Crypto market recovers after crash: what's next?

After the year’s largest crash, the digital asset market is recovering. Traders now assess whether BTC can hold above $120,000 as they await new macro signals.

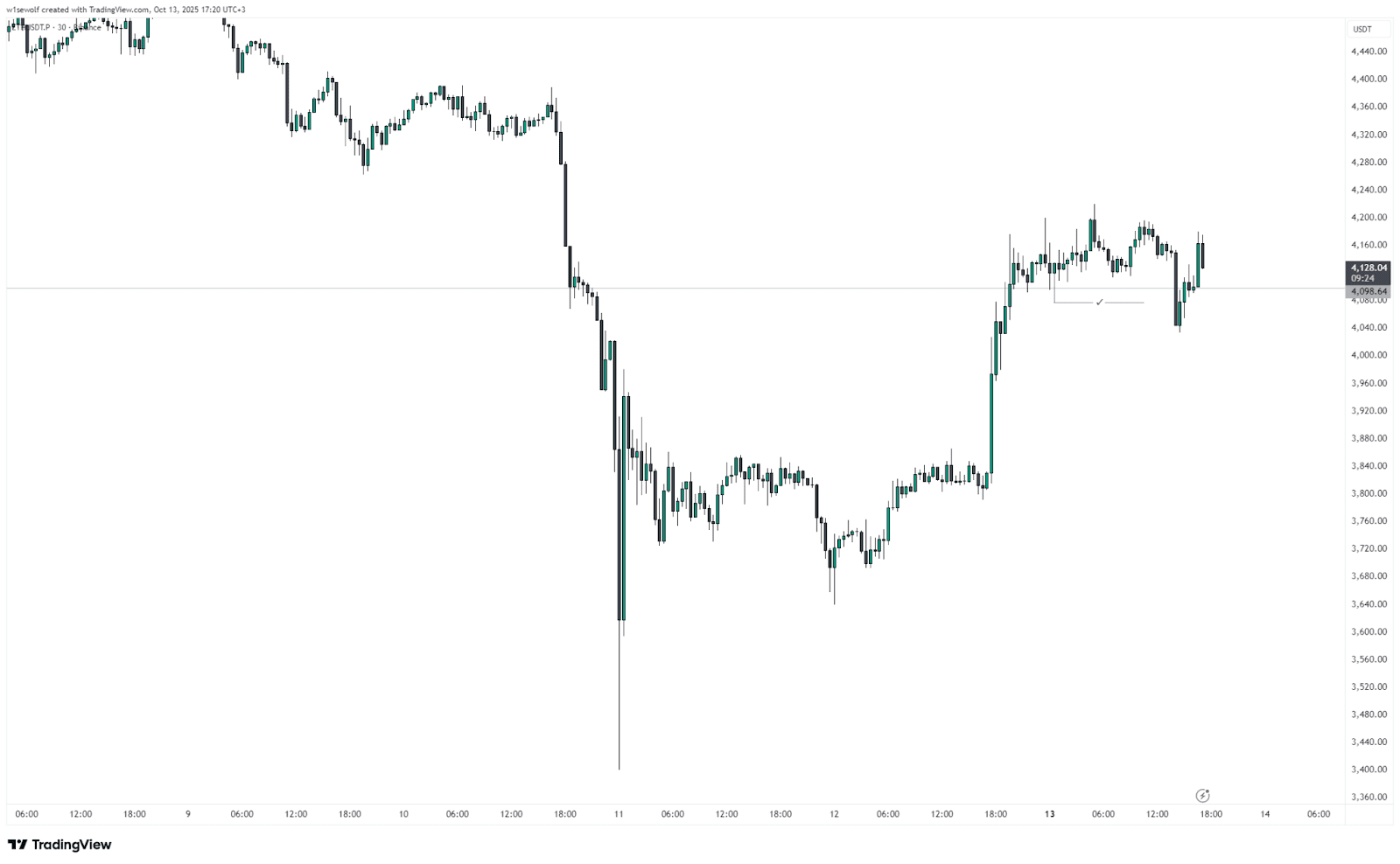

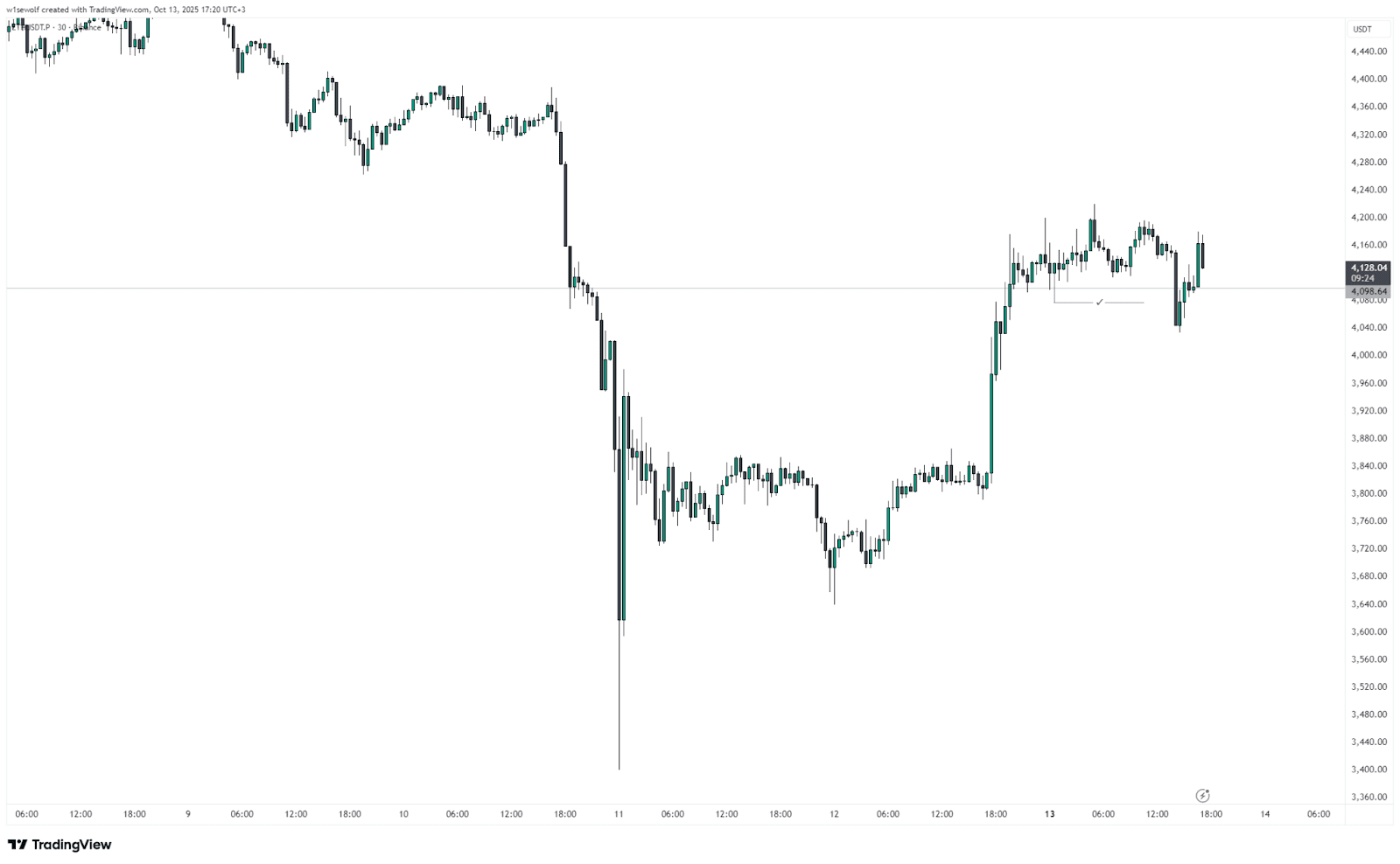

Bitcoin climbed to $115,000, Ethereum rose above $4,100, and total crypto market capitalization rebounded from $3.25 trillion (after collapsing on news of Donald Trump’s new tariffs on China) to around $4 trillion.

Paradoxically, the record $19 billion in liquidations helped flush excessive leverage from the market, laying the groundwork for a more stable recovery.

Following the historic weekend crash that wiped over $500 billion from total value, cryptocurrencies are showing steady gains. Some tokens, including BNB, even reached new all-time highs. The rebound was supported by XRP and DOGE, which gained 7.4% and 10%, respectively.

ETH value partially recovered after the October 11 flash crash. Source: TradingView

Analysts described the event as a classic market reset – a phase where panic-driven liquidations of overleveraged positions clear the market and create a stronger structural base.

According to Coinglass, funding rates on major exchanges fell to their lowest levels since the FTX collapse in 2022, while open interest in Bitcoin futures dropped by nearly half.

U.S.–China Trade War: Trump’s New Tariffs

The key trigger for the crash was the renewed escalation in the U.S.–China trade conflict. On October 11, President Donald Trump announced an additional 100% tariff on Chinese imports, on top of the existing 30%, raising duties to 130%.

The announcement, made on Truth Social, was accompanied by a pledge to impose new export restrictions on critical software starting November 1.

Trump said the move was a response to China’s tighter export controls on rare earth metals – vital for electronics production. He also canceled his planned meeting with Chinese President Xi Jinping and warned of further import restrictions.

The crypto community reacted sharply, accusing Trump of reckless policy moves and hinting at possible insider trading, as several large short positions were opened shortly before the tariff news.

Technical Failures in Exchange Risk Systems

Technical malfunctions on major exchanges amplified the crash. At the peak of selling pressure, liquidity evaporated and internal trading systems failed to handle the surge in orders.

Binance experienced widespread order book freezes, while some tokens temporarily collapsed to near zero due to oracle errors. Stablecoin USDe dropped to $0.65, and synthetic token wBETH to $0.20, triggering cascading liquidations.

In contrast, decentralized exchanges (DEXs) showed greater resilience – Uniswap handled record volumes of $10B, and Aave processed $180M in automated liquidations without delays, highlighting the strength of on-chain infrastructure.

