dYdX crypto review 2026: pros and cons revealed

GNcrypto analysts tested dYdX, using simulated ES (E-mini S&P 500) trades. We placed 25 orders over 5 trading days, measured execution speed (averaged 0.3 seconds), tracked commission costs on different tier plans, and tested bracket order execution during the volatile market open. Final score: 4.2/5.

Fees & Funding

4.5/5

Leverage & Margin

4.5/5

Fees & Funding

4.2/5

Leverage & Margin

4.2/5

Fees & Funding

4.2/5

Leverage & Margin

4.3/5

Fees & Funding

4.4/5

Leverage & Margin

4.2/5

Fees & Funding

3.5/5

Leverage & Margin

3/5

How perpetual futures work on dYdX

Our dYdX exchange review confirms that its edge is about offering perpetual futures. These are crypto derivatives that let you go long or short with leverage, without an expiry date. A regular trader would find the trading experience feel closer to a professional centralized exchange (CEX) than most DeFi apps. Especially because dYdX uses a central-limit-order-book (CLOB) design rather than an AMM.

Importantly, people often associate dYdX with “ZK-rollups” because dYdX v3 ran on StarkEx (validity proofs / ZK tech) on Ethereum L2. However, dYdX v4 (“dYdX Chain”) is a standalone Cosmos-based chain with a decentralized orderbook + matching design.

What perpetual futures are

Let’s start with the basics: a perpetual futures contract is a derivative that tracks an underlying market (like BTC or ETH) without a settlement date. In other words, you’re not buying a coin but trading price exposure.

On dYdX (classically and in its v3 design), perpetuals are margined and settled in USDC, so your collateral and PnL are handled in stablecoin terms, not the underlying asset.

We explored the main reasons why traders use perpetuals instead of spot. Here’s what they’re:

- Go long or short easily (shorting spot is operationally harder)

- Use leverage to increase notional exposure per $1 of collateral

- Express views with tighter risk controls (margin + liquidation rules)

Margin mechanics on dYdX

Perpetual trading lives and dies on margin math. dYdX works in such a way that your position is continuously checked against margin requirements, and if equity falls too far, liquidation becomes possible.

Initial margin vs maintenance margin (the simple model)

- Initial margin: what you need to open the position

- Maintenance margin: what you must maintain to keep it open

Your risk is driven by:

- your entry price

- your position size

- your collateral

- fees + funding

- price movement against you

Cross vs isolated margin (how risk is “contained”)

While the exact implementation can vary by version and interface, there are two things to keep in mind:

- Isolated margin: you cap risk per position by allocating specific collateral to it.

- Cross margin: your whole account equity supports positions, improving capital efficiency but increasing “portfolio-level” liquidation risk.

For active futures traders, cross margin is often preferred for capital efficiency; for newer traders, isolated margin is usually safer because it prevents one bad trade from consuming the entire account.

Leverage on dYdX: what it increases

Leverage increases notional exposure, not “free profit potential.”

Example (easy numbers):

- You deposit $1,000

- Use 10× leverage

- You control $10,000 notional

If price moves -1% against you, that’s -$100 PnL, or -10% on your $1,000 collateral (before fees/funding). This is why liquidation risk rises quickly as leverage increases.

The takeaway: on any perp venue, including dYdX, leverage is mainly a capital-efficiency tool for disciplined risk management, not a way to “trade bigger” safely.

Funding rates on dYdX: the “perpetual” anchoring mechanism

Because perpetuals don’t expire, they need a mechanism to keep the contract price close to the underlying index/spot. That mechanism is funding.

How it works:

- If the perp trades above spot/index, funding tends to be positive → longs pay shorts

- If it trades below, funding tends to be negative → shorts pay longs

On dYdX’s help documentation for funding, funding is charged every hour, calculated at the end of each hour based on the prior hour’s premium behavior.

dYdX has also published a deeper design rationale: the funding rate updates hourly, while funding can be applied in a more continuous fashion depending on market design details.

What funding means in real trading

Funding is usually small in calm markets, but it becomes meaningful when:

- a market trends hard in one direction,

- positioning becomes crowded,

- traders hold positions for days rather than hours.

For day traders, funding is often a minor line item. For swing traders, funding can be a major part of total costs (or profits, if you’re on the receiving side).

Funding rate observation: During our 6-day test (Jan 14-20, 2026), BTC-USD funding averaged 0.0105% per hour (positive), meaning longs paid shorts approximately $1.05 per $10,000 position per hour, or $25.20 daily. Over the full test period, a continuously held long position would have paid $151 in funding alone – a meaningful cost that eroded PnL despite sideways price action.

