Crypto venture funding doubled in 2025 thanks to RWA tokenization

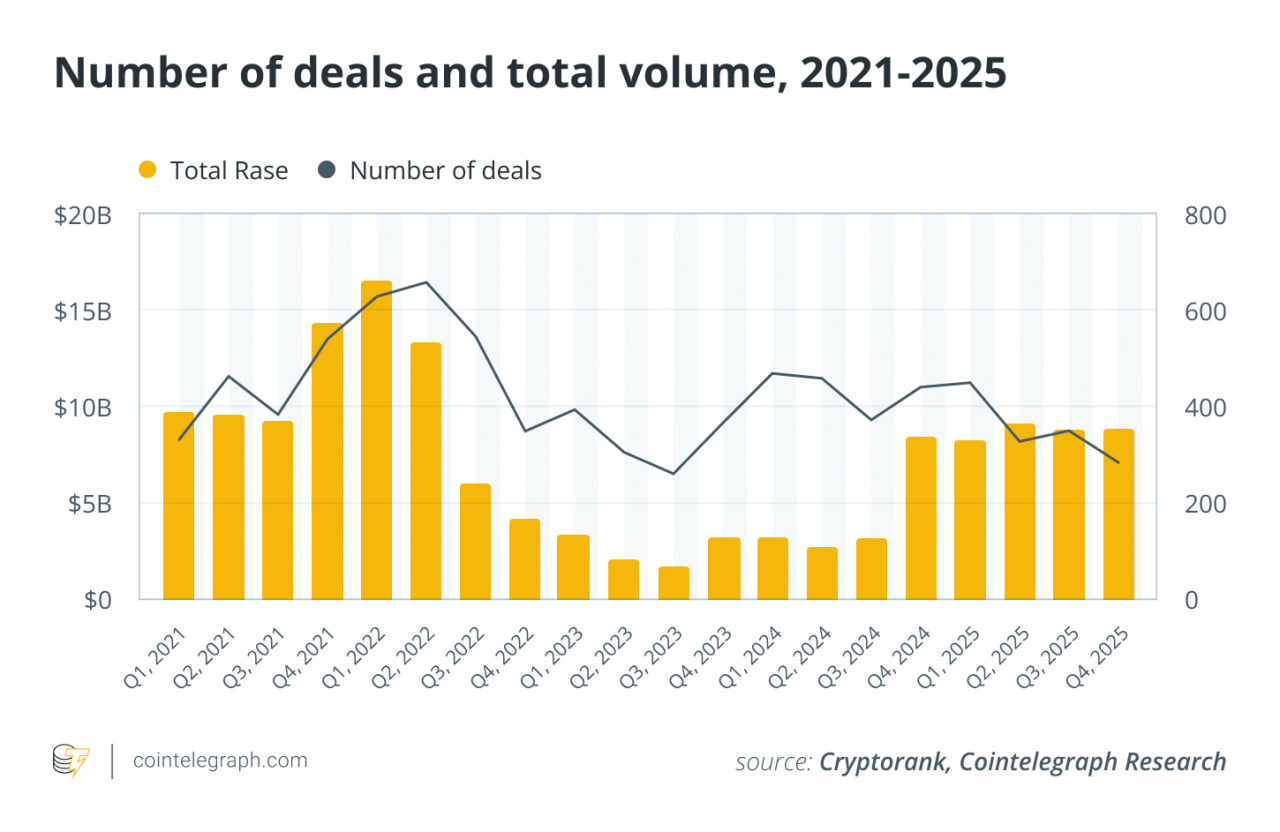

Crypto venture funding doubled in 2025 to $32.9 billion. The strongest growth came from the real-world asset tokenization sector.

Crypto venture funding doubled in 2025, reaching $32.9 billion — the sharpest rebound for the industry since the collapse of 2023. According to the report, the investment cycle shifted toward real-world asset (RWA) tokenization infrastructure, blockchain finance, and institutional-grade services — sectors investors view as the most resilient to market volatility.

RWA was the clear leader, attracting $6 billion and outpacing all other categories in deal volume and growth rate. Investors poured capital into projects focused on tokenizing money-market funds, debt instruments, and real financial flows. This includes startups issuing tokenized money-market products, next-generation asset-backed stablecoins, and platforms bridging traditional finance with blockchain infrastructure.

The second-fastest growing area was companies building products on Ethereum and other major ecosystems. Layer-2 networks, specialized blockchains, and developer infrastructure continued to expand, supported by the rise of RWA platforms, DeFi protocols, and enterprise blockchain initiatives.

Deal activity also increased across the board. After stagnating in 2024, total funding doubled in 2025, and average round sizes rose sharply. Unlike the NFT mania or speculative DeFi booms of prior cycles, capital in 2025 largely flowed into infrastructure and institution-focused projects.

Another growth factor was the renewed appetite of venture funds returning to the market after two years of caution. Major investors viewed 2025 as a recovery point and identified RWA as a segment capable of integrating with traditional finance and generating stable returns regardless of crypto market volatility.

Despite the rebound, the report notes that the market remains highly concentrated: a large share of capital went into a handful of major rounds, reflecting selective investment behavior and a preference for companies with proven models.

The research also highlights geographic shifts. The U.S. remains the dominant market, but 2025 saw a sharp increase in activity across Asia and the Middle East — regions emerging as RWA hubs thanks to regulatory support and institutional capital inflows.

The doubling of crypto venture investment signals that the industry is exiting its downturn and entering a new cycle built on infrastructure, institutional products, and real utility. RWA tokenization was the standout beneficiary of this shift and, based on 2025’s trajectory, is positioned to set the pace for the market heading into 2026.

Cointelegraph faced a major crisis at the end of 2025: search traffic dropped by nearly 80%, the newsroom went through large-scale layoffs, and a significant share of published content shifted to paid placements. The episode was seen as a sign of systemic problems in crypto media and a symptom of the broader transformation underway in the industry’s information landscape.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.