Crypto market flash crash on August 26: key reasons

Bitcoin fell below $109,000, triggering a cascade of liquidations and a market-wide decline. ETF inflows, option expirations, and regulatory risks added to the pressure, but experts' forecasts vary widely, ranging from $75K to $200K per BTC.

Just two weeks after hitting a local high, Bitcoin lost about 12%, and market capitalization fell by hundreds of billions of dollars. This movement looked particularly sharp against the backdrop of gold's stability and a moderate decline in stock indices.

Economist Peter Schiff drew attention to the contrast in this situation. In his post on X, he noted that even with massive purchases of BTC by public companies, the price did not remain at its peak.

According to him, the question "who is selling?" remains key, as Bitcoin's weakness relative to other assets signals possible internal market problems.

Mass liquidation of long positions intensified the decline of Bitcoin

The key factor behind the collapse was the large-scale closing of long positions in the derivatives market. According to data from the Glassnode analytics platform, August 25 saw one of the largest liquidations in the past year. In just one day, more than $150 million in long positions were wiped out as a result of the rapid decline in prices.

This decline triggered a cascade of liquidations, as traders' automatic orders with leverage were triggered simultaneously. As a result, the market faced a chain reaction: pressure on the price intensified as new positions were liquidated. This dynamic demonstrates the vulnerability of the cryptocurrency sector to the accumulation of excessive leverage.

The liquidation surge confirmed that even with sustained institutional interest in Bitcoin, the market remains prone to sharp corrections. The scale and speed of liquidations indicate that it is often the derivatives segment that becomes the main source of volatility when prices start to fall.

Investors are particularly attracted to put options, which are instruments that hedge against falling prices. Demand for them has risen sharply, especially in the $108,000–$112,000 range, indicating expectations of further declines. At the same time, the so-called "pain point" (the level at which most participants incur maximum losses) for BTC is currently around $116K, and for ETH – around $3,800.

Among the skeptics, economist Peter Schiff stands out, predicting a decline in BTC to $75,000, which is below Strategy's average purchase price.

The liquidation surge confirmed that even with sustained institutional interest in Bitcoin, the market remains prone to sharp corrections. The scale and speed of liquidations indicate that it is often the derivatives segment that becomes the main source of volatility when prices start to fall.