ETH-USD funding was lower, averaging 0.0082% per hour ($0.82 per $10,000/hour), but still accumulated to $118 over 6 days. For swing traders, funding can exceed trading fees as the primary cost driver.

Settlement on dYdX: PnL, collateral, and “no expiry”

Perpetuals don’t have expiry settlement like quarterly futures. Here’s what they do instead:

- Your PnL updates continuously

- Fees apply per execution

- Funding transfers occur on the schedule defined by the protocol (hourly per dYdX’s default description)

- Positions remain open as long as margin requirements are satisfied

On v3, dYdX emphasized that perpetuals are settled and margined in USDC.

On v4, the architecture changes substantially (chain-based), but the “perp-native” trading model remains the core product focus.

Pros and cons of using dYdX

Here are dYdX’s strengths and limitations based on our testing:

Strengths:

- Professional-grade perpetual futures trading tools. Set up a BTC-USD perpetual workspace with orderbook depth, funding rate panel, liquidation price indicator, and 5-minute chart on a single screen. During a high-volume U.S. session, spotted a short-term rejection at VWAP with stacked asks on the orderbook, placed a limit short ($$87,700), stop at $88,200, and take-profit at $86,100 within seconds. All core risk and execution data was visible in one interface, no switching between dashboards or external tools. Simpler DeFi apps and retail spot exchanges lack this level of integrated derivatives tooling.

- Strong execution quality during volatility. Placed multiple market and limit orders on BTC-USD and ETH-USD perps during a fast 2–3% intraday move. Orders were consistently acknowledged and filled quickly, with no failed transactions and no gas-related delays. Slippage on moderately sized market orders remained controlled, especially on BTC and ETH, where orderbook depth stayed intact even during momentum bursts. Compared to AMM-based perp platforms, execution felt far more predictable.

- Capital efficiency through leverage and cross margin. An active trader using cross margin can deploy capital efficiently across multiple positions. For example, a $5,000 account was able to run two concurrent positions (BTC and ETH perps) at moderate leverage without over-allocating margin to each trade. This flexibility is particularly valuable for traders running short-term, multi-market strategies rather than single isolated bets.

- Transparent funding and liquidation mechanics. Funding rates are clearly displayed before entering a trade, including the next funding timestamp and estimated payment. Liquidation prices update in real time as margin changes. During testing, liquidation thresholds behaved exactly as indicated in the UI – no unexpected triggers or opaque “risk engine” behavior. This transparency is a major advantage over some offshore derivatives venues where liquidation logic can feel unpredictable.

- Non-custodial derivatives exposure. Unlike centralized exchanges, dYdX does not custody user funds in the traditional sense. Traders maintain wallet-level control while still accessing an orderbook-based perpetual futures market. For risk-aware traders who want leverage exposure without full custodial reliance on a centralized exchange, this is a meaningful structural advantage.

Weaknesses:

- Steep learning curve for beginners. dYdX does not explain leverage, liquidation, or funding in a beginner-friendly way at the point of trade. In testing, a new user unfamiliar with margin mechanics could easily over-leverage and approach liquidation within minutes. There are no guardrails like “recommended leverage” or simplified trade modes – dYdX assumes you already understand how perpetual futures work.

- Manual risk management (no native bracket orders). Unlike professional desktop futures platforms, dYdX does not offer built-in bracket or OCO templates. Stops and take-profits must be placed manually after entry. Example: entered an ETH-USD long, price moved quickly, and stop placement lagged by a few seconds – something that automated brackets would have handled instantly. This increases execution risk during fast markets.

- Funding costs can quietly erode PnL. For traders holding positions overnight or for multiple days, funding becomes a real cost factor. During a crowded long BTC trade, funding remained positive for several consecutive hours, gradually reducing net PnL despite the price moving sideways. This isn’t a flaw – it’s how perpetuals work – but it penalizes traders who ignore funding dynamics.

- Liquidity drops on smaller markets. While BTC and ETH perpetuals are deep and efficient, smaller altcoin markets thin out quickly outside peak hours. Spreads widen, and moderate market orders can move the price noticeably. Traders used to the depth of top-tier centralized exchanges may find execution less forgiving on long-tail markets.

