Colombia requires crypto exchanges to report user data to the tax authority

DIAN has introduced rules requiring crypto platforms to disclose client data, including transaction volumes and balances. The first reports are due in 2027.

Colombia’s national tax authority, DIAN, has imposed mandatory reporting rules for crypto exchanges and other digital asset providers, requiring them to collect and transmit detailed information about users and their transactions. The framework is intended to strengthen oversight of taxpayers and reduce evasion in the country’s growing crypto sector.

Under Resolution 000240, the rules apply to exchanges, intermediaries, and platforms dealing with bitcoin, ether, stablecoins, and other cryptoassets. The obligation extends to both domestic companies and foreign services offering access to Colombian residents.

Required data includes account-holder identification, transaction volumes, the number of transferred tokens, their market value, and end-of-period balances. The system aligns with the OECD’s Crypto-Asset Reporting Framework to support international data sharing.

Although the resolution takes effect immediately, reporting obligations begin with the 2026 tax year. The first full report from crypto providers is due by the last business day of May 2027.

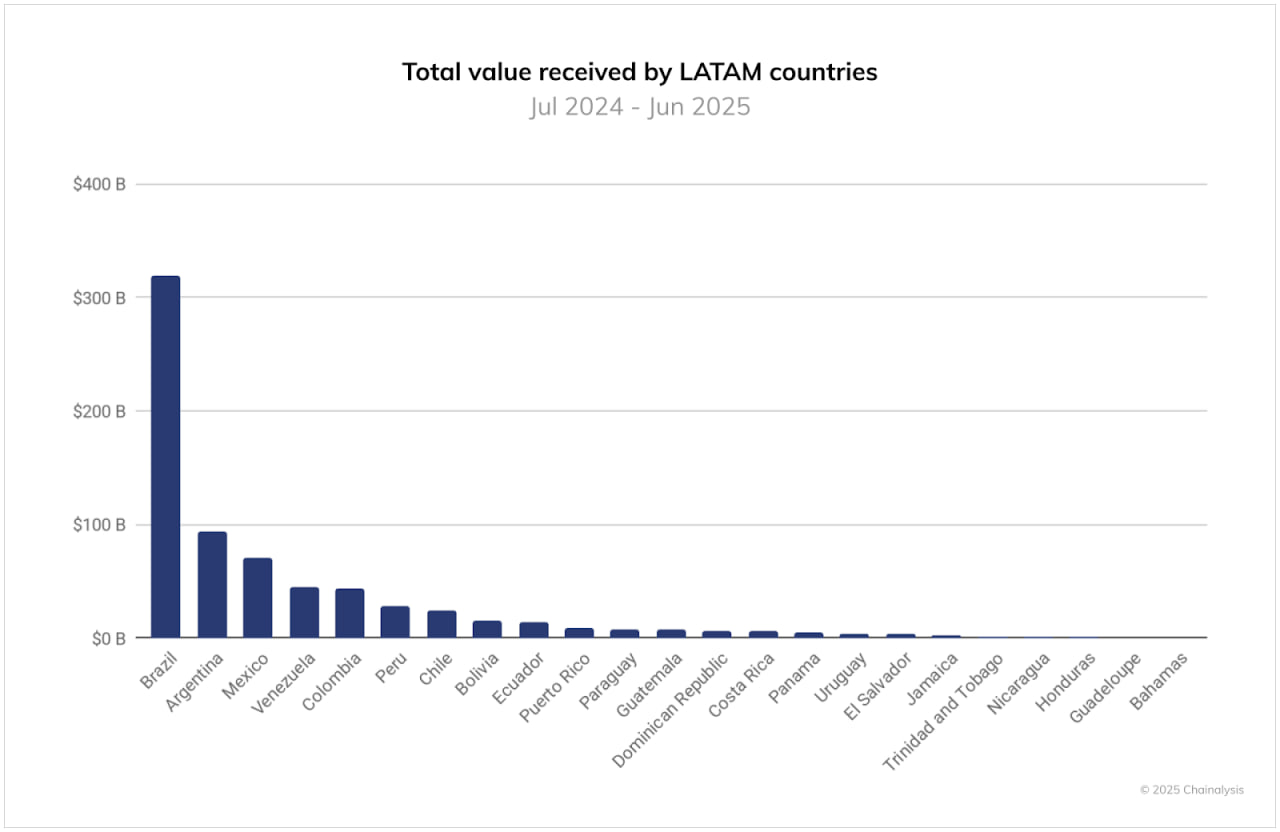

Colombia remains one of the largest crypto markets in Latin America. According to Chainalysis, it ranked fifth in the region with $44.2 billion in crypto transaction volume from July 2024 to June 2025, and posted the second-fastest growth rate after Brazil.

Previously, individuals were required to declare their crypto assets and gains in tax filings, but third-party platforms were not part of the enforcement process. The new mechanism will allow DIAN to cross-check user declarations against provider reports and better estimate the country’s total crypto holdings.

Noncompliance or incomplete reporting may result in fines of up to 1% of the value of unreported transactions.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.