ETF flows indicate a shift in interest between Bitcoin and Ethereum

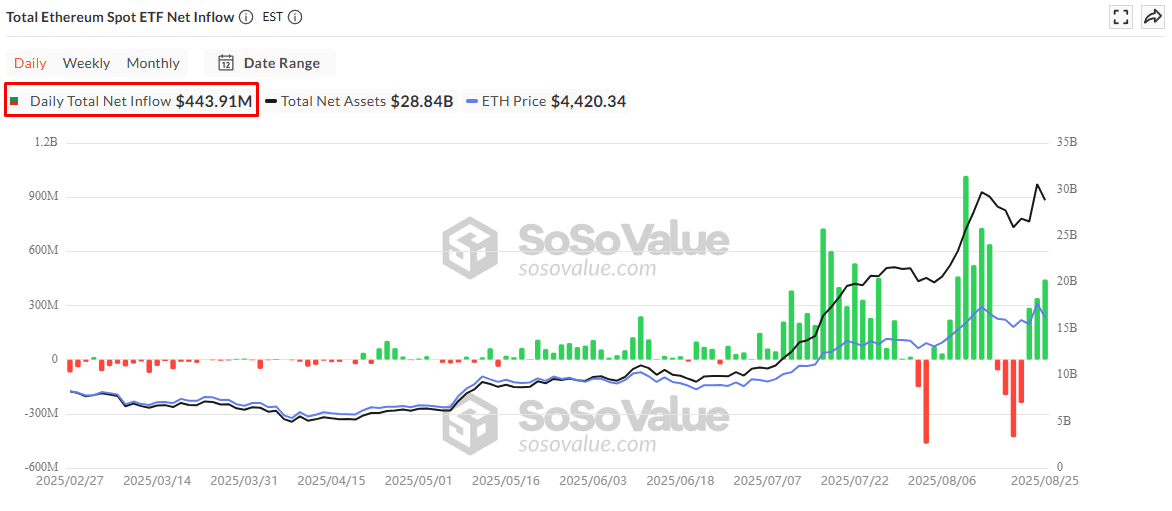

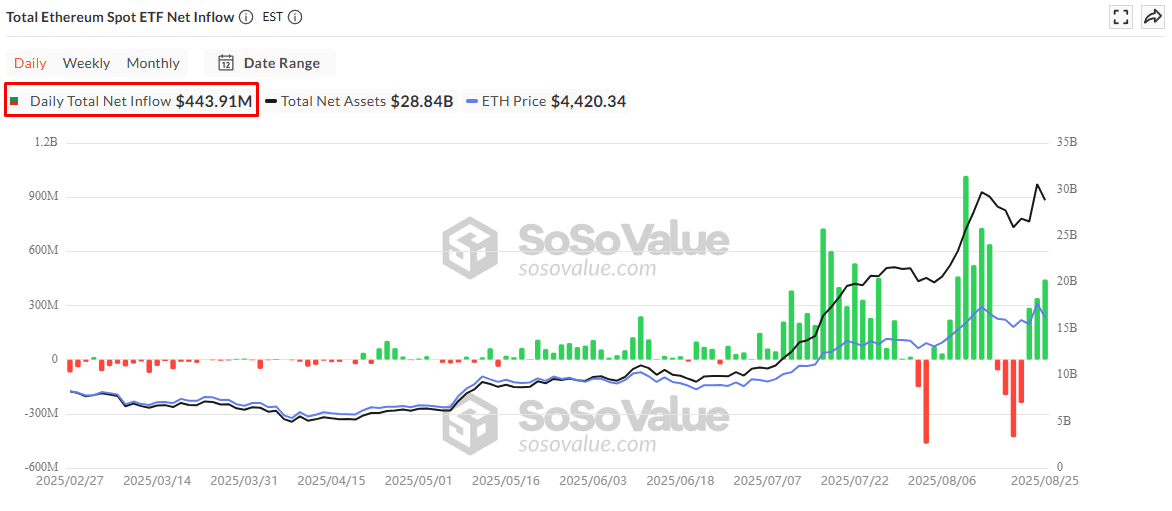

Capital flows in exchange-traded funds showed a noticeable shift in demand structure. Over the past 24 hours, Bitcoin ETFs recorded an inflow of approximately $219 million, which was the first positive result after several days of outflows. However, Ethereum funds proved to be much more popular, with total investments exceeding $444 million, most of which went to BlackRock's ETHA product.

The total amount invested in Ethereum ETFs was $444 million. Source: sosovalue.com

This trend reflects short-term capital rotation and growing institutional interest in ether amid the decline of bitcoin. For investors, this is a signal that the market has not yet lost confidence in digital assets, but preferences are shifting in favor of ETH. At the same time, ETF activity itself confirms that institutional demand remains strong despite increased volatility.

