Does MEXC work in USA? The Reality of Trading in 2026

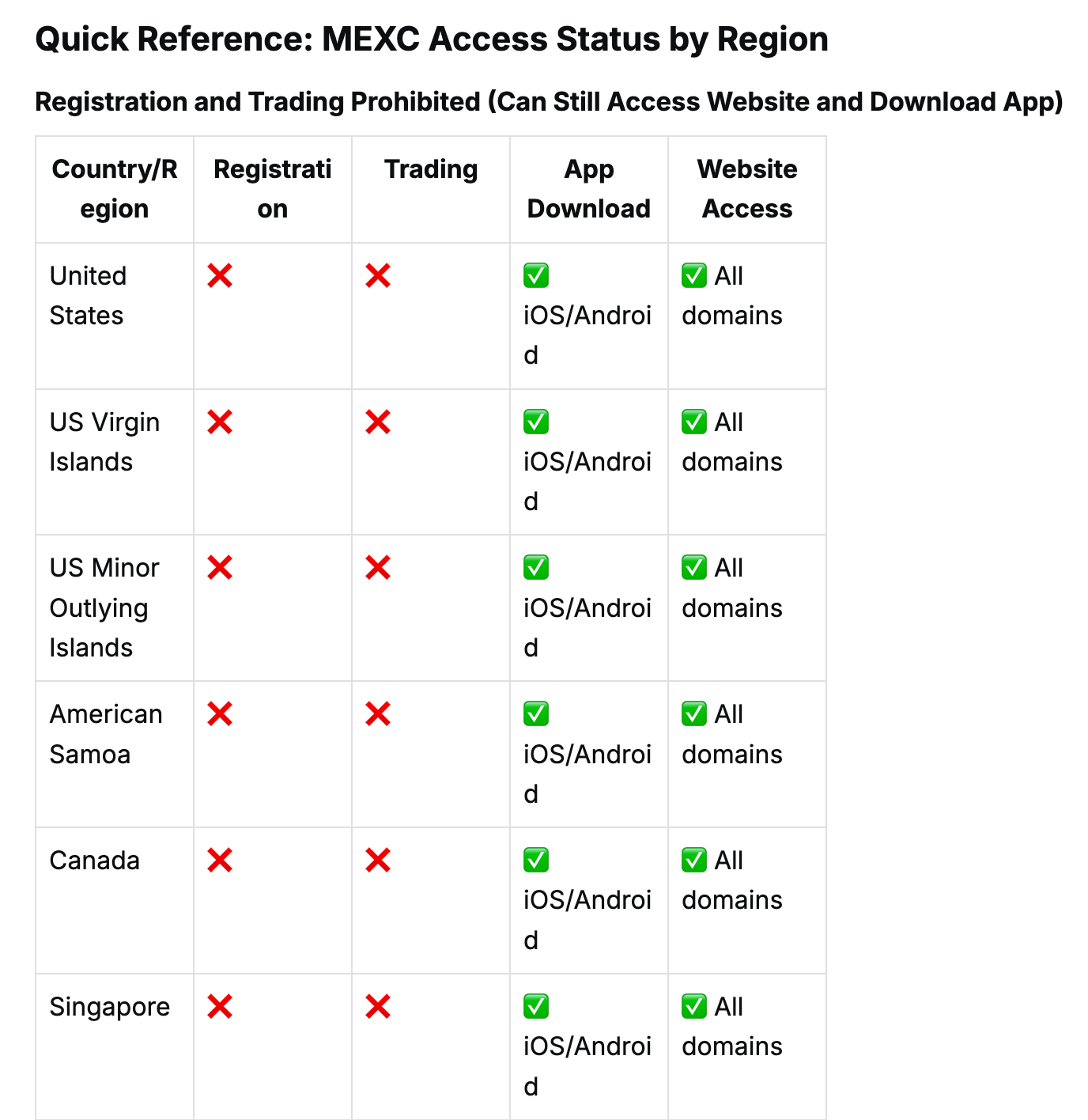

MEXC lists micro-cap tokens weeks before they hit Coinbase or Kraken – earning it the nickname “King of Gems”. For American traders, accessing it means bypassing geo-blocks with VPNs and risking frozen funds. We explain the strict bans, the dangers, and whether chasing 100x gains is worth it.

MEXC is the “forbidden fruit” of the crypto world. It is likely the first place you look when you see a micro-cap token pumping 300% on Twitter (X), only to realize it isn’t listed on Coinbase or Kraken. The appeal is obvious: aggressive listings, deep liquidity for small-cap alts, and historically lax KYC requirements..

For US traders, the experience is harsh: access denied. Unlike Binance or OKX, which launched limited US platforms to comply with regulators, MEXC geo-blocks the entire country. There is no “MEXC US.” If you try to log in from a US IP address, you are greeted with a blank screen or a strict service prohibition notice.

MEXC works well for international traders hunting leverage and meme coins early. For Americans, it’s a minefield. Discord groups whisper about using VPNs to bypass blocks, relying on lax identity checks. We tested these claims.

In 2026, MEXC tightened enforcement. Liquidity remains strong, but account flags and frozen funds for ToS violations happen more frequently than before. Below, we break down exactly how strict the ban is, the technical hurdles of the “VPN loophole,” and whether legitimate alternatives exist that let you hunt for gems without looking over your shoulder.

What MEXC offers as an exchange

MEXC has earned a reputation as the “Gem Hunter’s” exchange, famous for listing high-potential, low-cap tokens weeks or even months before they appear on major platforms like Coinbase or Binance. With over 2,000 cryptocurrencies and futures markets offering up to 200x leverage, it targets traders hunting volatility and early access.

This variety drives the question: can I use MEXC in the US to capture these opportunities before the mainstream crowd? Beyond just asset selection, MEXC is known for its ultra-competitive fee structure – often running promotions with 0% spot maker/taker fees – and a high-performance matching engine capable of 1.4 million transactions per second. It is a platform built for speed, speculation, and those willing to navigate the bleeding edge of the crypto market.

Why MEXC isn’t open to the U.S. market

MEXC doesn’t operate in the US by design. American financial regulations – enforced by the SEC and CFTC – require exchanges to register as Money Services Businesses (MSB), enforce strict KYC (Know Your Customer), and delist unregistered securities.

MEXC’s model does the opposite. It lists hundreds of new, unproven tokens (often securities) and offers 200x leverage to retail traders – products explicitly banned in the US.

Rather than dilute its offerings, MEXC has chosen to block the region entirely rather than water down its platform. This raises the question: can you use MEXC in the US by ignoring the rules? No. MEXC lists the United States as a “Prohibited Jurisdiction” in its Terms of Service. If their systems detect a US IP or identity, they freeze the account to avoid regulatory action.

Feature access for U.S.-based users

Unlike Binance or OKX, which offer limited “US-compliant” versions, MEXC provides zero official feature access to American residents. If you attempt to access the site with a standard US IP address, you will simply be blocked at the door with a “Restricted Jurisdiction” notice. There is no spot market, no wallet access, and certainly no derivatives trading authorized for US soil.

For those who bypass blocks with VPNs, the experience stays limited. Without KYC (Know Your Customer), you cannot link a US bank account, deposit USD, or join token Launchpads. Operating MEXC in USA in this “shadow” mode means you are trading without a safety net; you have no access to customer support for account recovery, and if the system flags your activity as suspicious, you have no valid ID to unlock your frozen funds. You essentially have access to the trading engine, but no safe way to get your money in or out.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.