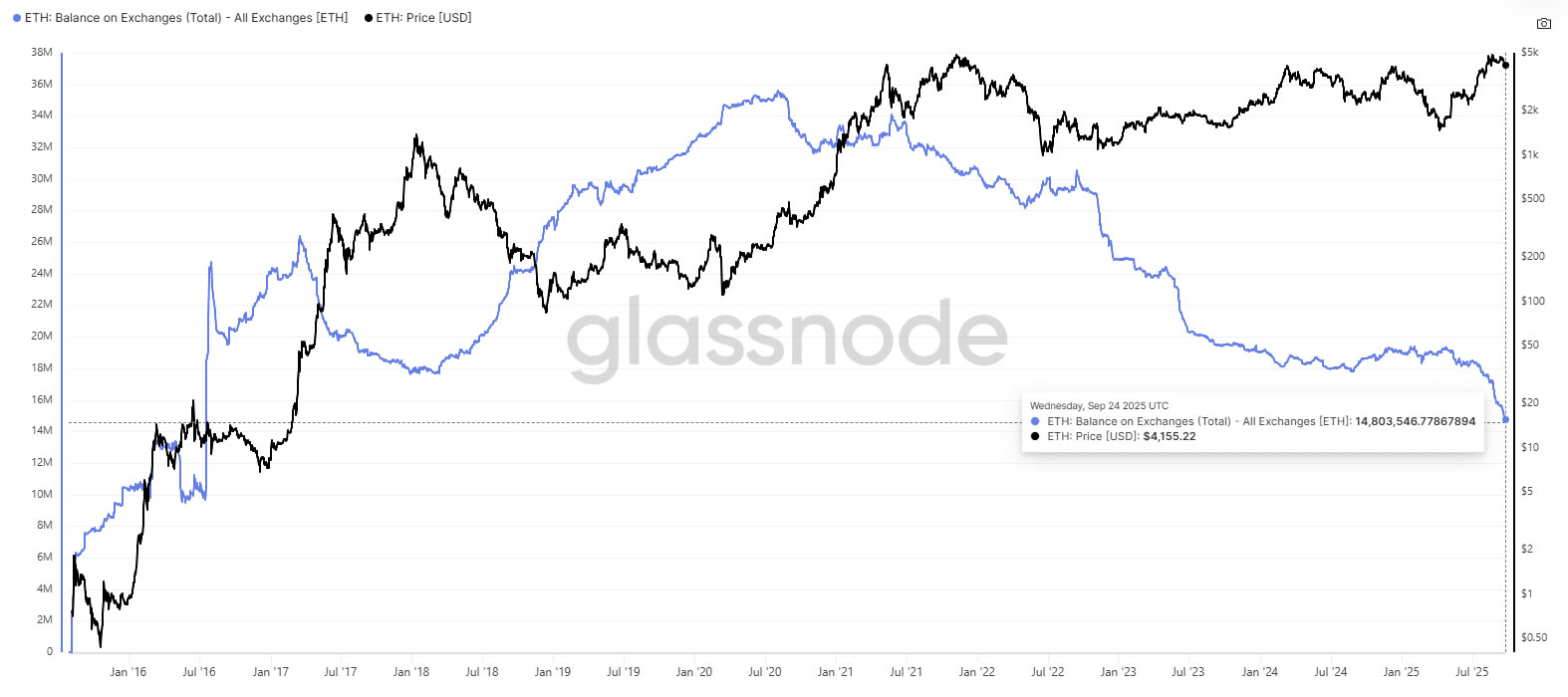

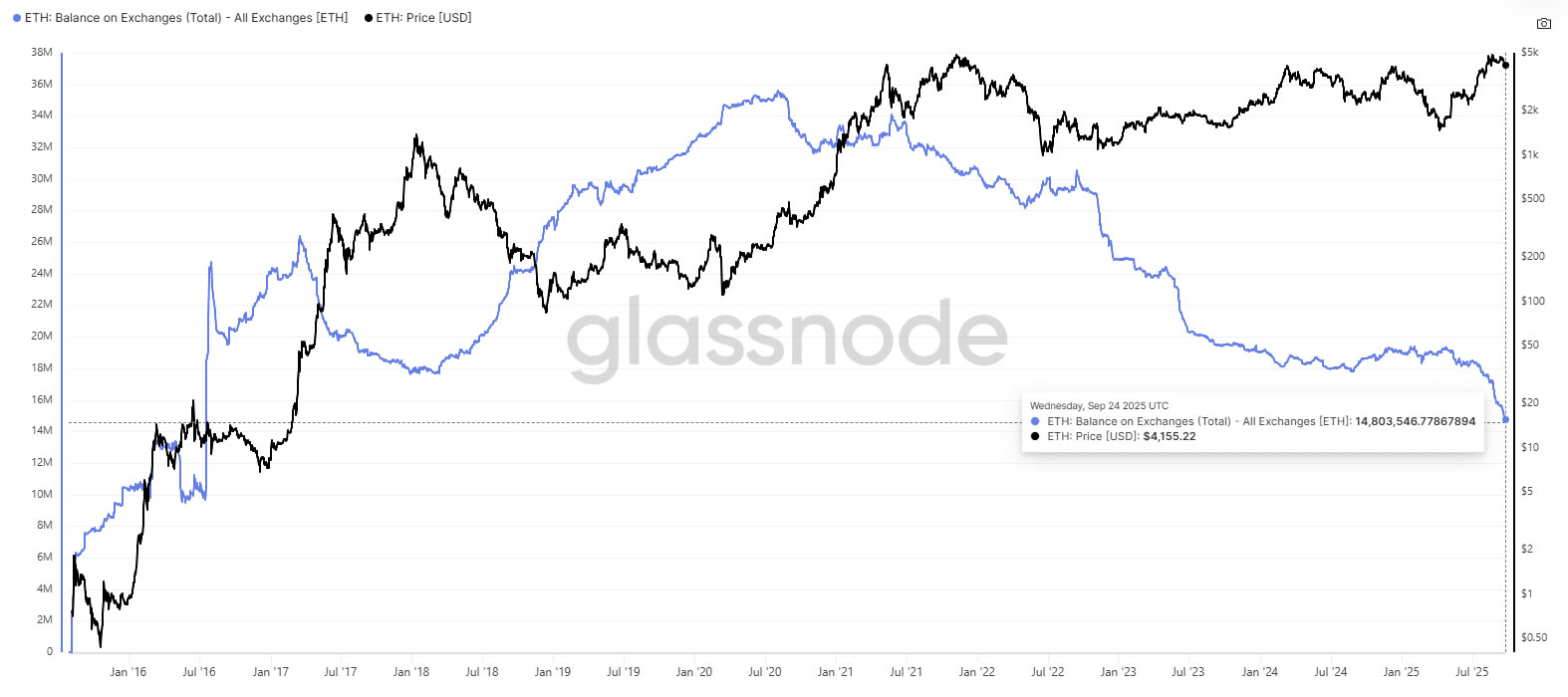

Ethereum exchange balances fall to 9-year low

Ethereum balances on centralized exchanges fell to 14.8 million ETH, marking the lowest level since 2016. The decline comes as institutional demand from U.S. spot ETFs and corporate treasuries accelerated withdrawals in recent weeks.

Glassnode data shows exchange balances at 14.8 million ETH, while CryptoQuant's exchange supply ratio dropped to 0.14, the weakest reading since July 2016. The declines have steepened since mid-July as digital asset treasuries and ETF custodians increased accumulation.

ETF demand has contributed significantly to the drain. U.S. spot Ether ETFs now hold approximately 6.75 million ETH, representing nearly 5.6% of the total supply. Total net assets in these funds rose to roughly $27.5 billion in September from about $10.3 billion in June.

Glassnode also recorded a single-day drawdown of 2.18 million ETH on Wednesday, a level exceeded only five times in the past decade. Analysts note that outflows typically represent transfers to self-custody, staking contracts or DeFi protocols, which can reduce near-term selling pressure on exchanges.

Restaking has become a major sink for on-exchange ether as well: EigenLayer’s total value locked hovered around $18–20 billion this month, underscoring how restaked ETH and liquid staking tokens are being redeployed into security markets for third-party services rather than left on centralized venues.

ETF demand has contributed significantly to the drain. U.S. spot Ether ETFs now hold approximately 6.75 million ETH, representing nearly 5.6% of the total supply. Total net assets in these funds rose to roughly $27.5 billion in September from about $10.3 billion in June.

ETH exchange balance. Source: Glassnode.

