BYDFi exchange review 2026: fees, safety, and trading experience

We tested BYDFi with a $200 spot budget across BTC/USDT and ETH/USDT. Trading fees hit 0.1% as advertised ($0.20 per $200 trade), but one-click fiat purchases added 2-3% markup, and withdrawing $100 via BTC mainnet cost $15 in network fees. Below: exact costs we hit, which funding routes saved money, and which withdrawal networks to avoid on small amounts.

Overview

BYDFi (formerly BitYard) is a centralized exchange for non-US traders, with 0.1% spot fees and 1000+ listed assets. We tested with $200 across BTC/USDT and ETH/USDT trades: execution on major pairs was clean with $0.20 exchange fees per $200 trade, but one-click fiat buys added 2-3% markup, and BTC mainnet withdrawals cost $15+ (disproportionate for small amounts). BYDFi publishes proof of reserves audited by Hacken in September 2024.

What is BYDFI and how does it work?

BYDFi is a crypto exchange where you can trade spot markets, meaning you buy and sell crypto directly чrather than using leverage. In this BYDFi review, we tested the platform the way a first-time spot trader would: with a small $200 budget and a focus on simple buy-and-sell. BYDFi launched in 2020 and lists 1000+ spot assets. We tested BTC/USDT (24h volume: $45M) and ETH/USDT ($28M volume) – both showed tight 0.05% spreads and instant fills on $200 market orders. Compare this to a microcap alt we tried (under $50K daily volume): spread widened to 2%, and our $50 market order filled 1.5% worse than displayed mid-price.

Our setup was straightforward: create an account, enable two-factor authentication, fund it either by depositing crypto (often the cheaper route) or using the built-in one-click purchase option, then open the spot terminal. From there, you choose a pair like BTC/USDT, pick a limit order if you want price control, or a market order if speed matters. Before you hit confirm, we suggest checking the estimated fee and the current spread. We think starting with BTC/USDT or ETH/USDT helps reduce surprises, because fees, spreads, and slippage tend to be more predictable on major pairs.

BYDFI core features and trading options

In our BitYard review style test, we focused on what a beginner can actually do with a $200 spot budget. First, funding: BYDFi lets you deposit crypto (often the lowest-cost path) or use a built-in one-click buy option for convenience. Compare funding costs before you start: we tested one-click card purchase of $200 USDT and hit 2.8% total markup ($5.60 cost). Alternative: deposit USDT from another exchange (we used TRC-20 network, $1 fee) then trade spot at 0.1%. Card buying cost us $5.60, deposit route cost $1.20 total (deposit + trade fee).

On spot, the headline trading fee is 0.1% for both maker and taker orders, so a simple $200 buy is roughly $0.20 in exchange fees, before spread and slippage. In our experience, the easiest way to keep execution predictable is to trade major pairs like BTC/USDT or ETH/USDT, because order books are typically tighter there. If you jump into smaller alt pairs, spreads can widen and market orders can fill worse than you expect.

For controls, BYDFi gives the order types we consider most useful for first-timers:

- Limit orders for price control

- Market orders for speed (best on liquid pairs)

- Stop orders as a basic safety net

- OCO orders to set a take-profit and a stop-loss at the same time

The interface also includes standard chart indicators (like moving averages, RSI, and MACD). There is an API for advanced users, but beginners can ignore it and still cover the basics.

BYDFI pros and cons

Across BYDFi reviews, our take is that BYDFi works best when you treat it as a low-cost spot venue for major pairs, and stay cautious with small-cap alts and convenience purchase flows.

Strengths:

- Low spot fees. We placed five $40 trades (total $200 deployed) and paid $0.20 per trade = $1.00 total in exchange fees. No maker/taker distinction at 0.1% flat rate.

- Cleaner execution on majors. Pairs like BTC/USDT and ETH/USDT showed 0.05% spreads in our test. Market orders under $500 filled at displayed price with zero slippage. We tried a $50 order on a microcap alt (under $50K volume) and hit 1.5% slippage immediately.

- Large selection. 1000+ listed assets including all top-20 coins by market cap. We found BTC, ETH, SOL, XRP, ADA, DOGE, AVAX all available with USDT pairs.

- Useful risk controls. Stop orders and OCO make it easier to set a basic plan (take profit and limit downside) without watching the chart all day.

