What to do when markets are falling? A guide for beginners

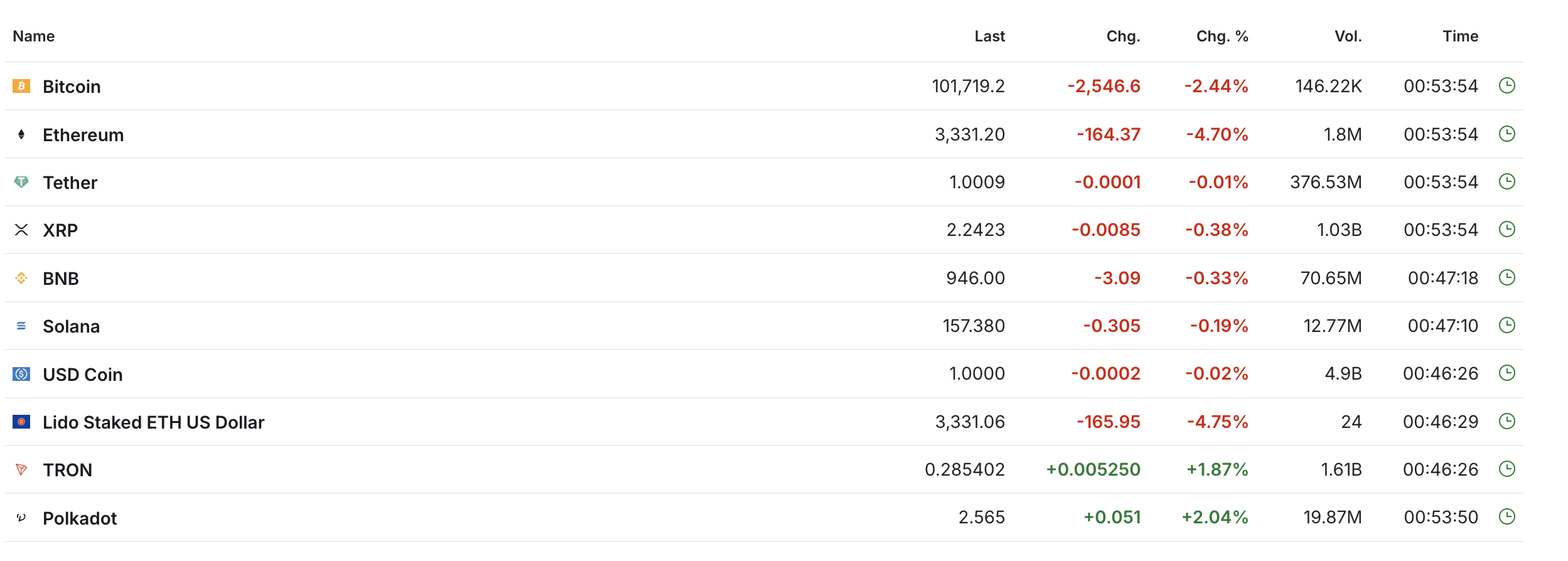

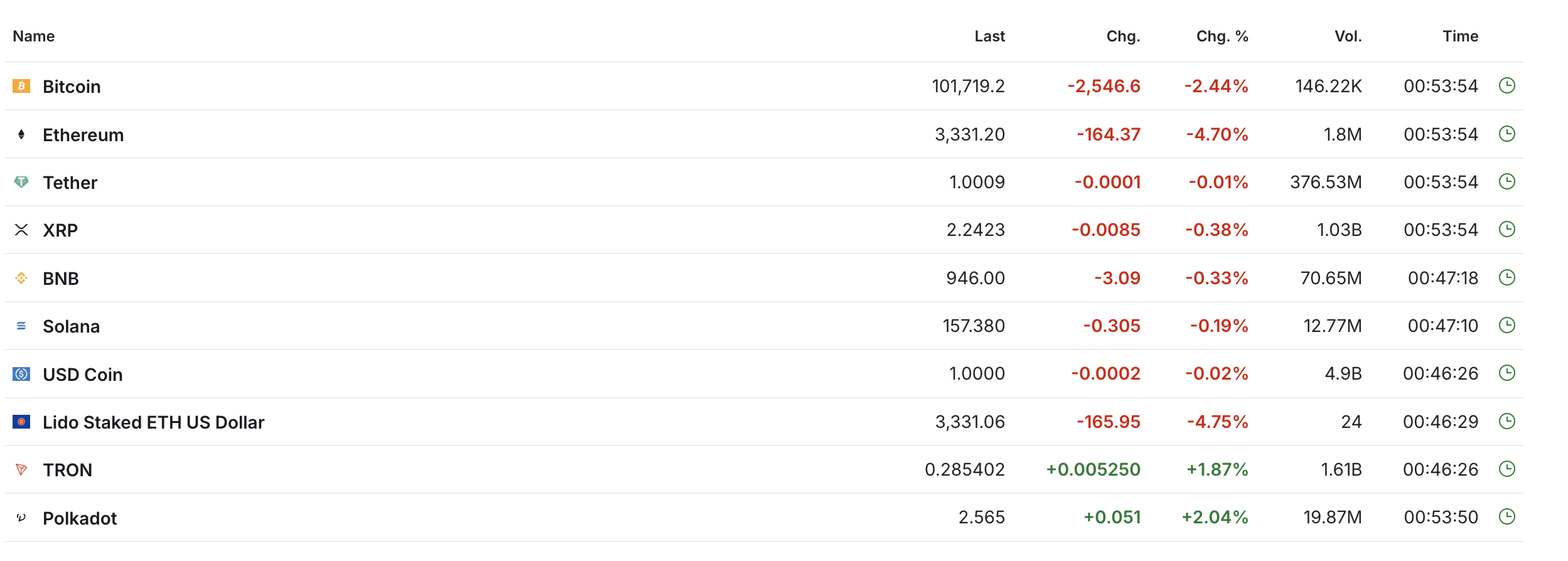

The market is in the hands of the bears today. In recent hours, major cryptocurrencies set fresh local lows: Bitcoin dipped below $100,000 and Ether briefly traded under $3,200.

Pressure spreads across the entire crypto sector, with altcoins sliding regardless of benchmarks and recently listed TGE tokens losing tens of percent within hours. This is not a conspiracy of venture whales. It is another turn of the cycle; it feels painful, yet it remains typical of risk markets.

Panic is natural at moments like this. To avoid becoming its hostage, regain control over the pace of decisions and the sources you trust for signals. How do you get through a sell‑off without abandoning your trading strategy?

The cryptocurrency market is showing a decline. Source: Investing

Hunting for the bottom is rarely the best move

When prices drop sharply, it’s tempting to “buy the dip” before it’s gone. In reality, that first impulsive purchase often becomes the first entry in a new list of losses. Accept that sitting out a few sessions doesn’t mean missing real opportunities. A short pause helps you regain clarity - to distinguish between bait prices and genuine entry points backed by data and context. Stopping for a moment isn’t inaction; it’s how you reclaim control over risk.

Acknowledge the loss and debrief it like an engineer

A loss is not a verdict; it’s data. Every negative outcome still counts as experience. Reconstruct your decision chain honestly: position size, entry logic, exit plan, invalidation level, source of the signal. Was it based on analysis, or driven by emotion and rumours? Did you average down without a clear plan?

This debrief is not about blame; it’s about understanding your behavior. Identify recurring patterns, write a few simple rules, and eliminate anything that violates them. The market does not keep a dossier of your defeats - it does something simpler. Over time, it separates those who learn from those who keep paying for the same mistakes.

First regain control over decisions, then rebuild the balance

During volatile periods, vision narrows to the chart and the process disappears from view. Take the opposite approach: restore a rhythm where patience is part of your strategy, and remember that doing nothing also counts as a position. Return to trading not to chase what you missed, but because you’re ready to follow your own risk and timing rules with clarity and discipline.

Once you can skip a trade without feeling deprived, you’ve regained control of the account - instead of letting the account control you.