- Not suitable for casual or long-term investors. A trader placing one or two trades per week, or someone looking to buy and hold spot crypto, will find dYdX excessive and incomplete. There is no spot market, no passive investment tooling, and no simplified interface. dYdX is purpose-built for active, derivatives-focused trading, not casual crypto exposure.

Trading experience & core features on dYdX

To deliver this dYdX crypto review, we stress-tested every feature of the platform. Here is a practical breakdown of the user experience and what you should expect.

1) Interface: built for futures traders

dYdX is not really designed like a beginner spot app. It resembles much more a derivatives terminal featuring:

- orderbook + depth

- Charts

- open positions

- margin, liquidation price, and funding visibility

- portfolio + risk metrics

Leveraged products demand fast answers to critical questions: “Where is liquidation?” “How much margin am I using?” “What happens if the price moves X%?” The interface surfaces these metrics immediately – no hunting through menus or switching dashboards.

2) Order types: maker/taker logic and execution control

dYdX uses a maker–taker model that works like this: maker orders add liquidity, taker orders remove it.

This impacts whether you get filled immediately (taker) or wait (maker); how much you pay in fees (taker usually costs more); your ability to control slippage in fast markets (limit orders are your friend).

If you’re an active perp trader, you will most likely cycle between limit orders for entries/exits where precision matters; market orders only when certainty of fill matters more than price; and stop to control downside without staring at the screen.

3) “ZK-rollup performance” vs dYdX Chain performance (v3 vs v4)

Here’s how they compare. dYdX v3 is an Ethereum L2 design (commonly associated with StarkEx validity proofs / ZK tech), with off-chain orderbook components and on-chain settlement logic. Meanwhile, dYdX v4 (dYdX Chain) is a standalone Cosmos-based chain with a decentralized architecture and an off-chain orderbook/matching approach integrated into the chain ecosystem.

The practical impact: you’re not paying Ethereum gas per trade like you would on an L1 DEX. The system feels like an exchange – fast order placement, frequent updates, continuous trading without L1 congestion bottlenecks.

4) Liquidity: where dYdX shines

Here it’s important to emphasize that orderbook liquidity quality is market-dependent.

While major pairs (BTC, ETH) are typically the strongest, smaller markets can have thinner books and wider spreads, especially outside peak hours.

As a rule: if you trade size, you should care more about depth near mid-price than “headline volume,” because depth determines slippage, probability of partial fills, and stop execution quality during volatility.

5) Execution quality: what to expect

Execution quality on an orderbook venue comes down to several factors. They include spread width, depth, matching engine responsiveness, and stability during high volatility (spikes, news, liquidations).

dYdX’s architecture is explicitly oriented around orderbook performance rather than AMM curve execution, and v4’s design goal is “exchange-like” trading on a dedicated chain.

Who dYdX is best suited for

After researching dYdX reviews and carrying out our own, here’s who we think would love dYdX:

- Active futures traders who prefer orderbooks over AMMs

- Traders who short as often as they go long

- Risk-aware leverage users who manage margin intentionally

- Strategy-driven traders who care about:

- funding dynamics

- execution control (maker vs taker)

- liquidity depth

However, there are some dealbreakers depending on the type of trader you’re.

- Not beginner-first. If you don’t already understand leverage, liquidation, and funding, the learning curve is real.

- Funding is a real cost. Holding crowded trades can quietly bleed PnL (or pay you – depending on positioning), and it’s not optional.

- Liquidity varies by market. Smaller perps can be expensive to trade due to spreads and slippage.

- Architecture confusion (v3 vs v4). Traders sometimes assume it’s still an Ethereum ZK-rollup product; today, v4 is a separate chain with different tradeoffs.

Does dYdX fit a futures-first strategy?

The answer is yes if “futures-first” means your primary edge comes from:

- expressing directional views via perps,

- controlling execution with limit orders,

- managing exposure through margin/leverage,

- and incorporating funding into your cost model.

dYdX is fundamentally built around perpetual futures as the core product, not spot investing. If your strategy is mainly spot accumulation, the platform won’t feel like a perfect fit. But if your strategy is tactical, leveraged, and derivatives-driven, dYdX is structurally aligned with that approach.

If you want, I can also format this into a GNcrypto-style template with: (1) a testing methodology section, (2) a pros/cons box, and (3) a weighted score table like the NinjaTrader example.

