcoin has now erased all gains made after Donald Trump’s re-election, and its current streak of monthly losses is the longest since 2018.

Analysts note that ETH’s technical setup remains weak: after losing the $2,800–$3,000 range, the asset has formed a firmly bearish structure. The downturn is reinforced by broader risk-off sentiment as investors exit risk assets and unwind crypto exposure, intensifying the downward momentum.

Derivatives are adding to the pressure. Funding rates for BTC perpetual futures remain negative, signaling a market dominated by short positions and expectations of further decline. This dynamic has limited any sustained attempts at recovery.

ETF outflows continue to worsen sentiment. Since October, investors have withdrawn roughly $3.2 billion from ETH funds, including $462 million since the start of 2026. Bitcoin ETFs have seen $7.9 billion in outflows over the same period, with $1.8 billion exiting this year alone. These withdrawals drain market liquidity and amplify the sell-side pressure on both assets.

Despite brief rebounds from recent lows, risk appetite remains weak. Volatility remains elevated, structural indicators skew negative, and traders continue to reposition while waiting for more supportive macro conditions.

Market participants believe that without renewed ETF demand, stronger macro signals, and a shift in derivatives activity, the odds of a sustained recovery for ETH and BTC remain low. For now, Ethereum and Bitcoin continue to fall in tandem, reflecting broad investor flight from risk assets.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.