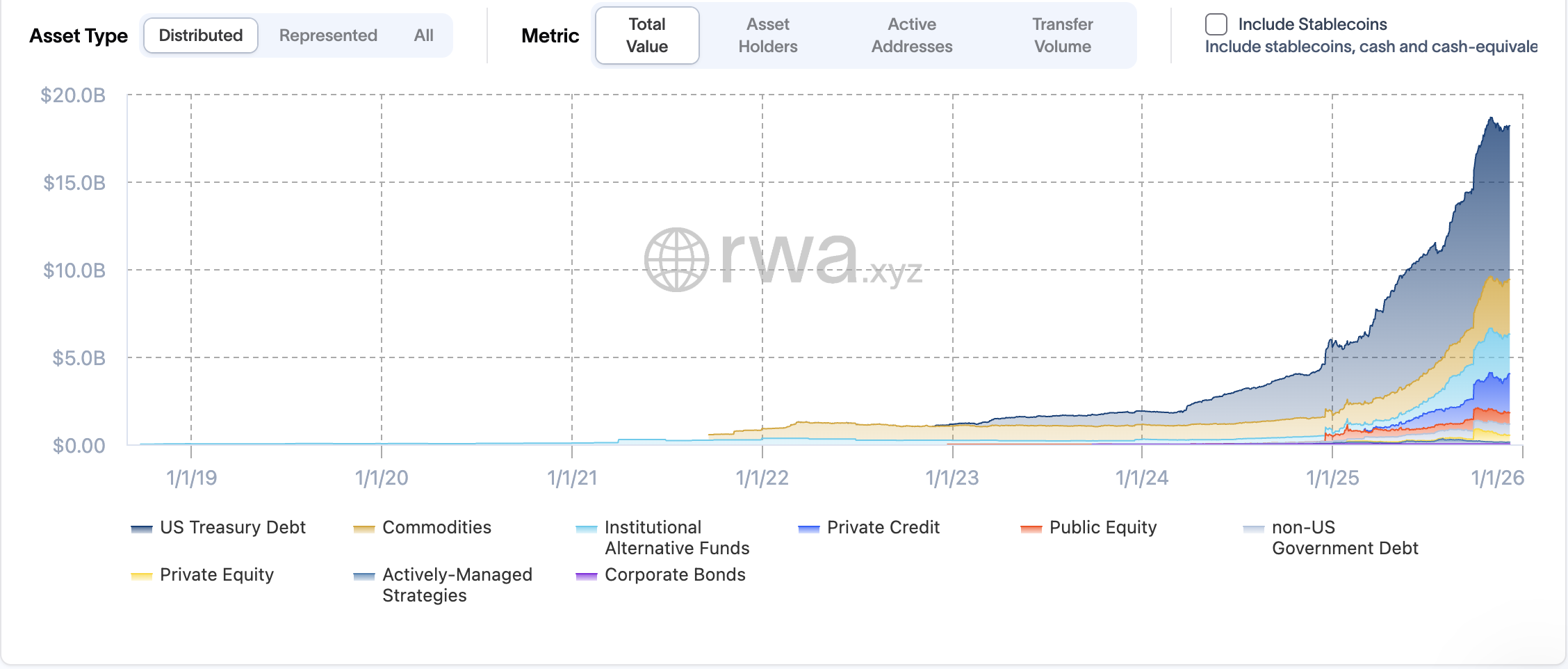

RWA market grows 229% in 2025 amid rising demand for tokenized Treasuries

CoinShares expects tokenized RWAs to keep expanding in 2026, with U.S. Treasuries at the center, after the market jumped 229% in 2025 to $18.1 billion on demand for dollar yield.

Digital asset investment company CoinShares projects U.S. Treasuries will steer growth in tokenized real-world assets in 2026, following a 229% rise in 2025 to $18.1 billion. The firm points to global demand for dollar yield and gains in onchain settlement efficiency.

In its 2026 Digital Asset Outlook, the digital asset manager reports that tokenized Treasuries more than doubled this year, increasing from $3.91 billion to $8.68 billion. Excluding stablecoins, the broader tokenized RWA market expanded from $5.5 billion at the end of 2024 to $18.1 billion. CoinShares notes that investors choose products backed by U.S. government debt when yields are available with limited extra risk, and it expects that pattern to continue next year.

Ethereum remains the dominant network for tokenized Treasuries, with the firm’s analysis putting more than $4.9 billion of U.S. government debt on that chain as of this week. Issuance, settlement and distribution are increasingly occurring directly on blockchains rather than through traditional custodial workflows.

The report says stablecoins reveal strong global demand for tokenized dollars, used both as reserves and for everyday transactions. But when investors, rather than transactors, have a choice, they typically prefer to hold U.S. Treasuries instead of dollars directly.

“Tokenisation has materially moved beyond the longtime narrative of crypto enthusiasts,” noted Matthew Kimmell, a digital asset analyst at CoinShares. “Real assets, issued by reputable firms, receiving material investment. Even real regulators engage with crypto rails as credible infrastructure.”

CoinShares describes the progress as visible in live markets but flags competition among networks and settlement systems. The firm indicated that it is still unclear how market share and liquidity will consolidate.

Chief executive Jean-Marie Mognetti summed up the shift: “If 2025 was the year of the graceful return, 2026 looks positioned to be a year of consolidation into the real economy.”

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.