Currency.com review 2026: what the platform offers for crypto trading

Our team tested Currency.com under live trading conditions to assess fees, leverage usage, order execution quality, and overall platform usability. We also assessed liquidity and key trust factors, assigning the platform a final score of 3.8/5.

Fees & Funding

4.5/5

Leverage & Margin

4.5/5

Fees & Funding

4.2/5

Leverage & Margin

4.2/5

Fees & Funding

4.2/5

Leverage & Margin

4.3/5

Fees & Funding

4.4/5

Leverage & Margin

4.2/5

Fees & Funding

3.5/5

Leverage & Margin

3/5

Currency.com is a crypto-focused trading platform offering tokenized assets, spot crypto trading, and futures-like leveraged positions. We tested the platform with $200 deposited, opening positions on BTC and ETH with leverage up to 10x and 20x. Trading fees matched the advertised rates (0.0125–0.075%), execution was stable on major trading pairs, but deposit, withdrawal, and funding fees added up on multi-day positions. The platform keeps client funds in segregated accounts but does not provide insurance, making Currency.com more suitable for experienced traders rather than fully risk-averse investors.

How Currency.com futures trading works

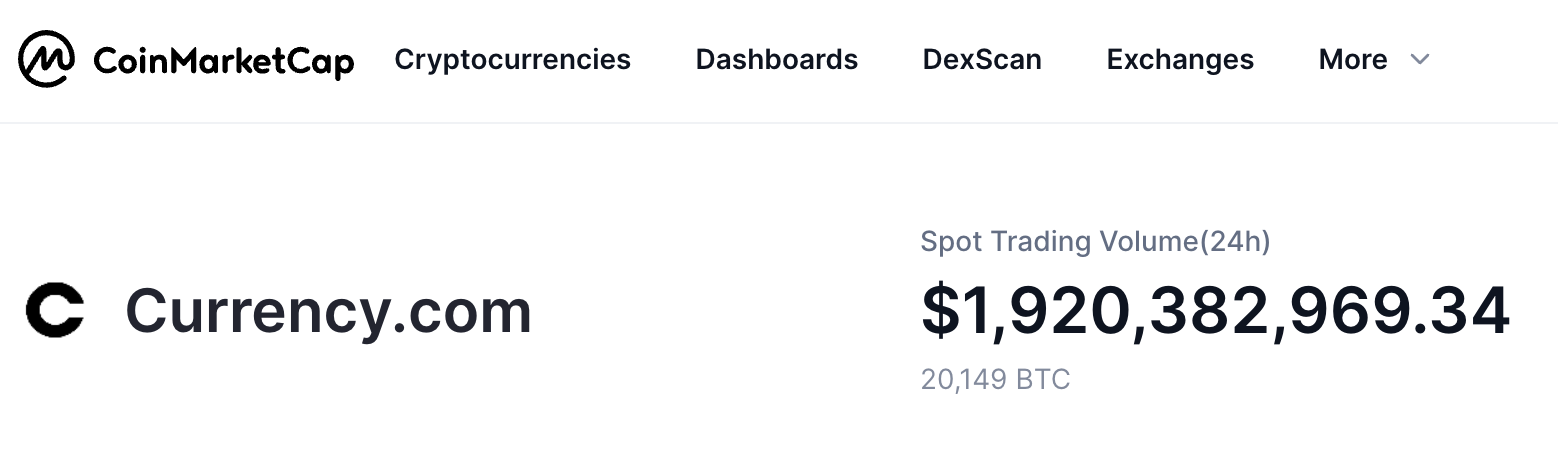

Currency.com operates as a cryptocurrency trading platform offering leveraged trading and is primarily geared toward active, speculative trading strategies. The exchange follows a Market Maker model, meaning that order execution takes place within its own proprietary trading infrastructure.

Traders can access leveraged crypto instruments with leverage of up to 1:20, enabling them to open positions that significantly exceed their initial capital. Based on our analysis in this Currency.com exchange review, all trades are executed via Currency.com’s proprietary web-based platform, with no integration of third-party trading terminals.

The minimum deposit required to start trading is $20, which makes the platform accessible even to retail traders with relatively limited capital.

Key features & trading tools

When analyzing the trading interface for our Currency.com review, we noted that the exchange places a strong emphasis on analytics and advanced decision-making tools. The platform offers a comprehensive feature set, including:

- Over 3,000 tradable instruments

- 229+ cryptocurrency assets

- Access to 75 technical indicators and charting tools

- Detailed price charts with historical data and percentage change metrics

- Built-in price alerts and price movement comparison tools

- A demo account funded with virtual BTC that fully replicates the functionality of a live account

- Support for copy trading

- Trading via a web-based platform and mobile applications (iOS and Android)

Overall, the exchange is clearly geared toward users who actively analyze the market and rely on technical indicators as a core component of their trading strategies.