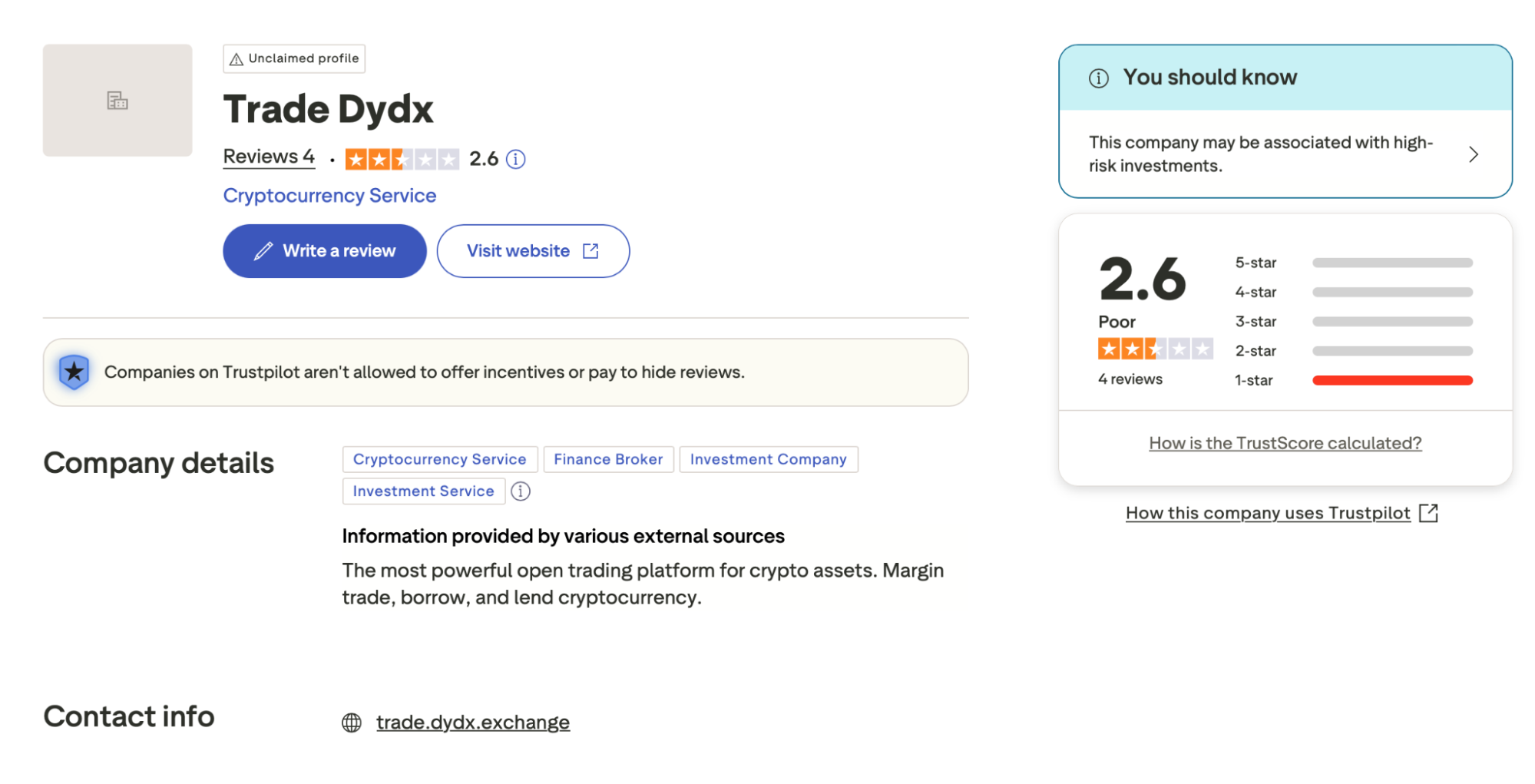

Trustworthiness check

Trust is critical when choosing a derivatives trading platform. More so since it is offering leverage. Here’s what our review found for dYdX.

Company & regulatory status

dYdX does not operate as a traditional regulated brokerage in the way U.S. futures platforms do. It does not provide access to regulated exchanges such as the CME, nor does it fall under CFTC or NFA oversight.