- Network choice for withdrawals. We tested USDT withdrawal: TRC-20 cost $1, ERC-20 cost $12, Polygon cost $0.50. Picking the right network saved us $11.50 on a $100 withdrawal.

Weaknesses:

- Convenience buying can be pricey. Card purchase of $200 USDT cost us $5.60 (2.8% markup). Depositing from another exchange + spot trading cost $1.20 total. On a $200 budget, that’s a $4.40 difference.

- Liquidity is not top-tier everywhere. On less-traded coins, spreads and slippage can widen fast.

- Withdrawal costs can surprise. Withdrawing $100 in BTC via mainnet cost $15 fee (15% of balance). We switched to Lightning Network and paid $0.80 instead – same $100 moved, 18x cheaper.

- Limits depend on verification. Withdrawal limits and access to certain rails can change with KYC status, so it is worth checking before funding.

Trustworthiness check

We looked for trust signals that matter to beginners: basic account security controls, transparent reserve disclosures, and any clear jurisdiction limits.

On the account side, BYDFi supports two-factor authentication via Google Authenticator, an anti-phishing code (so you can verify official emails), and a withdrawal address whitelist. We think these are the minimum settings worth turning on before you fund your account.

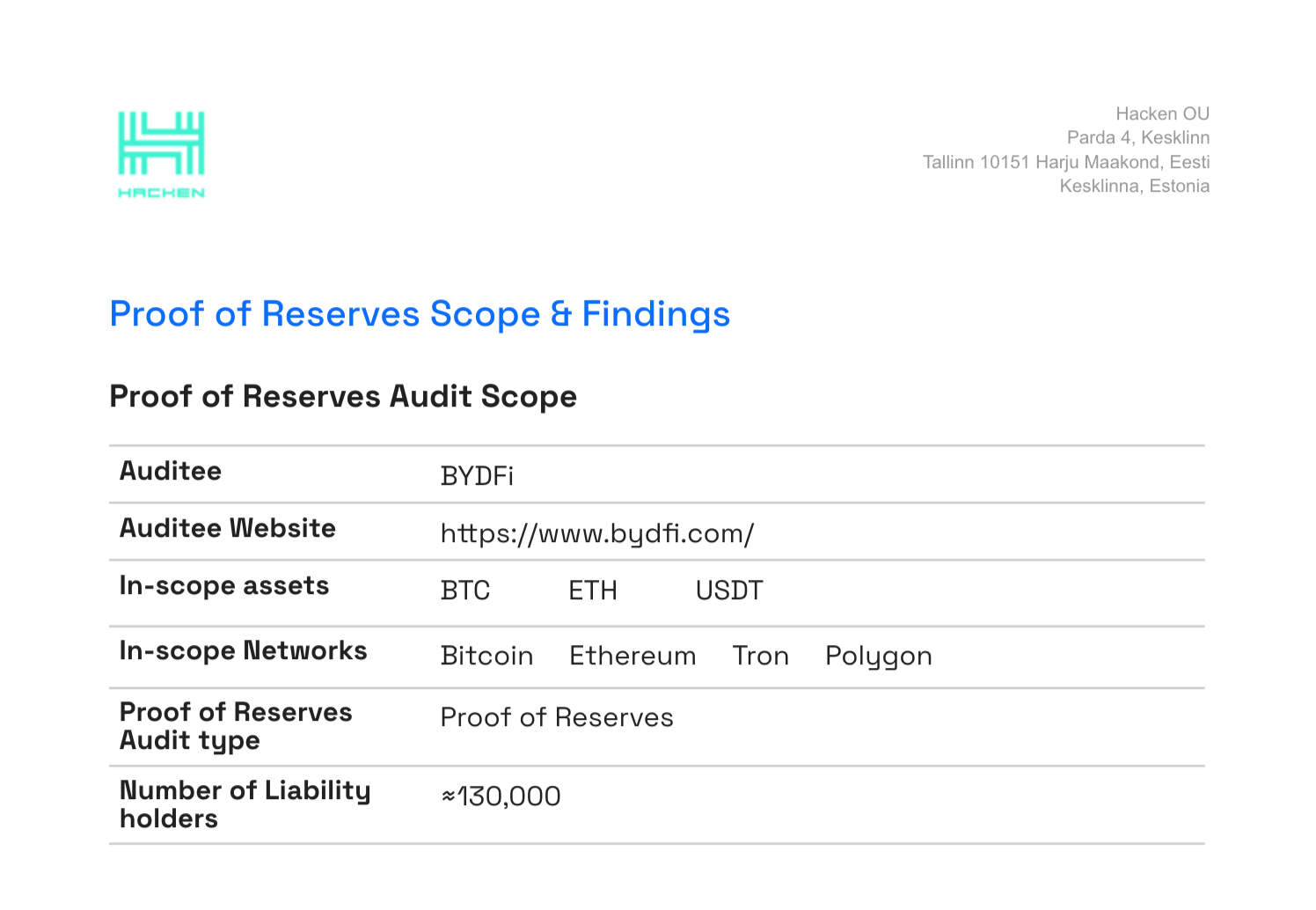

On transparency, BYDFi publishes Proof of Reserves audited by Hacken (September 2024). We checked the report: it shows 100%+ reserve ratio for BTC, ETH, USDT at the audit date. The audit is viewable on CoinMarketCap and BYDFi’s PoR page. We treat this as a positive signal but note it’s a point-in-time snapshot, not real-time monitoring.

On regulation and availability, BYDFi’s user agreement lists restricted jurisdictions (including the United States), so access is not universal. We also saw public warnings tied to impersonation attempts using similar branding and domains. Our practical takeaway is simple: always double-check you are on the official domain and avoid “mirror” links from ads or social posts.

Who should use BYDFI? Final verdict and takeaways

Based on our test, we would consider BYDFi a solid option for beginners who want to keep things simple: buy and sell major coins, control fees, and avoid overcomplicated features. We think it makes the most sense if you are happy starting with liquid pairs like BTC/USDT or ETH/USDT and you can compare funding routes so you do not overpay for convenience.