Centralized exchanges later blamed each other for the system failures. Representatives from OKX and Crypto.com called for independent audits of CEX operations. Crypto.com CEO Kris Marszalek stated that “billions of dollars disappeared from user accounts overnight,” demanding an investigation into price feeds and order execution accuracy.

Market Outlook: October 13, 2025

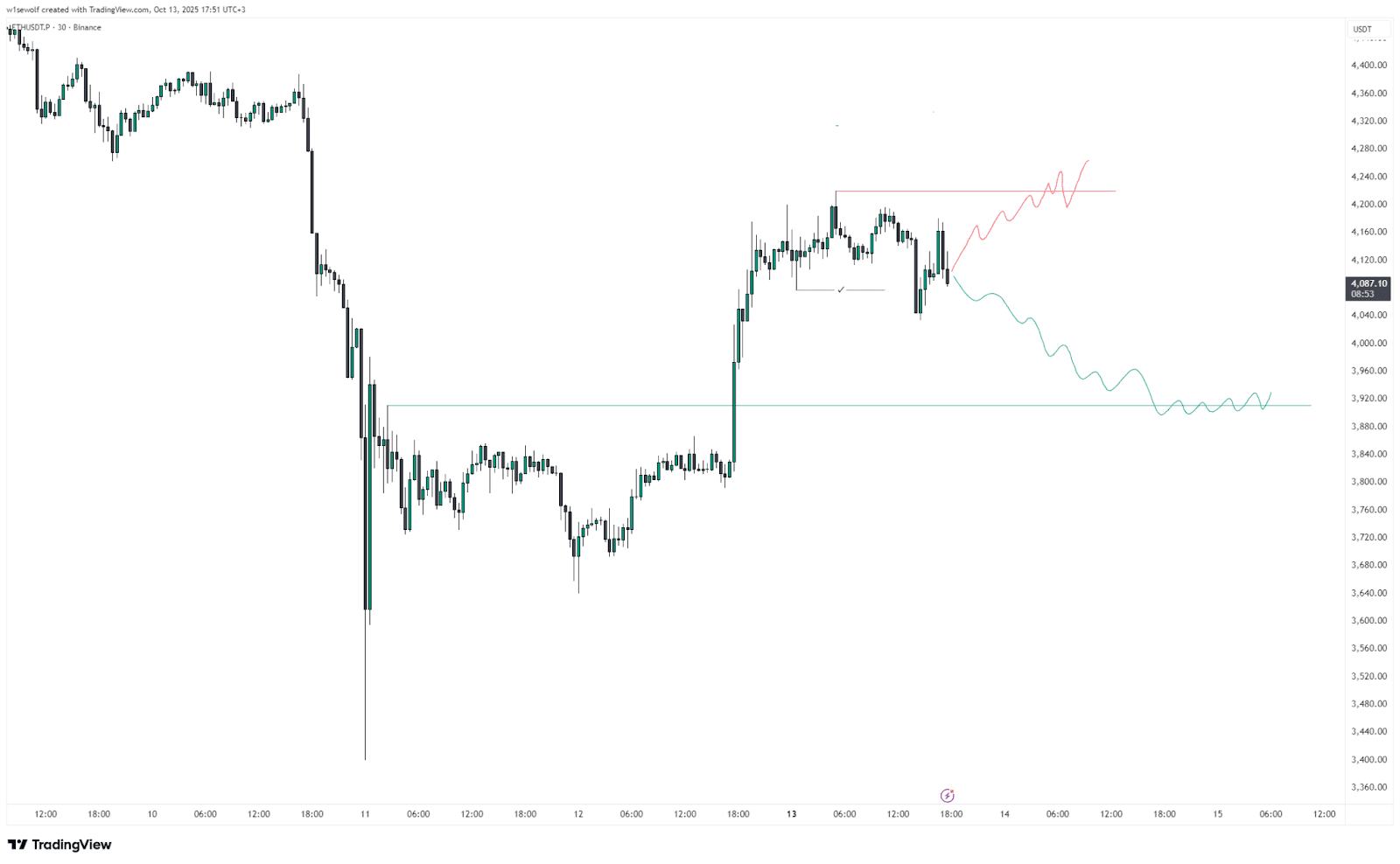

Key resistance for BTC lies between $120K-$123K – a breakout above this range could open the path toward $126K. Support sits near $110K, with a long-term psychological floor at $100K.For ETH, resistance is at $4.2K–$4.8K, with support at $3.8K–$3.9K. Sustained demand could push the price toward $5K.

Two potential scenarios for ETH value changes. Source: TradingView

In the coming days, the market will track three key factors:

- Developments in the U.S.–China trade standoff

- Funding rate movements

- Spot ETF inflows

- Base case: BTC consolidates in the $110K-$120K range with moderate volatility.

- Bullish scenario: A breakout above $123K leads to a $126K test, supported by institutional inflows.

- Bearish scenario: A drop below $110K may trigger a retest of $100K if tariff tensions escalate again.

Recommended