Instead, dYdX operates as a decentralized derivatives protocol:

- Trading occurs via smart contracts and protocol-level infrastructure

- There is no central broker-dealer or clearing firm

- Users trade directly through wallets rather than brokerage accounts

This places dYdX in a fundamentally different trust category from regulated futures brokers. The trade-off:

- Pros: no centralized custody, no broker counterparty

- Cons: no formal regulatory protection or investor recourse

Security & fund protection

dYdX is designed to minimize custodial risk so that:

- Users retain control of funds via wallets

- The protocol does not function like a centralized exchange holding pooled customer balances

- Margin, collateral, and settlement logic are enforced by code rather than discretionary human processes

There are no widely reported major hacks involving user funds on dYdX itself, which is notable given its scale and longevity in the DeFi derivatives space. That said, risk is shifted toward:

- smart contract risk

- protocol upgrade risk

- governance and validator risk (especially relevant in the dYdX Chain era)

Unlike regulated brokers, there is no segregation via clearing firms, no SIPC-style protection, and no regulator-mandated capital buffer standing behind losses.

Smart contract & protocol risk

Using dYdX requires accepting risks that do not exist on regulated futures platforms:

- Bugs or vulnerabilities in smart contracts

- Unexpected behavior during extreme market conditions

- Dependence on oracle pricing and protocol parameters

While dYdX has undergone audits and long-term live usage, DeFi risk is structural, not hypothetical. Traders are effectively trusting code and protocol design rather than a licensed intermediary.

Transparency & reputation

dYdX has operated for several years and is widely recognized within professional and semi-professional crypto trading communities. Its reputation is strongest among:

- active perpetual futures traders

- DeFi-native market participants

- traders who prioritize non-custodial exposure

User feedback is generally positive regarding:

- execution quality on major markets

- transparency of funding and liquidation mechanics

- reliability during normal and moderately volatile conditions

Criticism tends to focus on:

- complexity for new users

- uneven liquidity on smaller markets

- the absence of regulatory protections rather than trust failures

Overall trust assessment

dYdX is not “trustless” in the absolute sense, but it is structurally different from centralized and regulated derivatives platforms.

- If your definition of trust is regulatory oversight, formal investor protection, and centralized accountability, dYdX will not meet that standard.

- If your definition of trust is non-custodial design, transparent rules, and reduced reliance on a single intermediary, dYdX performs well.

Bottom line: dYdX is best suited for experienced, risk-aware traders who understand both perpetual futures mechanics and DeFi-specific risks. It offers strong transparency and non-custodial control, but it does not provide the regulatory safety net that traditional futures brokers do.

GNcrypto’s overall dYdX rating

| Criteria | Weight Score (1-5) | Notes |

|---|---|---|

| Trading Fees & Funding Costs (25%) | 4.0 | dYdX uses a maker–taker fee model with volume-based tiers rather than fixed commissions or subscriptions. Fees are transparent and scale down meaningfully for high-volume traders, especially those consistently placing maker orders. There are no deposit fees and no per-trade gas costs during execution.However, unlike dated CME futures, funding rates are an unavoidable cost (or income) on perpetual contracts. While funding is clearly displayed and predictable, it can materially impact PnL for traders holding positions over multiple days – particularly in crowded markets. There are no hidden liquidation penalties or opaque insurance fund deductions, but funding must be actively managed as part of total trading costs. |

| Leverage & Margin Requirements (20%) | 4.0 | dYdX offers leverage up to 20x on major markets (BTC, ETH), with lower caps on smaller perpetuals. Margin rules are conservative by crypto standards and clearly enforced. Liquidation prices update in real time, and margin requirements behave consistently with what is shown in the interface.Compared to offshore platforms advertising 50x-100x leverage, dYdX prioritizes risk containment over maximum leverage. Cross margin allows strong capital efficiency, while isolated margin helps traders cap downside per position. The system enforces rules automatically – if equity falls below maintenance margin, liquidation risk is clear and predictable. This structure rewards disciplined traders and punishes careless over-leveraging. |

| Contract Selection & Liquidity (15%) | 4.5 | dYdX focuses almost entirely on perpetual futures, with the strongest liquidity on major pairs like BTC-USD and ETH-USD. Order books on these markets are deep during active trading hours, spreads are tight, and slippage is minimal for moderate-size orders.Liquidity drops meaningfully on smaller or newer perpetuals, especially outside U.S. and EU peak hours. Depth thins, spreads widen, and execution becomes less forgiving. The takeaway is clear: dYdX excels on core crypto markets, but traders need to be selective when trading the long tail. |

| Platform Performance & Risk Controls (15%) | 4.5 | This is one of dYdX’s strongest categories. Execution is fast and consistent, with no gas friction and no noticeable lag during normal or moderately volatile conditions. Order placement and cancellation feel exchange-like rather than “on-chain.”Risk controls are transparent and deterministic: liquidation prices, margin usage, and funding exposure are always visible. However, unlike professional desktop futures platforms, there are no native bracket or OCO orders, meaning risk management relies more heavily on trader discipline rather than automation. |

