Crypto ETPs drew $2.5B despite falling BTC and ETH prices

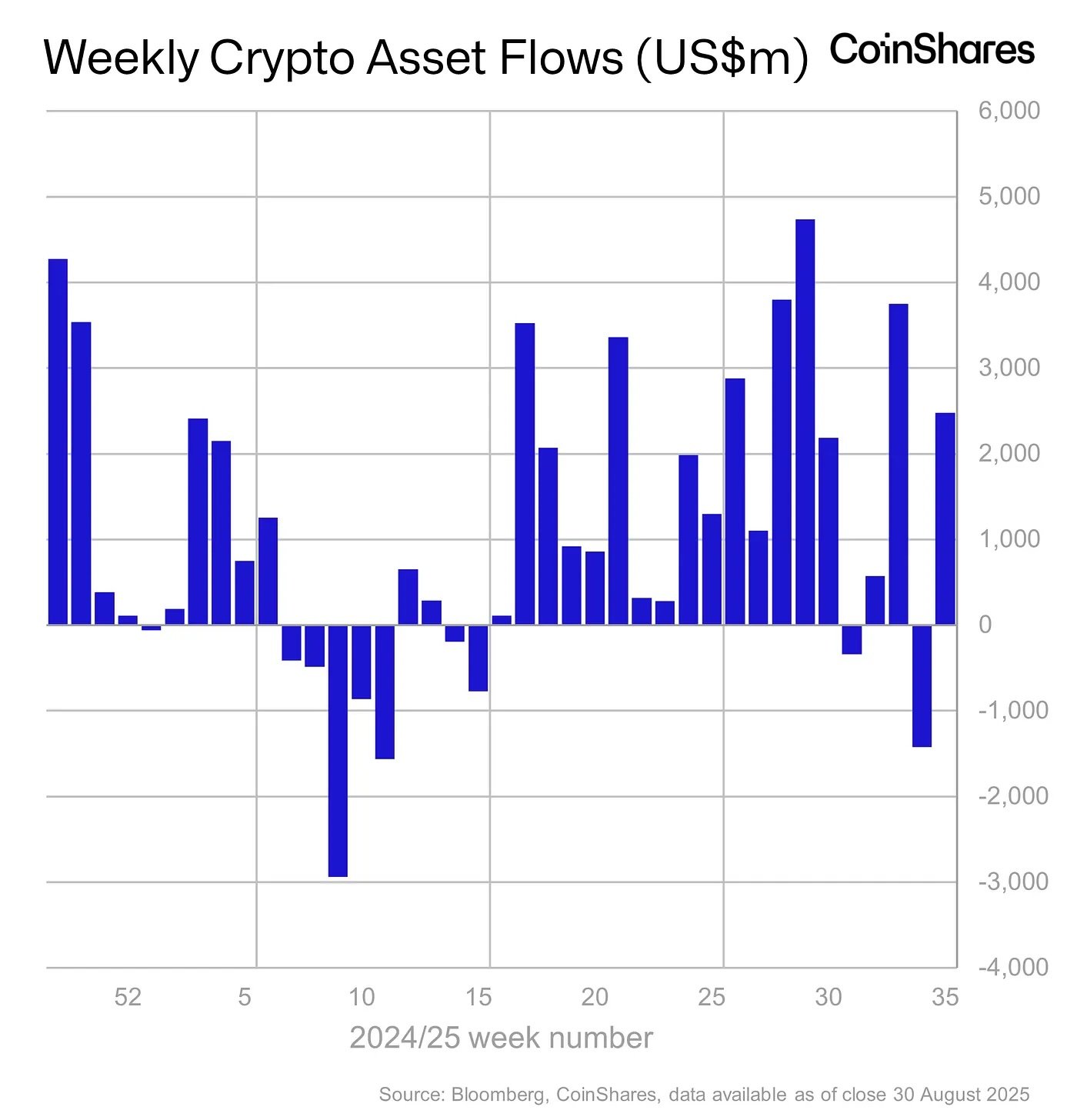

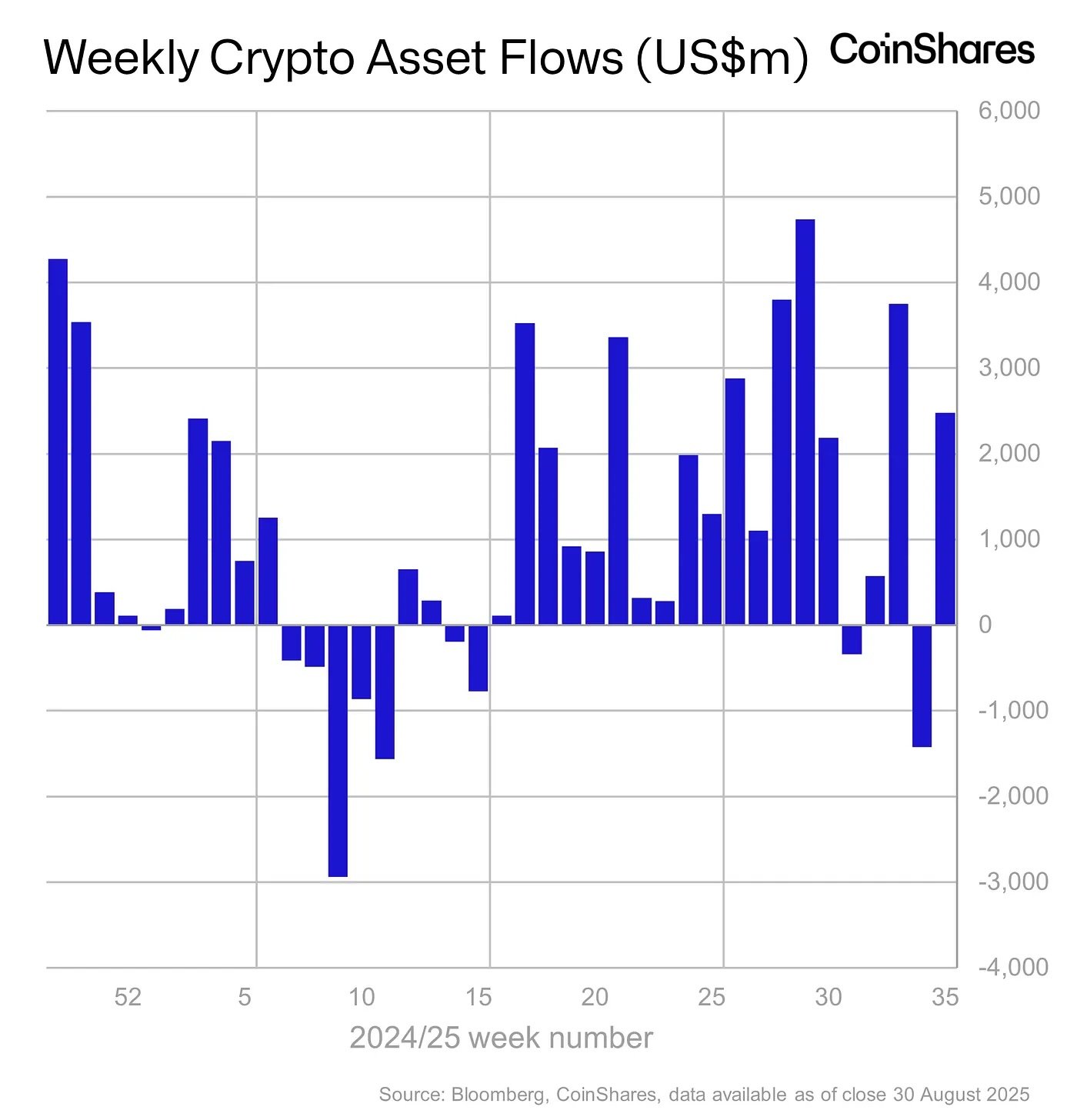

Global crypto exchange‑traded products (ETPs) recorded a rebound last week, capturing $2.48 billion in net inflows even as prices for Bitcoin and Ethereum declined.

Crypto ETPs attracted $2.48 billion in inflows last week, led by Ether products with $1.4 billion, while Bitcoin and other tokens also saw significant gains despite market weakness.

The inflows came despite Bitcoin and Ether's weekly declines of 2.22% and 3.15%. Over the last week, Spot Ether ETPs led inflows with $1.4 billion of the total inflows, while Bitcoin-linked products gained $748 million, according to a CoinShares report.

Other crypto ETPs also saw inflows, with Solana products gaining $177M and XRP $134M, buoyed by investor optimism around potential U.S. ETF approvals.

Last week saw an outflow of $1.4 billion. Thus, we are witnessing a noticeable shift in investor sentiment. For the month of August, total crypto ETP inflows amounted to $4.37 billion, contributing to a year‑to‑date total of $35.5 billion, an increase of 58%compared to the same period in 2024.

Meanwhile, assets under management across crypto funds dipped around 7% to $219 billion from $234.7 billion the previous week. Although August inflows were strong, they were considerably lower than July’s record $12 billion inflow, which followed a 15‑week inflow streak.

Despite ongoing inflows into crypto funds broadly, Bitcoin ETPs had seen $301 million in net outflows month‑to‑date, while Ether products accounted for nearly $4 billion – over 91% of August’s total inflows.

Crypto ETPs, financial products traded on established exchanges and tracking the price of cryptocurrencies, offer investors exposure to digital assets without requiring direct ownership of tokens. These instruments have increasingly attracted institutional and retail interest, especially amid evolving regulatory environments and growing demand for tradable crypto assets.

Recommended