Delta Exchange crypto exchange review 2026: a complete look at futures and options

GNcrypto conducted live derivatives trades on Delta Exchange to assess fees, leverage, order execution, and overall usability. We examined liquidity, contract variety, and key trust signals, ultimately rating the platform 3.9/5.

Fees & Funding

4.5/5

Leverage & Margin

4.5/5

Fees & Funding

4.2/5

Leverage & Margin

4.2/5

Fees & Funding

4.2/5

Leverage & Margin

4.3/5

Fees & Funding

4.4/5

Leverage & Margin

4.2/5

Fees & Funding

3.5/5

Leverage & Margin

3/5

Delta Exchange is a derivatives-focused trading platform that specializes in futures, perpetual contracts, and options, with limited spot markets and no asset custody. We tested the platform with a $200 deposit, opening leveraged positions on BTC/USDT and ETH/USDT perpetuals at 10x and 20x. Fees matched the advertised rates, and execution remained reliable on major pairs, though funding costs accumulated during multi-day holds. A 50x test position was liquidated in under 90 seconds following a 2% BTC drop. The platform does not publish a Proof of Reserves, making it better suited for experienced derivatives traders rather than long-term investors.

What Delta Exchange is

We tested Delta Exchange as a derivatives trading platform, and one thing became clear almost immediately: this is not a universal crypto exchange, but a service with a sharp focus on Delta futures, options, and perpetual contracts. The platform is designed for traders who profit from price movements rather than investors buying crypto for the long term.

Delta Exchange was founded in 2017 and officially launched in 2018. The company is registered in Saint Vincent and the Grenadines. In 2020, the exchange became the first to introduce USDT-settled call and put options with daily, weekly, and monthly expirations.

While reviewing the platform’s growth history, we noticed that its strongest traction came from Asia, particularly India. By 2024, Delta Exchange’s derivatives trading volume had exceeded $42 million, leading to the launch of a separate Delta Exchange India platform fully compliant with local regulatory requirements.

It’s important to note that spot trading plays a secondary role here. Delta Exchange is, first and foremost, a derivatives-focused platform.

Key features & tools

As we explored the platform’s functionality, it became clear that Delta Exchange is built entirely around active derivatives trading. According to multiple Delta Exchange reviews, the interface, tools, and product offering avoid unnecessary distractions – everything is centered on futures, options, and efficient position management.

Futures and perpetual contracts

We tested the futures section and found that the platform offers 76 trading pairs. Leverage ranges from 20× to 100× depending on the underlying asset.

Contracts are settled in USDT, BTC, or ETH.

The platform also supports perpetual contracts with no expiration date. These positions are maintained through a funding rate mechanism, allowing traders to hold positions without the need for constant rollovers or re-entry.

Options

We paid particular attention to the options segment, as it is one of Delta Exchange’s core products. The platform supports vanilla options, as well as spread options, including call spreads and put spreads.

We found that the range of expiration dates is fairly broad, spanning from daily to annual maturities, with strike price increments typically set at 2–5%.

All options are European-style and are exercised strictly on the expiration date before 12:00 UTC. For certain contracts, leverage of up to 200× is available.