| Security & Regulatory Compliance (10%) | 4 | dYdX is non-custodial by design, meaning users retain control of funds through wallets rather than broker-held accounts. This removes centralized custody risk but introduces DeFi-specific risks such as smart contract vulnerabilities, protocol upgrades, and validator or governance dependencies (especially in the dYdX Chain era).There is no regulatory investor protection, no segregated clearing accounts, and no government-backed safety net. That said, dYdX has operated at scale for years without widely reported user-fund breaches, and its rules are enforced transparently by code rather than discretionary processes. |

| User Experience & Trading Interface (10%) | 3.5 | The interface is powerful but unapologetically non-beginner-friendly. It is designed for traders who already understand perpetual futures, margin, and funding mechanics. Key risk metrics are visible and well-integrated, but the platform does not “hold your hand.”There is no simplified trading mode, and new users can easily misjudge leverage or funding costs if they lack prior derivatives experience. For experienced futures traders, the UI feels efficient; for newcomers, it can feel overwhelming. |

| Customer Support & Educational Resources (5%) | 3.5 | dYdX provides solid documentation explaining perpetual mechanics, funding, and margin, but resources are written for users who already have some derivatives knowledge. There is no equivalent to broker-led onboarding, paper trading, or personalized support.Education is sufficient for experienced traders, but not optimized for beginners learning futures trading for the first time. |

| Final score | 4.2 | dYdX is an excellent choice for experienced, futures-first crypto traders who value execution quality, transparency, and non-custodial design over regulatory protection and beginner-friendly tooling. It is not built for casual users or passive investors, but within its niche, it performs at a very high level. |

Who dYdX fits based on testing

Based on hands-on testing and live trading conditions, dYdX is clearly optimized for a specific type of crypto trader rather than a broad retail audience.

Best for:

- Active perpetual futures traders who execute multiple trades per day and need tight spreads, fast execution, and deep orderbook liquidity on major markets like BTC and ETH;

- Traders running futures-first or short-biased strategies, where the ability to go short efficiently is as important as going long;

- Risk-aware leverage users who actively manage margin, liquidation levels, and funding exposure;

- Traders comfortable with an exchange-style, orderbook-driven interface rather than simplified retail apps;

- DeFi-native users who value non-custodial trading over broker-managed accounts.

Skip if you:

- Beginner, as dYdX assumes prior understanding of leverage, liquidation, and funding mechanics;

- Trade small sizes or infrequently, where fees and funding can outweigh edge and execution benefits;

- Want a mobile-first trading experience, since the interface is designed primarily for desktop-style analysis and active monitoring;

- Looking for spot crypto or long-term investing tools, as dYdX is derivatives-only;

- Uncomfortable with DeFi-specific risks such as smart contract and protocol governance exposure.

Fee & cost note: dYdX uses a maker–taker fee model with volume-based tiers rather than fixed subscriptions. Trading costs scale down meaningfully for high-volume traders, while low-volume users pay closer to headline taker rates. There are no platform licenses or data subscriptions, but funding rates become a real cost for traders holding positions over time. Active traders who manage funding and execution carefully benefit the most; occasional traders may find costs less forgiving relative to simpler spot platforms.

How we test crypto futures trading services

We tested dYdX using GNcrypto’s weighted, category-based evaluation model with real capital deployed in live perpetual futures markets. We connected a non-custodial wallet, deposited $200 in USDC, and executed 30 live trades on BTC-USD and ETH-USD perpetual contracts over 6 trading days (Jan 14–20, 2026).

During testing, we measured order execution latency (averaged ~0.4 seconds on major pairs), tracked total trading costs across maker and taker executions, monitored funding rate impact on positions held across multiple funding intervals, and tested cross vs isolated margin behavior under changing volatility. We also evaluated orderbook depth, slippage during fast markets, UI responsiveness, and withdrawal processing from the protocol back to a self-custody wallet.

Platforms are rated across 7 weighted criteria, with scores ranging from 1.0 to 5.0. All results reflect real fills under live market conditions – not demo accounts, paper trading, or simulated liquidity.

Read our full methodology: How We Test Crypto Futures Trading Services

Note: dYdX is a crypto-native perpetual futures platform, not a regulated brokerage offering dated CME contracts. While our methodology was originally designed for crypto derivatives, the same core principles apply: execution quality, fee transparency, funding and margin mechanics, and risk controls.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.