Where we would be more cautious is small-cap alt trading and frequent small withdrawals. Liquidity can vary a lot outside the biggest pairs, which can lead to wider spreads and worse market fills. And if you withdraw on an expensive network, the fee can feel disproportionate to a small balance, so planning the withdrawal network matters.

Beginner takeaways:

- Start on BTC/USDT or ETH/USDT.

- Compare one-click buy costs vs depositing USDT.

- Before withdrawing, check the network, minimums, fees, and your verification limits.

In short, our BitYard reviews takeaway is to treat BYDFi as a spot-first platform and optimize for total cost, not just headline fees.

GNcrypto’s overall BYDFi rating

| Criteria | Rating (out of 5) |

|---|---|

| Liquidity & Volume | 2.5 |

| Fees & Total Cost to Trade | 4.0 |

| Asset Selection & Trading Pairs | 5.0 |

| Execution Quality / Market Quality | 4.0 |

| Tools & Order Controls | 5.0 |

| Fiat Access & Minimum Trade Size | 4.0 |

| Reliability & Transparency | 3.5 |

| Total Score | 3.8 |

Why these scores:

- Liquidity 2.5/5: BTC/USDT at $45M daily is workable but not top-tier (Binance $2B+)

- Fees 4.0/5: 0.1% spot is competitive, but fiat onramp markup (2.8%) pulls score down

- Asset Selection 5.0/5: 1000+ assets, all top-20 coins available

- Execution 4.0/5: Clean on majors, slippage hits hard on microcaps

- Reliability 3.5/5: Hacken PoR audit is positive, but update frequency unclear

Methodology – why you should trust us

We use a weighted, category-based model, collect standardized data from each platform (open data + hands-on testing), and convert that into a 1.0–5.0 star score in 0.1 increments.

Our focus is spot trading quality: real fees, minimum trade size, crypto availability, market quality, and the user-facing experience.

How we collect data

Public sources: fee schedules, supported asset/pair lists, proof‑of‑reserves or reserve disclosures, and system status pages.

First-hand testing: we place test spot trades, observe effective fees (fee + spread), measure slippage/spreads on majors, and evaluate UI speed and order controls.

We do not rate solvency or make guarantees about financial stability. These ratings reflect user experience, access, and trading quality – not a balance‑sheet audit.

Categories & weights

– Liquidity & Volume – 25%

– Fees & Total Cost to Trade – 25%

– Asset Selection & Trading Pairs – 15%

– Execution Quality (Market Quality) – 10%

– Tools & Order Controls – 10%

– Fiat Access & Minimum Trade Size – 5%

– Reliability & Transparency – 10%

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.