Demo trading

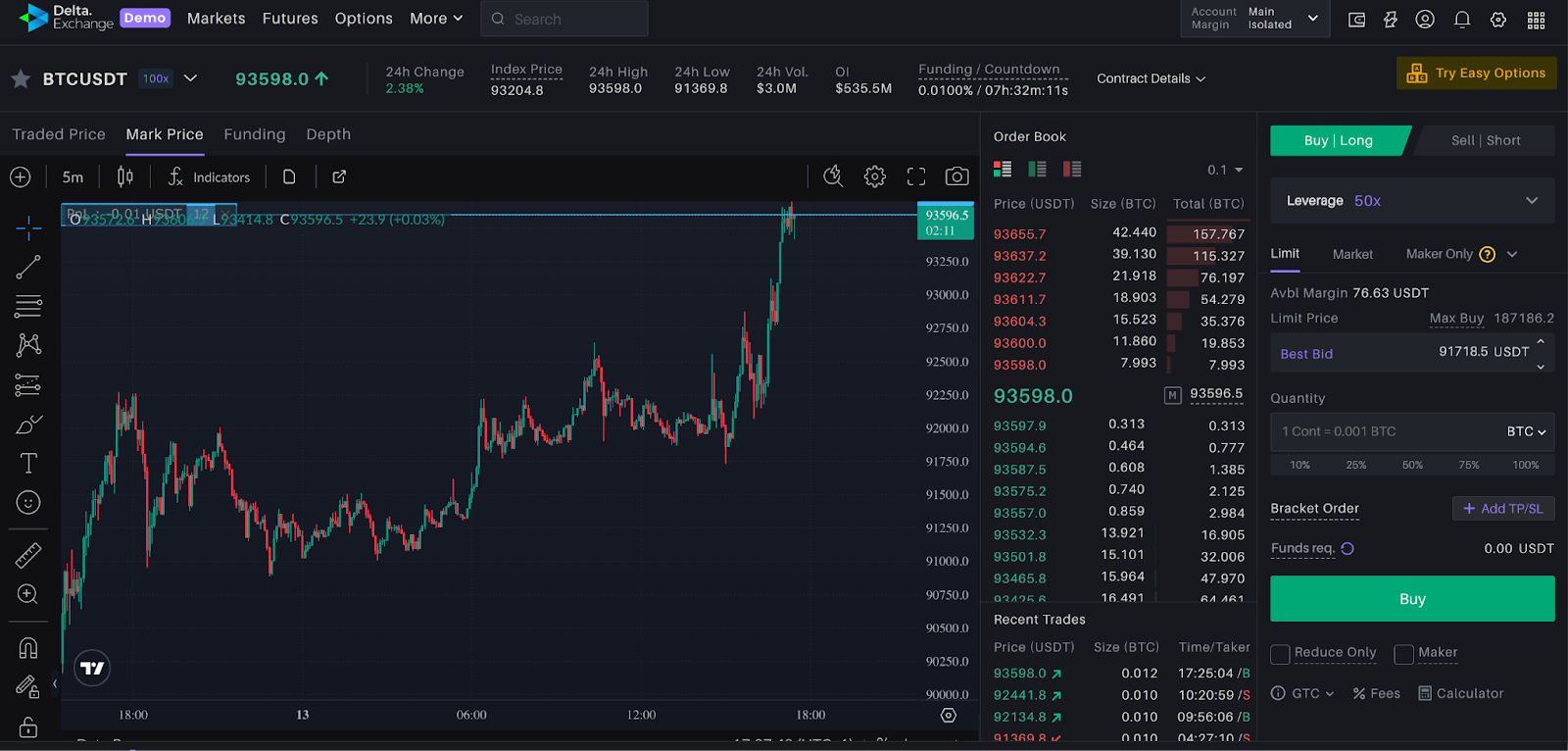

The demo environment requires creating a separate account, which is neither intuitive nor particularly practical. The demo platform closely mirrors the live trading terminal, making it useful for users who want to explore derivatives trading without financial risk.

However, we identified several limitations. The demo version is not available in the mobile app and does not support Robo strategies or staking functionality.

During testing, we also examined the Robo Trading section, which allows users to connect automated strategies, including:

- Top 20 Momentum (up to 2× leverage)

- Top 2 Momentum (BTC and ETH, up to 3× leverage)

- DeFi Momentum (up to 2× leverage)

- Cash–Futures Arbitrage (3× leverage)

- Large Cap AMM strategies for BTC/USDT and ETH/USDT

At the same time, the platform explicitly emphasizes that automated trading does not eliminate risk and does not guarantee results.

Interface and tools

In practice, the Delta Exchange interface is compact and well-organized. We liked that all core sections are accessible from the top navigation menu, making it easy to switch between futures, options, and order management.

During live trading, we had no issues using the charting tools, contract list, or the panel displaying active orders and open positions. We also noted that the demo and live trading terminals are nearly identical, eliminating the need to adjust to a new interface after moving from demo to real trading.

Who Delta Exchange is best for

Based on our testing, we concluded that Delta Exchange is best suited for:

- experienced traders,

- users who actively trade futures and options,

- traders who require high leverage,

- users located in regions where the platform is officially available.

The platform also makes an effort to make derivatives trading more accessible to newcomers through its Demo platform and Robo Trading features. However, our Delta Exchange crypto trading platform review showed spot trading is extremely limited – with only six available trading pairs – which makes the platform less convenient for casual or spot-focused users.

Delta Exchange is not available in the United States, Canada, the United Kingdom, and several other jurisdictions, a critical factor that should be verified before registering.

When compared to larger derivatives platforms, the exchange falls short in terms of overall versatility but stands out as a highly specialized venue for futures and options trading, particularly for users in Asia and India.

Delta pros and cons

After several days of active live-market testing on Delta Exchange, we identified where the platform truly offers advantages for traders – and where its limitations lie, which is important to understand upfront.

Strengths:

- Strong focus on derivatives. We opened simultaneous positions on BTC, ETH, and SOL across futures and perpetual contracts. The platform made it easy to switch between contracts and apply different strategies, which is particularly useful for diversification and hedging.

