Crypto market analysis: BTC's correction and altcoin stagnation

The dynamics of the cryptocurrency market point to a prolonged downtrend, focused on the correction of Bitcoin (BTC) and significant stagnation in the altcoin sector.

Bitcoin has corrected by more than 13% from its all-time high. However, this appears to be a normal technical correction, with on-chain data pointing to the final stage of the downturn.

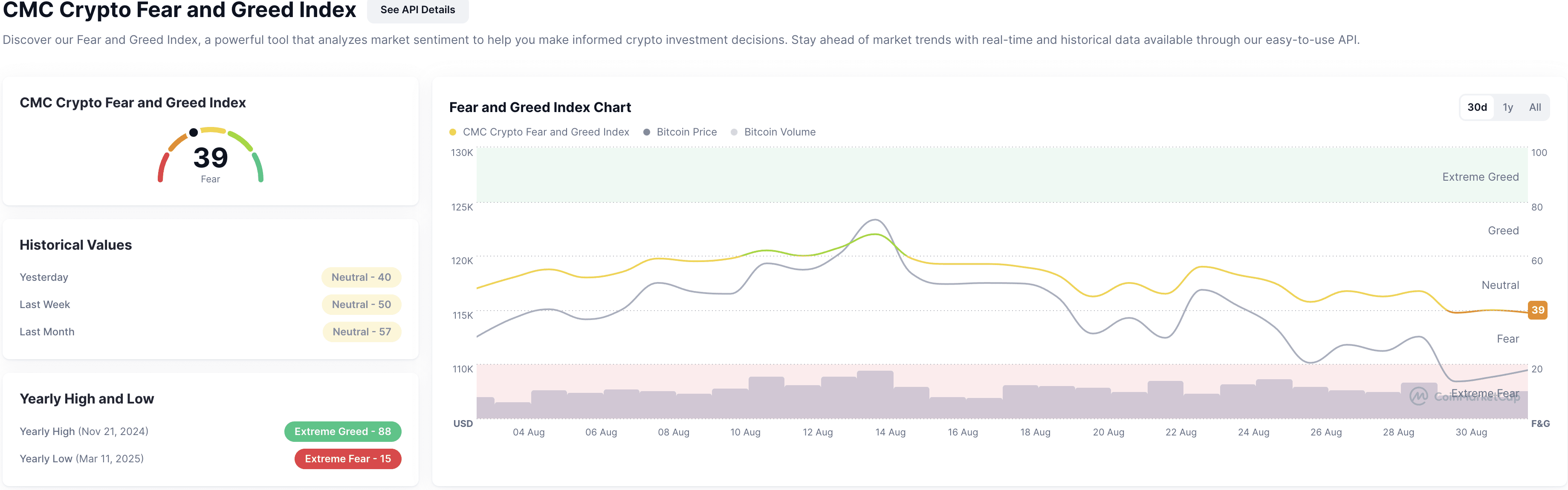

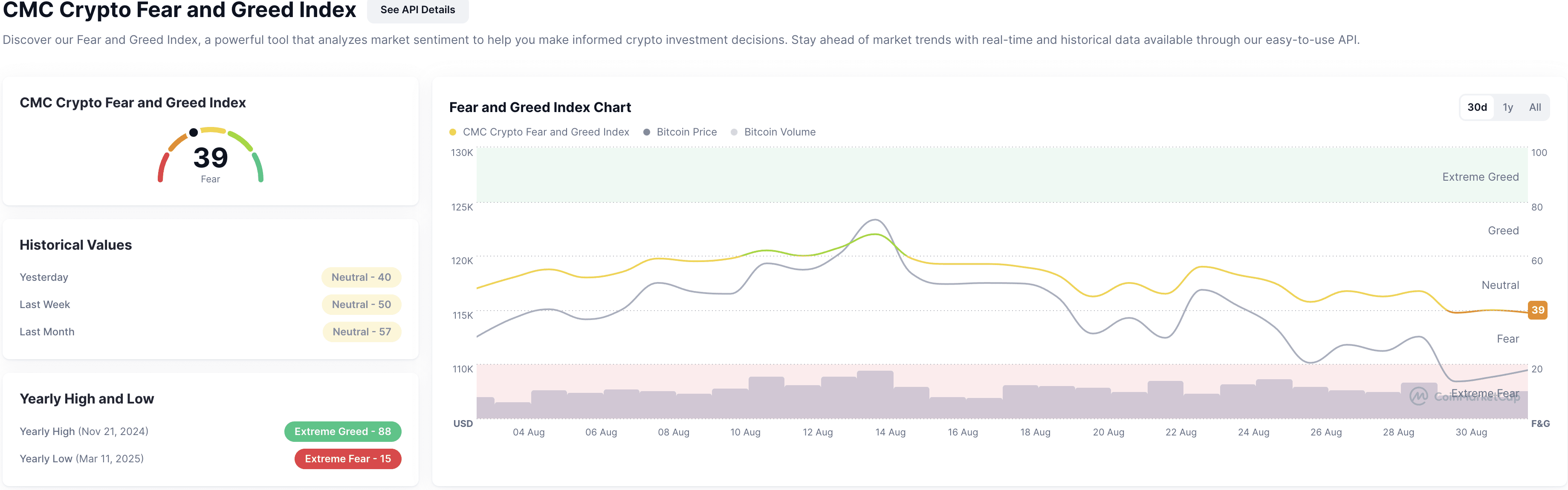

The current market situation is also confirmed by the Fear & Greed Index. The latest index readings indicate a shift from "Neutral" to "Fear." A value of 39, reflecting the current sentiment, highlights growing caution and uncertainty among investors. Historically, such fear phases have often marked market bottoms, as retail investors panic-sell near the lows.