Option expirations and derivative pressure increase market volatility

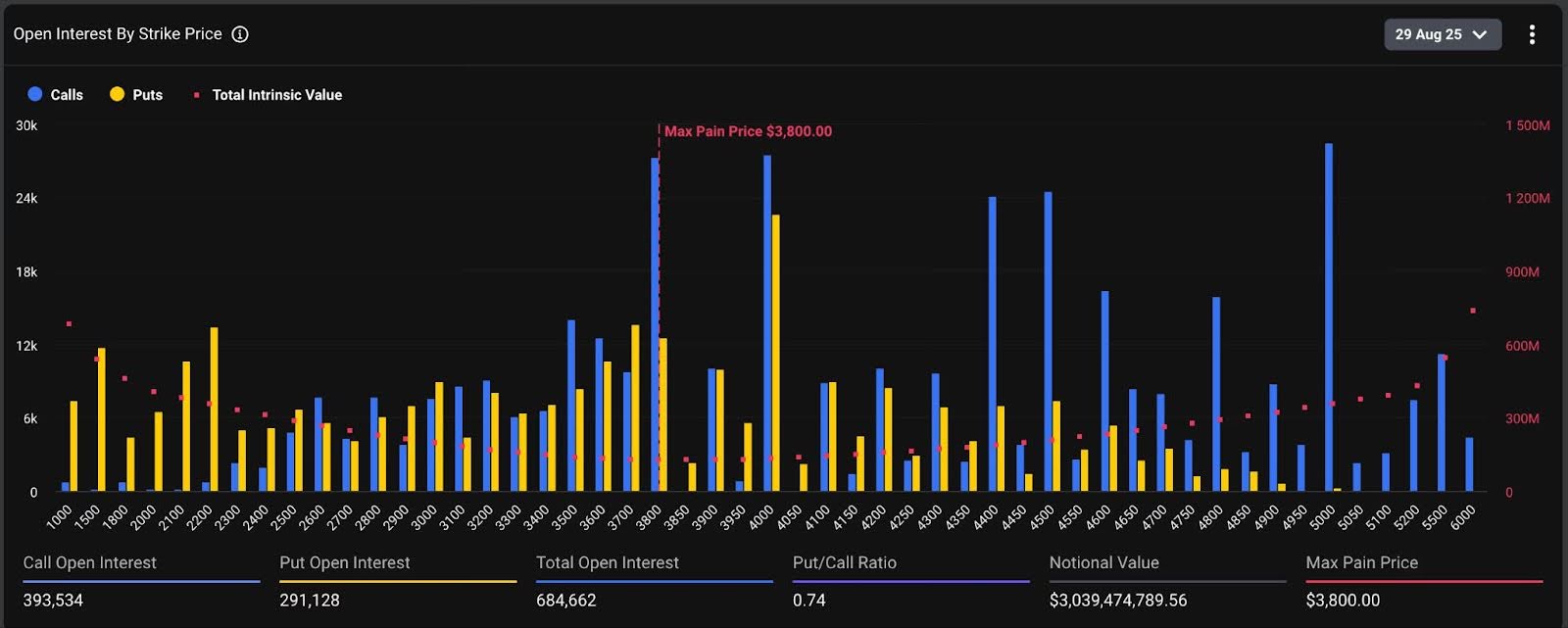

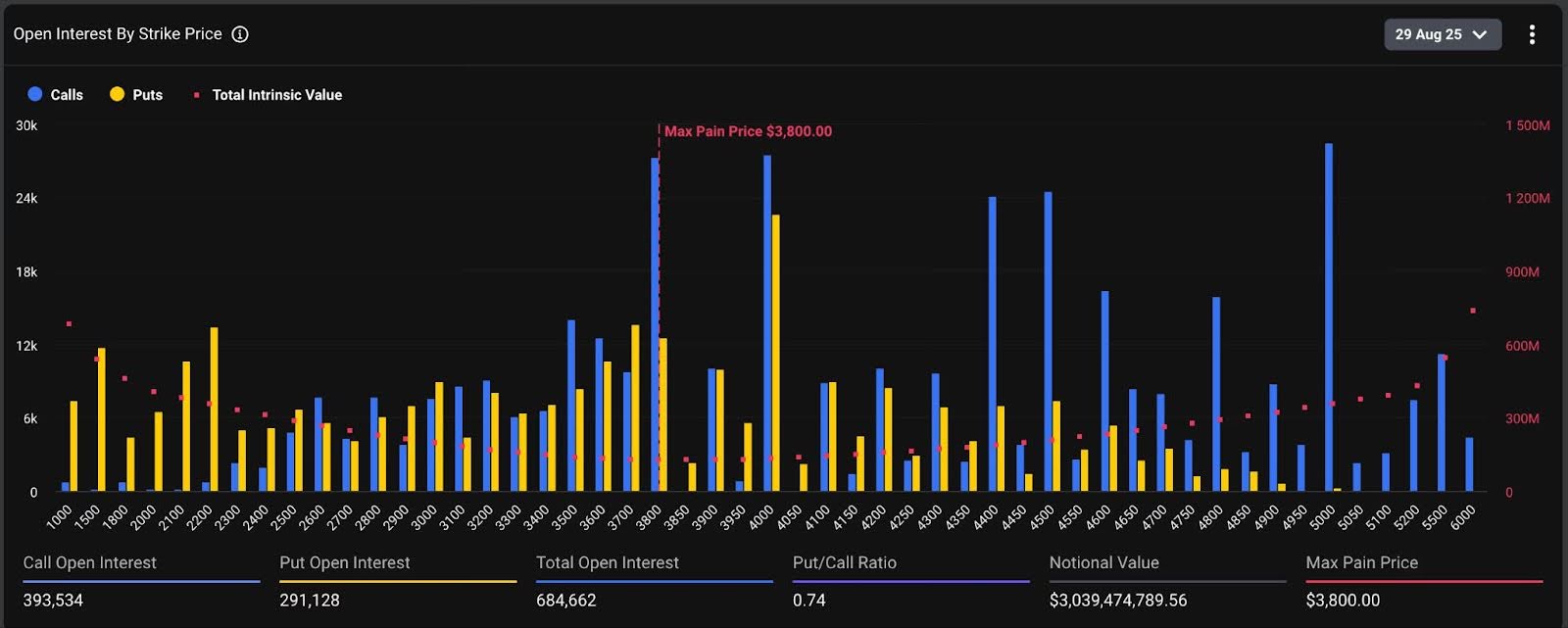

An additional factor contributing to instability was the approaching expiration date of options – contracts that give the right to buy or sell an asset at a predetermined price. This week, more than $14.6 billion in Bitcoin and Ether options are approaching expiration, which is having a strong impact on the market.

Investors are particularly attracted to put options, which are instruments that hedge against falling prices. Demand for them has risen sharply, especially in the $108,000–$112,000 range, indicating expectations of further declines. At the same time, the so-called "pain point" (the level at which most participants incur maximum losses) for BTC is currently around $116K, and for ETH – around $3,800.

The so-called "pain point" for BTC. Source: coindesk.com

High interest in defensive instruments reinforces bearish sentiment and makes the market even more susceptible to sharp fluctuations.

Analysts disagree: from bearish forecasts to long-term optimism

Experts are divided on the future dynamics of Bitcoin. Some believe that the decline is only gaining momentum and that the price could fall significantly below current levels. Others, on the contrary, view the correction as a natural part of the cycle and an opportunity to enter the market at a favorable price.

Among the skeptics, economist Peter Schiff stands out, predicting a decline in BTC to $75,000, which is below Strategy's average purchase price.

Optimists, on the other hand, are bullish: Bitwise analysts expect a rise to $200,000 by the end of 2025, pointing to continued institutional interest.

At the same time, long-term forecasts remain predominantly positive: experts point to the continuing accumulation of Bitcoin and sustained demand for Ether. This means that the current correction can be viewed as a temporary phase in the cycle rather than a trend reversal.