- High leverage. While testing leverage of up to 100× on BTC/USDT, we were able to open positions significantly larger than our actual capital. This is a clear advantage for experienced traders, but beginners should proceed with caution – margin can be wiped out very quickly during periods of high volatility.

- Demo platform for practice. We tested the demo environment and found that it closely mirrors the live trading interface. This allows traders to safely test strategies and familiarize themselves with the platform before committing real funds.

- Robo Trading. We connected the Top 20 Momentum automated strategy and monitored its performance. Everything functioned as expected, with positions opening and closing according to the algorithm. This feature is especially convenient for traders with limited time.

- Security. We noted the presence of two-factor authentication, anti-phishing codes, and manual withdrawal reviews. Based on our testing, the platform offers a strong sense of security, with funds protected via cold storage and multi-signature transactions.

- India-specific version. Delta Exchange India operates fully legally and supports INR, making it convenient for local users while ensuring compliance with regional regulations.

Weaknesses:

- Limited spot trading. We attempted to buy a small amount of ETH for long-term holding – it wasn’t possible. The platform offers only six spot trading pairs; everything else is derivatives-focused.

- Restricted networks for deposits and withdrawals. Withdrawing USDT via ERC20 incurs a $10 fee, significantly higher than most other exchanges.

- Regional restrictions. We tried to register using a VPN from the U.S., but access was blocked. The platform is unavailable in the United States, Canada, the United Kingdom, and several other jurisdictions.

- No demo platform in the mobile app. The demo version is only accessible through the web interface.

Trustworthiness check

During our review of Delta Exchange’s reliability, we noted several important points.

The platform has been operational since 2018 and has not reported any hacks or major security incidents during that time. This is supported by multiple reviews highlighting the stability of its security systems.

Delta Exchange employs:

- cold storage for funds

- multi-signature wallets

- two-factor authentication (2FA)

- anti-phishing codes

- manual review of all withdrawals

We also observed that all users are required to complete KYC, and enhanced verification provides additional benefits, indicating compliance with AML requirements.

Special attention should be given to Delta Exchange India, which is registered with the Financial Intelligence Unit (FIU). This ensures the platform operates legally in India and complies with local regulations.

It is important to note, however, that Delta Exchange is not available in the U.S. and certain other countries, meaning it is not regulated by U.S. financial authorities.

GNcrypto’s overall Delta Exchange rating

| Criteria | Rating (out of 5) | Weight | Notes |

|---|---|---|---|

| Trading Fees & Funding Costs | 4/5 | 25% | Trading fees are low (0%), though USDT network fees can be higher, particularly on TRC20. Deposits are free of charge |

| Leverage & Margin Requirements | 4/5 | 20% | Leverage goes up to 100× on futures and perpetual contracts, and up to 200× on options. Settlements are flexible via USDT, BTC, or ETH. There is no built-in protection for novice traders |

| Contract Selection & Liquidity | 4/5 | 15% | The platform offers 76 futures trading pairs, along with vanilla and spread options. Spot trading is limited to just six pairs. Liquidity is strong for BTC and ETH, but lower for altcoins |

| Platform Performance & Risk Controls | 4/5 | 15% | The trading terminal is stable, and the Demo platform closely mirrors the live platform. High leverage can quickly deplete margin, but manual withdrawal verification helps safeguard assets |

| Security & Regulatory Compliance | 4/5 | 10% | Multi-signature cold wallets, 2FA, anti-phishing measures, and KYC/AML compliance. Delta Exchange India is FIU-registered. No Proof of Reserves is published |

| User Experience & Trading Interface | 3.5/5 | 10% | The interface is compact but may be challenging for beginners. The Demo platform is not available on the mobile app |

| Customer Support & Educational Resources | 3.5/5 | 5% | Support is responsive, and the Demo platform along with Robo Trading help users learn, but educational resources are limited |

Final Score: 3.9/5

Our verdict: Delta Exchange offers a wide range of futures, perpetual contracts, and options with low fees, along with useful tools such as Demo platform and Robo Trading for strategy testing.

Methodology – why you should trust us

We tested Delta Exchange using our weighted, category-based model, depositing $200 in BTC and opening leveraged positions (10x-50x) on BTC/USD and ETH/USD perpetuals. We monitored funding rates over 5 days, tested stop-loss execution during volatility, measured spreads during US and Asia trading hours, and withdrew funds to verify processing times. We rate platforms on 7 weighted criteria with scores from 1.0 to 5.0. Our testing uses real capital, not demo accounts.

Read our full methodology: How We Test Crypto Futures Trading Services

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.