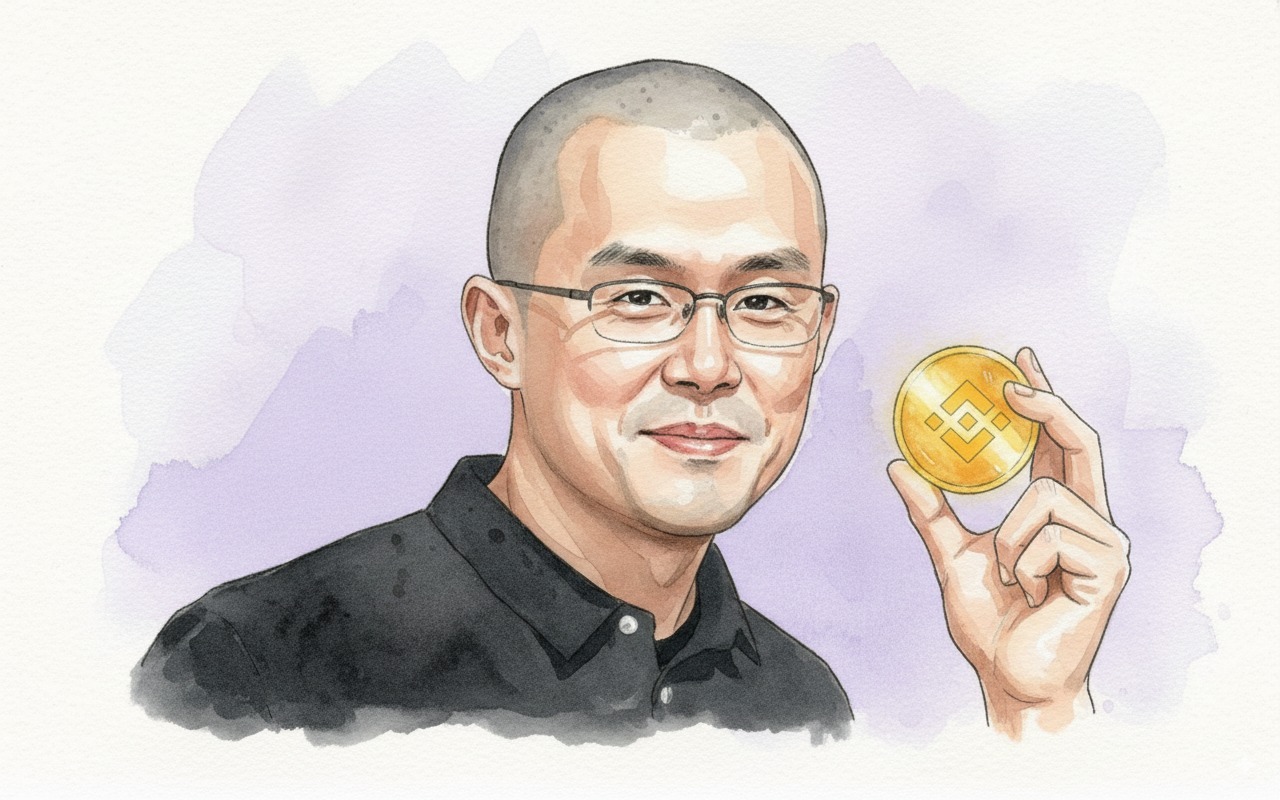

CZ crypto story: how the Binance founder shaped digital asset markets

The story of Changpeng Zhao is the journey of a man who transformed technical expertise into one of the most expansive crypto infrastructures of the modern era. Today, his vision and the sheer scale of Binance continue to impact the market, challenge regulators, and redefine how millions of people perceive digital wealth.

Career before Binance: building CZ’s professional foundation

Changpeng Zhao, an industry icon known simply as CZ, was born in 1977 in Lianyungang, Jiangsu Province, to a family of educators. His father was a professor and his mother was a teacher, creating an environment that prioritized academic excellence from an early age. Political shifts eventually forced the family to emigrate from China, and in the late 1980s, they relocated to Vancouver. As a teenager, CZ worked part-time jobs at McDonald’s and gas stations to help his family find their footing in their new home.

Education served as his primary vehicle for upward mobility. He studied Computer Science at McGill University in Montreal, where he developed a deep understanding of high-load system architectures. After graduation, Zhao began his career developing infrastructure for high-frequency trading firms. These roles presented challenges that demanded engineering precision and the ability to build resilient systems capable of operating under immense constant pressure.

His interest in cryptocurrency wasn’t born out of speculation, but rather out of a curiosity about the mechanics of decentralized architecture. His time at Blockchain.info and his involvement in OKCoin projects allowed him to identify the weaknesses in existing solutions and visualize what a truly global crypto service should look like.

When critics later debated his influence or calculated CZ net worth, they often overlooked that the foundation of his success was laid long before Binance. It was his early experience in programming and financial systems that allowed CZ to recognize the massive growth potential of the crypto market long before his peers.

Founding Binance: turning a vision into a global powerhouse

When Changpeng Zhao launched Binance in 2017, the market was already growing, but its infrastructure remained chaotic and often counterintuitive. Platforms frequently crashed under heavy load, processed transactions slowly, and offered limited functionality. Zhao encountered these issues daily; his background in high-frequency trading gave him a clear blueprint for the scale and speed a crypto exchange needed to achieve global dominance.

