Coinbase debit card review: fees, limits and real risks

We ordered the Coinbase Card, linked it to our Coinbase account, paid in stores and online, tried ATM withdrawals and foreign currency payments, and watched how crypto-to-fiat conversion and spread fees affect the final cost.

We tested the Coinbase Card the way a typical exchange user would. After ordering both the virtual and physical cards, we linked them to our account and funded a dollar balance. We connected the card to Apple Pay and Google Pay, paid in stores and online, and tried withdrawing cash from an ATM.

What we liked most about the Coinbase Card is its deep integration with the exchange. There is no need to move funds to a separate account, and all purchases and rewards appear instantly in the Coinbase app. The main drawback is the cost of convenience. Conversion spreads and credit card service fees can eat into a meaningful share of funds.

What the Coinbase Card offers

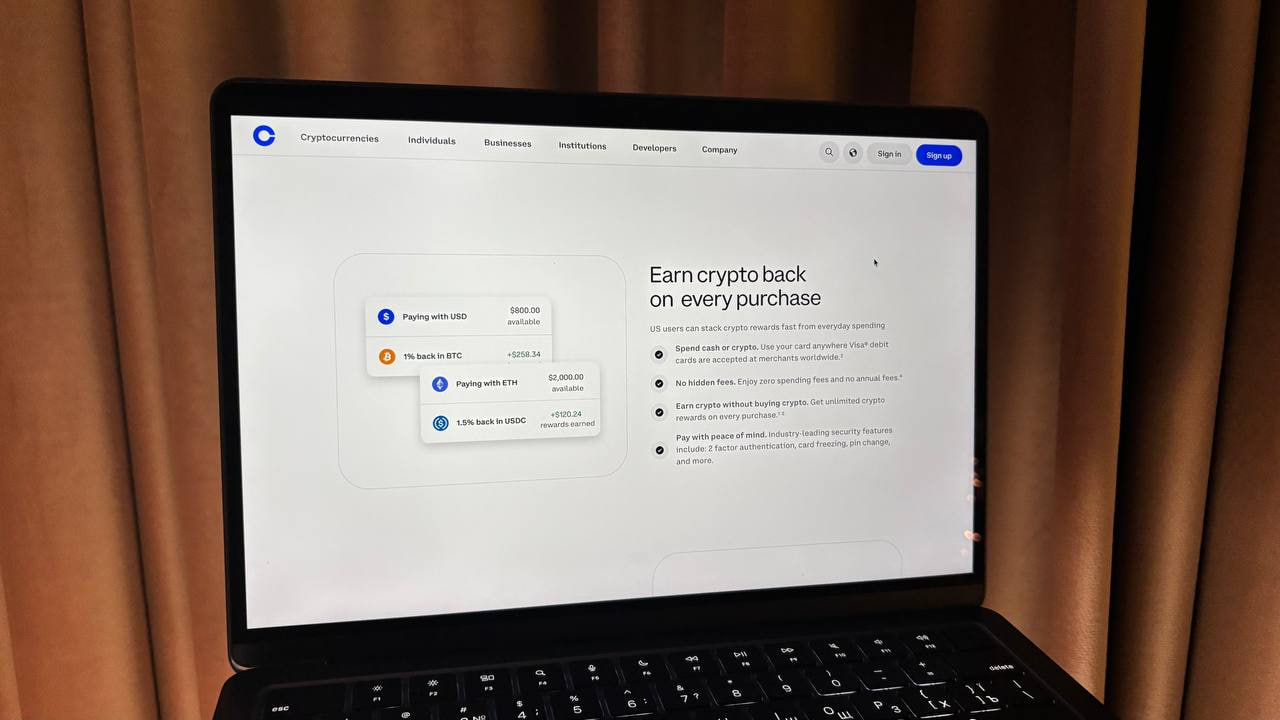

The card can be linked to dollar balances on Coinbase and to part of your crypto portfolio, and used anywhere Visa debit cards are accepted. For merchants, it looks like a standard bank card. The entire crypto layer stays inside the Coinbase account.

What we liked most was earning crypto rewards on every purchase. We simply selected an asset from the list of available tokens, and rewards were credited in that coin. The list changes from time to time, but it typically includes major assets such as BTC, ETH, and USDC.

Rewards do not expire, but specific offers and reward rates can change. The app always shows which token is currently active and how long the offer lasts.

As most Coinbase Card reviews note, there’s no transaction fee on card payments, no annual fee, and spending settles at the rate shown when you select the funding source. This does not eliminate potential spreads when converting crypto to fiat, but in our experience the card does not add extra card payment fees beyond standard banking terms.

On security, the card relies on the same protections as the main account. These include two-factor authentication, one-tap card freezing, PIN changes, and transaction notifications. The Coinbase Card is not available in certain sanctioned or restricted countries. The list includes Afghanistan, Belarus, China, Cuba, Russia, Turkey, Venezuela, and several other jurisdictions. If you are located in one of them, the card cannot be activated or used.

Crypto spending & conversions

When paying with the debit Coinbase Card, we first chose the funding source in the app, either a dollar balance or a specific crypto asset.

In the Card section, there is a Paying with option that lets you switch the spending source in one tap. The card does not spend directly from the blockchain. If USD is selected, the purchase goes through as a standard debit transaction. If crypto is selected, Coinbase first converts the required amount into dollars and then sends the payment through the Visa network. For the merchant, it is always a regular USD transaction.

When spending crypto, the main cost is embedded in the exchange rate. Based on our Coinbase Card review, there is no separate card transaction fee, but a spread is applied when buying or selling crypto. This spread is how the platform earns on the conversion.

