Chainalysis says crypto crime hit at least $154B

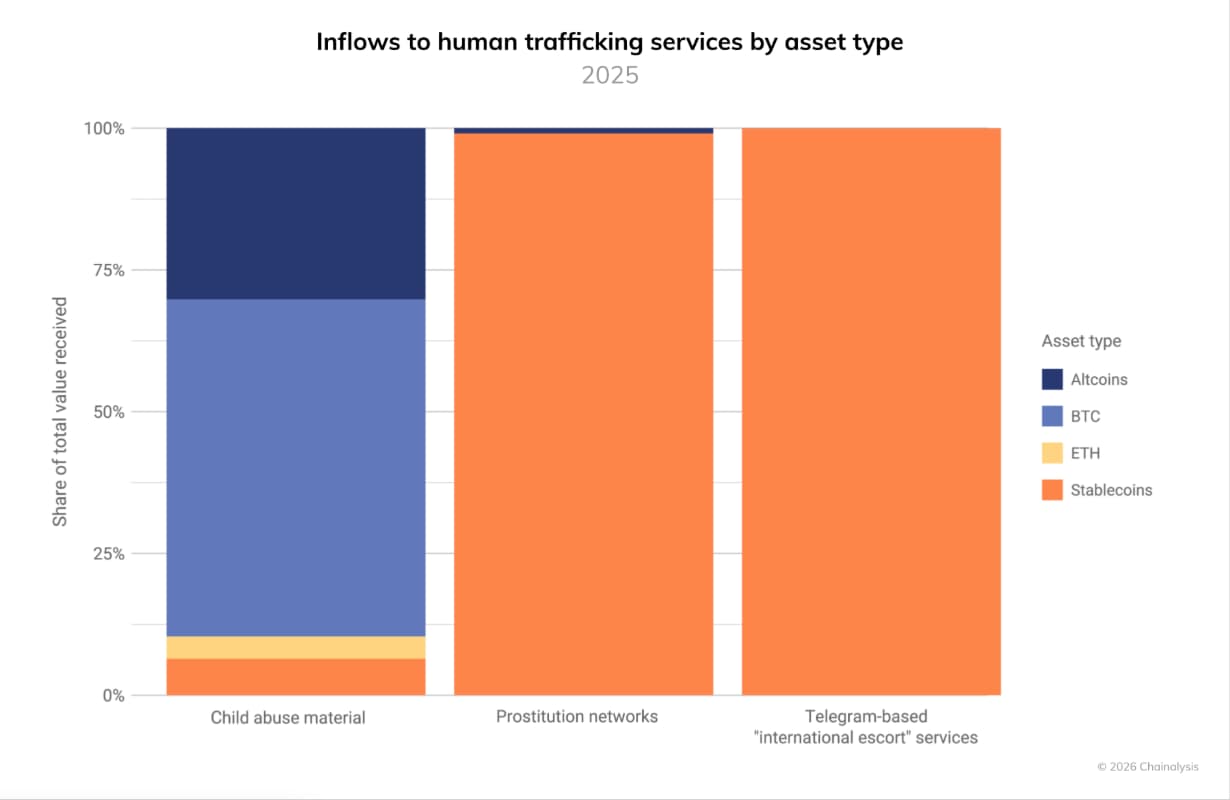

The latest Chainalysis crime snapshot suggests the risk picture is changing more than it is disappearing. Stablecoins now dominate illicit flows, and sanctions-related activity is reshaping where the biggest on-chain threats come from.

Chainalysis estimates that illicit crypto addresses received at least $154 billion in 2025, a 162% year-over-year increase, according to its 2026 Crypto Crime Report introduction. The firm says the jump was driven largely by sanctioned entities, where value received rose 694% versus the prior year.

Even with the record headline number, Chainalysis frames the problem as concentrated rather than pervasive. Its estimate for illicit activity as a share of attributed on-chain volume stayed below 1%. The bigger shift is what criminals are using. Stablecoins accounted for 84% of illicit transaction volume in 2025, continuing a multi-year trend toward assets that are easier to move across borders without price swings.

The report’s other themes read like a map of where enforcement and compliance pressure may land next.