The outflows reflect a broad reduction in immediately sellable Ether on centralized platforms. CryptoQuant data shows the 30-day moving average of total ETH exchange net flows reached its lowest (most negative) level since late 2022 this week, indicating sustained withdrawals.

Glassnode also recorded a single-day drawdown of 2.18 million ETH on Wednesday, a level exceeded only five times in the past decade. Analysts note that outflows typically represent transfers to self-custody, staking contracts or DeFi protocols, which can reduce near-term selling pressure on exchanges.

Restaking has become a major sink for on-exchange ether as well: EigenLayer’s total value locked hovered around $18–20 billion this month, underscoring how restaked ETH and liquid staking tokens are being redeployed into security markets for third-party services rather than left on centralized venues.

Exchange balances have been declining since mid-2020 and are roughly half their level of two years ago, reflecting a longer shift toward staking and off-exchange custody among both retail and institutional investors. Recently, BitMine chairman Tom Lee called Ethereum a “truly neutral network” that Wall Street will choose.

While periods of falling exchange supply are often associated with tighter available liquidity for sellers, price does not always respond immediately. ETH slipped below $4,100 Wednesday morning after a week of declines, and blockchain researchers believe that the queue for Ethereum will grow after the release of Kiln validators.

While periods of falling exchange supply are often associated with tighter available liquidity for sellers, price does not always respond immediately. ETH slipped below $4,100 Wednesday morning after a week of declines, and blockchain researchers believe that the queue for Ethereum will grow after the release of Kiln validators.