In the transaction history, we saw two entries: the conversion of the selected asset into USD and the card payment itself. Formally, these are two separate actions, first an exchange, then a spend. In the US, this means each crypto-funded purchase may be a taxable event. The conversion locks in the sale price of part of the portfolio, which must be reported for tax purposes.

Fees, limits & taxes to consider

This section sums up the key things to know about fees, limits, and taxes. Without these, no Coinbase debit card review would be complete.

The main points we highlight for readers:

- $0 issuance and maintenance fee for the debit Coinbase Card;

- no Coinbase fees on purchases or withdrawals, but a spread applies when converting crypto;

- daily limits: up to $25,000 on the card balance, up to $5,000 in top-ups, and up to $1,000 in cash withdrawals;

- crypto spending and token rewards in the US are treated as taxable events.

Coinbase does not charge for card issuance, monthly maintenance, in-store and online purchases, cash withdrawals, or international transactions. Additional fees may come from ATM operators, which can apply their own fixed charges for withdrawals or balance inquiries.

Our main costs appeared when we paid with crypto rather than dollars. Conversion to fiat was done at Coinbase’s rate with a spread over the market price, and that spread quietly reduced the amount we received.

Card limits are fairly strict. You cannot hold more than $25,000 on the balance. Top-ups are capped at $5,000 per day, and the daily ATM withdrawal limit is $1,000. Card spending is also limited to $2,500 per 24 hours. This was enough for everyday use, but we would not rely on the card as a primary account for large volumes or frequent cash withdrawals.

Taxes also matter. When paying with crypto using the debit Coinbase Card, you are effectively selling part of your asset for dollars before completing the purchase. In the US, this counts as a taxable sale with a gain or loss that must be reported. Card rewards paid in tokens are also treated as income at their market value at the time they are credited.

Pros, cons & limitations

How the Coinbase Card behaves in everyday use:

Strengths:

- Simple integration with a Coinbase account – no need to move funds between separate accounts

- You can spend both fiat and crypto, with rewards paid in the selected token

- transparent card pricing: no issuance or maintenance fees, and no separate purchase fee

- Convenient in-app management: choose the spending source, switch reward tokens, instantly freeze the card

- Support for Apple Pay and Google Pay, making mobile payments genuinely convenient

Weaknesses:

- Real costs are hidden in the spread when converting crypto to dollars

- strict limits on balance, top-ups, cash withdrawals, and daily spending

- Each crypto-funded payment in the US becomes a separate taxable event

- Rewards depend on changing offers, so rates and conditions must be checked regularly in the app

- The card is fully dependent on Coinbase operations; without account access and KYC, it is unusable

Overall, the card is convenient if you already keep part of your funds on Coinbase and are willing to accept the limits and tax overhead in exchange for an easy way to spend both crypto and dollars from a single app. If your goal is to pay with crypto without extra accounting friction, the Coinbase Card quickly makes it clear that beneath the polished interface, it is still a traditional bank card with conversion mechanics and tax implications.

Trustworthiness check

The Coinbase Card is a standard Visa debit card. In the US, it is issued by Pathward, N.A., an FDIC member, with Marqeta as the processor. Coinbase handles the interface and crypto conversion, while dollar transactions follow standard banking rules and the Visa network.

Account and card security rely on 2FA and additional safeguards. Coinbase actively recommends hardware keys and multiple two-factor methods. In the app, users can instantly freeze the card, cancel and reissue it, manage the PIN, and receive notifications for every transaction.

Here are past public incidents involving the Coinbase Card we identified:

- In 2021, a vulnerability in SMS-based 2FA combined with phishing led to fund losses for at least 6,000 users. Coinbase stated that it reimbursed affected customers and strengthened its multi-factor authentication protections.

- In 2025, Coinbase disclosed another case. Some overseas support agents and contractors shared customer data with criminals. The leaked information included names, contact details, partial Social Security numbers, and banking details for a limited number of users, but not passwords, private keys, or funds. The data was used for social engineering. Coinbase refused to pay a ransom, pledged to reimburse users who were tricked into sending money, and estimated the total cost of the incident at hundreds of millions of dollars.

The card itself relies on the issuing bank and Visa, but account security hygiene matters. Avoid relying solely on SMS-based 2FA, be cautious with emails and calls claiming to be support, and do not keep balances on the linked account that you would not be prepared to lose in the event of a successful phishing attack.

GNcrypto’s overall Coinbase Card rating

| Criterion | Score |

|---|---|

| Fees & costs | 3.5 |

| Rewards & cashback | 3.5 |

| Supported currencies & regions | 4.5 |

| Card limits & spending controls | 3.5 |

| Security & fraud protection | 3.5 |

| User experience & app integration | 4.5 |

| Customer support & card delivery | 3.0 |

| Total | 3.7 / 5 |

How we test crypto cards

At GNcrypto, we put transparency above marketing. Every score in this Coinbase Card review is based on real-world use. We issue the card in our own name, complete KYC, fund the account, pay in stores and online, test ATMs, and make foreign currency purchases. We track how quickly top-ups and refunds are processed, how cashback behaves, where hidden fees appear, and which limits actually get in the way of daily use.

We do not conduct code audits or full penetration testing of the issuer. Our assessments reflect what can be verified externally: pricing, limits, app behavior, security features, and support quality. Partnerships do not affect ratings. We do not sell scores or promote cards in rankings for money.

Categories & weights

For all crypto cards, including the Coinbase Card, we use the same seven-criterion scoring system. Fees and rewards carry the most weight. If a card is expensive to use or offers little in return, a polished interface will not make up for it.

- Fees & costs – 25%

- Rewards & cashback – 20%

- Supported currencies & regions – 15%

- Card limits & spending controls – 15%

- Security & fraud protection – 10%

- User experience & app integration – 10%

- Customer support & card delivery – 5%

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.