DASH rises 71% in 24 hours amid a privacy-coin rally

DASH has become one of the market’s most dynamic assets, jumping 71% over the past 24 hours and reaching $64. The surge came amid a rotation of capital into privacy coins and far outpaced the performance of most digital assets.

The DASH rally coincided with an upswing across the entire privacy-token segment, including Monero (XMR), Decred (DCR), and Horizen (ZEN). The altseason index increased 47% over the month, reflecting stronger interest in volatile assets and technologies offering enhanced privacy features. Against this backdrop, the market favored coins with stable liquidity and broad exchange coverage.

One growth factor was expanded availability of DASH in Europe, where the asset received support through spot trading pairs. Improved infrastructure in regulated jurisdictions increased liquidity depth, allowing buyers to enter the market without sharp pullbacks. This enabled smoother upward movement and sustained momentum.

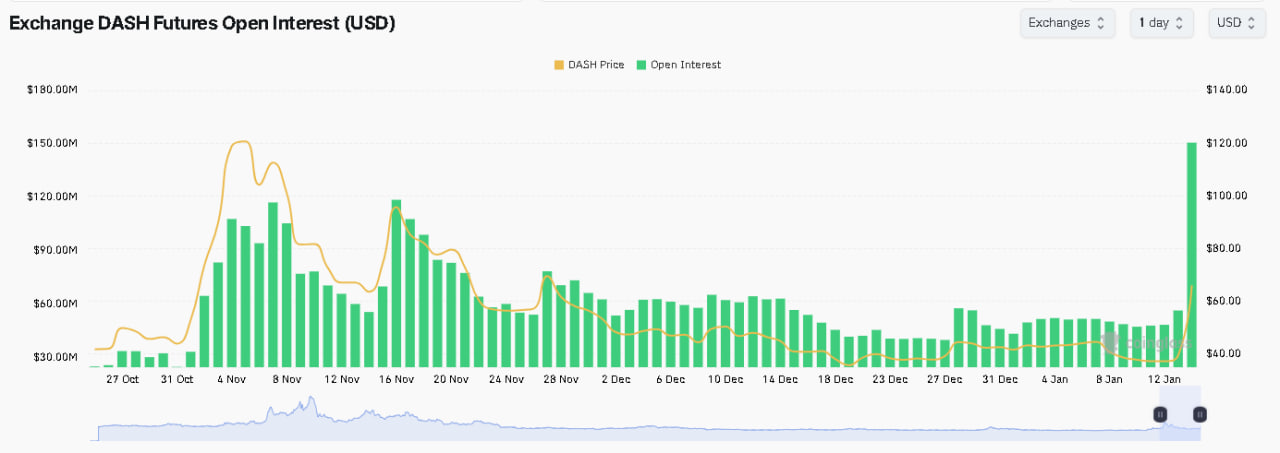

Additional support came from the derivatives market. Open interest rose above $150 million — the highest level in recent months. Funding turned positive for the first time since November 2025, signaling traders’ willingness to pay to hold long positions. The rally showed no signs of overheating, suggesting the early stage of a potentially sustainable upward trend.

Investor interest is also supported by the network’s fundamental characteristics. DASH positions itself as a payments-focused cryptoasset with fast, low-cost transactions, giving users the choice between transparent transfers or transactions with enhanced privacy via CoinJoin. The network’s two-tier architecture — miners and masternodes — enables instant transactions through InstantSend and provides additional security features.

From a technical standpoint, the asset held a key demand zone near $48.50 and moved back above major moving averages. The nearest resistance sits at $70.85. A steady breakout above this level could open the way for further growth, while a failure to hold support may pull the price back toward the $50 range.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.