Fees, costs & leverage

Like most Currency.com reviews, we analyzed the platform’s fee structure, leverage options, and deposit/withdrawal policies to provide a clear picture of trading costs.

Trading fees:

- market maker fee – 0.025%

- market taker fee – 0.075%

- trading fees may start from as low as 0.0125%

- cryptocurrency exchange fees – approximately 0.2%

Leverage and financing:

- maximum leverage – up to 1:20

- leveraged positions are subject to overnight / funding fees, which vary depending on the instrument and prevailing market conditions

Deposits and withdrawals:

Minimum deposit: $20 (or equivalent in other currencies), making the platform accessible to most retail traders.

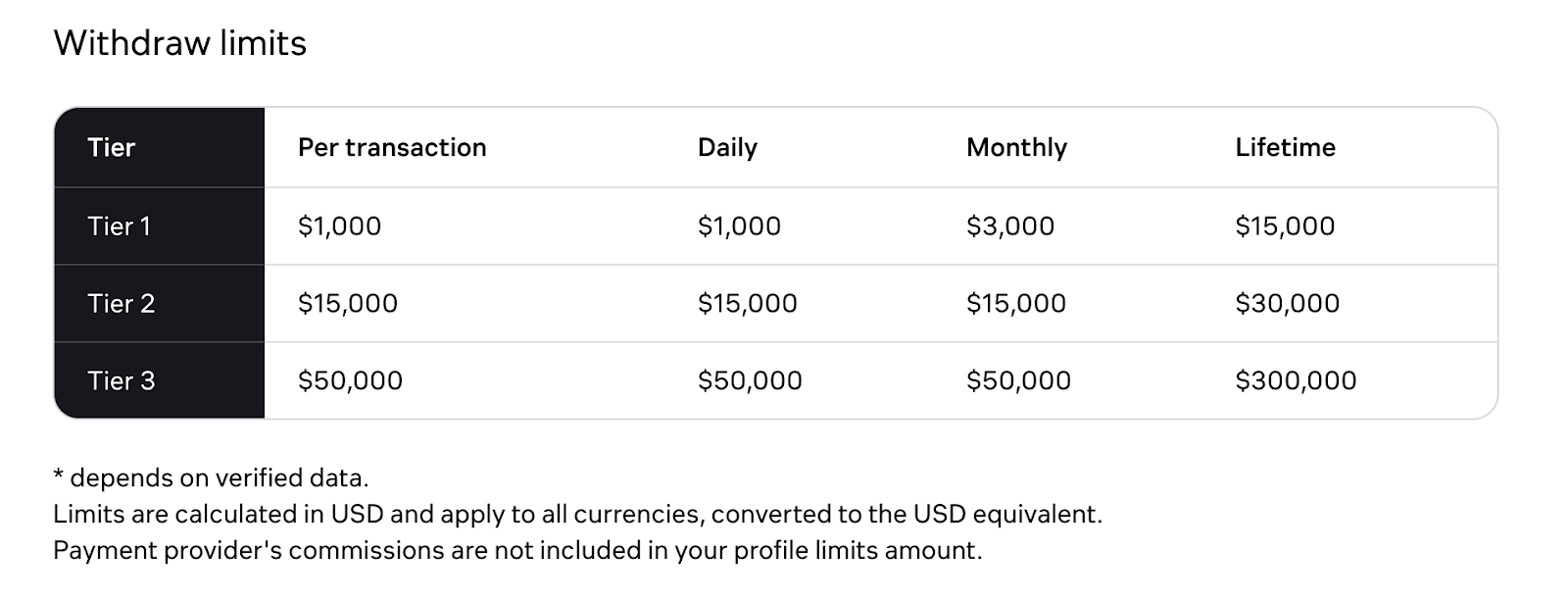

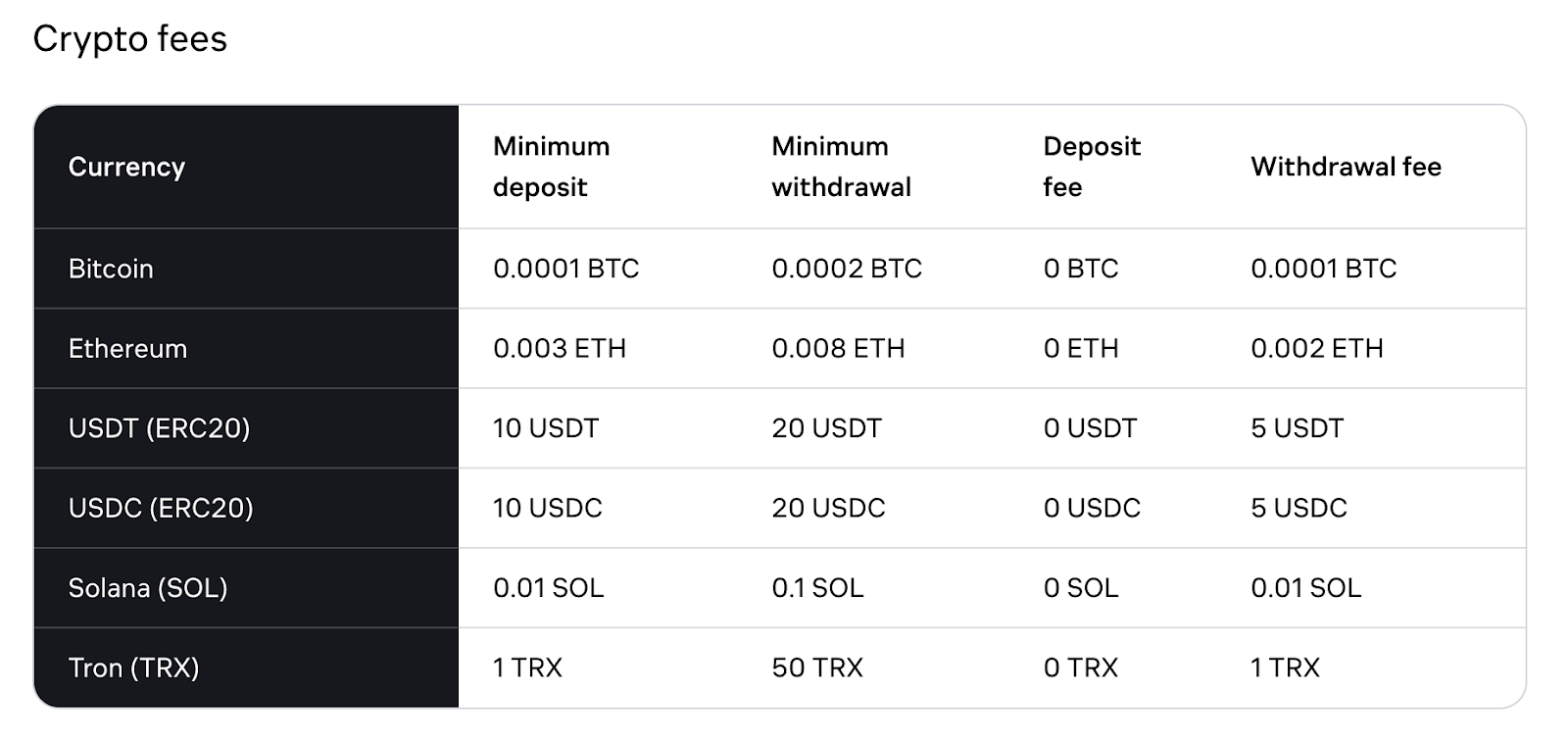

Minimum withdrawal depends on the method and currency:

- Local bank transfers – from $20

- International SWIFT transfers – from $250

- Cryptocurrencies – minimum amounts vary by coin (e.g., BTC ≈ 0.0002 BTC, ETH ≈ 0.008 ETH, USDT/USDC ≈ 20 tokens)

Withdrawal fees vary depending on the method and currency and may include both a fixed fee and a percentage of the withdrawal amount.

Supported methods: bank transfers, credit/debit cards, UnionPay, Yandex Pay, and crypto wallets.

Client funds are held in segregated accounts; however, no fund insurance coverage is provided.

Currency.com pros and cons

As part of our evaluation, we tested the platform over several days, assessing trading conditions, the fee structure, available instruments, and the overall interface logic. Based on this hands-on testing, we identified a number of practical advantages and limitations that users are likely to encounter when working with Currency.com in real trading conditions.

Strengths:

- Low entry threshold: A minimum fiat deposit of $20 and a minimum cryptocurrency deposit starting from 0.0001 BTC (or the equivalent in other supported cryptocurrencies) allow users to begin trading with limited risk. For instance, we opened a BTC position worth $25 and were able to test the platform’s trading mechanics without incurring any significant losses.

- Wide range of instruments within a single interface: With over 3,000 assets and 229+ cryptocurrencies available, the platform enables the construction of a diversified portfolio while testing multiple strategies simultaneously – without the need to switch between different services.