The initial launch of Binance was funded via an ICO, raising approximately $15 million in just a few weeks. Key participants included angel investors like Roger Ver and Chandler Guo, alongside early crypto enthusiasts who purchased BNB during the public token sale. This capital allowed the team to focus entirely on technical execution without needing to constantly pitch the idea’s viability to institutional investors. From day one, CZ’s mission was to build a platform that could handle the throughput of traditional markets while remaining agile enough for a diverse range of digital assets.

Binance’s rise was meteoric. Within months, it became the industry leader in trading volume. Users flocked to the platform for its high-speed order execution, low fees, and the speed at which it listed new tokens, often far ahead of competitors. During this era, Zhao’s name became synonymous with CZ crypto, an engineering-first approach to infrastructure that prioritized technical performance over flashy marketing.

The success of Binance was no fluke. It was the direct result of several strategic decisions:

- A heavy investment in a proprietary matching engine that outperformed the competition

- An aggressive expansion of tradable assets

- 24/7 technical support, which the team famously managed manually during the early months

This synergy of engineering and operational excellence, reflected in Binance review, turned the platform into the benchmark for the entire crypto industry.

Leadership style & philosophy: crafting the Binance culture

Changpeng Zhao’s management style has always been a blend of engineering discipline and an intuitive grasp of customer needs. For his dev team, seeing how a system performs during a crisis is always more valuable than discussing hypothetical risks. As a result, traders became accustomed to a product that evolved as rapidly as the market itself.

However, beneath the surface, the company faced internal struggles that were rarely made public. As Binance scaled, compliance became a major point of friction: legal teams pushed for tighter controls, while CZ feared that excessive bureaucracy would stifle innovation. During this pivotal time, the role of those who could balance speed with security became paramount. One such figure was Yi He, co-founder and Zhao’s partner. She championed a horizontal management model and protected a culture where employees could directly influence the product. She essentially served as the company’s internal stabilizer, particularly as Binance faced mounting pressure from financial regulators and CZ faced legal charges.

Following CZ’s resignation as CEO as part of a settlement with the U.S. Department of Justice, this established management system prevented the company’s collapse. Leadership was handed over to Richard Teng, a seasoned executive with extensive regulatory experience. Teng’s arrival marked a shift from Zhao’s style, introducing more structure, standardized processes, and a relentless focus on compliance. This transition demonstrated that Binance’s culture was not merely a reflection of CZ’s personality but a collective effort by those who built it alongside him.

While public discourse often centered on Changpeng Zhao net worth, for him, the primary focus remained the engineering resilience of his systems and his team’s ability to withstand the pressure of regulatory scrutiny and legal challenges.

Global expansion of Binance: scaling through the storm

Binance’s global trajectory moved in tandem with its increasingly complex legal status. The exchange grew faster than the rules of the crypto market were written, leading to a historic clash between the tech giant and U.S. regulators.

United States. To enter the U.S. market, Binance launched a dedicated platform, Binance.US, designed to operate under full regulatory oversight. However, this did not shield the company from scrutiny. In 2023–2024, the U.S. Department of Justice charged Binance and CZ personally with violating AML and sanctions laws. The exchange pleaded guilty, agreed to a record-breaking fine of over $4.3 billion, and committed to a massive overhaul of its internal compliance. Zhao stepped down as CEO and served a prison sentence, becoming perhaps the most high-profile tech entrepreneur to be convicted of systemic compliance failures.

Europe. Conversely, Binance found success in Europe, securing licenses in France, Italy, Spain, Cyprus, and several other EU nations. This created a striking paradox: while the exchange was in crisis in the U.S., it was successfully entrenching itself across European markets.

UAE. Dubai emerged as a primary hub for Binance. Local regulators viewed the exchange as a cornerstone of the region’s Web3 economic strategy. Following CZ’s departure, the company’s operational heart settled here as a neutral jurisdiction welcoming innovation.

CIS and Asia. Markets like Kazakhstan, Ukraine, and Turkey remained vital growth drivers. Binance worked diligently to build infrastructure while emphasizing compliance with global sanctions, a move designed to mitigate further regulatory blowback.

It was during this turbulent era that the public began to ask more frequently: Who is CZ? How could the man who built a global empire find himself at the center of a legal hurricane while still wielding massive influence over the market from the sidelines?

Life after stepping back from Binance: how CZ reshaped the global crypto ecosystem

Changpeng Zhao’s impact on the industry became most evident in the wake of his legal battles. When the founder of the world’s largest crypto exchange pleaded guilty and served time, the market finally grasped the stakes involved for even its most powerful players. Yet, CZ’s influence did not wane. The exchange continued its operations under Richard Teng, while Zhao himself became a symbol of the ambitious entrepreneur who built faster than governments could regulate.

The political fallout was even more significant. In October 2025, Donald Trump issued a full pardon to CZ, labeling him a victim of the previous administration’s overreach. This decision ignited fierce debate, particularly following reports regarding potential links between Binance and political lobbying efforts within the crypto industry. The pardon divided the community: some saw it as a path for Changpeng Zhao return, while others viewed it as proof that business and politics are more intertwined than publicly admitted.

Meanwhile, the Binance ecosystem continues to evolve. Initiatives like Giggle Academy, partnerships with international charities, and projects focused on Web3 modernization reflect a vision for long-term impact that transcends the scandals.

To some, Changpeng Zhao is the visionary who built the world’s most successful crypto ecosystem. To others, he is a cautionary tale of how the ambitions of a single entrepreneur can alter the course of entire industries and influence international politics.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.