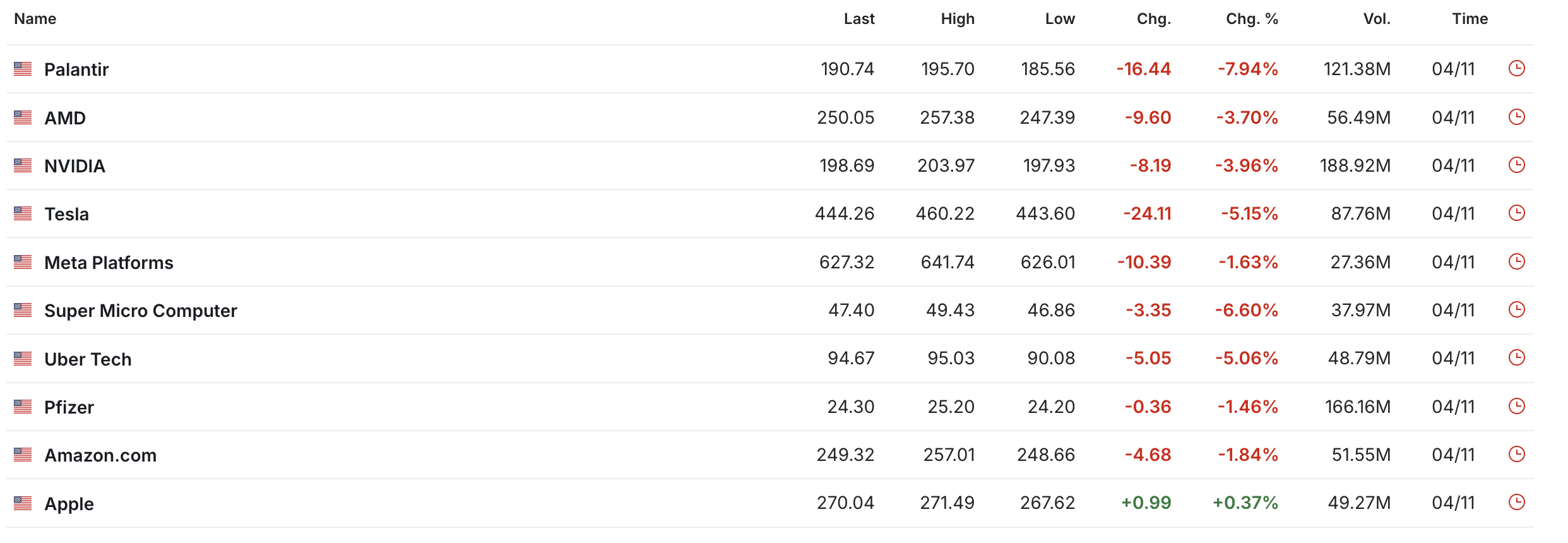

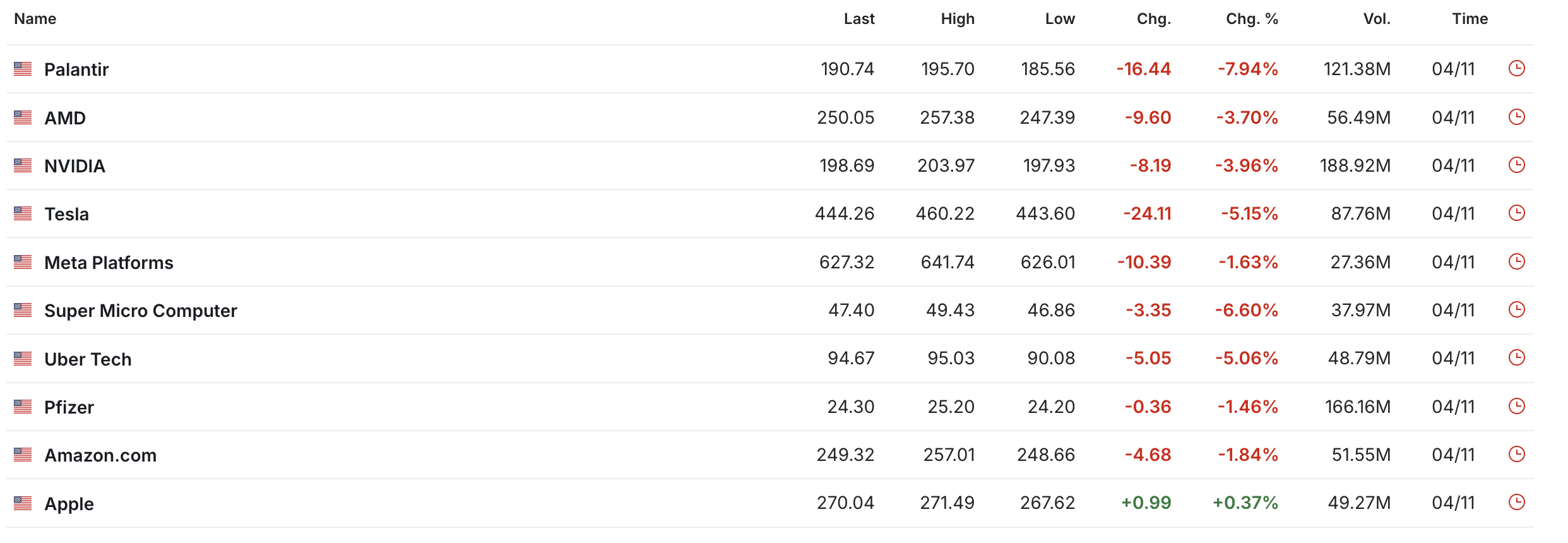

Tech stocks fell Source: Investing

Focus on what you can control

At times of abnormal volatility do not try to forecast the market by instinct. Instead of chasing pullbacks, turn to the background: who moves capital and where, at which levels positions concentrate, where demand actually shows up. On‑chain analytics helps to see these layers; services such as Nansen and Arkham show flows, large‑wallet activity and signals of ecosystem health.

Study the state of the market within your own process. Form a hypothesis, mark the invalidation level in advance, set acceptable risk and only then open a trade. The goal is not to guess; the goal is to repeat controlled actions.

Do not try to win it back immediately

The rush to make losses back usually multiplies errors. A trader opens positions too often and at the wrong time, chooses leverage that risks a margin call and loses discipline.

Markets move in cycles and accumulation follows sell‑offs. The most reliable way to come out ahead is not to speed up but to outlast the drawdown and prepare for recovery. Build your cash buffer and turn your entry and exit criteria into a habit. Traders who keep to their strategy through sideways phases and poor liquidity usually meet the next rally more calmly and capture more of it than those who fight every single day of decline.

Today’s bears will fade as previous ones did. Opportunities will return if you keep your composure.

Recommended