- Advanced analytical tools: When opening an ETH position, we applied multiple indicators and chart types at once, which provided clear insights into potential entry and exit points without relying on third-party analytical platforms.

- Fully featured demo account: We tested a 10x leveraged strategy on a demo account that closely mirrors real market conditions, allowing us to validate the approach safely before committing real capital.

- Multi-device accessibility: By opening positions and monitoring the market simultaneously on desktop and mobile, we confirmed that the web platform and mobile applications (iOS and Android) synchronize instantly.

Weaknesses:

- Noticeable deposit and withdrawal fees: We tried to withdraw $200 via USD (International SWIFT). Logically, 0.1% of $200 is just $0.20. But the exchange charges a minimum fee of $50, which made the actual commission 250 times higher than what the percentage implies.

- Lack of fund insurance: Although client funds are held in segregated accounts, all force majeure risks ultimately fall on the user, which becomes particularly relevant when managing larger positions.

- Interface complexity for beginners: During initial testing, we found the indicator settings and asset selection somewhat overwhelming, which may complicate the first trades for less experienced users.

- Regional restrictions: The platform is not available to clients from the United States and Russia, limiting accessibility for users in these regions.

- No MT4/MT5 support: Traders accustomed to standard trading terminals will need to adapt to Currency.com’s proprietary interface, which may slow down execution during the initial learning phase.

Trustworthiness check

When assessing the reliability of Currency.com, we focused on security, fund storage, and the availability of company information.

Fund storage. Client funds are held in segregated accounts, which reduces the risk of the company using them for its own operations. However, there is no insurance coverage, and in the event of a force majeure, the investor bears full responsibility for their assets.

Customer support. We tested Currency.com’s 24/7 support via chat, email, and phone. Responses were fast – usually within a few minutes – and provided practical guidance on opening and closing positions. We also reviewed the platform’s built-in educational materials and technical tooltips, which proved genuinely helpful for navigating indicators and configuring the trading interface.

Reviews and reputation. On Trustpilot, Currency.com has a rating of 4.3 out of 5 based on around 2,000 reviews. On the Apple App Store, the mobile app holds an average rating of 4.7 out of 5, while on Google Play, the app has a rating of 3.9 out of 5. Users most often praise the platform’s stability, fast order execution, and responsive customer support, though some mention occasional withdrawal delays and identity verification issues.

In 2022, Currency.com received the international financial ADVFN Awards in the following categories:

- Best Crypto Exchange in the CIS

- Best Website for Cryptocurrency Data

- Best Crypto Exchange in the MENA Region

GNcrypto’s overall rating

| Criteria | Rating (out of 5) | Weight | Notes |

|---|---|---|---|

| Trading Fees & Funding Costs | 3.5/5 | 25% | Low trading fees (from 0.0125% to 0.075%), but deposit/withdrawal fees and funding fees when using leverage noticeably increase overall costs |

| Leverage & Margin Requirements | 3.5/5 | 20% | Leverage up to 1:20 – moderate and lower than on derivative exchanges; suitable for risk management but limits aggressive trading strategies |

| Contract Selection & Liquidity | 4.5/5 | 15% | Over 3,000 instruments and 229+ cryptocurrencies – a strong point of the platform, particularly for portfolio diversification |

| Platform Performance & Risk Controls | 4/5 | 15% | The proprietary platform offers 75 indicators, stable performance, and a demo account, but lacks MT4/MT5 support |

| Security & Regulatory Compliance | 3.5/5 | 10% | AML/KYC procedures are in place, and client funds are held in segregated accounts, but there is no fund insurance |

| User Experience & Trading Interface | 3.5/5 | 10% | The interface is functional but cluttered; it requires experience and some time to get used to |

| Customer Support & Educational Resources | 4/5 | 5% | 24/7 support, extensive educational and analytical resources, and a demo account for practice |

Final Score: 3.8/5

Our verdict: Currency.com stands out with a wide asset selection, strong analytics, and a low entry barrier. However, moderate leverage and relatively high funding, deposit, and withdrawal costs make it better suited for experienced traders than for cost-sensitive or conservative users.

Methodology – why you should trust us

We tested Currency.com using our weighted, category-based model, depositing $200 in BTC and opening leveraged positions (10x-50x) on BTC/USD and ETH/USD perpetuals. We monitored funding rates over 5 days, tested stop-loss execution during volatility, measured spreads during US and Asia trading hours, and withdrew funds to verify processing times. We rate platforms on 7 weighted criteria with scores from 1.0 to 5.0. Our testing uses real capital, not demo accounts.

Read our full methodology: How We Test Crypto Futures Trading Services

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.