Institutional funds and companies continue to accumulate assets, reducing their available supply. However, September is historically considered an unfavorable month for Bitcoin, which increases investor caution and adds uncertainty in the short term.

Altcoins are following Bitcoin's decline amid falling liquidity

The decline in Bitcoin triggered a chain reaction across the entire market, putting altcoins under even greater pressure. Leading tokens fell in price by between 9% and 12% in just one day, confirming the systemic nature of the correction and the high degree of interdependence within the cryptocurrency sector.

Solana (SOL) suffered the biggest losses, falling more than 11% to the $186–188 range. Dogecoin (DOGE) fell about 10% and traded around $0.21, while Cardano (ADA) lost 9%. Chainlink (LINK) also recorded a significant decline, falling 11%.

Experts cite weak liquidity and sharp sell-offs, which amplified the effect of the decline, as the main reasons for such a large-scale drop. These factors made altcoins particularly vulnerable, turning a local collapse into a broad correction across the entire sector.

Conclusion

The flash crash on August 26 showed that the crypto market remains extremely vulnerable to a combination of factors, ranging from mass liquidations on derivatives to pressure from options and shifts in capital flows. Even with sustained institutional interest, sharp fluctuations can trigger massive sell-offs and billions in losses.

At the same time, long-term forecasts remain predominantly positive: experts point to the continuing accumulation of Bitcoin and sustained demand for Ether. This means that the current correction can be viewed as a temporary phase in the cycle rather than a trend reversal.

Recommended