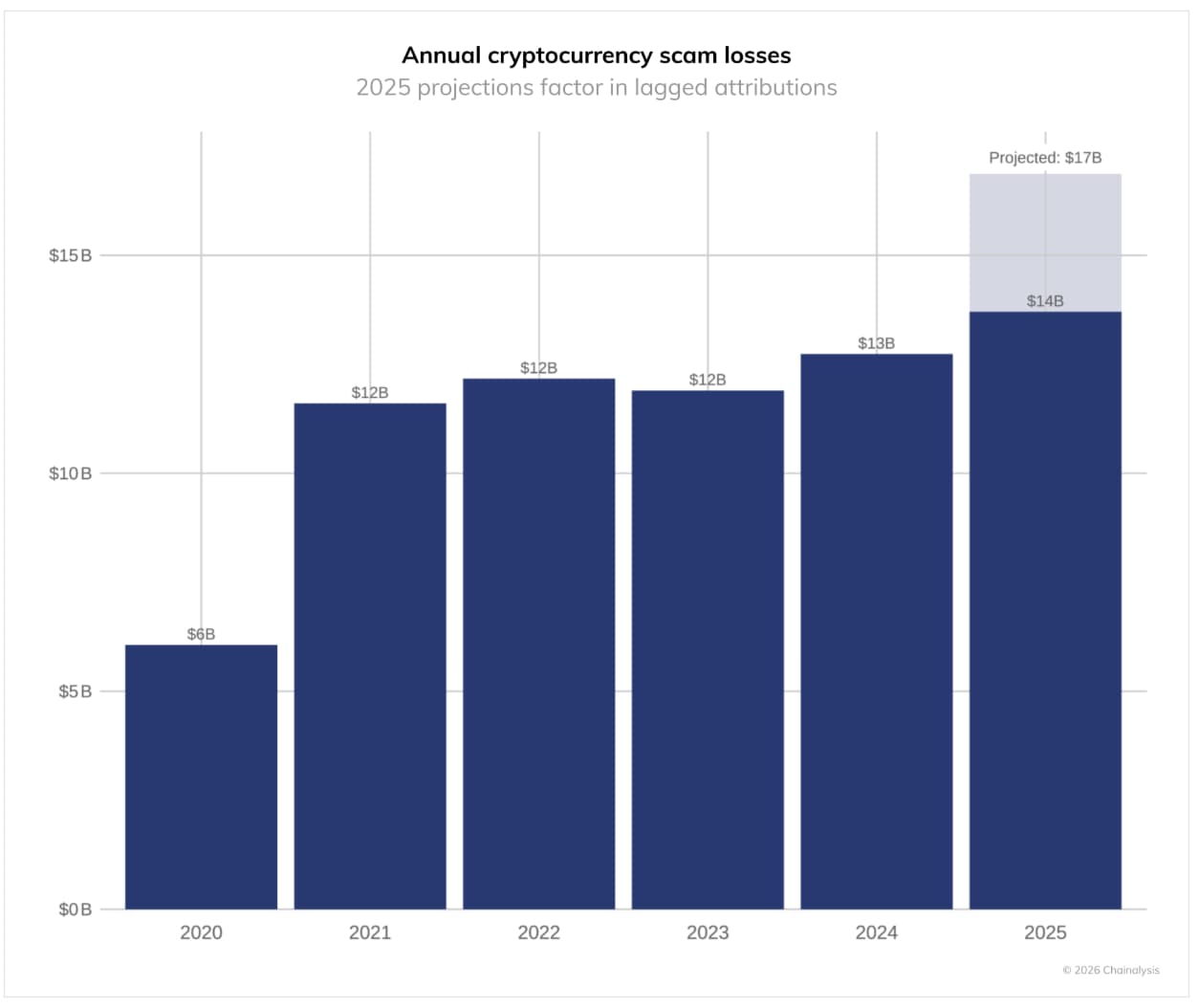

Scams and fraud kept growing. Chainalysis estimates at least $14 billion in on-chain scam revenue in 2025 and projects the figure could exceed $17 billion as more addresses are identified. In its scams chapter, the company notes impersonation schemes grew 1,400% year over year, while the average scam payment jumped to $2,764 from $782 in 2024.

Hacking remained a major source of losses. Chainalysis says DPRK-linked hackers alone stole $2 billion in 2025, with the February Bybit exploit nearly $1.5 billion, described as the largest digital heist in crypto history.

Money laundering infrastructure also looks more industrial. Reuters, citing Chainalysis research, reported that money launderers received at least $82 billion in crypto in 2025. It highlighted Chinese-language laundering networks that processed about $16.1 billion last year, using nearly 1,800 active wallets and handling close to $40 million per day.

Chainalysis separately reported an 85% year-over-year rise in crypto flows to suspected human trafficking services, reaching hundreds of millions across identified services, with heavy Telegram usage and links to laundering networks.

Taken together, the report suggests 2025’s crypto crime story was less about one dominant category and more about scale, stablecoin rails, and professionalized services that help illicit actors move funds faster and farther.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.