Fear and Greed Index 09/01/2025. Source: coinmarketcap

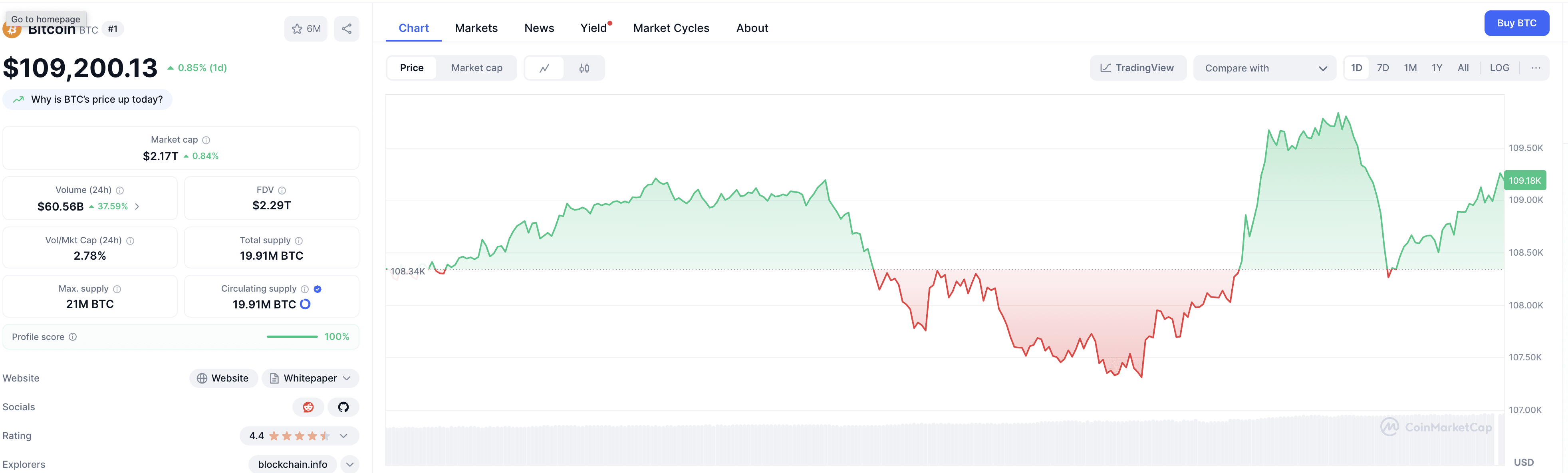

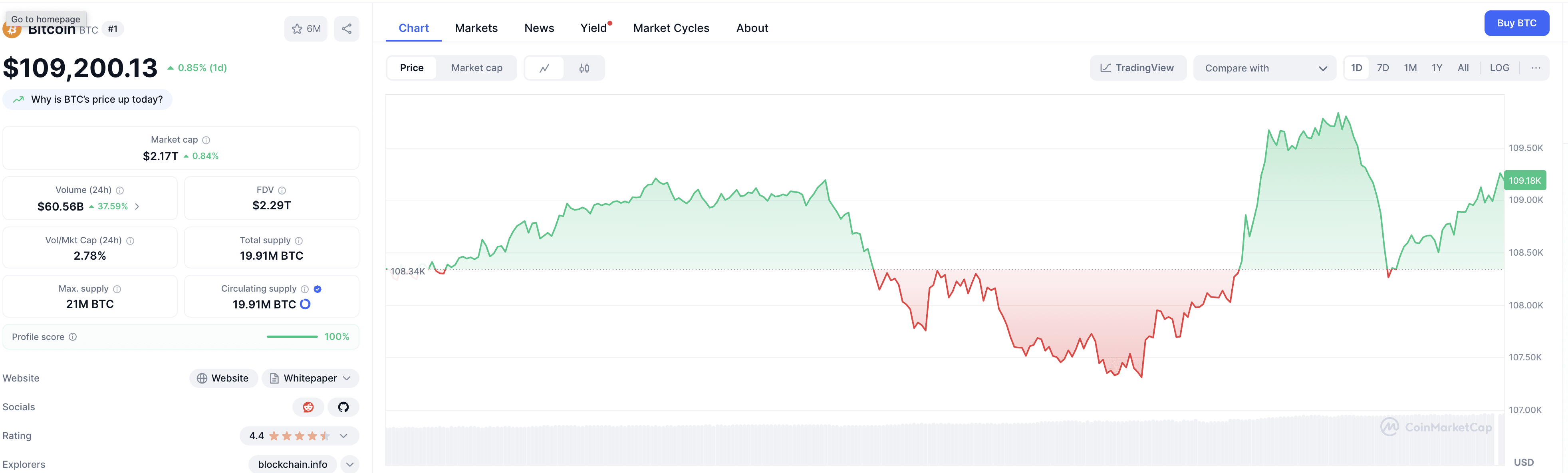

Bitfinex analysts believe that a potential cyclical bottom could form in the range of $93,000 to $95,000. They state that the realized price of short-term holders around $108,900 is seen as a key threshold — a break lower could signal deeper losses.

Meanwhile, this morning’s drop was quickly reversed, with BTC rebounding nearly 1% to trade above $109,000.

Bitcoin rate 09/01/2025. Source: coinmarketcap

At the same time, the altcoin sector shows even weaker dynamics, reflecting a broader “risk-off” mood among investors. Major altcoins such as Ethereum (ETH), XRP, Cardano (ADA), and Dogecoin (DOGE) have posted double-digit losses. Yet institutional demand for ETH remains steady, underscoring continued long-term confidence. However, most of the capital shifts in altcoins stem from fund rotation rather than fresh inflows.

The broader economic background also influences the crypto market. Mixed US macro data – steady consumer spending, sticky inflation, and a cooling labor market – are adding to uncertainty. These factors, along with regulatory changes such as clarifications from the CFTC on offshore exchanges and growing corporate adoption of digital assets add to a complex but cautiously positive long-term outlook.

Analysts at Bitfinex also suggest that September could mark the cyclical low, with structural drivers expected to return in Q4 and support a recovery.

Recommended